RF GaN Device Market Trends and Forecast

The technologies in the RF GaN device market have undergone significant changes in recent years, with a shift from traditional silicon-based RF technologies to more advanced Gallium Nitride (GaN)-based technologies. This shift has enabled higher power efficiency, better thermal management, and greater frequency bandwidth for RF devices. Additionally, there has been a transition from discrete RF GaN devices to module-based solutions, which integrate multiple components into a single package, enhancing performance and reducing system complexity. Moreover, the RF GaN device market has seen advancements in power amplifiers for telecommunications and consumer devices, as well as for specialized applications in radar, electronic warfare, and Satcom. These changes are improving signal quality, reliability, and overall system performance, contributing to the growth of RF GaN technology in various high-performance industries, including aerospace, defense, automotive, and wireless communication.

Emerging Trends in the RF GaN Device Market

The RF GaN (gallium nitride) device market is rapidly evolving, driven by the demand for higher performance, efficiency, and reliability in various applications, from telecommunications to aerospace. GaN technology, with its ability to deliver superior power density, thermal management, and frequency bandwidth, is transforming industries that rely on RF (Radio Frequency) devices. This shift is opening up new opportunities across multiple sectors, such as defense, automotive, and consumer electronics. Below are five emerging trends shaping the RF GaN device market.

• Increased Adoption of GaN Power Amplifiers in Telecommunications: The shift towards 5G networks is driving the demand for high-efficiency power amplifiers in telecommunications. GaN devices offer higher power density, efficiency, and reliability, which makes them ideal for meeting the rigorous demands of 5G infrastructure. The transition from traditional silicon-based amplifiers to GaN-based solutions is enhancing signal strength and coverage, contributing to the smooth rollout of next-gen networks.

• Integration of GaN Technology in Aerospace and Defense: The aerospace and defense sectors are increasingly adopting GaN RF devices for applications such as radar, electronic warfare, and satellite communications (Satcom). GaN’s ability to handle high power levels and its robustness in extreme environments make it a valuable component for these high-performance, mission-critical applications, improving operational efficiency and reliability.

• Shift Toward GaN Modules for System Integration: There is a growing trend towards integrating multiple RF components, including amplifiers and other circuitry, into a single GaN module. This modular approach not only reduces system complexity but also improves performance by minimizing losses associated with interconnects and enhancing thermal management. It is becoming increasingly popular in industries requiring compact, high-power solutions, such as automotive and consumer electronics.

• Rise of GaN in Automotive Radar Systems: The adoption of GaN technology is expanding in the automotive industry, particularly in radar systems used for driver-assistance and autonomous driving technologies. GaN devices offer high frequency and power efficiency, crucial for radar systems that demand precision and reliability. As the automotive sector continues to innovate with self-driving cars, GaN will play an important role in enabling more advanced radar technologies.

• Advancements in GaN for RF Energy Applications: GaN devices are becoming a cornerstone for RF energy applications, such as industrial heating, medical treatments, and material processing. GaN’s high power efficiency and thermal management properties make it suitable for applications that require high output power. The growing focus on energy-efficient systems is propelling the use of GaN in these sectors, providing a more sustainable alternative to traditional RF technologies.

The emerging trends in the RF GaN device market highlight a shift toward higher efficiency, better performance, and miniaturized solutions across various industries. From telecommunications to aerospace and automotive, GaN technology is driving innovations that enhance power handling, thermal efficiency, and integration. As these trends continue to unfold, the RF GaN market is set to reshape the future of RF devices by enabling new capabilities and expanding the scope of applications for next-generation technologies.

RF GaN Device Market : Industry Potential, Technological Development, and Compliance Considerations

The RF GaN (gallium nitride) device technology is rapidly emerging as a disruptive force across various industries due to its high power efficiency, superior thermal management, and wider frequency bandwidth compared to traditional silicon-based RF devices.

• Potential in Technology:

GaN technology has the potential to revolutionize sectors such as telecommunications, aerospace, defense, automotive, and RF energy applications. The primary disruption comes from GaN’s ability to handle higher power levels and operate at higher frequencies, enabling more compact, efficient, and higher-performance devices.

•Degree of Disruption:

The shift to GaN devices from traditional silicon-based solutions is highly disruptive, particularly in power amplifiers and RF communication systems. This transition improves signal strength, reliability, and energy efficiency in critical applications like 5G networks, radar systems, and satellite communications.

