The Impact of COVID-19 is included in US UPR Market. Buy it today to get an advantage.

Request the impact of COVID-19 on your product or industry

US UPR Market Trends and Forecast

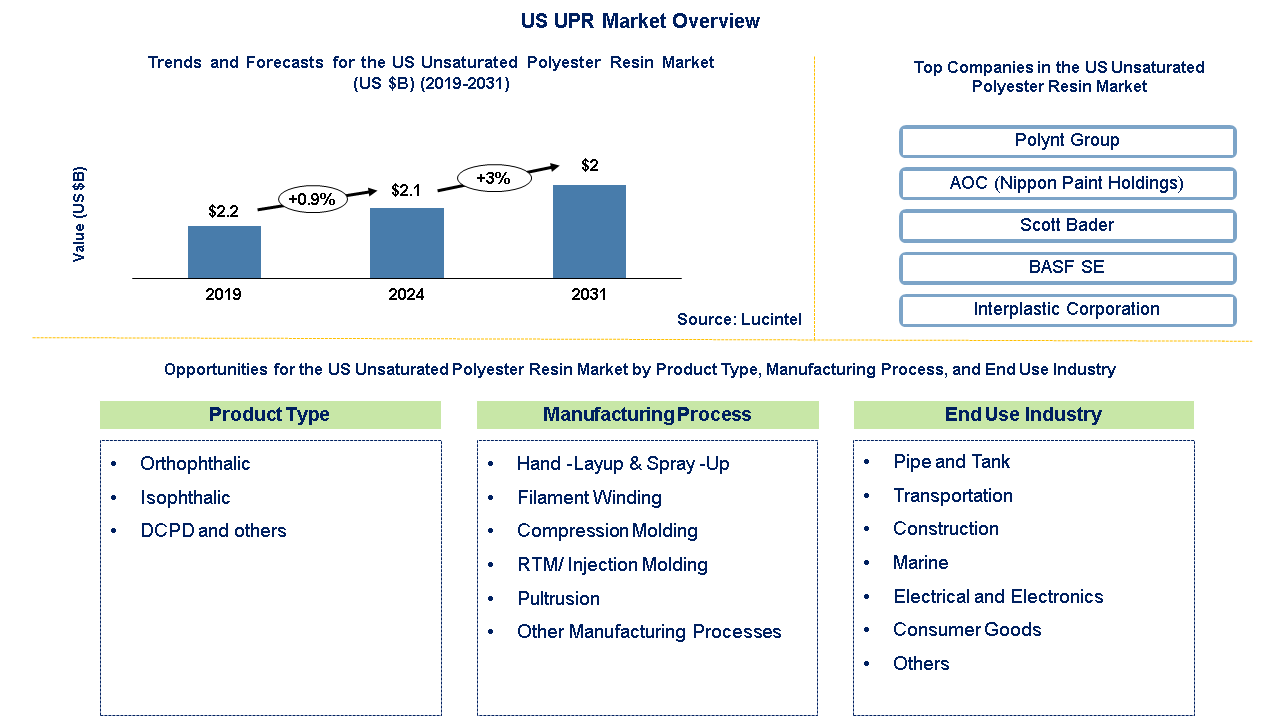

Lucintel finds that the future of the US UPR market looks promising with opportunities in construction, pipe and tank, marine, transportation, electrical and electronics, and consumer goods end uses. The US UPR market is expected to reach an estimated $2 billion by 2031 with a CAGR of 3% 2024 to 2031. The major driver for market growing demand for UPR in the construction industry, growth in automotive sector, and increasing demand for UPR in industrial applications.

Most of the US UPRs are made from raw materials like glycols (e.g., propylene glycol, diethylene glycol), unsaturated acids or anhydrides (e.g., maleic anhydride, fumaric acid), and saturated acids or anhydrides (e.g., phthalic anhydride, isophthalic acid). To reduce viscosity and enable crosslinking during the curing process, typically a reactive diluent such as styrene monomer is used. Additionally, there are inhibitors (such as hydroquinone) used to control the polymerization process and fillers or additives in order to improve particular properties of resins. Typically, US unsaturated polyester resin (UPR) is favorably priced compared to other markets. Its lower manufacturing costs and availability of raw materials locally sometimes give US UPR a cost advantage. It should be noted that prices can fluctuate among different grades of resins in the market depending on quality and specific applications when compared with international counterparts.

