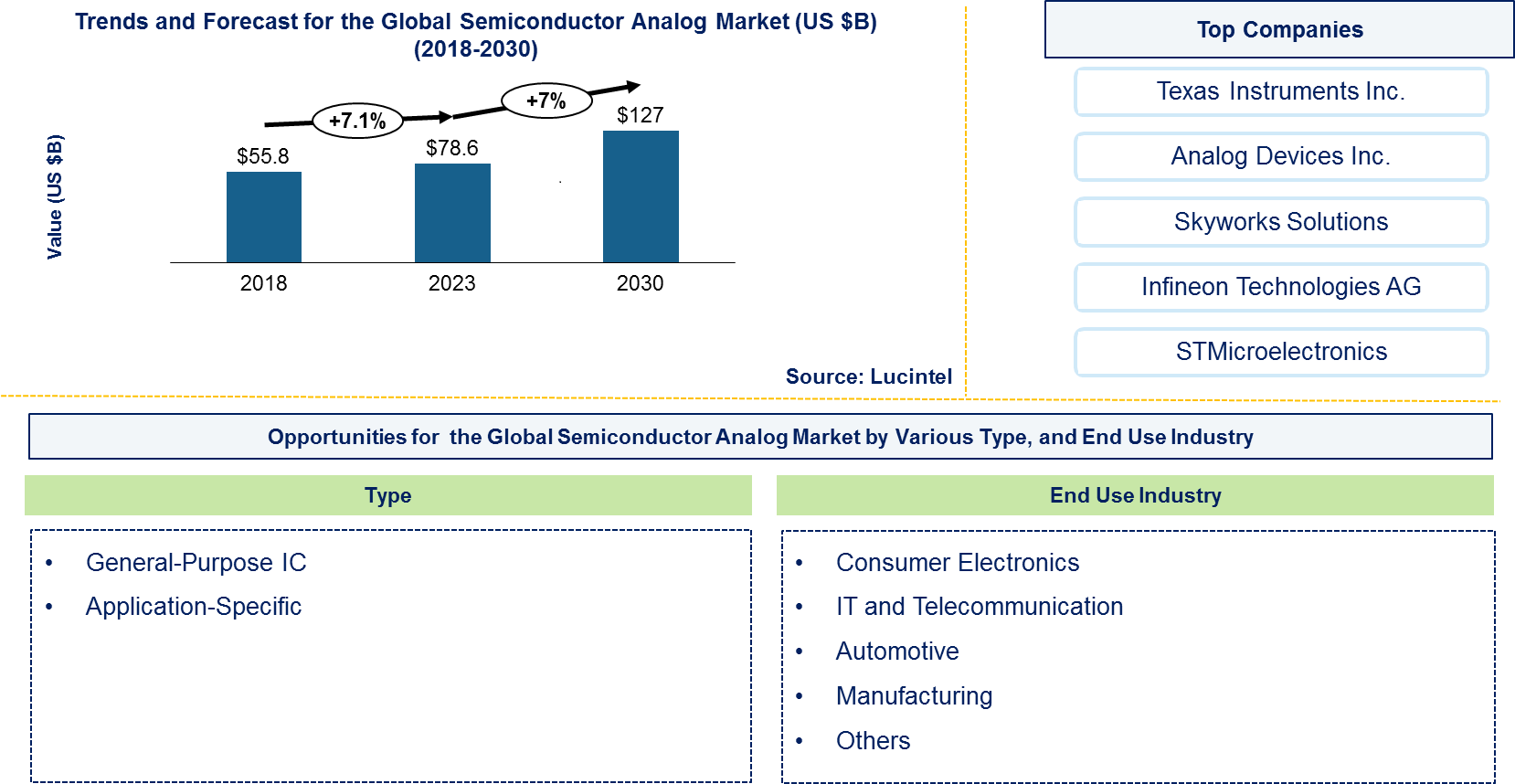

Semiconductor Analog Market Trends and Forecast

The future of the global semiconductor analog market looks promising with opportunities in the consumer electronic, IT & communication, automotive, and manufacturing industries. The global semiconductor analog market is expected to reach an estimated $127 billion by 2030 with a CAGR of 7% from 2023 to 2030. The major drivers for this market are increasing investments in 5G network, growing trend of advanced technologies like IOT, and higher utilization of consumer electronics by people.

