Thermoset Resin in Adhesive Market Trends and Forecast

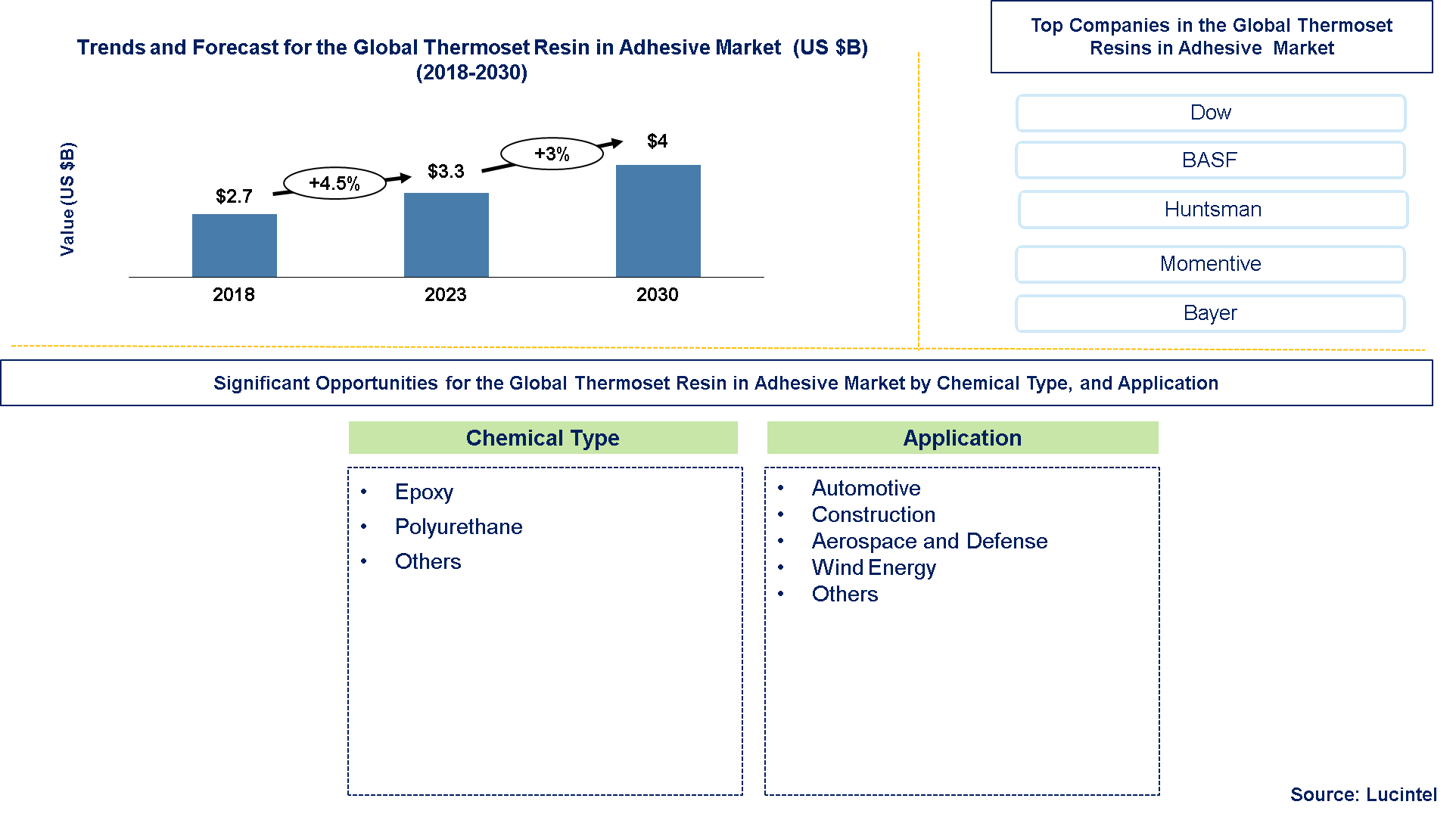

The future of the global thermoset resin in adhesive intermediate material market looks promising with in the automotive, construction, aerospace and defense, and wind energy market. The global thermoset resin in adhesive market is expected to reach an estimated $4 billion by 2030 with a CAGR of 3% from 2023 to 2030. The major growth drivers for this market are high-performance materials, technological advancements in adhesive formulations, and growth in end-user industries.