-

Lucintel forecasts that construction will remain the largest end use industry over the forecast period due to growing infrastructure projects, renovations, and the rising demand for lightweight, durable composite materials.

-

Pultrusion will remain the largest manufacturing process over the forecast period due to superior strength-to-weight ratios for structural applications, and increased use of lightweight composites to improve fuel efficiency and reduce emissions.

Country wise Outlook for the US UPR Market

The US UPR market is witnessing substantial growth, driven by increased demand from various end use industries such as pipe and tank, transportation, construction, construction, marine, electrical and electronics, and others. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major US UPR producers in key regions: US.

Emerging Trends in the US UPR Market

Emerging trends in the US UPR market shaping its future applications and market dynamics:

-

Growth in Demand for Lightweight and High-Performance Composites: The U.S. unsaturated polyester resin (UPR) market is experiencing a significant shift towards lightweight materials in industries such as automotive, aerospace, and construction. UPR-based composites offer a high strength-to-weight ratio, corrosion resistance, and durability, making them ideal for structural applications. The automotive industry, in particular, is increasingly using UPR composites for vehicle weight reduction to improve fuel efficiency and meet stringent emission standards. Additionally, UPR is gaining traction in infrastructure projects for bridges, pipes, and utility poles due to its cost-effectiveness and resistance to environmental factors.

-

Rising Adoption of Sustainable and Bio-Based UPR: With growing environmental concerns and regulatory pressure, the U.S. UPR market is witnessing increased demand for bio-based and recyclable resin solutions. Companies are investing in renewable raw materials derived from vegetable oils, lignin, and bio-based glycols to develop greener alternatives. Bio-based UPR reduces dependency on petrochemicals and lowers carbon emissions, aligning with sustainability goals in various industries. Several manufacturers have already introduced eco-friendly UPR formulations, targeting applications in automotive, marine, and consumer goods. This trend is expected to accelerate as brands prioritize circular economy initiatives and government policies support green chemistry innovations.

-

Expanding Applications in Renewable Energy: The UPR market in the U.S. is seeing strong growth in the renewable energy sector, particularly in wind energy applications. UPR-based composites are widely used in the production of wind turbine blades due to their excellent mechanical properties, lightweight nature, and resistance to harsh environmental conditions. As the U.S. government continues to push for renewable energy expansion, including offshore and onshore wind projects, demand for high-performance UPR formulations is expected to rise. Additionally, UPR is being explored for photovoltaic panel structures and energy storage components, further expanding its role in the clean energy industry.

-

Technological Advancements in Fire-Retardant UPR: Fire safety regulations and stringent building codes are driving the development of fire-retardant UPR in the U.S. construction and transportation sectors. Advancements in halogen-free flame-retardant additives are enhancing the thermal stability and self-extinguishing properties of UPR composites without compromising mechanical performance. These innovations are crucial in building applications such as fire-resistant doors, wall panels, and insulation materials. Similarly, in the railway and aerospace industries, improved fire-resistant UPR is gaining attention to enhance passenger safety. The continuous R&D in this area is expected to create new opportunities for manufacturers and expand the market reach of UPR in safety-critical applications.

-

Increasing Investment in Infrastructure and Smart Cities: The US governments focus on infrastructure modernization, including roads, bridges, and water management systems, are fueling demand for UPR-based materials. Fiberglass-reinforced UPR composites are preferred for their corrosion resistance, lightweight nature, and long lifespan in applications such as water pipelines, sewage treatment plants, and modular construction. The shift towards smart cities is also boosting the adoption of UPR in prefabricated construction materials, urban furniture, and eco-friendly transportation infrastructure. The emphasis on long-term durability and low maintenance costs is positioning UPR as a key material in next-generation infrastructure projects.

