Semiconductor Silicon Wafer Market Trends and Forecast

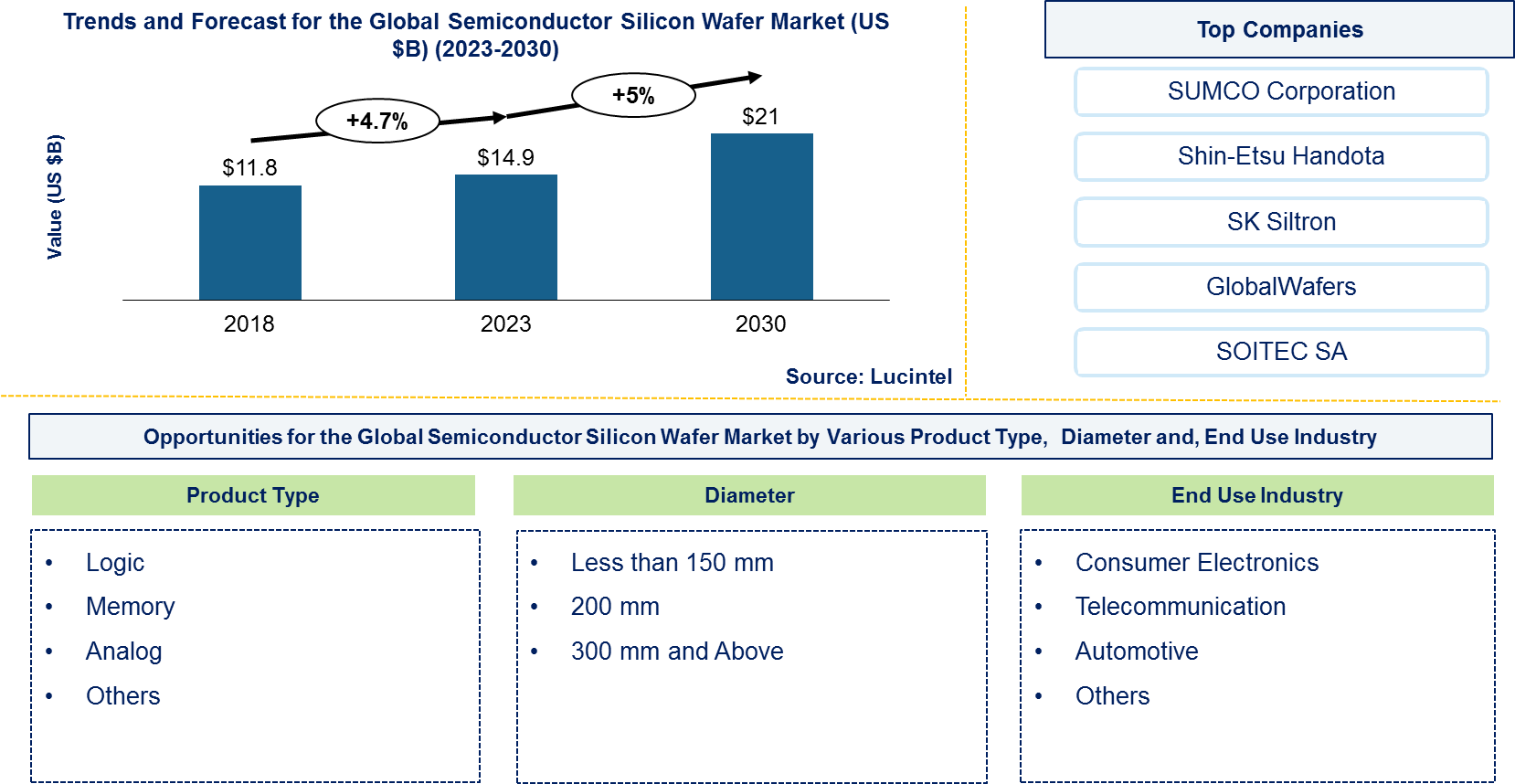

The future of the global semiconductor silicon wafer market looks promising with opportunities in the consumer electronics, telecommunication, and automotive industries. The global semiconductor silicon wafer market is expected to reach an estimated $21 billion by 2030 with a CAGR of 5% from 2023 to 2030. The major drivers for this market are growth of automotive semiconductor and increasing deployment of GPS tracking system.