To make semiconductor analog devices, key components include semiconductor wafers (silicon, GaAs, SiC), dopants (phosphorus, boron) for modifying electrical properties, and metallization materials (aluminum, copper) for electrical connections. Insulating materials (silicon dioxide, silicon nitride) and passivation layers protect and insulate the circuitry. Photoresists are used in photolithography, and bonding materials (gold, silver wires) and encapsulation materials (epoxy resins) ensure device protection and mounting. The price of semiconductor analog devices varies based on complexity and application. Standard analog devices are typically cost-effective due to high-volume production. In contrast, high-performance and specialty analog components, like those using GaAs or SiC, are more expensive due to advanced materials and manufacturing processes. Compared to digital ICs, analog devices are generally pricier, but they often cost less than cutting-edge mixed-signal or RF ICs. Prices fluctuate based on technology and specific application requirements.

• Lucintel forecast that application-specific will remain the largest type segment over the forecast period

• Within this market, automotive segment is projected to record the highest growth due to increasing demand for electric and autonomous cars and increasing penetration for analog chips in the automotive electronics components.

• APAC is expected to witness the highest growth during the forecast period due to increasing demand for electronics goods and robust growth in the automotive industry.

Country wise Outlook for Semiconductor Analog Market

The semiconductor analog market is witnessing substantial growth globally, driven by increased demand from various industry such as consumer electronics, IT & telecommunication, automotive, and manufacturing. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major semiconductor analog producers in key regions: the USA, China, India, Japan, and Germany.

Emerging Trends in the Semiconductor Analog Market

Emerging trends in the semiconductor analog market shaping its future applications and market dynamics:

• Integration with Digital Technologies: The convergence of analog and digital technologies is leading to mixed-signal ICs that combine analog and digital functions on a single chip, improving performance and reducing space.

• Advanced Process Technologies: Innovations in semiconductor manufacturing, such as smaller node processes and advanced materials like silicon carbide (SiC) and gallium nitride (GaN), are enhancing the performance, efficiency, and power handling of analog devices.

• Increased Use in Automotive Applications: There is a growing demand for analog components in automotive electronics, driven by advancements in autonomous driving, electric vehicles (EVs), and advanced driver-assistance systems (ADAS).

• Growth in Industrial Automation: Analog devices are increasingly used in industrial automation and IoT (Internet of Things) applications, providing critical functions such as sensors, signal conditioning, and real-time data processing.

• High-Frequency and RF Applications: The rise of 5G and other high-frequency communication technologies is boosting the need for high-performance analog components capable of operating at gigahertz frequencies with low noise and high linearity.

A total of 60 figures / charts and 50 tables are provided in this 139-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Development in the Semiconductor Analog Market

Ongoing innovations and advancements in various sectors of the semiconductor analog market which have been highlighted by recent developments:

• Enhanced Integration: Advances in integration technology have led to more sophisticated mixed-signal ICs that combine analog and digital circuits on a single chip. This integration improves performance, reduces power consumption, and minimizes the overall footprint of electronic systems.

• Advanced Materials and Processes: The adoption of advanced materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN) has improved the performance of analog devices in high-power and high-frequency applications. These materials enable better thermal management, higher efficiency, and greater power density.

• Automotive Electronics: The automotive industry is driving innovation in analog components, particularly for electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Recent developments include more precise sensors, power management ICs, and robust analog devices designed to meet automotive standards.

• Industrial and IoT Applications: Analog technologies are evolving to support the growing demands of industrial automation and the Internet of Things (IoT). This includes developments in high-precision sensors, signal conditioning, and real-time data processing that are crucial for smart industrial and IoT systems.

• High-Frequency and RF Technologies: With the expansion of 5G and other high-frequency communication technologies, there have been significant advancements in analog components designed for RF applications. This includes improvements in signal integrity, linearity, and noise reduction.

Strategic Growth Opportunities for Semiconductor Analog Market

The field of semiconductor analog is ripe with strategic growth opportunities as industries increasingly focus more on sustainability, efficiency and autonomy. Here are some key areas to consider:

• Integration with Digital Technologies: The rise of mixed-signal ICs, which integrate analog and digital circuits on a single chip, represents a significant growth opportunity. This integration allows for more compact, efficient designs and improved performance in electronic systems. As industries increasingly demand multifunctional and space-saving solutions, companies that excel in integrating analog and digital technologies stand to benefit greatly.

• Advanced Materials and Processes: The adoption of advanced materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN) is driving growth in high-power and high-frequency applications. These materials offer superior thermal management, power density, and efficiency compared to traditional silicon. Investing in the development and production of analog devices using these materials can position companies as leaders in sectors such as automotive power systems, telecommunications, and industrial automation.

• Automotive Electronics: The automotive industry’s shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is creating a substantial demand for advanced analog components. Opportunities lie in developing high-precision sensors, power management ICs, and robust analog devices that meet stringent automotive standards. Companies that innovate in this space can tap into the growing market for smart, reliable automotive electronics.