Recent Developments by the US UPR Market

Recent developments in the US UPR market by various companies highlight ongoing innovations and advancements across different sectors:

-

Surge in Demand for Bio-Based UPR: There is a growing preference for bio-based unsaturated polyester resins, driven by environmental concerns and regulatory pressures. These resins, derived from renewable resources such as plant oils and natural fibers, offer sustainable alternatives to traditional petrochemical-based resins. Industries such as automotive and construction are increasingly adopting bio-based UPRs to reduce carbon footprints and meet sustainability goals. The shift towards eco-friendly materials aligns with global efforts to combat climate change and promotes the development of green technologies. This trend not only supports environmental sustainability but also creates new market opportunities for manufacturers focusing on innovative, renewable solutions.

-

Expansion in Renewable Energy Applications: The renewable energy sector, particularly wind energy, is significantly driving UPR demand. UPR-based composites are essential for manufacturing wind turbine blades due to their lightweight and durable properties. As the U.S. invests more in renewable energy infrastructure, the demand for UPR in this sector is expected to rise. The material’s ability to withstand harsh environmental conditions and its cost-effectiveness make it ideal for large-scale renewable energy projects. This development enhances the performance and longevity of renewable energy installations and contributes to the broader adoption of sustainable energy solutions across the country.

-

Technological Advancements in UPR Formulations: Recent innovations have led to UPR formulations with enhanced UV resistance and thermal stability, broadening their applications in the construction and automotive sectors. Additionally, the integration of smart technologies into UPR products, such as embedding sensors for real-time performance monitoring, is gaining traction. These advancements align with the growing demand for high-performance materials. Improved durability and functionality make UPR-based products more competitive with traditional materials. The continuous development in this area reflects the industry’s commitment to meeting evolving consumer needs and regulatory standards, thereby driving further market growth.

-

Strategic Industry Collaborations and Investments: Key industry players are engaging in strategic collaborations, mergers, and acquisitions to strengthen their market position and expand their product portfolios. Investments in research and development are focused on creating high-performance and sustainable UPR solutions. These strategic moves aim to enhance production capacities, optimize supply chains, and foster innovation in product offerings. Collaborations between resin manufacturers and end-user industries facilitate the development of customized UPR formulations tailored to specific application requirements. Such partnerships and investments play a crucial role in driving technological advancements and meeting the increasing demand for UPR across various sectors.

-

Emphasis on Regulatory Compliance and Environmental Standards: The U.S. UPR market is increasingly influenced by stringent environmental regulations aimed at reducing volatile organic compound (VOC) emissions and promoting sustainable practices. Manufacturers are focusing on developing low-VOC and eco-friendly UPR formulations to comply with these regulations. This emphasis on regulatory compliance ensures that UPR products meet environmental standards, thereby enhancing their acceptance in environmentally conscious markets. Adhering to such regulations not only reduces environmental impact but also strengthens companies’ market positions by aligning with consumer preferences for sustainable products.

These developments highlight the evolving nature of the UPR market in the US, with a focus on sustainability, local production, and performance-driven innovations to meet both domestic and international demands.

Strategic Growth Opportunities for the US UPR Market

The US UPR market is poised for growth with opportunities in high-performance applications, bio-based resin development, and the renewable energy sector. Strategic advancements in technology and partnerships will further drive innovation and market expansion.

-

Expansion into High-Performance Applications: One of the most significant growth opportunities for the U.S. UPR market is expanding into high-performance sectors such as aerospace, defense, and industrial machinery. UPR can be tailored for specialized applications, with enhancements in fire resistance, impact strength, and thermal stability. By addressing the specific demands of these industries, UPR could position itself as an alternative to traditional materials like metals, creating new revenue streams and increasing market share..

-

Bio-Based Resin Development: As environmental concerns rise, the demand for sustainable, bio-based UPR alternatives is increasing. Manufacturers can capitalize on this by developing bio-based resins that are derived from renewable resources, such as plant oils and natural fibers. These resins appeal to industries seeking eco-friendly materials and can help meet stricter regulatory requirements while positioning brands as sustainable market leaders..