semiconductor silicon wafers, the main component is high-purity silicon, derived from quartz sand. Dopants like boron and phosphorus are used to modify electrical properties. Chemicals such as hydrochloric acid and hydrofluoric acid are employed for cleaning and etching. High-temperature furnaces are needed for melting and crystal growth. Finally, polishing materials are used to achieve a smooth wafer surface. The price of semiconductor silicon wafers varies widely: standard 200mm wafers typically cost between $10 and $50 each, while high-purity or specialized wafers can range from $50 to $150. Advanced or large-diameter wafers (e.g., 300mm) may exceed $150. Prices are influenced by factors such as wafer quality, production technology, and market competition. Major manufacturers often have competitive pricing due to economies of scale and advanced production techniques.

• Lucintel forecasts that 300 mm and above will remain the largest market over the forecast period due to growth of 5G and data center applications.

• Consumer electronics will remain the largest end use industry over the forecast period due to growth of smartphones, tablets, phablets, refrigerators, ACs, TVs, home theaters, and washing machines. Semiconductor silicon wafer for automotive industry is expected to witness the highest growth over the forecast period due to growth of Advanced Driver-Assistance Systems (ADAS), touch-free human-machine interfaces, adaptive cruise control, and automatic braking systems in automotive.

• Asia Pacific will remain the largest region over the forecast period due to growth of telecommunications, automotive and consumer electronics industries

Country wise Outlook for Semiconductor Silicon Wafer Market

The semiconductor silicon wafers market is witnessing substantial growth globally, driven by increased demand from various industry such as consumer electronics, IT & telecommunication, automotive, and manufacturing. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major semiconductor silicon wafers producers in key regions: the USA, China, India, Japan, and Germany.

Emerging Trends in the Semiconductor Silicon Wafer Market

Emerging trends in the semiconductor silicon wafers market shaping its future applications and market dynamics:

• Larger Wafer Sizes: The shift towards larger wafer sizes, such as 300mm (12-inch), is becoming more prevalent. Larger wafers increase production efficiency and reduce costs per chip, driving the transition from 200mm (8-inch) wafers.

• Advanced Materials: There is growing interest in using advanced materials like silicon-on-insulator (SOI) and germanium to improve performance and power efficiency. These materials are essential for developing high-performance, low-power electronic devices.

• 3D Integration: Innovations in 3D wafer stacking and interconnects are being explored to enhance chip performance and reduce size. This trend involves stacking multiple layers of semiconductor devices to create more compact and powerful integrated circuits.

• Enhanced Processing Technologies: Advances in etching, deposition, and photolithography technologies are enabling finer features and higher device densities. Techniques like extreme ultraviolet (EUV) lithography are pushing the boundaries of semiconductor fabrication.

• Sustainability and Recycling: There is a growing focus on making semiconductor production more sustainable. Efforts include improving the efficiency of raw material use, reducing waste, and developing recycling processes for silicon wafers and other semiconductor materials.

A total of 75 figures / charts and 58 tables are provided in this 129-page report to help in your business decisions. Sample figures with some insights are shown below

Recent Development in the Semiconductor Silicon Wafer Market

Ongoing innovations and advancements in various sectors of the semiconductor silicon wafers market which have been highlighted by recent developments:

• Adoption of 300mm Wafers: The transition from 200mm to 300mm wafers is accelerating, driven by their ability to increase production efficiency and reduce per-chip costs. 300mm wafers are becoming the industry standard for high-volume semiconductor manufacturing.

• Advanced Lithography Techniques: The integration of extreme ultraviolet (EUV) lithography is enabling the fabrication of smaller and more precise features on wafers. EUV lithography enhances the resolution of semiconductor patterns, crucial for advancing to smaller technology nodes like 5nm and beyond.

