Recovered Carbon Black Market Trends and Forecast

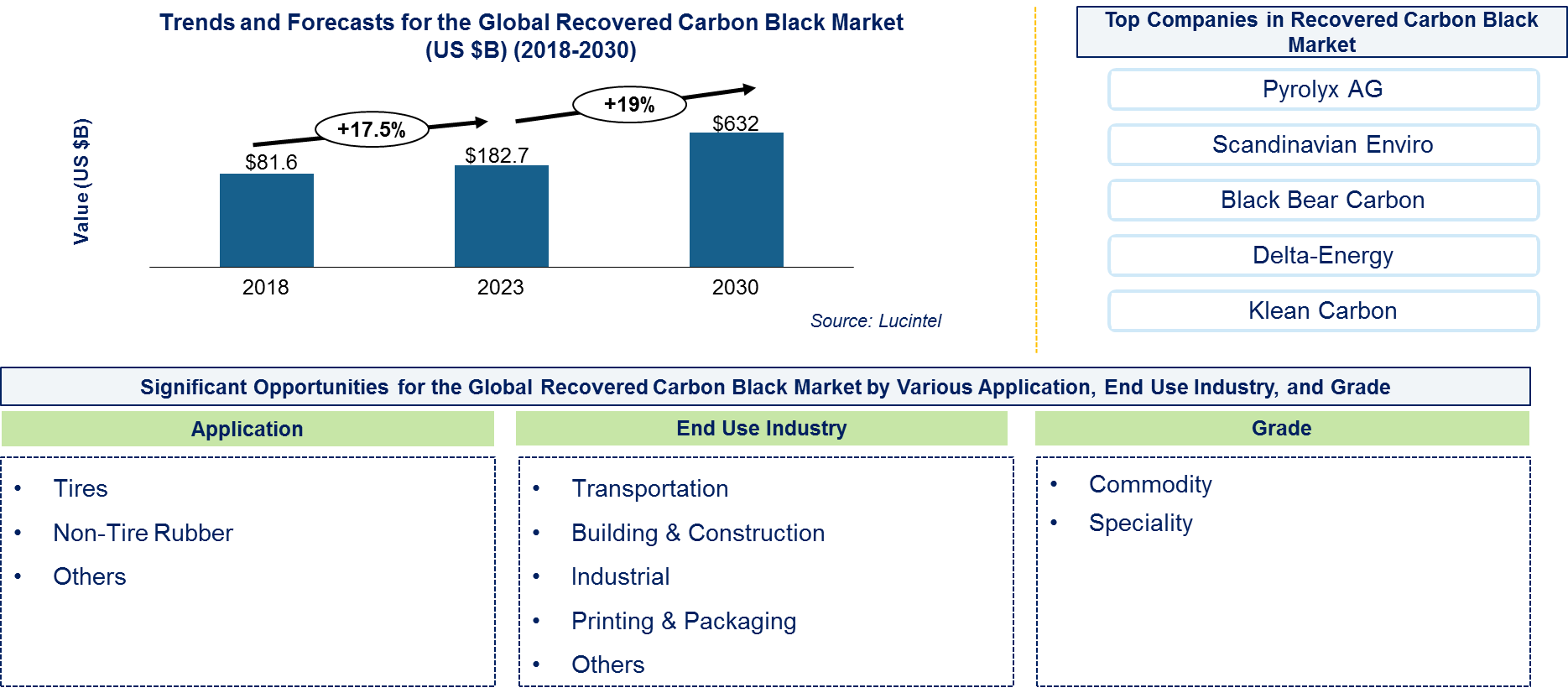

Lucintel finds that the future of the global recovered carbon black market looks promising with opportunities in the transportation, industrial, building & construction, and packaging industries. The global recovered carbon black market is expected to reach an estimated $632 billion by 2030 with a CAGR of 19% from 2024 to 2030. The major drivers for this market are increasing use of recovered carbon black in the tire industry and growing environmental concern towards low carbon footprints.

Recovered Carbon Black (rCB) is a sustainable material obtained from the recycling of end-of-life tires and other rubber products. It serves as a valuable additive in various industries, primarily due to its reinforcing properties. rCB is produced through processes that thermally decompose rubber, recovering carbon black, which is traditionally derived from petroleum-based sources. Carbon is the main component, constituting about 60-80% of rCB. This carbon provides excellent reinforcement and durability, making it a crucial ingredient in rubber and plastic formulations. Ash and inorganic residues are residual compounds that remain after the recovery process. They typically consist of silica, metals, and other inorganic materials found in the original rubber products, present in smaller quantities.