• Current Technology Maturity Level:

GaN technology has reached a significant level of maturity in the RF market, with manufacturers such as Qorvo, Wolfspeed, and MACOM leading the development of GaN-based RF devices. While GaN technology has been commercialized in specific sectors like telecommunications and aerospace, it is still evolving in automotive radar and RF energy applications.

•Regulatory Compliance:

The adoption of GaN devices in regulated industries like defense, aerospace, and telecommunications requires compliance with strict environmental and performance standards. Regulatory bodies, such as the FCC (Federal Communications Commission) and military organizations, impose stringent requirements to ensure reliability and safety, driving further innovation in GaN device manufacturing.

Recent Technological development in RF GaN Device Market by Key Players

The RF GaN (gallium nitride) device market is experiencing significant growth due to advancements in power efficiency, high-frequency operation, and thermal management capabilities. As the demand for high-performance RF devices increases across industries such as telecommunications, aerospace, defense, and automotive, leading companies like Qorvo, Skyworks Solutions, Qualcomm Technologies, Analog Devices, NXP Semiconductors, Wolfspeed, and MACOM are leveraging GaN technology to meet emerging needs. These key players are introducing innovative solutions that are pushing the boundaries of RF applications, from 5G infrastructure to radar and Satcom technologies.

• Qorvo’s: Qorvo has been at the forefront of GaN adoption, particularly in 5G applications. The company has developed GaN-based power amplifiers that support the high bandwidth and power requirements of 5G infrastructure. Their GaN solutions offer improved efficiency and lower heat generation, essential for 5G base stations and telecom infrastructure. This development positions Qorvo as a key enabler in the 5G rollout, driving advancements in mobile communication.

• Skyworks Solutions: Skyworks Solutions continues to lead the development of GaN-based power amplifiers designed for 5G applications. The company has introduced new GaN-based products that support higher frequency bands and deliver greater power efficiency, which is crucial for both 5G NR (New Radio) and IoT devices. These innovations are helping to drive the global expansion of 5G networks by improving signal quality and performance.

• Qualcomm Technologies: Qualcomm Technologies has integrated GaN technology into its next-generation RF solutions for wireless communication. The company focuses on high-frequency GaN devices used in smartphones, base stations, and automotive applications. Qualcomm’s GaN innovations are paving the way for more efficient and powerful wireless communication systems, particularly as the demand for 5G services and IoT devices grows globally.

• Analog Devices: Analog Devices has been advancing GaN technology for high-performance applications in aerospace and defense. The company has launched GaN-based power amplifiers that are optimized for radar systems and electronic warfare. These devices offer superior performance in extreme environments, making them ideal for defense and aerospace applications where power efficiency, durability, and reliability are critical.

• NXP Semiconductors: NXP Semiconductors has been leveraging GaN technology in automotive and IoT markets. They have developed GaN-based solutions for automotive radar, helping to improve the performance of driver assistance and autonomous vehicle systems. NXP’s focus on GaN technology enables the development of highly efficient, compact, and reliable solutions for power management and connectivity in smart transportation and IoT applications.

• Wolfspeed’s: Wolfspeed, a leader in wide-bandgap semiconductors, has made substantial strides in developing GaN-based solutions for power electronics and 5G infrastructure. The company’s GaN-on-Silicon products are being used in telecom base stations, military applications, and industrial equipment, offering superior performance in terms of power density and thermal management. Wolfspeed’s advancements are setting new industry standards for high-efficiency, high-power applications.

• MACOM: MACOM has focused on developing GaN-based power amplifiers for telecom and defense applications. Their GaN power amplifiers provide high output power and efficiency, essential for demanding applications in radar, electronic warfare, and satellite communications. MACOM’s innovations are helping drive the adoption of GaN technology in critical sectors that require reliable and high-performance RF devices.

Recent developments in the RF GaN device market show significant progress in both performance and application across various sectors. Key players like Qorvo, Skyworks, Qualcomm, Analog Devices, NXP, Wolfspeed, and MACOM are at the forefront of integrating GaN technology into products that support 5G, aerospace, automotive, and military applications. These advancements in GaN are enhancing power efficiency, signal reliability, and performance in a wide range of industries, paving the way for the next generation of RF technologies. As these companies continue to innovate, GaN technology will play an increasingly vital role in enabling high-performance RF solutions worldwide.

RF GaN Device Market Driver and Challenges

The RF GaN (gallium nitride) device market has seen remarkable growth due to its increasing adoption in high-performance applications across industries such as telecommunications, aerospace, defense, and automotive. GaN technology, known for its superior power efficiency, thermal management, and frequency bandwidth capabilities, is transforming the RF landscape. However, this market also faces challenges, such as high development costs, competition, and regulatory hurdles. Below are the key drivers and challenges impacting the RF GaN device market.