• Silicon-on-Insulator (SOI) Technology: SOI wafers are gaining traction due to their ability to improve performance and reduce power consumption in high-speed and low-power devices. This technology isolates semiconductor devices from the substrate, enhancing electrical characteristics.

• Innovations in Wafer Materials: Research is focused on alternative materials like silicon-germanium (SiGe) and compound semiconductors for specialized applications. These materials offer improved performance for specific use cases, such as high-frequency and high-power applications.

• Enhanced Wafer Processing: Developments in chemical mechanical planarization (CMP) and atomic layer deposition (ALD) are improving wafer surface quality and precision. These advancements enable the production of higher-quality wafers with reduced defects and better uniformity.

• Sustainability Initiatives: The industry is increasingly focused on sustainable practices, including efforts to reduce the environmental impact of wafer production. Innovations in recycling processes and reducing energy consumption during manufacturing are becoming priorities.

Strategic Growth Opportunities for Semiconductor Silicon Wafer Market

The field of semiconductor silicon wafers is ripe with strategic growth opportunities as industries increasingly focus more on sustainability, efficiency and autonomy. Here are some key areas to consider:

• Integration with Digital Technologies: The increasing convergence of analog and digital systems is a major growth driver. The development of mixed-signal ICs, which integrate both analog and digital functions on a single chip, offers significant benefits in terms of reduced size, cost, and power consumption. As consumer electronics, automotive, and industrial systems demand more compact and multifunctional solutions, companies that excel in integrating analog and digital technologies can gain a competitive edge.

• Advancements in Materials and Manufacturing: The adoption of advanced materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN) is opening new opportunities for analog devices, especially in high-power and high-frequency applications. SiC and GaN offer superior thermal performance, higher efficiency, and greater power density compared to traditional silicon. Investing in the development of analog devices using these materials can position companies as leaders in sectors like electric vehicles, power management, and telecommunications.

• Automotive Electronics: The automotive industry’s shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) presents a significant growth opportunity for analog components. High-precision sensors, power management ICs, and robust analog devices are essential for automotive applications. As the demand for smarter, safer, and more efficient vehicles increases, companies that innovate in automotive-grade analog technologies can capture a substantial market share.

• Industrial Automation and IoT: The expansion of industrial automation and the Internet of Things (IoT) is driving demand for analog components in sensors, signal conditioning, and real-time data processing. Analog devices are crucial for high-precision measurements, reliable connectivity, and energy-efficient operation in smart factories and connected devices. Developing solutions that support these applications offers significant growth potential.

• High-Frequency and RF Technologies: The proliferation of 5G technology and other high-frequency communication systems is increasing the demand for analog components with high-frequency capabilities and low noise. Innovations that enhance signal integrity, reduce interference, and improve linearity are essential for meeting the performance requirements of next-generation communication networks.

• Power Management Solutions: With a growing emphasis on energy efficiency and sustainability, there is a rising need for advanced analog power management solutions. Developing highly efficient voltage regulators, power converters, and battery management ICs can address the demand for energy-efficient electronics across various applications, from consumer devices to industrial equipment.

By taking advantage of these strategic growth opportunities, the semiconductor silicon wafers market can realize its full potential and transform numerous industries through strength, lightness, versatility.

Semiconductor Silicon Wafer Market Driver and Challenges

Semiconductor silicon wafer has a very important role in many industry like consumer electronics, telecommunication, and automotive. The changing market dynamics are being driven by the growing demand for electronics, advancements in technology, expansion of automotive electronics and growth in 5g and communication technologies. however, challenges like high production costs, supply chain disruptions, and technological complexity.

The factors responsible for driving the semiconductor silicon wafers market include:

• Growing Demand for Electronics: The increasing use of electronics in consumer devices, automotive systems, and industrial applications is driving the demand for silicon wafers. Silicon remains the primary material for semiconductor fabrication, making it essential for producing integrated circuits (ICs) used in a wide range of electronic products.

• Advancements in Technology: Innovations in semiconductor technology, including smaller process nodes and more advanced fabrication techniques, are boosting demand for high-quality silicon wafers. These advancements enable the production of more powerful and efficient electronic devices.

