Outsourced Semiconductor Assembly and Testing Market Trends and Forecast

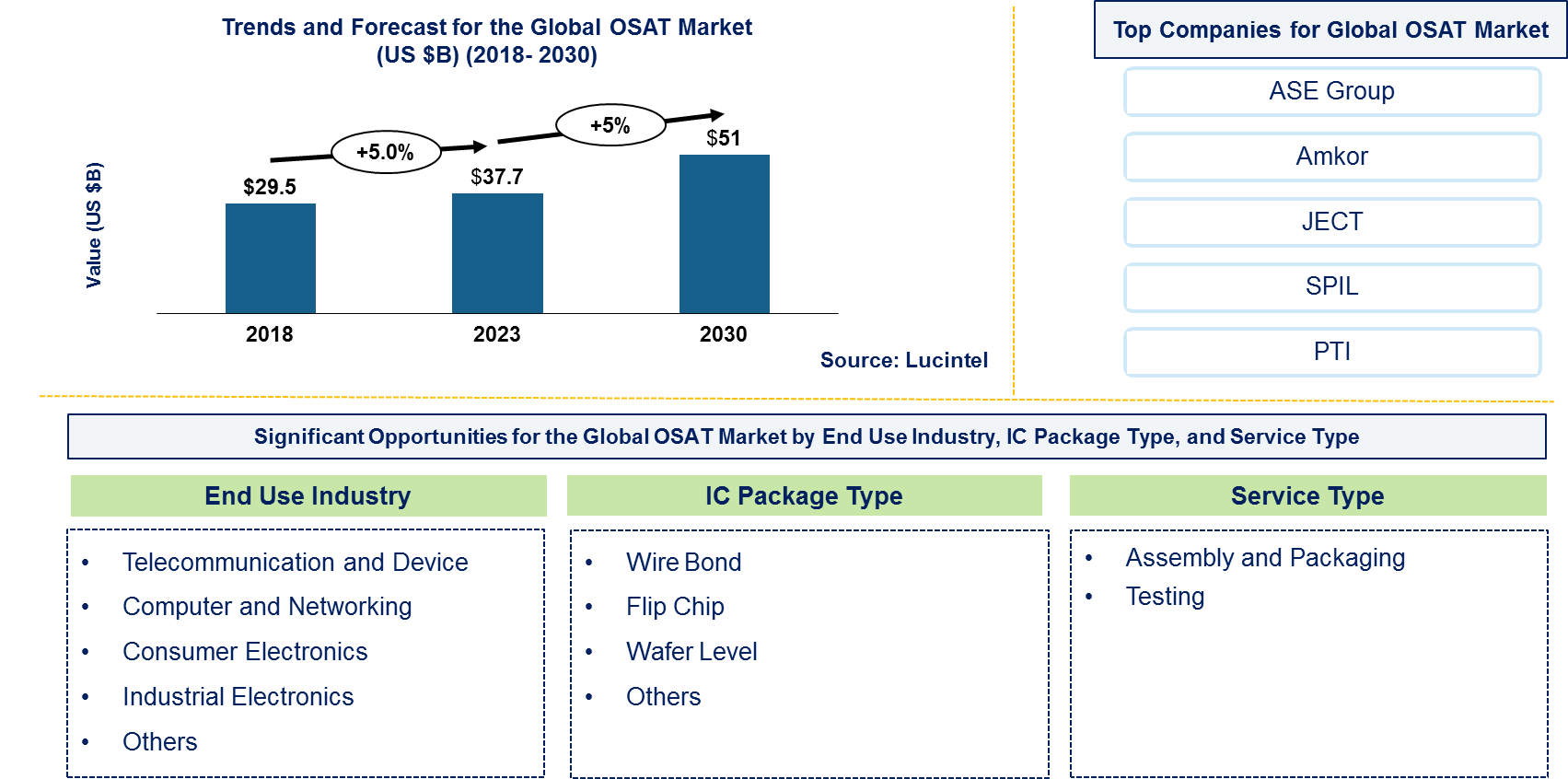

The future of the global outsourced semiconductor assembly and testing (OSAT) market looks promising with opportunities in the automotive, telecommunication, computing & networking, consumer electronic, and industrial industries. The global outsourced semiconductor assembly and testing market is expected to reach an estimated $51 billion by 2030 with a CAGR of 4% from 2024 to 2030. The major drivers for this market are increasing semiconductor content within electronics products to provide greater functionality and higher levels of performance, growth in demand for smartphones and internet connected devices, and increasing electronic content in automotive for safety, navigation, fuel efficiency, emission reduction, and entertainment system.