• Industrial and IoT Applications: The expansion of industrial automation and the Internet of Things (IoT) is driving demand for analog components used in sensors, signal conditioning, and real-time data processing. Growth opportunities include developing analog solutions that support high-precision measurements, robust connectivity, and energy-efficient operation. Addressing the needs of smart factories and connected devices offers significant potential for market expansion.

• High-Frequency and RF Technologies: The proliferation of 5G technology and other high-frequency applications presents a strategic opportunity for analog devices designed for RF and communication systems. Innovations that enhance signal integrity, reduce noise, and improve linearity can cater to the increasing demand for high-speed, reliable communication.

• Power Management Solutions: With a growing emphasis on energy efficiency across various sectors, there is a rising need for advanced analog power management solutions. Developing highly efficient voltage regulators, power converters, and battery management ICs can capitalize on the trend towards sustainable and energy-efficient technologies.

By taking advantage of these strategic growth opportunities, the semiconductor analog market can realize its full potential and transform numerous industries through strength, lightness, versatility.

Semiconductor Analog Market Driver and Challenges

Semiconductor analog has a very important role in many industry like consumer electronics, IT & telecommunication, automotive, and manufacturing. The changing market dynamics are being driven by the awareness of sustainable solutions has risen, technology improvements, reduced costs and more efficiency and IOT expansion and WSNs. however, challenges like initial cost and return on investment, technological limitations, standardization and compatibility.

The factors responsible for driving the semiconductor analog market include:

1. Technological Advancements: Innovations in semiconductor manufacturing, such as smaller process nodes and advanced materials like Silicon Carbide (SiC) and Gallium Nitride (GaN), are driving the development of more efficient and high-performance analog devices. These advancements support higher power density, better thermal management, and improved overall performance.

2. Growth in Automotive Electronics: The automotive industryÄX%$%Xs transition to electric vehicles (EVs) and the increasing complexity of advanced driver-assistance systems (ADAS) are boosting demand for analog components. These components are crucial for power management, sensor accuracy, and robust signal processing in modern vehicles.

3. Expansion of Industrial Automation and IoT: The rise of Industry 4.0 and the Internet of Things (IoT) is increasing the need for analog devices in sensors, signal conditioning, and real-time data processing. Analog components are essential for precise measurements and reliable communication in smart industrial systems and connected devices.

4. High-Frequency and RF Applications: The growth of 5G technology and other high-frequency communication systems is driving demand for analog components with high-frequency capabilities and low noise. Innovations in RF and high-speed analog devices are crucial for supporting the performance requirements of next-generation communication networks.

5. Focus on Power Efficiency: Increasing emphasis on energy efficiency and sustainability across various sectors is fueling demand for advanced analog power management solutions. High-performance voltage regulators, power converters, and battery management ICs are in demand to meet the needs of energy-efficient electronics.

Challenges facing the semiconductor analog market are:

1. High Production Costs: Advanced analog devices, particularly those using new materials like SiC and GaN, often come with higher production costs due to complex manufacturing processes and raw material expenses. This can impact pricing and competitiveness in cost-sensitive markets.

2. Design and Integration Complexity: The integration of analog and digital functions on a single chip, while beneficial, adds complexity to the design and manufacturing processes. Ensuring reliability and performance in these mixed-signal devices requires advanced engineering and increased development time.

3. Supply Chain and Raw Material Constraints: The semiconductor industry faces supply chain challenges, including shortages of key raw materials and disruptions in global supply networks. These constraints can impact the availability and cost of analog components.

4. Rapid Technological Change: The fast pace of technological advancements in the semiconductor industry can lead to obsolescence of existing analog devices. Companies must continuously innovate and adapt to stay competitive and meet evolving market demands.

Innovation in semiconductor analog technology includes the development of mixed-signal ICs that integrate analog and digital functions, enhancing performance and reducing space. Advanced materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) are improving power efficiency and high-frequency applications. Innovations in sensor technology and power management support automotive and industrial advancements. High-frequency analog components are evolving to meet the demands of 5G and beyond. Additionally, miniaturization and integration in System-on-Chip (SoC) designs are enabling more compact and efficient electronic devices.

Semiconductor Analog Suppliers and Their Market Share

The semiconductor analog is highly competitive, with several key players such as Texas Instruments Inc., Analog Devices Inc., Skyworks Solutions, Infineon Technologies AG, STMicroelectronics have established their presence in the market and hold a significant market share. To know the current market share of each of major players Contact Us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies semiconductor analog companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Semiconductor analog companies profiled in this report includes.

• Texas Instruments Inc.

• Analog Devices Inc.