-

Technological Advancements in Resin Formulations: Investing in R&D to improve UPR formulations, such as enhanced UV resistance and heat resistance, will open up new market applications, particularly in construction, automotive, and marine sectors. Customizing UPR to meet the evolving needs of these industries can boost product competitiveness and expand market reach.

-

Strategic Partnerships and Mergers: Strategic collaborations, mergers, and acquisitions can help UPR manufacturers expand their market presence, optimize production capabilities, and access new technologies. Partnering with key industries that require specific UPR formulations or collaborating with end-users in various sectors will facilitate product innovation and support market growth.

-

Growing Demand for Light Weight Materials: The growing demand for lightweight and durable materials in the automotive sector is driving the use of UPR-based composites. As automakers seek to improve fuel efficiency, reduce emissions, and enhance electric vehicle (EV) performance, UPR composites are increasingly used in manufacturing lightweight body panels, bumpers, and other parts. Additionally, UPRs are valued for their high strength, corrosion resistance, and impact resistance, making them ideal for producing durable automotive components that can withstand harsh conditions.

The US UPR market holds significant growth potential through strategic initiatives like expanding into high-performance sectors, developing bio-based resins, and tapping into the renewable energy industry. Technological advancements and strategic partnerships will further strengthen market positioning. By embracing these opportunities, companies can drive sustainable growth and innovation in the UPR industry.

US UPR Market Drivers and Challenges

The US Unsaturated Polyester Resin (UPR) market is experiencing steady growth, driven by increasing demand from industries such as construction, automotive, marine, and renewable energy. UPR’s lightweight, durability, and cost-effectiveness make it a preferred material for various applications. However, the market also faces challenges, including environmental concerns and raw material price volatility. Understanding the key drivers and challenges shaping the market is crucial for businesses to capitalize on opportunities and mitigate risks.

The factors responsible for driving the US UPR market include:

-

Growing Construction Sector: The booming U.S. construction industry is a major driver of UPR demand. Used in composite materials for roofing, panels, and pipes, UPR offers durability, corrosion resistance, and design flexibility. The trend towards lightweight and high-strength materials further supports its growth.

-

Rising Automotive and Transportation Applications: The push for lightweight vehicles to improve fuel efficiency and reduce emissions is increasing UPR adoption in automotive components such as bumpers, body panels, and interior parts. UPR-based composites help manufacturers meet regulatory standards without compromising performance.

-

Expansion in Renewable Energy Applications: The growth of wind energy is driving demand for UPR in turbine blades and related structures. UPR's strength, weather resistance, and cost-effectiveness make it ideal for producing durable, high-performance wind turbine components.

-

Advancements in Bio-Based and Low-Styrene UPR: Innovation in sustainable resins, including bio-based and low-styrene UPR, is gaining traction due to increasing environmental regulations and consumer demand for eco-friendly materials. These formulations offer reduced VOC emissions and improved sustainability.

Challenges in the US UPR market include:

-

Raw Material Price Volatility: The fluctuating costs of raw materials like styrene, maleic anhydride, and glycols impact production costs and pricing strategies for UPR manufacturers. Dependence on petroleum-based inputs adds to the market’s vulnerability to economic and geopolitical fluctuations.

-

Environmental and Regulatory Challenges: Stricter environmental regulations on VOC emissions and hazardous chemicals are pressuring manufacturers to adopt cleaner production methods. Compliance with stringent U.S. EPA standards and industry regulations adds to operational costs and complexity.

-

Competition from Alternative Materials: UPR faces competition from epoxy, vinyl ester, and thermoplastics, which offer superior properties in specific applications. The continuous development of high-performance alternatives challenges UPR’s market position, requiring ongoing innovation to maintain competitiveness.

The US UPR market is poised for growth, driven by expanding applications in key industries, technological advancements, and a shift toward sustainable formulations. However, challenges such as raw material price fluctuations, regulatory constraints, and competition from alternative materials must be addressed. Companies that prioritize innovation, sustainability, and strategic partnerships will be best positioned to capitalize on emerging opportunities and sustain long-term market success..

List of Composites in the US UPR Market

Companies in the US market compete on the basis of resin quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies composites in US UPR market companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the composites in US UPR market companies profiled in this report include.