Raw materials essential to this process include silicon wafers, leadframes, encapsulants and bonding wires. Silicon wafers are a primary component of semiconductor devices. Leadframes are the electrical connections in packages. Encapsulants are resin materials for protection of the semiconductor parts. Gold or copper is commonly used to make bonding wires that are internal connections within the semiconductor package. Die bonding, wire bonding and encapsulation combine these components to make completed semiconductor products.

The price for OSAT services is not uniform as it depends on such factors as technology complexity, volume, and specific customers’ requirements. In general, the cost of OSAT services tends to be competitive vs in-house assembly and test operations leading to benefits from economies of scale as well as focused know-how. Nevertheless, costs can prove higher than those of plain packaging alternatives because they reflect superior technological advancement and quality control. It is very often this competitive pricing structure that attracts widespread adoption of OSATs in the semiconductor industry.

• Lucintel forecast that assembly & packaging will remain the largest segment over the forecast period due to growing demand for telecom infrastructure and electronic products across the globe.

• Within this market, consumer electronics segment is projected to record the highest growth due to growing acceptance of 5G technologies and increasing consumption of smart televisions, tablets, and smartphones.

• Asia Pacific is expected to witness the highest growth during the forecast period due to growing adoption of IoT (internet of things), increasing electronic content per vehicle, and growing industrial automation in countries, such as China, Taiwan, and India.

Country wise Outlook for the OSAT Market

Geographically, the OSAT market is expanding around the world with varying dynamics across regions. The U.S. and Taiwan are major participants in advanced technologies while China and Southeast Asia offer competitive pricing and growth opportunities. South Korea and Japan contribute with their technological know-how while Europe focuses on niche applications. Below image highlights recent developments by major carbon fiber producers in key regions: the USA, Germany, China, Singapore, Taiwan, and South Korea.

Emerging Trends in the OSAT Market

Emerging trends in the OSAT market shaping its future applications and market dynamics:

• Advanced Packaging Technologies: 3D packaging, wafer-level packaging (WLP), and system-in-package (SiP) solutions.

• Artificial Intelligence (AI) Integration: Manufacturing in assembly and testing process using machine learning and AI.

• Increase of 5G and IoT Applications: For instance, packaging solutions have been designed for infrastructure as well as Internet of Things (IoT) devices which are built for 5G deployments.

• Minimalism Focus: Customer electronics industry plus wearable devices constantly prefer ever smaller more compact semiconductors.

• Emergence and Advancement of New Approaches to Testing: To address the intricacies of advanced semiconductor technologies, new testing methodologies and equipment have been adopted.

A more than 150-page report is developed to help in your business decisions. Sample figures with some insights are shown below.

Recent Developments in the OSAT Market

Ongoing innovations and advancements in various sectors of the OSAT market which have been highlighted by recent developments:

• Advanced Package Innovations: The effort to enhance performance and shrinkage in the modern packaging technology, such as 3D stacking, fan-out wafer level packaging (FOWLP), and high-density interconnect substrates (HDI).

• Boosted Testing Capabilities: Improved accuracy and efficiency of evaluating semiconductor reliability and performance through advanced testing techniques and equipment like inline testing and automated test equipment (ATE).

• Incorporation of Artificial Intelligence: This involves the use of AI and machine learning for predictive maintenance, process optimization, and quality control, among others that will make manufacturing more intelligent.

• Embracing Sustainability: Addressing environmental concerns by using lead-free solder materials in production processes that are energy efficient in order to meet local regulations.

• Venturing into New Markets: Emerging markets such as Southeast Asia and China are witnessing a growth in OSAT services due to increasing demand for consumer electronics coupled with favorable policies towards semiconductor industry development.

Strategic Growth Opportunities for OSAT Market

The semiconductor industry is changing quickly, and some OSAT companies are adopting new methods to utilize this dynamism for their growth. Some key strategic growth opportunities for this market include:

• Advancements in Technology: This includes the rapid development of semiconductor technology, including the emergence of 5G, IoT and AI that gives a lot of opportunities for growth by OSAT players. As devices become more complex and require higher performance, the demand for advanced packaging solutions such as System-in-Package (SiP) and 3D packaging has been increasing.

• Emerging Markets: A good opportunity exists in expanding into emerging markets such as India, Southeast Asia, or Latin America. In these areas there is an increasing demand for electronics and consumer devices which consequently leads to a need for semiconductor assembly and testing services. Being established in these markets will give OSAT companies a competitive advantage as well as open up new revenue streams.

• Increased Demand for Automotive Electronics: The fact that the automotive industry is moving towards electric vehicles (EVs) and autonomous driving technology means that there is a high demand for semiconductors. Packaging vendors can tap into this trend by providing specialized packaging and testing solutions suitable for automotive application, which are often characterized by high reliability needs.

