Silane Market Trends and Forecast

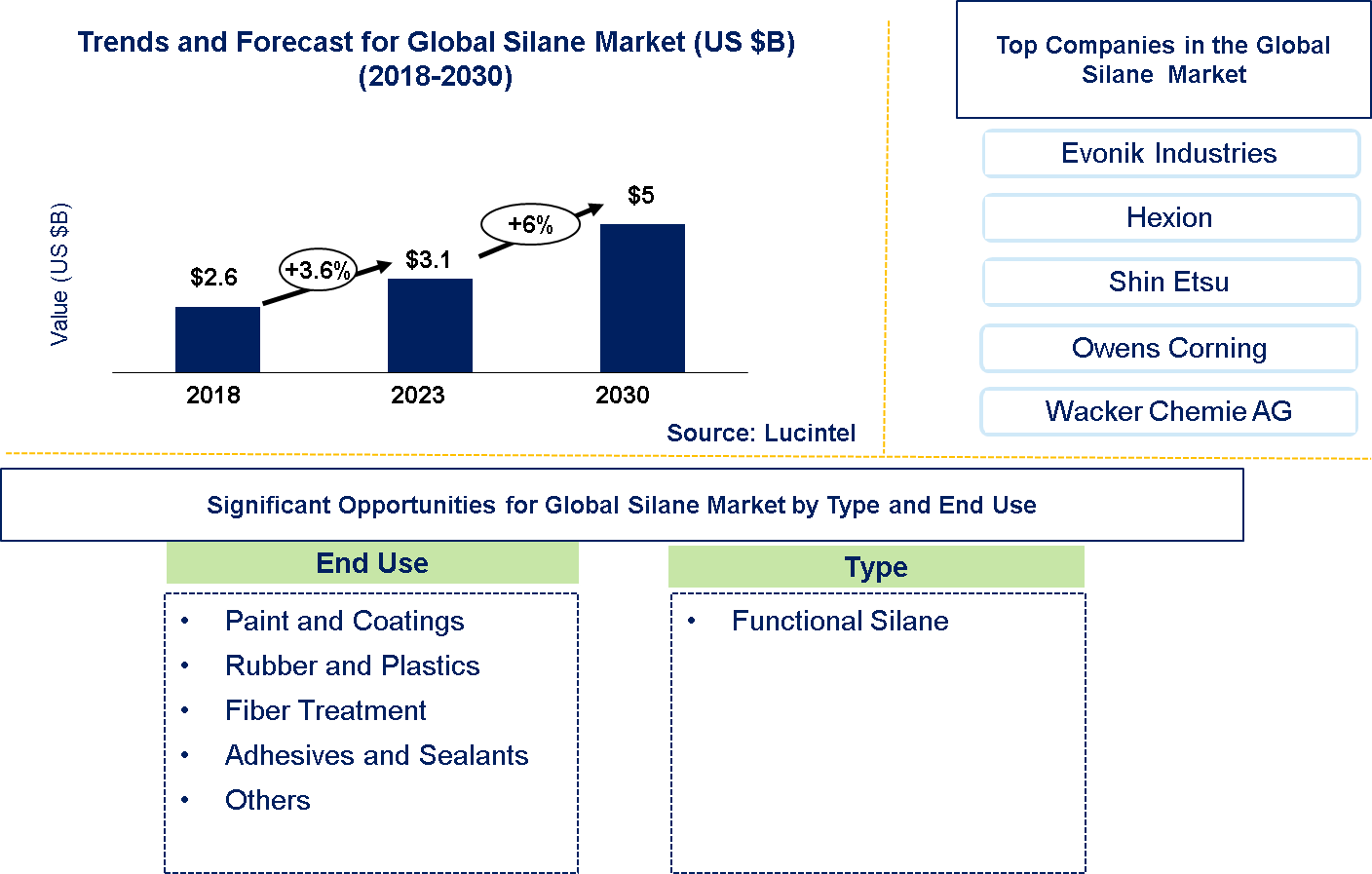

Lucintel finds that the future of the silane manufacturing market looks good with opportunities in end use application segments, including paints and coatings, rubber and plastics, adhesives and sealants, fiber treatment, and others. The silane market is expected to reach an estimated $5 billion by 2030 with a CAGR of 6% from 2023 to 2030. The major drivers for growth in this market are increasing demand for green tires, composite materials, and growing demand for water based coating formulations.