• Lucintel forecasts that tires will remain the largest application over the forecast period supported by the increasing adoption of recovered carbon black by major tire companies for environment sustainability and for lowering manufacturing cost.

• Transportation will remain the largest end use industry during the forecast period supported by increasing demand for tire and mechanical rubber goods.

• Asia Pacific will remain the largest region by value and volume and it is also expected to witnesses the highest growth over the forecast period due to higher vehicle production and strong domestic & export demand for tires.

Country wise Outlook for Recovered Carbon Black Market

The market is witnessing substantial growth globally, driven by increased demand from transportation, industrial, building & construction, and packaging industries. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major recovered carbon black producers in USA, Germany, China, India, Japan, and Brazil.

Emerging Trends in the Recovered Carbon Black Market

The recovered carbon black market's size has been expanding rapidly, driven by its increasing adoption in various applications. The market size is influenced by factors such as advancement in production method and increasing adoption in plastics, coatings, and construction materials. The market size is estimated to continue its upward trajectory as industries across the globe seek to improve performance, efficiency, and sustainability.

Emerging trends in recovered carbon black market are shaping its future applications and market dynamics:

• Sustainability and Circularity: One of the main drivers for the rCB market is the growing emphasis on sustainability. Companies are adopting principles of circular economy, which encourages recycling and utilizing eco-friendly materials. rCB helps in waste reduction, promoting resource efficiency and hence a contribution to global sustainability goals.

• Development or Advancement in Production: Efficiency and yield in rCB manufacturing are being improved by advancements like pyrolysis and gasification in terms of production technologies. These advances help enhance the quality as well as consistency of recovered carbon black making it a more competitive substitute for virgin carbon black.

• Exponential Growth in Application Areas: Recovered carbon black has begun to find new applications beyond its traditional uses such as tire manufacturing or rubber goods only. Its adoption rate is increasing for sectors including plastics, coatings and construction materials. This widening market gives an insight into its different application requirements across many industries.

• Legal Support & incentives: Government regulations that promote sustainable practices as well as waste reduction create a favorable environment for rCB. Consequently, recycling initiatives have been incentivized with the use of environmentally friendly materials to encourage investment into rCB production resulting into further growth among others that expand this industry.

• Expanding demand from Automotive Industry: The automobile sector increasingly demands the use of rCB in tire production and other components due to its advantages to the environment. This follows an industry-wide commitment towards reduced carbon emissions while integrating sustainable materials into manufacturing processes.

• Collective Initiatives: There is an upward trend where manufacturers partner with recyclers and research institutions for collective purposes. The goal of these collaborations is innovation around existing, as well as optimization of new processes involved in producing recovered carbon black thereby enhancing their quality and widening their field.

A total of 112 figures / charts and 93 tables are provided in this 187-page report to help in your business decisions. Sample figures with insights are shown below.

Recent Developments in Recovered Carbon Black Market

Recent developments in the recovered carbon black market reflect ongoing advancements in technology, expanding applications across industries, and evolving consumer needs.

• Technological Innovations: Recent technological innovations in the production of rCB have boosted its efficiency and yield through improved pyrolysis and gasification methods, which in turn has seen an increased interest in these process which help in a better quality of recovery that makes rCB a more desirable option over virgin carbon black.

• Increased Production Capacity: They are now expanding their production capacities to meet the growing demand, making them major players in the rCB sector. New facilities are being established worldwide, especially in Europe and North America for steady supply of recovered carbon black.

• Regulatory Support and Incentives: Governments around the globe are enacting laws that encourage use of sustainable materials such as Recovered Carbon Black (rCB). Investments into rCB manufacturing are therefore being driven by incentives to recycle products and employ environmentally-friendly business models thereby boosting growth of this market.

• Growing Applications in Various Industries: The application of rCB is growing beyond conventional rubber and tire manufacturing with new applications including plastic industry, coating industry, construction materials among others indicating broader acceptance within diverse sectors.