• Integration of Advanced Testing Solutions: With ever-growing complexity of semiconductor products, there is an increasing requirement for highly sophisticated testing methodologies. Therefore, the use of automated test equipment (ATE), per-sensor test techniques etc., may be employed to ensure precision & efficacy during testing procedures thereby improving service offerings available while meeting strict quality demands set forth in modern semiconductors applications.

• Sustainability Initiatives: In line with growing focus on sustainability and environmental stewardship, green practices can provide potential avenues for growth within OSAT firms. Some environmentally friendly processes & materials like lead-free solder or energy efficient manufacturing approaches attract environmentally conscious clients; moreover they also help in compliance with global regulations.

• Strategic Partnerships and Mergers: By entering into strategic partnerships or pursuing mergers and acquisitions, OSAT firms could gain new technologies, markets, and clients. This can be achieved through cooperation with technology vendors, research institutions & other industry players thus enhancing the capabilities and driving growth.

• Customization and Niche Markets: Differentiation for OSAT providers from competitors can be achieved by providing tailor made solutions to specific customer needs or niche markets. Therefore, specializing in fields like high frequency applications, medical devices or aerospace will open up opportunities for growth leading to a strong market position.

OSAT Market Driver and Challenges

Technological advancements, increased demand in semiconductors, cost-effectiveness of outsourcing, more research and development allocations and sustainable programs are the major factors influencing the OSAT market. Nonetheless, it has some difficulties such as high investment costs, complex technology requirements, supply chain interruptions, intense rivalry among others, compliance with the law regulations, lack of qualified personnel and economic instability.

The factors responsible for driving the OSAT market include:

• Technological Advancements and High-Performance Computing Needs: Innovations in 3D packaging wafer-level packaging (WLP), and system-in-package (SiP) solutions coupled with growing demand for advanced packaging to support high-performance computing data centers and AI-driven technologies facilitate further growth of the OSAT market.

• Growth in Semiconductor Industry and Expansion of 5G and IoT: The global semiconductor demand for consumer electronics automotive industry as well as industrial applications is being driven by rising demands along with rolling out of 5G networks throughout the world together with increasing use of IoT devices which call for advanced packaging solutions in order to fuel OSAT market.

• Cost-Effectiveness of Outsourcing: By outsourcing assembly and testing services to OSAT providers enable companies save on cost hence enabling them to concentrate on their core activities thus reducing capital outlay thus stimulating the expansion of this industry.

• Increased R&D Investments and Innovation: Substantial investments in research & development result into advanced packaging & testing solutions that improve semiconductor device performance & reliability driving market growth.

• Sustainability Initiatives and Eco-Friendly Practices: Adoptions are made towards green manufacturing needs within semiconductors packing through utilizing sustainable materials/processes that appeal both ecologically conscious customers/regulators globally.

Challenges in the OSAT market are:

• High Capital Expenditure and Technological Complexity: A lot is needed especially when it comes to investing in machinery for producing semiconductors. Advanced machines need large sums of money which smaller firms cannot cope with hence becoming a threat for new entrants or small players due technological changes too fast.

• Supply Chain Disruptions and Intense Competition: It is susceptible to supply chain disturbances that are due to geopolitical tensions, natural calamities among others thus competition rises leading to low prices hence requiring companies to make their products different from one another every time.

• Environmental and Regulatory Compliance: OSAT providers often have challenges associated with complying with environmental regulations as well as those of other regions resulting into high operational costs and complexity.

• Skilled Workforce Shortage and Economic Fluctuations: Additionally there is a lack of professionals who are skilled in the field of advanced packaging and testing processes which affects its ability to meet the increased customer requirement. Furthermore, economic crisis and global market fluctuations determine increase or decrease in demand for semiconductors as well as OSAT services.

The OSAT (Outsourced Semiconductor Assembly and Test) market is driven by technological advancements, the growing semiconductor industry, cost-effective outsourcing, increased R&D investments, and sustainability initiatives. However, the market faces challenges such as high capital expenditures, complex technological requirements, supply chain disruptions, intense competition, regulatory compliance, and a shortage of skilled professionals. Balancing these drivers and challenges is essential for sustained growth and innovation in the OSAT market.

OSAT Suppliers and Their Market Shares

In this globally competitive market, several key players such as Advanced Semiconductor, Amkor, Jiangsu Changjiang Electronics Technology, Siliconware Precision Industries, PTI (Powertech Technology Inc.), United Test and Assembly Center, King Yuan Electronics, ChipMOS, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies carbon fiber companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the OSAT companies profiled in this report include.

• Advanced Semiconductor

• Amkor

• Jiangsu Changjiang Electronics Technology

• Siliconware Precision Industries

• PTI (Powertech Technology Inc.)