Silane is a very important chemical in different sectors, and it is typically made from silicon metal, hydrogen gas or hydrochloric acid. Silane gas is produced by complex manufacturing processes that involve the thermal decomposition and hydrolysis of these materials. Concerning its price competitiveness, the cost of silane can vary significantly due to factors such as market demand, availability of raw materials and production efficiency. In contrast with other functional silane or silicon-based substances among these being its pricing structure which hinges on its unique chemical properties however this value is added across various sectors notably electronics automotive construction whose price fluctuations also affect silane’s market value compared to other firms within the same industry.

• Lucintel forecasts that the paint and coatings segment and the fiber treatment segment will show above average growth during the forecast period.

• The paint and coatings segment is expected to remain the largest market in terms of value and volume consumption. The major driver for this segment are increasing automotive production, growing investments in building and infrastructure, and rising demand for water based coating formulations.

• Asia Pacific (APAC) is expected to remain the largest region by value and volume; APAC is also expected to experience the highest growth over the forecast period due to growth in end use industries. Increasing automotive production, rising construction and infrastructure activities, expanding electronic market, and demand for rubber and plastic products especially in China and India are the major growth drivers.

Country wise Outlook for the Silane Market

The silane market is witnessing substantial growth globally, driven by increased demand from various industries such as sports. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major silane producers in key regions: the USA, EU, China, India, and Brazil

Emerging Trends in the Silane Market

Emerging trends in the silane market shaping its future applications and market dynamics:

• Increased Demand in Construction and Infrastructure: Silanes are vital to construction materials like adhesives, coatings, and sealants as they enhance adhesion, waterproofness, and longevity. Silanes are needed more to strengthen durability and performance of these materials due to increasing infrastructure projects globally especially in developing countries.

• Shift towards Sustainable and Eco-Friendly Solutions: In a variety of fields, it is noticeable that companies strive for ecological balance by making use of environment friendly raw materials. This is where silanes come into play as there are now renewable sources used for their production or they have become low-VOC (Volatile Organic Compound) formulations. They help meet the needs of environmentally conscious buyers as well as regulatory policies aiming at minimizing environmental harm.

• Growth in Automotive and Transportation Sectors: Silanes serve a role in vehicle manufacture such as lightweight composites, tire enhancement for better fuel efficiency through adhesion and reinforcement properties. The demand for electric vehicles (EVs) coupled with advances in automotive materials also drive silane adoption within this industry.

• Advancements in Adhesive and Sealant Applications: They improve adhesion on different substrates for adhesive bonding process which exhibit considerable moisture resistance while prolonging the life span of products necessary in binders or glues. The emergence of hybrid silane-modified polymers (SMPs)and Silane-Terminated Polymers(STPs),on the other hand have led to development of new age sealants having outstanding properties that surpass those possessed by traditional ones.

• Growing Importance in Electronics and Semiconductor Industries: In electronics, silanes are used to coat surfaces improving adhesion while protecting from moisture damage corrosion etc. As semiconductor technology continues to evolve rapidly alongside electronic devices, specialized silanes tailored toward precise surface modification with advanced material compatibility will be highly sought after.

• Focus on Research and Development: Ongoing research and development efforts are focused on enhancing the properties and functionalities of silanes. This includes developing silanes with tailored chemical functionalities for specific applications, improving their compatibility with various substrates, and optimizing their performance under challenging environmental conditions.

• Regulatory and Compliance Considerations: Regulatory pressures regarding environmental and health safety standards continue to influence the silane market. Manufacturers are investing in developing silanes that comply with stringent regulations such as REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances), ensuring market acceptance and sustainability.

