The Impact of COVID-19 is included in the United States Carbon Black Market. Buy it today to get an advantage.

Request the impact of COVID-19 on your product or industry

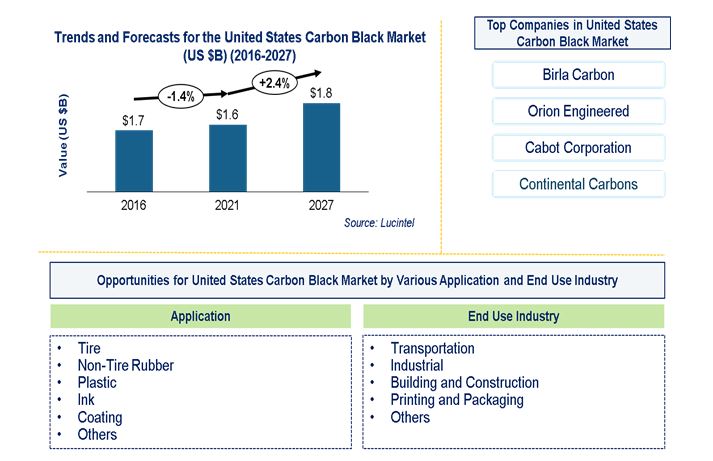

United States Carbon Black Market Trends and Forecast

The future of the United States carbon black market looks promising with opportunities in the transportation, industrial, building and construction, and printing and packaging market. The United States carbon black market is expected to reach an estimated $1.8 billion by 2027 with a CAGR of 2.4% from 2021 to 2027. The major drivers for this market are growing demand for carbon black from tire and industrial rubber compound.

Emerging Trends in the United States Carbon Black Market

Emerging trends, which have a direct impact on the dynamics of the industry, include shift from commodity to more specialized grade carbon black and increasing use of carbon black as pigment in lightweight auto parts to enhance the conductivity and UV protection properties.

A total of 63 figures / charts and 18 tables are provided in this 101-page report to help in your business decisions. A sample figure with insights is shown below. To learn the scope of benefits, companies researched, and other details of the carbon black in textile market report, please download the report brochure.

The United States Carbon Black by Segment

The study includes a forecast for the United States carbon black market by application and end use industry as follows:

United States Carbon Black Market by Application [Value ($M) and Volume (Kilotons) shipment analysis for 2016 – 2027]:

United States Carbon Black Market by End Use Industry [Value ($M) and Volume (Kilotons) shipment analysis for 2016 – 2027]:

List of United States Carbon Black Companies

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies United States carbon black companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the United States carbon black companies profiled in this report includes.

United States Carbon Black Market Insight

-

Lucintel predicts that the tire application is expected to remain the largest segment during the forecast period supported by continuously increasing fleet size of passenger cars and light commercial vehicles.

-

Within the carbon black market, the transportation industry is expected to remain the largest market by value and volume. Increasing demand for tire and other rubber molded parts are expected to spur growth for this segment over the forecast period

Features of United States Carbon Black Market

-

Market Size Estimates: United States Carbon black market size estimation in terms of value ($M) and volume (kilotons)

-

Trend and Forecast Analysis: Market trends (2016-2021) and forecast (2022-2027) by various segments.

-

Segmentation Analysis: Market size by application and end use industry.

-

Growth Opportunities: Analysis of growth opportunities in different application and end use industry for the United States carbon black market.

-

Strategic Analysis: This includes M&A, new product development, and competitive landscape for the United States carbon black market.

-

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the United States carbon black market size?

Answer: The United States carbon black market is expected to reach an estimated $1.8 million by 2027

Q2. What is the growth forecast for United States carbon black market?

Answer: The United States carbon black market is expected to grow at a CAGR of 2.4% from 2021 to 2027.

Q3. What are the major drivers influencing the growth of the carbon black in textile market?

Answer: The major drivers for this market are growing demand for carbon black from tire and industrial rubber compound.

Q4. What are the major applications or end use industries for United States carbon black?

Answer: Transportation is the major end use industries for United States carbon black.

Q5. What are the emerging trends in United States carbon black market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include shift from commodity to more specialized grade carbon black and increasing use of carbon black as pigment in lightweight auto parts to enhance the conductivity and UV protection properties.

Q6. Who are the key United States carbon black companies?

Answer: Some of the key carbon black companies are as follows:

-

Birla Carbon

-

Cabot Corporation

-

Orion Engineered Carbons

-

Continental Carbon

Q7.Which United States carbon black application segment will be the largest in future?

Answer: Lucintel predicts that the tire application is expected to remain the largest segment during the forecast period supported by continuously increasing fleet size of passenger cars and light commercial vehicles.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high growth opportunities for the United States carbon black market by application (tire, non-tire rubber, plastic, ink, coating, and others) and end use industry (transportation, industrial, building and construction, printing and packaging, and others)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 Which country will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 5 years in this market?