Interposer Market Trends and Forecast

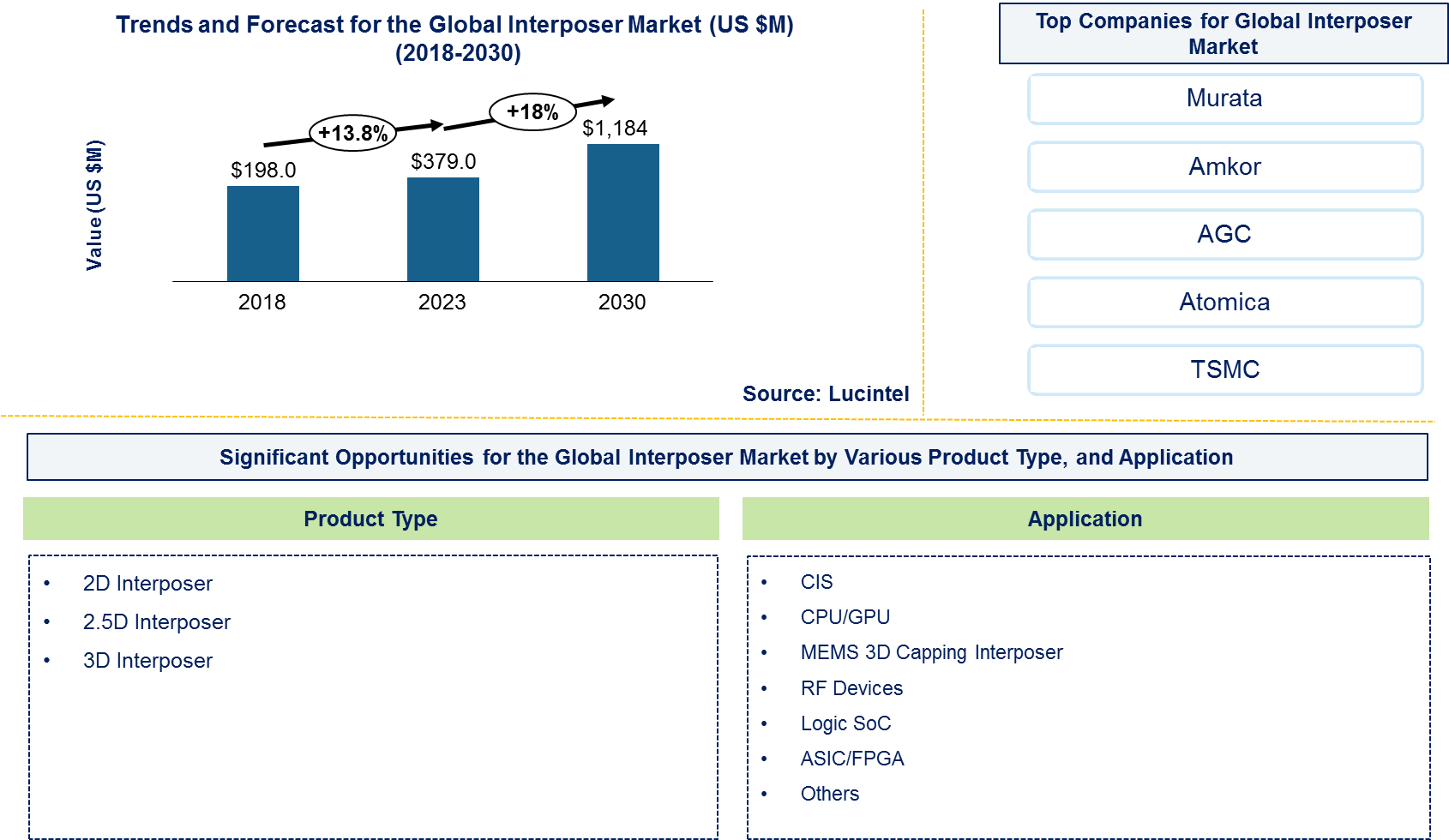

Lucintel finds that the future of the interposer market looks promising with opportunities in the CIS, CPU/GPU, MEMS 3D capping interposer, RF devices, logic SoC, and ASIC/FPGA markets. The global interposer market is expected to reach an estimated $1,184 million by 2030 with a CAGR of 18% from 2023 to 2030. The major drivers for this market are growing demand for higher performance in various industries and increasing advancement in semiconductor technology.