-

Polynt Group

-

AOC (Nippon Paint Holdings Co., Ltd)

-

INEOS Composites (KPS Capital Partners)

-

Scott Bader

-

Interplastic Corporation

-

BASF SE

-

Allnex (PTT Global Chemical Group)

US UPR Market by Segment

Lucintel forecasts that construction will remain the largest end use industry over the forecast period due to increasing infrastructure projects, renovations, and the demand for lightweight, durable composite materials. The study includes a forecast for the US UPR market by end use industry, product type, and manufacturing process as follows:

By End Use Industry [Value ($M) and Volume (M lbs.) Analysis for 2019 – 2031]:

-

Pipe and Tank

-

Transportation

-

Construction

-

Marine

-

Electrical and Electronics

-

Consumer Goods

-

Others

By Product Type [Value ($M) and Volume (M lbs.) Analysis for 2019 – 2031]:

-

Orthophthalic

-

Isophthalic

-

DCPD and Other Product Types

By Manufacturing Process [Value ($M) and Volume (M lbs.) Analysis for 2019 – 2031]:

-

Hand Layup & Spray-Up

-

Filament Winding

-

Compression Molding

-

RTM/Injection Molding

-

Pultrusion

-

Other Manufacturing Processes

Features of the US UPR Market

-

Market Size Estimates: The US UPR Market size estimation in terms of value ($M) and volume (M lbs.).

-

Trend and Forecast Analysis: Market trends (2019-2024) and forecast (2025-2031) by various segments.

-

Segmentation Analysis: Market size by end use industry, product type, and manufacturing process.

-

Growth Opportunities: Analysis of growth opportunities in different end use industries, product type, and manufacturing process.

-

Strategic Analysis: This includes M&A, new product development, and competitive landscape for the US UPR market.

-

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the US UPR market size?

Answer: The US UPR market is expected to reach an estimated $2 billion by 2031.

Q2. What is the growth forecast for US UPR market?

Answer: The US UPR market is expected to grow at a CAGR of 3% from 2024 to 2031.

Q3. What are the major drivers influencing the growth of the US UPR market?

Answer: The major driver for this market is growing demand for UPR in the construction industry, growth in automotive sector, and increasing demand for UPR in industrial applications.

Q4. What are the major applications or end use industries for the US UPR market?

Answer: Construction and Pipe and tank are the major end use industries in the US UPR Market.

Q5. What are the emerging trends in composites in US UPR market?

Answer: Emerging trends, which have a direct impact on the dynamics of the US UPR market, include growth in demand for lightweight and high-performance composites, rising adoption of sustainable and bio-based UPR, expanding applications in renewable energy, technological advancements in fire-retardant UPR, and increasing investment in infrastructure and smart cities.

Q6. Who are the key composites in US UPR market companies?

Answer: Some of the key composites in US UPR market companies are Polynt Group, AOC (Nippon Paint Holdings Co., Ltd), INEOS Composites (KPS Capital Partners), Scott Bader, Interplastic Corporation, BASF SE, and Allnex (PTT Global Chemical Group)

Q7.Which composites in US UPR market manufacturing process will be the largest in future?

Answer: Lucintel forecasts that pultrusion is expected to remain the largest manufacturing process over the forecast period due to superior strength-to-weight ratios for structural applications and increased use of lightweight composites to improve fuel efficiency and reduce emissions.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 10 key questions

Q.1 What are some of the most promising potential, high growth opportunities for the US UPR Market by end use industry (pipe and tank, transportation, construction, marine, electrical and electronics, consumer goods, and others), product type (orthophthalic, Isophthalic, and DCPD and others), manufacturing process (hand-lay up & spray-up, filament winding, compression molding, RTM/injection molding, pultrusion, and other manufacturing processes)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.4 What are the business risks and threats to the market?

Q.5 What are the emerging trends in this market and the reasons behind them?

Q.6 What are the changing demands of customers in the market?

Q.7 What are the new developments in the market? Which companies are leading these developments?

Q.8 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.9 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.10 What M & A activities have taken place in the last 7 years in this market?