• Collaborative Partnerships: In addition there have been increased strategic collaborations between manufacturers, recyclers, and research institutions aimed at optimizing various stages involved during the production processes so as to enhance competitive advantage through innovation purposes on rCB market development.

• Consumer Awareness and Demand: Companies such as major brands are seeking out rCB as a crucial ingredient due to increasing consumer request for environment friendly products. They are promoting their wares with usage of RCB so that they can appeal to eco-conscious customers who will help boost its profile on the market.

• Investment in Research and Development: Large sums have been invested into research aiming at enhancing performance characteristics shown by rCBs while other researchers aim at improving material properties towards meeting stringent conditions required for various industries hence guaranteeing it remains competitive.

Strategic Growth Opportunities for Recovered Carbon Black Market

Technological advances, regulatory changes and evolving consumer preferences will create strategic growth opportunities for the recovered carbon black market. Below are the key strategic growth opportunities for recovered carbon black:

• Expansion of New Applications: However, rCB has been used for some time only in tyres and rubber products, but it can also be applicable to plastics, coatings and building materials. Companies looking to venture into these emerging applications will strengthen their market base and open up new revenue opportunities.

• Technological Innovations: Companies willing to improve the efficiency and quality of rCB should invest in innovative production technologies such as enhanced pyrolysis and gasification methods. Advances that increase yield as well as optimize product characteristics will make rCB a competitive substitute for virgin carbon black.

• Sustainability Partnerships: Collaboration with sustainable-focused manufacturers, brands and research institutions is mutually beneficial. Such partnerships may result in eco-friendly products which are then marketed to promote the benefits of rCB thereby increasing its visibility in the market.

• Government Incentives and Regulations: This can be enabled by taking advantage of government policies that support recycling and sustainable materials development thus encouraging market growth. Engaging policymakers to obtain funding or incentives for rCB initiatives can help improve production capacity as well as facilitate its penetration into markets.

• Consumer Education and Awareness: Strategic marketing campaigns highlighting the sustainability and performance advantages of products containing rCB can attract environmentally conscious consumers who have knowledge about environmental benefits related to rCB’s adoption.

• Focus on Quality Improvement: To stay competitive, it is crucial that high-quality rCB meeting industry standards is produced constantly. By doing so, one gains the trust of customers hence it may successfully replace traditional carbon black in various applications.

Recovered Carbon Black Market Driver and Challenges

The recovered carbon black market thrives on strong sustainability trends and technological developments but also faces some cost, quality, and market awareness drawbacks. To continue its growth and success in the industry, it is important to take on these issues while building on market drivers. The factors responsible for driving the recovered carbon black market include:

1. Growing Demand for Sustainable Materials: The rise of environmental consciousness has spurred the demand of sustainable alternatives like recovered carbon black (rCB). Both businesses and customers are going for green products to cut back on their carbon footprints.

2. Regulatory Support: Governments worldwide have passed regulations and offers incentives that promote recycling and the use of sustainable materials. This kind of regulations environment motivates investment in rCB production and usage.

3. Expansion of Application Areas: rCB is being increasingly adopted by a number of industries outside traditional tire and rubber applications, such as plastics, paints, coatings, or building materials. The proliferation in applications fuels market growth.

4. Technological Advancements: Innovations in the production technologies including improved pyrolysis and gasification methods are making rCB more efficient with better quality. These shifts make rCB become an alternative to virgin carbon black.

5. Consumer Awareness and Preferences: More consumers now prefer certain products due to an upsurge in consumer awareness about sustainability that incorporates recovered materials. Brands with emphasis on using rCB can appeal to environmentally conscious customers.

Challenges facing the recovered carbon black market are:

1. Cost Competitiveness: Production costs for rCB are sometimes higher than those for traditional petroleum-based carbon black. Consequently, this price disparity may undermine large scale adoption by manufacturers thereby impeding its penetration into the market.

2. Quality and Performance Variability: Maintaining consistent quality and performance standards for rCB can be difficult. Divergent material properties caused by differences in manufacturing processes may make it uncompetitive especially when applied in specific use areas.

3. Limited Awareness in Emerging Markets: Some regions still have limited knowledge about the advantages associated with rCB. This lack of understanding may slow down market growth and uptake within emerging economies that do not prioritize sustainability practices yet.