An interposer is a specialized component used in semiconductor packaging to enable connectivity between different integrated circuits (ICs) or between an IC and its package substrate. It acts as an intermediate layer with a substrate material typically made of silicon, glass, or ceramic. Key components of an interposer include multiple layers of metal traces or vias for electrical connections, known as routing layers. These layers facilitate the transmission of signals and power between ICs and provide pathways for through-silicon vias (TSVs), which are vertical conductive paths that penetrate through the interposer. Bump or pad structures on the interposer's surface allow for the attachment of ICs using solder bumps or conductive adhesives. Dielectric layers insulate the metal traces to prevent electrical short circuits, ensuring reliability.

• Lucintel forecasts that ASIC/FPGA will remain the largest application during the forecast period due to growing demand of artificial intelligence, autonomous car, and machine learning.

• 2.5D interposer will remain the largest segment due to better speed, power, heterogeneous integration, and simplified integration properties.

• Asia Pacific will remain the largest region over the forecast period due to the presence of large foundries and manufacturing hub for electronic devices. Economic growth, growing urbanization, growing disposable income, and increasing adoption of digital technologies, such as 5G, Internet of things (IoT), and artificial intelligence (AI) driving the demand for semiconductor and advance IC packaging in this region, thereby demand for interposer will also grow.

Country wise Outlook for Interposer Market

The interposer market is witnessing substantial growth globally, driven by increased demand from various applications such as CIS, CPU/GPU, MEMS 3D capping interposer, RF devices, logic SoC, and ASIC/FPGA markets. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major organophosphorus flame retardant producers in key regions: the USA, Canada, Germany, China, India, and Brazil.

Emerging Trends for Interposer Market

The interposer market's size has been expanding rapidly, driven by the increasing adoption of interposer in various applications. The market size is influenced by factors such as development of advanced packaging technologies in interposers, system and heterogeneous integration in interposers, and development of environment-friendly interposers. The market size is estimated to continue its upward trajectory as industries across the globe seek to improve performance, efficiency, and sustainability.

Emerging trends in the interposer market are shaping its future applications and market dynamics:

• Advanced Packaging Technologies: The growth is towards 2.5D and 3D integration through use of interposers to achieve better performance and lower size levels. Stacking multiple ICs vertically or side-by-side using these technologies reduces latency and enhances data transfer speeds.

• High-Density Interconnects: Efforts in interposer designs are driven towards increasing the number of connections allowing for more efficient signal and power transmission among integrated circuits. This helps in meeting the demands of smaller form factors ad increased bandwidth in electronic devices.

• System Integration and Heterogeneous Integration: Through interposers, heterogeneous components like CPUs, GPUs, memory, sensors etc can be brought together into a single package. This boosts overall system performance, power efficiency and reliability.

• Application Expansion: Besides traditional sectors such consumer electronics as well as telecommunications; interposers are also being used across different industries such as automotive, healthcare, aerospace among others because they require high level of reliability, thermal management and signal integrity that can only be achieved by using an interposer based solution.

• Material Innovations: The properties of interposers’ materials such as low-loss dielectrics and high-conductivity metals have been improved on by technology advancements. This is critical for enabling heat dissipation and signal transmission which are important for high-performance computing systems as well as AI/IoT emerging technologies.

• Environmental Sustainability: Developing environmentally friendly interposer technologies that employ recyclable materials while reducing the carbon footprint associated with semiconductor packaging processes is becoming increasingly important.

A total of 107 figures / charts and 68 tables are provided in this 205-page report to help in your business decisions A sample figure with insights is shown below.