The factors responsible for driving the RF GaN device market include:

• Rising Demand for 5G and Wireless Communication: The global rollout of 5G networks is a major driver for RF GaN devices. GaN technology supports the high frequency, power, and bandwidth requirements of 5G infrastructure, enabling faster data speeds and enhanced connectivity. This has led to an increased demand for GaN-based power amplifiers in telecom base stations and mobile devices.

• High Efficiency and Power Density: GaN devices offer significantly higher efficiency and power density compared to traditional silicon-based RF devices. Their ability to handle high power and operate at higher frequencies with lower energy losses makes them ideal for high-performance applications in defense, aerospace, and telecommunications, driving growth in these sectors.

• Aerospace and Defense Advancements: RF GaN devices are gaining traction in defense and aerospace applications, particularly in radar, electronic warfare, and satellite communication systems. GaN technology’s ability to operate under extreme conditions while providing high power efficiency is fueling its adoption in mission-critical military and defense applications.

• Electric Vehicles and Automotive Market Expansion

The automotive industry’s push toward electric vehicles (EVs) and autonomous driving systems is driving the adoption of RF GaN devices. GaN technology is used in automotive radar systems, which are critical for advanced driver assistance systems (ADAS) and autonomous vehicle navigation. The growing demand for EVs and autonomous vehicles is contributing to this market’s expansion.

• Cost Reduction and Production Scalability: As manufacturing processes for GaN devices improve, production costs are expected to decrease. The scalability of GaN-based systems for mass production is making it more viable for large-scale industrial applications, contributing to broader adoption across industries such as telecommunications, automotive, and consumer electronics.

Challenges in the RF GaN device market are:

• High Initial Development and Production Costs: Although RF GaN devices offer superior performance, the initial development and production costs are high, particularly for advanced power amplifiers. This can be a significant barrier for small to medium-sized enterprises (SMEs) looking to adopt this technology, limiting the pace of adoption in cost-sensitive industries.

• Competitive Market Landscape: The RF GaN device market is highly competitive, with numerous players offering similar technologies. As more companies enter the market, differentiation becomes challenging, and pressure on pricing increases. This competition could lead to squeezed profit margins and higher pressure on product innovation.

• Regulatory Compliance and Environmental Concerns: Compliance with environmental regulations, such as those related to waste management, energy efficiency, and hazardous materials, remains a challenge for GaN device manufacturers. Companies must continuously adapt their products to meet stringent regulations in various industries, particularly in telecommunications, automotive, and defense sectors.

• Integration with Legacy Systems: Integrating GaN technology with existing legacy systems can be difficult and costly, especially in industries such as aerospace and telecommunications. Retrofitting older systems to accommodate GaN devices requires significant investment in R&D and system redesigns, posing a barrier to widespread adoption.

The RF GaN device market is being significantly driven by the growing demand for 5G infrastructure, automotive advancements, and high-performance applications in aerospace and defense. These opportunities are pushing technological innovations in GaN devices, improving energy efficiency, power density, and thermal management. However, challenges such as high development costs, market competition, and regulatory compliance need to be addressed for broader market penetration. Despite these challenges, RF GaN technology is poised to play a critical role in enabling next-generation wireless communication, advanced automotive systems, and mission-critical military applications.

List of RF GaN Device Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies, RF GaN device companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the RF GaN device companies profiled in this report include.

• Qorvo

• Skyworks Solutions

• Qualcomm Technologies

• Analog Devices

• NXP Semiconductors

• Wolfspeed

RF GaN Device Market by Technology

• Technology Readiness by Technology Type: Module-based RF GaN technology is rapidly advancing and is ready for broader adoption, particularly in 5G, radar, and defense sectors. The technology is already being integrated into infrastructure projects and is preferred for its power efficiency and space-saving advantages. However, it still faces challenges in terms of high manufacturing costs and the need for more robust thermal management solutions. Discrete RF GaN technology is more mature and has been widely used in specialized applications such as military radar and satellite communications. While it offers greater flexibility and design customization, discrete devices are generally larger and less power-efficient compared to integrated modules. The technology readiness for discrete GaN is solid but remains focused on niche, low-volume applications. Competitive intensity is high, with companies racing to offer more efficient, higher-performance solutions. Regulatory compliance remains a challenge for both technologies, particularly for military and aerospace applications, where safety and durability standards are stringent. For module-based devices, successful integration into next-generation 5G networks, electronic warfare systems, and autonomous vehicles will be key to driving widespread adoption, while discrete solutions remain critical for specific high-reliability applications.