The silane market is positioned for growth as it has several applications in construction, automotive, electronics and other industries. Silane formulations are evolving to meet the sustainability demands, technological advancements and regulatory compliance leading to a wider application scope. In order to benefit from these changing global silane market dynamics that are shaped by innovation, environmental consciousness and compliance with legal framework, the industry players should adapt accordingly

A total of 120 figures / charts and 94 tables are provided in this 177-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Silane Market

Recent developments in silane market highlighting ongoing innovations and advancements across different sectors:

• Nanotechnology Silanes for Advanced Applications: The increasing popularity of nanometer size silanes has led to a higher level of surface modification and increased efficiency in various fields including electronics, coatings, and biomaterials. Among others, these will be used by high-tech companies because they have excellent adhesion, diffusion barrier properties and compatibility with novel materials.

• Silane focus is on functional ones: These are preferred for their ability to tune properties of materials and improve performance in special applications. Examples of such include silanes that contain amino, epoxy or vinyl groups that are used as an additive for better bonding, cross-linking, and composite formation in the adhesive industry.

• Demand trends in Renewable Energy: Due to the use of silanes for making Photovoltaic (PV) modules needed for solar energy production especially; demand for them has gone up as renewable sources expand. Such compounds increase encapsulant adhesion strength & moisture resistance thus improving durability, weatherability and efficiency of PV modules ultimately driving growth within the sector.

• Green and Sustainable Initiatives: Efforts to make eco-friendly sustainable silane formulations are gaining momentum. Stakeholders in this sector want eco-silane products that reduce GHG emissions from production processes through the use of bio-based feedstock options or less volatile organic compound (VOC) or solvent-free alternatives. These interventions support global commitments towards greener business practices thereby boosting uptake among pro-environment sectors.

• Technological Innovations in Coatings and Adhesives: Coating systems have been transformed by advances made in silane technology leading to durable flexible products with enhanced performance characteristics. Some examples included within this category consist of Silane Modified Polymers (SMPs) and Silane Terminated Polymers (STPs) which mix the best polymer features with those exhibited by silanes producing quality construction materials meant for hard duty tasks under automotive sector aerospace industries among others.

• Asia-Pacific Expanding Markets: Silanes are still a major item in the expanding markets of Asia-Pacific since more industries are coming up here rapidly and new cars are being manufactured. Some of the main building, electronic and automobile industry hubs like China, India; South East Asian countries etc. have been at the receiving end of increased investments leading to a rise in demand for silanes across many applications.

• Collaborative Research and Development: Innovation on silane technology is being driven by partnerships between companies, research institutions and universities. These research consortiums focus on various fronts including development of new silane chemistries, improving manufacturing processes for silanes targeting novel applications that come with emerging trends in market demands.

Strategic Growth Opportunities for Silane Market

• Expansion in Construction and Infrastructure: Silanes are increasingly used to enhance the durability, withstand harsh weather conditions and sustainable of building materials in building projects. These include applications such as concrete treatments, waterproofing membranes and sealants that address the increasing desire for high performance buildings.

• Focus on Eco-friendly Solutions: Silane manufacturers now face a growing demand for environmentally friendly products that can align with sustainability objectives. There are innovations, which have been made on recyclable and biodegradable silanes not only to meet regulatory stipulations but also appeal to environmentally aware consumers and businesses who want more eco-friendly options.

• Technological Advancements in Manufacturing Processes: Continuous improvements in manufacturing technologies are critical for enhancing production efficiency, reducing costs, and expanding market competitiveness. This encompasses progressions in process automation, feedstock utilization as well as quality control systems.

• Expansion into Automotive and Electronics Applications: Silanes play a critical role in automotive adhesives, sealants, and coatings, offering superior bonding properties and corrosion resistance. Similarly, they are essential in electronics for surface modification and semiconductor manufacturing, tapping into the expanding electronics market.