Recent Developments in Interposer Market

Ongoing innovations and advancements in various sectors of the interposer market which have been highlighted by recent developments:

HPC Adoption on the Rise: High-performance computing (HPC) has seen a rise in the use of interposers in order to enhance data transfer speeds and decrease power consumption, which support artificial intelligence (AI), machine learning, and data centers advancements.

Expanding Automotive Electronics: The automotive sector is utilizing interposer technologies for advanced driver assistance systems (ADAS), electric vehicles (EVs), and autonomous driving. Such devices add reliability and performance that contribute to automotive safety and efficiency.

Advancements in 2.5D and 3D Integration: The current technology trend entails adopting interposers for 2.5D and 3D integration to do stacking of several ICs either vertically or side by side. This approach involves higher levels of integration, better handling of heat build-up, and smaller sizes in electronic gadgets.

Technological Collaboration and Partnerships: A semiconductor company’s collaborative effort with packaging providers as well as research institutions is hastening the development of interposer-based solutions. Partnership agreements have been established so as to improve interposer design capabilities, material properties as well as production processes that can meet with changing industrial needs.

Focus on Miniaturization and Power Efficiency: New approaches towards the design of interposers place greater emphasis on miniaturization as well as improvements in electrical functionality. There are efforts being made to explore new materials or methods for building that would enable them to be smaller while still maintaining good electrical performance.

Strategic Growth Opportunities for Interposer Market

The interposer market is very dynamic due to its unique properties of enhanced performance and better thermal management. Some key strategic growth opportunities for this market include:

• Data centers and high-performance computing (HPC): It is the need for faster data processing and reduced latency in HPC and data centers that has led to the adoption of interposers for 2.5D, and 3D integration to occur. These enable enhanced thermal management as well as denser packaging of chips.

• Telecommunications Infrastructure and 5G: For instance, advanced semiconductor solutions capable of handling higher data rates, supporting complex RF architectures are required for the rollout of 5G networks. In telecommunications equipment, Interposers improve signal integrity and reliability by integrating RF components into them.

• Automotive Electronics: The use of interposer technologies in ADAS, EVs, autonomous vehicles among others is very crucial in the automotive industry. This results in system performance enhancement; power consumption reduction; sensors integration; processor integration which ensures both vehicle safety as well as connectivity.

• Consumer Electronics: For compact designs and improved functionality smartphones such as tablets and wearable devices are dependent on interposers. Single package multiple chip integrations have been made possible through this technology hence better performance with device size reduction while minimizing power usage.

• Medical Devices and IoT: The healthcare sector demand miniature, robustly performing electronics. With interposer technology medical devices sensors integration can be realized as well as communication modules thus enabling progressions like remote monitoring healthcare diagnostics.

• Technological Advancements: Innovations that have continued to be seen include better designs of interposers materials used for making them as well as manufacturing procedures adopted over time which result in high performances reliability at a friendly cost. The future industry needs require investment R&D on next generation interposer solution

• Environmental Sustainability: Manufacturers are increasingly becoming keen n issues concerning energy consumption during production thereby lowering environmental impacts related to their activities by developing environmentally friendly interposer technologies using recyclable materials. Such practices confer considerable market advantage within the world of interposers today.

Interposer Market Driver and Challenges

Interposer has a very important role in many applications including CIS, CPU/GPU, MEMS 3D capping interposer, RF devices, logic SoC, and ASIC/FPGA. The changing market dynamics are being driven by the growing demand for higher performance in various industries and increasing advancement in semiconductor technology. However, challenges like cost consideration and technological complexity to sustain growth and innovation in interposer market. The factors responsible for driving the interposer market include:

• Demand for Higher Performance: An enhanced level of computing efficiency is necessary, especially in data centers, artificial intelligence (AI), and high-performance computing (HPC). Interposers which support 2.5D and 3D integration facilitate compact packaging as well as improved performance.

• Miniaturization and Space Efficiency: Interposers allow the integration of many chips into small devices which are required by consumer electronics and mobile gadgets to be utilized efficiently by making a better use of space while increasing functionality.