4. Supply Chain Constraints: Relying on agricultural feedstocks to produce rCB creates vulnerability across supply chain management systems. Raw material availability challenges at different rates will affect production stability.

5. Regulatory Hurdles: Although regulations can be supportive to rCB, complicated regulatory environments may pose challenges for manufacturers. Adhering to diverse standards in different regions could require more resources and investments.

The recovered carbon black (rCB) market is positioned for growth, driven by increasing demand for sustainable materials, supportive regulatory environments, and technological advancements. As businesses and consumers prioritize eco-friendly solutions, rCB offers a compelling alternative to traditional carbon black, contributing to reduced carbon footprints and enhanced environmental stewardship. Its expanding application areas, from traditional tire and rubber uses to newer sectors like plastics and coatings, further fuel market potential.

Recovered Carbon Black Suppliers and their Market Shares

In this globally competitive market, several key players such as Scandinavian Enviro Services, Black Bear Carbon, Delta-Energy, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us by email at helpdesk@lucintel.com. Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies recovered carbon black companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the recovered carbon black companies profiled in this report includes.

• Scandinavian Enviro Services

• Black Bear Carbon

• Delta-Energy

• Klean Carbon

These companies have established themselves as leaders in recovered carbon black industry, with extensive product portfolios, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within recovered carbon black market are evolving, with the entry of new players and the emergence of recovered carbon black technologies. Additionally, collaborations between raw material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

0

Recovered Carbon Black Market by Segment

Major segments of recovered carbon black experiencing growth include transportation, and building and construction industry. This recovered carbon black market report provides a comprehensive analysis of the market's current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments, including by application, end use industry, and grade. The report offers insights into regional dynamics, highlighting the major markets for recovered carbon black and their growth potentials. The study includes trends and forecast for recovered carbon black market through 2030, segmented by application, end use industry, grade, and region are as follows:

By Application [Volume (Kilotons) and Value ($M) Analysis for 2018 – 2030]:

• Tire

• Non-Tire Rubber

• Others

By End Use Industry [Volume (Kilotons) and Value ($M) Analysis for 2018 – 2030]:

• Transportation

• Industrial

• Building and Construction

• Printing and Packaging

• Others

By Grade [Volume (Kilotons) and Value ($M) Analysis for 2018 – 2030]:

• Commodity

• Specialty

By Region [Volume (Kilotons) and Value ($M) Analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

Features of Recovered Carbon Black Market

Market Size Estimates: Recovered carbon black market size estimation in terms of value ($M) and volume (kilotons)

Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

Segmentation Analysis: Market size by various segments, such as application, end use industry, and grade in terms of value ($M) and volume (kilotons)

Regional Analysis: Recovered carbon black market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different application, end use industry, grade, and regions for the recovered carbon black market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for the recovered carbon black market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the growth forecast for recovered carbon black market?

Answer: The recovered carbon black market is expected to grow at a CAGR of 19% by 2030.

Q2. What are the major drivers influencing the growth of the recovered carbon black market?

Answer: The major drivers for this market are increasing use of recovered carbon black in the tire industry and growing environmental concern towards low carbon footprints.

Q3. What are the major applications or end use industries for recovered carbon black?

Answer: Transportation will remain the largest end use industry during the forecast period supported by increasing demand for tire and mechanical rubber goods.

Q4. What are the emerging trends in recovered carbon black market?

Answer: An emerging trend that has a direct impact on the dynamics of the industry includes increasing waste tire management.

Q5. Who are the key recovered carbon black companies?

Answer: Some of the key recovered carbon black companies are as follows:

• Scandinavian Enviro Services

• Black Bear Carbon

• Delta-Energy

• Klean Carbon

Q6.Which recovered carbon black product segment will be the largest in future?

Answer: Lucintel forecasts that tires will remain the largest application over the forecast period supported by the increasing adoption of recovered carbon black by major tire companies for environment sustainability and for lowering manufacturing cost.

Q7: In recovered carbon black market, which region is expected to be the largest in next 7 years?

Answer: Asia Pacific is expected to remain the largest region and witness the highest growth over next 7 years.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising, high-growth opportunities for the global recovered carbon black market by application (tire, non-tire rubber, and others), by end use industry (transportation, industrial, building and construction, printing and packaging, and others), by grade (commodity and specialty) and by region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 5 years in this market?