• Diversification into Healthcare and Personal Care Products: The healthcare and personal care sectors present opportunities for silanes in medical devices, where they are used for biocompatibility and surface modification. In cosmetics and personal care products, silanes contribute to stability and performance enhancements

Silane Market Drivers and Challenges

The silane market, which is crucial for the construction industry, automobile manufacturing, electronics and clean energy sector among others, has a vibrant outlook as it grows with technological advancements and various applications. Silanes are chemical substances used in industries to improve adhesiveness of different materials as well as endurance durability and performance. The demand for novel silane solutions will continue to rise in line with increased emphasis on sustainability and performance by industrial sectors amid global infrastructure development race. Nonetheless, this market is also facing some barriers including; complicated regulations, high production costs and stiff competition from other players. In order to navigate through the changing landscape of the silane market stakeholders need to comprehend these dynamics in order to leverage on opportunities presented by the same.

The key drivers for the Silane Market

• The Demand Boom in Construction and Infrastructure: Silane is vital for enhancing the performance of other construction materials like adhesives, sealants, and coatings. Growing global infrastructure projects necessitate use of silanes that enhance longevity, waterproofing as well as durability of such buildings and infrastructures.

• Growth in Automotive Industry: In the automotive industry, silanes are key to improving tire performance metrics, exploiting lightweight materials to enhance fuel efficiency as well as providing better adhesion when it comes to composite materials. More advanced silane technologies are therefore demanded by increase in the automotive industry particularly in emerging markets.

• Increasing Adoption into Electronics and Semiconductors: Silanes serve a critical role surface modification and protection in electronics manufacturing, semiconductor manufacturing and display technologies. Advancement in technology has necessitated using more silanes so as to improve device performance and reliability due to a surge in demand for consumer electronics.

• Renewable Energy Technology Improvements: Silanes used for encapsulant materials in photovoltaic (PV) modules improve weatherability and efficiency within the solar energy sector. This will result into increased demand for silanes used PV module production due to the prominence of renewable energy sources globally hence expanding solar installations.

• Technological Innovations Driving Coatings And Adhesives Development: The development of market thrived on innovations in regard with silane based coatings; adhesives’ sealants among others. These have been developed through functionalized silanes thus have found application ranging from automobile coating manufacturing industries’ glues because they help boost their chemical resistance strength along with endurance levels.

• Government Regulations and Green Initiatives: This has led to a rise environmental awareness causing manufacturers to come up with eco-friendly formulations of silanes which comply with strict VOC emission standards. Moreover, environmentally-conscious companies are increasingly opting for sustainable silane products obtained from bio-renewable feedstock or having limited ecological damage.

The key challenges in the Silane Market

• High Price of Silane Products: The cost of silanes may be relatively high as the expense of raw materials and specialized manufacturing process are involved. Market adoption can be limited by high production costs, particularly in emerging markets and price-sensitive industries.

• Silane Chemistry Complexity: To achieve desired performance characteristics, accurate formulation is needed for complex silane chemistry. For manufacturers however, developing new silane products with optimized properties while still being compatible with a wide range of substrates poses technical challenges.

• Market Fragmentation and Intense Competition: There are several global and regional players who compete in the silane market offering a variety of products. Products need to be innovative, quality assured and customer service excellence as competition is intense.

• Supply Chain Risks: Silane industry is prone to supply chain disruptions such as transportation problems or even geopolitical issues that affect availability of raw materials. In order to maintain production schedules and satisfy customers’ needs there must be a reliable supply chain.

• Regulatory Compliance and Safety: Tight regulations on chemical safety, handling, environmental impact etc. may apply to silanes. It takes significant resources as well as expertise to comply with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) among other local standards.

• Limited Awareness and Education: Users have little understanding about the positive aspects or uses of silanes mainly if they come from emerging markets or those sectors which have not embraced the technology before. Educating them through training initiatives will thus lead to increased market penetration thus encouraging use of solutions based on silanes.