These companies have established themselves as leaders in the OSAT industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the OSAT market are evolving, with the entry of new players and the emergence of innovative OSAT technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

OSAT Market by Segment

This category of the market has been experiencing massive growth and it includes advanced packaging technologies such as System-in-Package (SiP) and 3D packaging, driven by the need to make electronic devices smaller in size and more efficient. Moreover, automotive electronics is also expanding at a fast pace due to electric vehicles (EVs) and autonomous driving which needs high-end semiconductor solutions. Besides, there are increasing demands for advanced assembly and testing services due to growth of 5G technology and Internet of Things (IoT). Another significant development area involves high-performance computing (HPC) data centers that require sophisticated packaging systems for improving processing power intensification and efficiency requirements.

The study includes trends and forecast for the global OSAT market by service type, packaging type, application, and region as follows:

OSAT Market by Service Type [Value ($B) Analysis from 2018 to 2030]:

• Assembly & Packaging

• Testing

OSAT Market by Packaging Type [Value ($B) Analysis from 2018 to 2030]:

• Wire Bond

• Flip Chip

• Wafer Level

• Others

OSAT Market by Application [Value ($B) Analysis from 2018 to 2030]:

• Automotive

• Telecommunications

• Computing & Networking

• Consumer Electronics

• Industrial

OSAT Market by Region [Value ($B) Analysis from 2018 to 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

Features of the OSAT Market

• Market Size Estimates: Outsourced semiconductor assembly and testing market size estimation in terms of value ($B)

• Trend And Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Outsourced semiconductor assembly and testing market size by various segments, such as by service type, packaging type, application, and region

• Regional Analysis: Outsourced semiconductor assembly and testing market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis on growth opportunities in different by service type, packaging type, application, and regions for the outsourced semiconductor assembly and testing market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the outsourced semiconductor assembly and testing market.

FAQ

Q1. What is the outsourced semiconductor assembly and testing (OSAT) market size?

Answer: The global outsourced semiconductor assembly and testing (OSAT) market is expected to reach an estimated $51 billion by 2030.

Q2. What is the growth forecast for the OSAT market?

Answer: The global outsourced semiconductor assembly and testing market is expected to grow with a CAGR of 5% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the OSAT market?

Answer: The major drivers for this market are increasing semiconductor content within electronics products to provide greater functionality and higher levels of performance, growth in demand for smartphones and internet connected devices, and increasing electronic content in automotive for safety, navigation, fuel efficiency, emission reduction, and entertainment system.

Q4. What are the major segments for OSAT market?

Answer: The future of the outsourced semiconductor assembly and testing market looks promising with opportunities in the automotive, telecommunication, computing & networking, consumer electronic, and industrial application industries.

Q5. Who are the key outsourced semiconductor assembly and testing companies?

Answer: Some of the key outsourced semiconductor assembly and testing companies are as follows:

• Advanced Semiconductor

• Amkor

• Jiangsu Changjiang Electronics Technology

• Siliconware Precision Industries

• PTI (Powertech Technology Inc.)

Q6. Which OSAT segment will be the largest in future?

Answer: Lucintel forecast that assembly & packaging will remain the largest segment over the forecast period due to growing demand for telecom infrastructure and electronic products across the globe.

Q7. In outsourced semiconductor assembly and testing market, which region is expected to be the largest in next 7 years?

Answer: Asia Pacific is expected to witness the highest growth during the forecast period due to growing adoption of IoT (internet of things), increasing electronic content per vehicle, and growing industrial automation in countries, such as China, Taiwan, and India.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. What are some of the most promising, high-growth opportunities for the global outsourced semiconductor assembly and testing market by service type (assembly & packaging and testing), packaging type (wire bond, flip chip, wafer level, and others), application (automotive, telecommunications, computing & networking, consumer electronics, and industrial), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which segments will grow at a faster pace and why?

Q.3. Which region will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the key challenges and business risks in this market?

Q.5. What are the business risks and competitive threats in this market?

Q.6. What are the emerging trends in this market and the reasons behind them?

Q.7. What are some of the changing demands of customers in the market?

Q.8. What are the new developments in the market? Which companies are leading these developments?

Q.9. Who are the major players in this market? What strategic initiatives are key players pursuing for business growth?

Q.10. What are some of the competing products in this market and how big of a threat do they pose for loss of market share by material or product substitution?

Q.11. What M&A activity has occurred in the last 5 years and what has its impact been on the industry?

For any questions related to outsourced semiconductor assembly and testing market or related to outsourced semiconductor assembly and testing companies, outsourced semiconductor assembly and testing market size, outsourced semiconductor assembly and testing market share, outsourced semiconductor assembly and testing analysis, write Lucintel analyst at email: helpdesk@lucintel.com we will be glad to get back to you soon.