Thermosetting adhesives made from resin, hardener and filler. The more common resins are epoxy, phenolic and polyester which form the adhesive bonding strength and durability. Curing agents or hardeners like peroxides or amines initiate the cure in the adhesive. Adhesive properties get improved by adding fillers such as silica or glass fibers, apart from modifying viscosity. By reason of their sophisticated chemical features and healing courses, thermoset resins adhesives are more costly than conventional adhesives. They cost this way for superior performance in high stress and high temperature uses. Their strength and unique properties justify their extra cost even if they are expensive.

• Lucintel forecasts that in this market, epoxy resin adhesives will remain the largest end use supported by growing automotive production and increasing focus on lightweight materials.

• Automotive will remain the largest segment over the forecast period supported by its high performance characteristics and it is also expected to witness the highest growth over the forecast period.

• Asia Pacific is expected to remain the largest market by value and volume. ROW is expected to witness the highest growth over the forecast period because of growing demand from automotive and other end uses.

Country wise Outlook for the Thermoset Resin in Adhesive Market

The thermoset resin in adhesive market is witnessing substantial growth globally. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major thermoset resin in adhesive producers in key regions: the USA, Germany, China, and India.

Emerging Trends in the Thermoset Resin in Adhesive Market

Emerging trends in the thermoset resin in adhesive Market shaping its future applications and market dynamics:

• The Growth of Formulation Technology: Advanced thermoset resins that have high performance characteristics which include better resistance to heat, chemicals and improved strength. New formulation techniques are serving the needs of challenging sectors like aerospace, vehicles among others.

• Customization for Specific Use: Designing resin formulations in order to cater to different sectors including custom adhesives for extreme temperatures and unique bonding requirements in electronic gadgets.

• Rising Demand for Lightweight Materials: The Use of lightweight thermosetting adhesive resins in automobiles is increasing to decrease vehicle weight, increase fuel efficiency and reduce accidents. Adhesives have been created with a view to joining light materials such as carbon fibers and advanced composites.

• Aerospace Applications: The airline industry has shifted towards lightweight thermosetting adhesives as one way of reducing weight on airplanes hence saving fuel. These types of adhesives form very strong bonds but they weigh very little because aircraft parts need not be heavy.

• Increased Use in Renewable Energy: Thermosetting resin adhesives are increasingly being used in the manufacture and repair of wind turbines due to their durability under harsh weather conditions. The adhesives are essential for bonding components within windmill blades and other structures. To last longer and work better, solar modules utilize thermoset resin adhesive. Thus, this is how it supports efficient and reliable renewable energy systems.

A total of 140 figures / charts and 97 tables are provided in this 205-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Thermoset Resin in Adhesive Market

Recent developments in thermoset resin in adhesive market by various companies highlight ongoing innovations and advancements across different sectors:

Aerospace Industry

• Advanced Formulations: A new range of thermoset resin in adhesive specifically for aerospace applications was introduced by Huntsman Advanced Materials. They have improved heat resistance and durability as they meet the rigorous requirements that come with aircraft making and maintenance.

• Partnerships: Hexcel and 3M announced a strategic collaboration to develop next-generation adhesives for aerospace composite materials, aiming to improve bonding performance and reduce weight in aircraft components.

Automotive Sector

• Innovative Products: BASF launched a high-performance automotive adhesive based on thermoset resins targeting lightweight materials such as carbon fiber composites. This is designed to lighten cars while maintaining their classiness, efficiency, and security in line with industry’s stringent regulations.

• Expansion: H.B. Fuller has broadened its portfolio of adhesives with the addition of new thermoset resins meant for automotive assembly processes that will enhance adhesion performance even in harsh environments thereby giving them best possible durability.

Construction and Infrastructure

• New Solutions: Sika AG introduced advanced thermosetting resin adhesives for construction applications including high-strength bonding solutions for structural elements and prefabricated components. These products target the rising demand for sustainable construction materials.

• Local Production: Pidilite Industries set up a new production facility in India to manufacture thermoset resin in adhesive for the construction sector, aiming to cater to increasing infrastructure development needs in the region.

Electronics and Consumer Goods

• Smart Adhesives: Loctite developed a range of smart integrated technology thermosetting adhesive systems used in electronics. They feature enhanced thermal conductivity as well as electrical insulation which are crucial to modern electronics.