In a word, the silane market is full of potential and even more exciting than that. Infrastructure developments have increased significantly, and this has pushed the demand for silanes up. Nevertheless, the sector is characterized by complexity in chemistry due to strict regulatory compliance and competition from other players. A dynamic and competitive global market that ensures sustainability through innovative solutions, sustainable practices, and regulatory conformity as well as addresses these challenges will position its stakeholders to succeed. To ensure sustainability of growth and market leadership in future years requires continuous innovation in terms of technology, cooperation across different industries involved with silicones, responsiveness to emerging trends

Silane Market Suppliers and Their Market Shares

In this globally competitive market, several key players such as Evonik Industries, Dow, Owens Corning, Hexion, Shin Etsu, and Wacker Chemie AG etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum mark

Silane Market by Segment

Silane market growth is being witnessed across several significant segments in line with technological advancements and expanding usage of the product in various industries. The construction and infrastructure sectors are utilizing silanes as sealants, adhesives, and coatings to enhance strength and water-proofing ability amidst increasing global infrastructure projects. Silanes are utilized by automotive and transportation industries to improve tire performance as well as raise fuel efficiency in lightweight materials while also optimizing adhesion especially in composites given the current surge in electric vehicle production. Silanes are critical in electronics and semiconductor for specific surface modification, moisture protection, among other things requiring good stickiness that supports rapid development of high performance electronic devices or displays. Photovoltaic firms continue to adopt silanes for enhancing solar panel durability and efficiency motivated by global renewable energy inclination. Silanes’ versatility plays a key role toward improving bonding strength, flexibility, and surface properties of adhesives & sealants; bio-medicals; paints & lacquers exemplifying their importance to modern industrial solutions.

Silane Market by End Use [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Paint and Coatings

• Rubber and Plastics

• Fiber Treatment

• Adhesives and Sealants

• Others

Silane Market by Type Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Functional Silane

• Mono Silane

Silane Market by Region [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

Features of Silane Market

• Market Size Estimates: Silane market size estimation in terms of value ($M) and volume ( M lbs)

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Market size by end use, type, and region

• Regional Analysis Composite cardboard tube packaging market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different end use, type, and region

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for silane market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in silane market or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ_

Q1. What is the silane market usage?

Answer: The consumption of silane market is expected to reach an estimated $5 billion by 2030.

Q2. What is the growth forecast for silane market?

Answer: The use of silane market is expected to grow at a CAGR of 6% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the use of silane market?

Answer: The major drivers for this market are increasing demand for green tires, composite materials, and growing demand for water based coating formulations.

Q4. What are the major applications of silane market?

Answer: Paint and Coatings, and rubber and plastics are the major application segments for silane market.

Q5. What are the emerging trends in silane market?

Answer: Emerging trends, which have a direct impact on the dynamics of the silane industry, include increasing demand for silane for smart surface treatment and low VOC emitting process.

Q6. Who are the key companies of silane market?

Answer: Some of the key flame retardant resin companies in the global transportation composites market are as follows:

• Evonik Industries

• Owens Corning

• Hexion

• Shin Etsu

• Wacker Chemie AG

Q7.Which will be the largest segment in the future in the g silane market usage?

Answer: Lucintel forecasts that the paint and coatings segment is expected to remain the largest market in terms of value and volume consumption. The major driver for this segment are increasing automotive production, growing investments in building and infrastructure, and rising demand for water based coating formulations.

Q8: In terms of silane market, which region is expected to be the largest in the next five years?

Answer: Asia Pacific (APAC) is expected to remain the largest region by value and volume; in next 7 years APAC is also expected to experience the highest growth over the forecast period due to growth in end use industries. Increasing automotive production, rising construction and infrastructure activities, expanding electronic market, and demand for rubber and plastic products especially in China and India are the major growth drivers

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. .What are some of the most promising, high-growth trends in the global silane market by type (functional silane and mono/chloro silane), end use (paint and coatings, rubber and plastics, adhesives and sealants, fiber treatment and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 5 years in this market?