• Expansion of Automotive Electronics: The automotive industryÄX%$%Xs shift towards electric vehicles (EVs), advanced driver-assistance systems (ADAS), and infotainment systems is driving demand for silicon wafers. These applications require advanced semiconductor components that rely on high-performance silicon wafers.

• Growth in 5G and Communication Technologies: The rollout of 5G networks and the increasing need for high-speed communication technologies are fueling demand for silicon wafers. High-frequency and high-performance components used in 5G infrastructure and devices require advanced silicon wafer technology.

• Rise of IoT and Smart Devices: The proliferation of Internet of Things (IoT) devices and smart technologies is contributing to the growing demand for silicon wafers. These applications require a variety of semiconductor components, all of which start with silicon wafers.

Challenges facing the semiconductor silicon wafers market are:

1. High Production Costs: The manufacturing of silicon wafers involves complex and costly processes, including high-purity silicon production, crystal growth, and wafer slicing. These high production costs can impact the overall price of semiconductor devices and affect profitability.

2. Supply Chain Disruptions: The semiconductor industry has experienced supply chain disruptions due to geopolitical tensions, natural disasters, and pandemics. These disruptions can lead to shortages of raw materials and delays in wafer production and delivery.

3. Technological Complexity: The constant advancement in semiconductor technology requires silicon wafers to meet increasingly stringent specifications. This complexity in production and quality control can be challenging and costly for wafer manufacturers.

4. Environmental and Regulatory Constraints: The production of silicon wafers involves significant energy consumption and environmental impacts. Regulatory requirements related to environmental sustainability and waste management are becoming stricter, posing challenges for manufacturers to comply while managing costs.

Innovation in semiconductor silicon wafers includes advanced fabrication techniques like EUV lithography and Atomic Layer Deposition (ALD) for finer features and improved performance. High-performance materials such as Silicon-On-Insulator (SOI) and larger wafer diameters enhance device efficiency and manufacturing scalability. Technologies like 3D integration with Through-Silicon Vias (TSVs) and developments in flexible and transparent wafers are pushing the boundaries of application. Efforts towards eco-friendly manufacturing and enhanced thermal management address environmental and performance challenges. These advancements drive the evolution of silicon wafer technology in modern electronics.

Semiconductor Silicon Wafer Suppliers and Their Market Share

The semiconductor silicon wafers is highly competitive, with several key players such as Texas Instruments Inc., Analog Devices Inc., Skyworks Solutions, Infineon Technologies AG, STMicroelectronics have established their presence in the market and hold a significant market share. To know the current market share of each of major players Contact Us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies semiconductor silicon wafers companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Semiconductor silicon wafers companies profiled in this report includes.

• SUMCO Corporation

• Shin-Etsu Handotai

• SK Siltron

• GlobalWafers

• SOITEC SA

• Okmetic

• Wafer Works Corporation

• Episil-Precision

These companies have established themselves as leaders in the semiconductor silicon wafers industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the semiconductor silicon wafers market are evolving, with the entry of new players and the emergence of innovative semiconductor silicon wafers. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Semiconductor Silicon Wafer by Segment

The semiconductor silicon wafer market is experiencing significant growth in key segments. In consumer electronics, the demand for advanced silicon wafers is driven by the need for high-performance processors and memory chips in devices like smartphones and tablets. The telecommunication sector benefits from silicon wafers used in high-speed communication components and infrastructure, essential for supporting 5G networks and other advanced technologies. In the automotive industry, the growth of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is increasing the demand for silicon wafers used in power management, sensors, and electronic control units. These expanding applications highlight the crucial role of silicon wafers in modern technology and industry advancements.