• Product Launch: Dow Chemical Company recently unveiled consumer-oriented thermosetting adhesive system particularly designed with emphasis on having strong bonds and being environmental friendly; hence improving reliability and performance of various electronic devices.

Strategic Growth Opportunities for Global Thermoset Resin in Adhesive Market

Expansion to New Markets

• Asia-Pacific Region: This region is undergoing rapid industrialization and its manufacturing industry is expanding. The automobile, electronic, and building sectors will rise further due to increasing demand for sophisticated stick solutions.

• Latin America and Africa: New market prospects in Latin America and Africa are available as infrastructure developments have now started taking place in these regions as well as industrial activities. Manufacturing facilities and distribution networks set up locally can capture these new markets.

Innovative Product Development

• High-Temperature and High-Stress Applications: Investing in R&D to develop epoxy adhesive for thermo-setting resin capable of withstanding extreme temperatures or stress conditions for use in industries such as aerospace, defense, high-performance automotive applications among others.

• Enhanced Adhesive Properties: Focus on developing adhesives which possess greater flexibility, impact resistance as well as adhesive strength that meet changing demands of multiple applications.

Strategic Partnerships and Alliances

• Collaborations with OEMs: Establishing strategic partnerships with original equipment manufacturers (OEMs) so that thermosetting resins can be incorporated into new product designs at the development stage thereby ensuring they are compatible while enhancing market presence.

• Research Collaborations: Research institutions and technology providers are the partners from whom we gain insights into adhesive technologies driving innovation, new application areas but also keep pace with changes brought by the industry.

Sustainability Initiatives

• Green Chemistry Practices: Sustainable manufacturing practices under “green chemistry” encompass eco-friendly thermoset resin in adhesive. This involves minimizing environmental footprints from production processes while designing low environmental footprint adhesives through reducing their environmental impact during manufacture.

• Circular Economy Approaches: Circular economy principles direct our efforts towards developing recyclable or biodegradable adhesives that contribute to sustainability objectives and address waste management related regulatory pressures.

.

Thermoset Resin in Adhesive Market Drivers and Challenges

The thermoset resin in adhesive market is pivotal in industries requiring corrosion-resistant storage solutions. Driven by benefits like growing demand for high-performance materials, technological advancements in adhesive formulations, and growth in end-user industries, it faces challenges such as high initial cost and environmental and regulatory compliance.

The key drivers for the Global Thermoset Resin in Adhesive Market Include:

1. Growing Demand for High-Performance Materials: Industries including aerospace, automotive and electronics are key contributors to market demand for thermoset resin in adhesive on account of their superior mechanical strength, durability as well as heat resistance. They are necessary in applications involving high-performance bonding such as aeronautical structures, car parts and electronics supporting a product’s enhanced safety, reliability, and service life.

2. Technological Advancements in Adhesive Formulations: Advances in polymer chemistry have led to improved thermal stability, chemical resistance, and curing processes that have resulted in new adhesives with far-reaching benefits to major industries including consumer goods among others.

3. Growth in End-User Industries: Construction industry has expanded over time while the demand for renewable energy resources is increasing resulting to increased consumption of thermosetting adhesive materials. They are used in construction for structural bonding purposes whereas; in renewable energy sector they are very essential during manufacture of wind turbines and solar panels among others due to their reliable properties compared to other types of adhesive products.

Challenges in the Thermoset Resin in Adhesive Market

1.High Cost of Raw Materials: The production costs associated with manufacturing thermosetting resins are generally high because raw materials utilized such as epoxy resins come at higher prices when compared with non-epoxy alternatives or alternative chemistries available globally leading also to elevated production costs which can increase end product price hence limiting its adoption rate within markets that are highly sensitive on pricing thereby undermining competitiveness mainly within strongly budgeted industries as well.

2. Environmental and Regulatory Compliance: Businesses must comply with stringent environmental laws governing volatile organic compounds (VOCs), waste management and recycling when using thermoset resin in adhesive. Ongoing investments into research & development programs aimed at creating environmentally friendly formulations and adjusting to ever changing rules coupled with operational complexities and costs are all required in order for them to stay compliant with the relevant regulations.