• Competitive Intensity and Regulatory Compliance: The RF GaN device market exhibits high competitive intensity, with numerous players, including Qorvo, Skyworks, and MACOM, competing for market share in both module and discrete segments. Module-based solutions are gaining traction due to their ability to deliver improved performance and integration, fueling intense competition among companies developing these solutions for 5G and aerospace applications. Discrete GaN devices, while still relevant for custom or specialized applications, face increasing pressure as modules offer superior scalability and lower total system cost. Regulatory compliance is a critical factor for both types of technology, especially in industries like aerospace, defense, and telecommunications, where standards such as RoHS, REACH, and military-specific certifications apply. Companies must invest in meeting these regulations while ensuring product performance across a range of conditions. For module-based solutions, compliance with stringent electromagnetic interference (EMI) and thermal management standards is also essential. As both technologies advance, the ability to meet regulatory requirements while maintaining competitive pricing will determine market leaders.

• Disruption Potential by Technology Type: The RF GaN device market is witnessing a disruption driven by the transition from discrete devices to module-based solutions. Module-based RF GaN devices offer higher integration, improved power efficiency, and reduced complexity, making them ideal for 5G, radar, and aerospace applications. They provide a compact, cost-effective alternative to traditional discrete devices, which are often larger and more complex to integrate. Modules enhance system performance by consolidating multiple components into a single package, enabling faster, more reliable communications and reducing time-to-market. Discrete GaN devices, however, continue to offer flexibility and customization, particularly for specialized or lower-volume applications, such as military and satellite communications. The growing preference for integrated, multi-functional solutions in telecommunications and defense industries is accelerating the shift towards modules. This disruption is expected to drive broader adoption in high-performance sectors like telecommunication, automotive, and industrial IoT. While both technologies have their advantages, the move toward higher integration and compact designs is expected to dominate, especially with the growing demand for smaller, more efficient RF solutions.

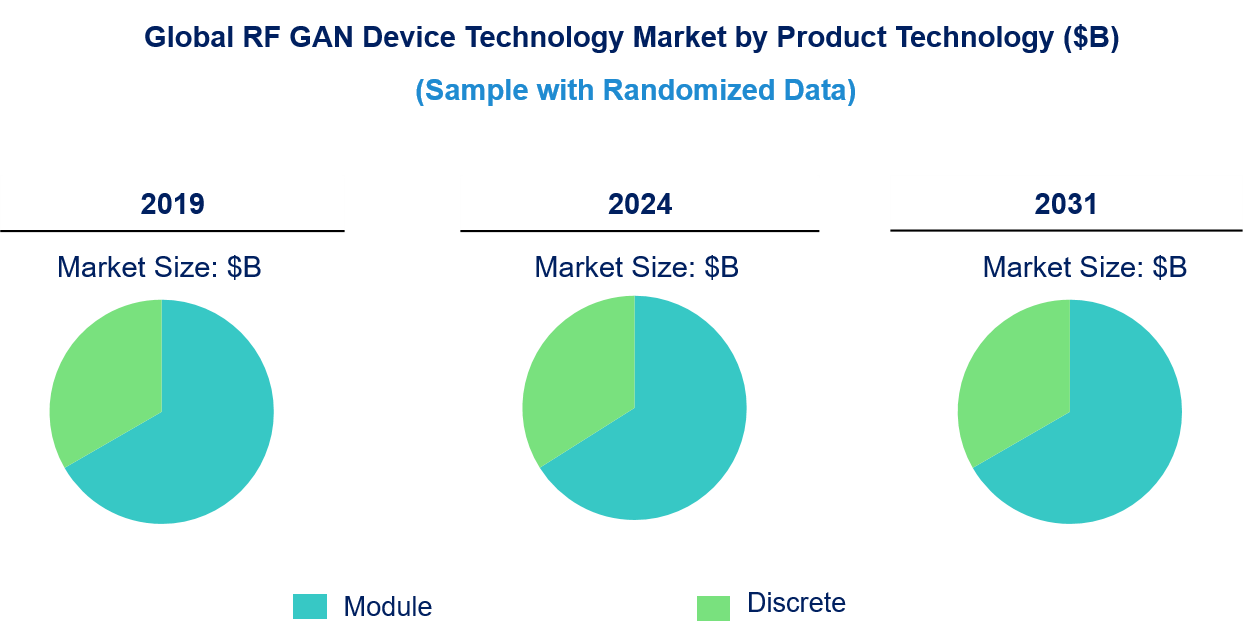

RF GaN Device Market Trend and Forecast by Product Technology [Value from 2019 to 2031]:

• Module

• Discrete

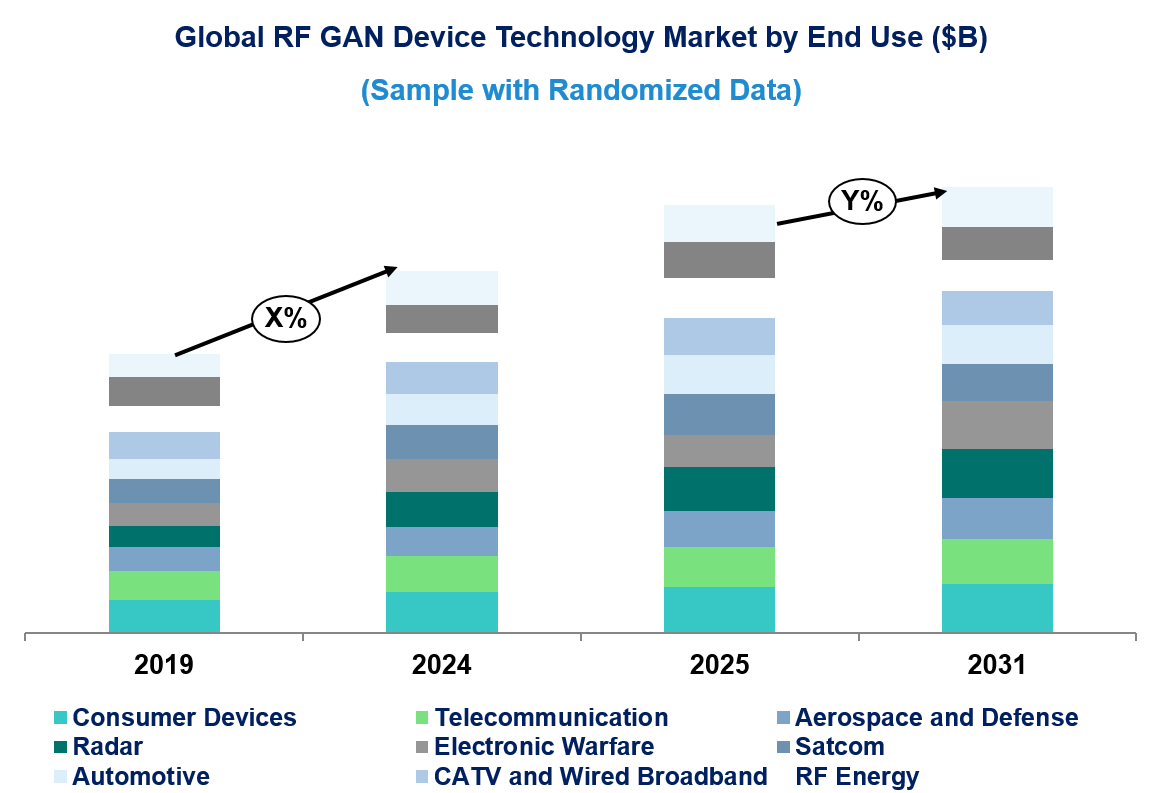

RF GaN Device Market Trend and Forecast by End Use Industry [Value from 2019 to 2031]:

• Consumer Devices

• Telecommunication

• Aerospace and Defense

• Radar

• Electronic Warfare

• Satcom

• Automotive

• CATV and Wired Broadband

• RF Energy

• Test and Measurement

RF GaN Device Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the RF GaN Device Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global RF GaN Device Market

Market Size Estimates: Rf gan device market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global RF GaN device market size by various segments, such as end use industry and product technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global RF GaN device market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different end use industries, technologies, and regions for technology trends in the global RF GaN device market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global RF GaN device market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global rf gan device market by product technology (module and discrete), end use industry (consumer devices, telecommunication, aerospace and defense, radar, electronic warfare, satcom, automotive, catv and wired broadband, rf energy, and test and measurement), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different product technologies? What are the drivers and challenges of these prodcut technologies in the global RF GaN device market?

Q.5. What are the business risks and threats to the technology trends in the global RF GaN device market?

Q.6. What are the emerging trends in these product technologies in the global RF GaN device market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global RF GaN device market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global RF GaN device market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this RF GaN device technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global RF GaN device market?