This semiconductor analog market report provides a comprehensive analysis of the marketÄX%$%Xs current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments product type, diameter, end use industry. The report offers insights into regional dynamics, highlighting the major markets for energy harvesting system and their growth potentials. The study includes trends and forecast for the semiconductor silicon wafer market product type, diameter, end use industry, and region as follows:

By Product Type [$B Analysis from 2018 – 2030]:

• Logic

• Memory

• Analog

• Others

By End Use Industry [$B Analysis from 2018 – 2030]:

• Consumer Electronics

• Telecommunication

• Automotive

• Others

By Diameter [$B Analysis from 2018 – 2030]:

• Less than 150 mm

• 200 mm

• 300 mm and Above

By Region [$B Analysis from 2018 – 2030]:

• North America

• United States

• Canada

• Mexico

• Europe

• Germany

• UK

• France

• Asia Pacific

• China

• Japan

• South Korea

• Taiwan

• India

• Rest of the World

Features of Semiconductor Silicon Wafer Market

• Market size estimates: Global semiconductor silicon wafer market size estimation in terms of value ($B) shipment.

• Trend and forecast analysis: Market trend (2016-2021) and forecast (2022-2027) by various segments and regions.

• Segmentation analysis: Market size by various segments such as by product type, diameter, end use industry, and region.

• Regional analysis: Global semiconductor silicon wafer market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth opportunities: Analysis on growth opportunities in different product type, diameter, end use industry and regions for global semiconductor silicon wafer market.

• Strategic analysis: This includes M&A, new product development, and competitive landscape of the global semiconductor silicon wafer market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in semiconductor silicon wafer or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the semiconductor silicon wafer market size?

Answer: The global semiconductor silicon wafer market is expected to reach an estimated $21 billion by 2030

Q2. What is the growth forecast for semiconductor silicon wafer market?

Answer: The semiconductor silicon wafer market is expected to grow at a CAGR of 5% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the semiconductor silicon wafer market?

Answer: The major drivers for this market are growth of automotive semiconductor and increasing deployment of GPS tracking system.

Q4. What are the major applications or end use industries for semiconductor silicon wafer market?

Answer: Consumer electronics. Telecommunication, and Automotive are the major end use industry for semiconductor silicon wafer market.

Q5. What are the emerging trends in semiconductor silicon wafer market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include the large size semiconductor silicon wafer and integrating nanotechnology with silicon wafer technology.

Q6. Who are the key semiconductor silicon wafer companies?

Answer: Some of the key Semiconductor Silicon Wafer companies are as follows:

• SUMCO Corporation

• Shin-Etsu Handotai

• SK Siltron

• GlobalWafers

• SOITEC SA

• Okmetic

• Wafer Works Corporation

• Episil-Precision

Q7. Which semiconductor silicon wafer product segment will be the largest in future?

Answer: Lucintel forecasts that 300 mm and above size of silicon wafer will remain the largest market over the forecast period due to growth of 5G and data center applications.

Q8. In semiconductor silicon wafer market, which region is expected to be the largest in next 5 years?

Answer: Asia Pacific is expected to remain the largest region and witness the highest growth over next 7 years

Q9. Do we receive customization in this report?

Answer:Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the global semiconductor silicon wafer market by product type (logic, memory, analog and others), diameter (less than 150 mm, 200 mm and 300 mm and above), end use industry (consumer electronics, telecommunication, automotive and others), and region (North America, Europe, Asia Pacific, and Rest of the World (ROW))?

Q. 2. Which segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5. What are the business risks and threats to the semiconductor silicon wafer market?

Q.6. What are the emerging trends in semiconductor silicon wafer market and the reasons behind them?

Q.7. What are some changing demands of customers in the semiconductor silicon wafer market?

Q.8. What are the new developments in the semiconductor silicon wafer market? Which companies are leading these developments?

Q.9. Who are the major players in the semiconductor silicon wafer market? What strategic initiatives are being implemented by key players for business growth?

Q.10.What are some of the competitive products and processes in the semiconductor silicon wafer market, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11. What M&A activity has occurred in the last 7 years?

For any questions related to semiconductor silicon wafer market or related to mono semiconductor silicon wafer, IC grade semiconductor silicon wafer, DSP silicon wafer, N-type silicon wafer, silicon carbide wafer, semiconductor silicon wafer companies, semiconductor silicon wafer market size, semiconductor silicon wafer market share, semiconductor silicon wafer analysis, write Lucintel analyst at email: helpdesk@lucintel.com we will be glad to get back to you soon.