There, the thermoset resin in adhesive market is driven by technological innovations and the growing demand from high-performance industries. Nonetheless, it has to deal with hurdles because of expensive raw materials and regulatory compliance. Overcoming these challenges through eco-friendly formulations and efficient production methods will be vital in capturing market growth opportunities.

Thermoset Resin in Adhesives Suppliers and Their Market Shares

In this globally competitive market, several key players such as Dow, BASF, and Huntsman etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies thermoset resin in adhesive companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the thermoset resin in adhesive companies profiled in this report includes.

• Dow

• BASF

• Huntsman

• Momentive

• Bayer

• Polynt

• AOC

• Olin Epoxy

These companies have established themselves as leaders in the global thermoset resin in adhesive market, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the thermoset resin in adhesive market are evolving, with the entry of new players and the emergence of innovative thermoset resin in adhesive market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Thermoset Resin in Adhesive Market by Segment

The major growing segments of thermosetting resin adhesives are aerospace and automotive industries as they need bonding solutions that are able to withstand high temperature. The sector of electronics is expanding because of the need for adhesives having excellent thermal stability and electrical insulation. Furthermore, construction industry makes use of these adhesive materials due to their long lastingness and strong bond in structural application as well.

The study includes a forecast for the thermoset resin in adhesive industry market by type, application, and region as follows:

Thermoset resin adhesive market by chemistry [Value ($M) Volume (M lbs/Kilo ton) Analysis for 2018 to 2030]:

• Epoxy Resin

• Polyurethane Resin

• Others

Thermoset resin adhesive market by end use application [Value ($M) Volume (M lbs/Kilo ton) Analysis for 2018 to 2030]:

• Automotive

• Construction

• Aerospace and Defense

• Wind Energy

• Others

Thermoset resin adhesive market by region [Value ($M) Volume (M lbs/Kilo ton) Analysis for 2018 to 2030]:

• North America

• Europe

• Asia Pacific

• Rest of the World

Features of Thermoset Resin in Adhesive Market

• Market Size Estimates: thermoset resin adhesives market size estimation in terms of value ($M) and (M lbs).

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Market size by chemical type and application,

• Regional Analysis: thermoset resin in adhesive market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different chemical type, application, and region for the thermoset resin in adhesive market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the thermoset resin in adhesive market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

.

If you are looking to expand your business in Thermoset Resin Adhesivesor adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the thermoset resin in adhesive market size?

Answer: The global thermoset resin in adhesive market is expected to reach an estimated $4 billion by 2030.

Q2. What is the growth forecast for thermoset resin in adhesive market?

Answer: The thermoset resin in adhesive market is expected to grow at a CAGR of 3% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the thermoset resin in adhesive market?

Answer: The major growth drivers for this market are growing demand for high-performance materials, technological advancements in adhesive formulations, and growth in end-user industries.

Q4. What are the major applications or end use industries for thermoset resin in adhesive?

Answer: Automotive is the major application for thermoset resin in adhesive.

Q5. What are the emerging trends in thermoset resin in adhesive market?

Answer: Emerging trends which have a direct impact on the dynamics of the industry include the growth of formulation technology, customization for specific use, rising demand for lightweight materials, aerospace applications, and increased use in renewable energy.

Q6. Who are the key thermoset resin in adhesive companies?

Answer: Some of the key thermoset resin in adhesive companies are as follows:

• Dow

• BASF

• Huntsman

• Momentive

• Bayer

• Polynt

• AOC

• Olin Epoxy

Q7.Which thermoset resin in adhesive fiber type segment will be the largest in future?

Answer: Lucintel forecasts that epoxy resin based thermoset resin in adhesive will remain the largest segment and it is also expected to witness the highest growth over the forecast period supported by its high performance characteristics.

Q8. In thermoset resin in adhesive market, which region is expected to be the largest in next 7 years?

Answer:Asia Pacific is expected to remain the largest region and witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer:Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high growth opportunities for the global thermoset resin in adhesive market by chemical type (epoxy, polyurethane, and others), application (automotive, construction, aerospace and defense, wind energy, and others), and region (North America, Europe, Asia Pacific and Rest of the World)?

Q. 2. Which segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5. What are the business risks and threats to the market?

Q.6. What are the emerging trends in this market and the reasons behind them?

Q.7. What are the changing demands of customers in the market?

Q.8. What are the new developments in the market? Which companies are leading these developments?

Q.9. Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11. What M & A activities have taken place in the last five years in this market?