• Skyworks Solutions

• Infineon Technologies AG

• STMicroelectronics

• Qorvo

• NXP Semiconductor

• ON Semiconductor Corporation

• Microchip Technology

• Renesas Electronics Corporation

These companies have established themselves as leaders in the semiconductor analog industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the semiconductor analog market are evolving, with the entry of new players and the emergence of innovative semiconductor analog. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Semiconductor Analog by Segment

The semiconductor analog sector is seeing significant growth across several key segments. In consumer electronics, analog components enhance performance in devices like smartphones and home appliances. The IT and telecommunication industries rely on analog technology for efficient data conversion and high-frequency signal processing. The automotive sector benefits from analog devices used in advanced driver-assistance systems (ADAS) and electric vehicles (EVs), improving safety and efficiency. Additionally, the manufacturing sector leverages analog components for automation, control systems, and real-time data processing. This broadening application base underscores the expanding role and importance of semiconductor analog technology in diverse fields.

This semiconductor analog market report provides a comprehensive analysis of the marketÄX%$%Xs current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments type, and end use industry. The report offers insights into regional dynamics, highlighting the major markets for energy harvesting system and their growth potentials. The study includes a forecast for the global semiconductor analog market by type, end use industry, and region, as follows:

Semiconductor Analog Market by Type [Value ($B) Analysis from 2017 to 2028]:

• General Purpose IC

• Application Specific

Semiconductor Analog Market by End Use Industry [Value ($B) Analysis from 2017 to 2028]:

• Consumer Electronics

• IT & Telecommunication

• Automotive

• Manufacturing

• Others

Semiconductor Analog Market by Region [Value ($B) Analysis from 2017 to 2028]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

Features of Semiconductor Analog Market

• Market Size Estimates: Semiconductor analog market size estimation in terms of value ($B)

• Trend And Forecast Analysis: Market trends (2017-2022) and forecast (2023-2028) by various segments and regions.

• Segmentation Analysis: Semiconductor analog market size by various segments, such as by type, end use industry, and region

• Regional Analysis: Semiconductor analog market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis on growth opportunities in different by type, technology, end use industry, and regions for the semiconductor analog market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the semiconductor analog market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in semiconductor analog or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the semiconductor analog market size?

Answer: The global semiconductor analog market is expected to reach an estimated $127 billion by 2030.

Q2. What is the growth forecast for semiconductor analog market?

Answer: The global semiconductor analog market is expected to grow with a CAGR of 7% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the semiconductor analog market?

Answer: The major drivers for this market are increasing investments in 5G network, growing trend of advanced technologies like IOT, and higher utilization of consumer electronics by people.

Q4. What are the major segments for semiconductor analog market?

Answer: The future of the global semiconductor analog market looks promising with opportunities in the consumer electronic, IT & communication, automotive, and manufacturing industries.

Q5. Who are the key semiconductor analog companies?

Answer: Some of the key semiconductor analog companies are as follows:

• Texas Instruments

• Qualcomm Technologies

• STMicroelectronics

• Skyworks Solutions

• Infineon Technologies

• NXP Semiconductors

• On Semiconductor

• Microchip Technology

• Intel Corporation

Q6. Which semiconductor analog segment will be the largest in future?

Answer:Lucintel forecast that general purpose IC will remain the largest type segment over the forecast period due to growing demand for enhanced battery efficiency of smartphones and optimal power utilization in the 5G cellular networks.

Q7. In semiconductor analog market, which region is expected to be the largest in next 7 years?

Answer: APAC is expected to witness the highest growth during the forecast period due to increasing demand for electronics goods and robust growth in the automotive industry.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. What are some of the most promising, high-growth opportunities for the global semiconductor analog market by type (general purpose IC and application specific), end use industry (consumer electronic, IT & telecommunication, automotive, manufacturing, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which segments will grow at a faster pace and why?

Q.3. Which region will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the key challenges and business risks in this market?

Q.5. What are the business risks and competitive threats in this market?

Q.6. What are the emerging trends in this market and the reasons behind them?

Q.7. What are some of the changing demands of customers in the market?

Q.8. What are the new developments in the market? Which companies are leading these developments?

Q.9. Who are the major players in this market? What strategic initiatives are key players pursuing for business growth?

Q.10. What are some of the competing products in this market and how big of a threat do they pose for loss of market share by material or product substitution?

Q.11. What M&A activity has occurred in the last 7 years and what has its impact been on the industry?

For any questions related to semiconductor analog market or related to semiconductor analog companies, semiconductor analog market size, semiconductor analog market share, semiconductor analog analysis, write Lucintel analyst at email: helpdesk@lucintel.com we will be glad to get back to you soon.