• Advancements in Semiconductor Technology: Technological development in the field of semiconductor fabrication and packaging techniques necessitates interposers that can support finer pitch interconnects, higher data rates and better thermal management.

• Application Expansion: Their versatility and adaptability across diverse industries have resulted in their extension from conventional applications such as consumer electronics to automotive (for ADAS and electric vehicles), telecommunications (for 5G infrastructure), healthcare (for medical devices and wearables).

Challenges facing the interposer market are:

• Cost Considerations: The addition of interposer technology to semiconductor packages complicates the manufacturing process thereby increasing its associated costs. It remains difficult to strike a balance between cost-effectiveness while maintaining performance demands.

• Technological Complexity: Engineering interposers that satisfy stringent electrical and thermal performance requirements notably for 2.5D & 3D integration calls for advanced knowledge in materials, manufacturing, design etc.

• Reliability and Yield: Maintaining high yield rates throughout the life cycle of products based on an interposer is therefore a major challenge. In addition ensuring consistent quality and performance at large-scale production is still vital.

• Supply Chain Risks: A reliance on global supply chain for raw materials, equipment or even expert knowledge may be problematic during times of geopolitical tensions or interruptions.

• Regulatory and Environmental Compliance: Compliance with international regulations pertaining to material used in interposers plus environmental sustainability practices makes production processes much more complicated thereby creating additional costs.

Sustaining growth and effectively addressing ever-changing market trends requires stakeholders in the interposer sector to navigate these challenges.

Interposer Suppliers and their Market Shares

In this globally competitive market, several key players such as Murata, Amkor, AGC, Atomica, TSMC, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us by email at helpdesk@lucintel.com.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies interposer companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the interposer companies profiled in this report includes.

• Murata

• Amkor

• AGC

• Atomica

• TSMC

These companies have established themselves as leaders in interposer industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within interposer market are evolving, with the entry of new players and the emergence of connector technologies. Additionally, collaborations between component suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

0

Interposer Market by Segment

Major segments of interposer experiencing growth include CIS, CPU/GPU, MEMS 3D capping interposer, RF devices, logic SoC, and ASIC/FPGA applications. These segments reflect increasing demand driven by technological advancements and sustainability goals across diverse industries.

This fillers in the interposer market report provides a comprehensive analysis of the market's current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments, including product type and application. The report offers insights into regional dynamics, highlighting the major markets for interposer and their growth potentials. The study includes trends and forecast for the interposer market by product type, application, and region as follows:

Interposer Market by Product Type [$M Analysis for 2018 – 2030]:

• 2D Interposer

• 2.5D Interposer

• 3D Interposer

Interposer Market by Application [$M Analysis for 2018 – 2030]:

• CIS

• CPU/GPU

• MEMS 3D Capping Interposer

• RF Devices

• Logic SoC

• ASIC/FPGA

• Others

Interposer Market by Region [$M Analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

Features of Interposer Market

Market Size Estimates: Interposer market size estimation in terms of value ($M)

Trend and Forecast Analysis: Market trends (2018 – 2030) and forecast (2024-2030) by various segments and regions.

Segmentation Analysis: Market size by product type and application

Regional Analysis: Interposer market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different product type, application, and regions for the interposer market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for the interposer market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the interposer market size?

Answer: The global interposer market is expected to reach an estimated $1,184 million by 2030

Q2. What is the growth forecast for interposer market?

Answer: The interposer market is expected to grow at a CAGR of 18% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the interposer market?

Answer: The major drivers for this market are growing demand for higher performance in various industries and increasing advancement in semiconductor technology.

Q4. What are the major applications or end use industries for interposer?

Answer: ASIC and MEMS are the major end use industries for interposer.

Q5. What are the emerging trends in interposer market?

Answer: Emerging trends, which have a direct impact on the dynamics of the interposer industry, include development of advanced packaging technologies in interposers, system and heterogeneous integration in interposers, and development of environment-friendly interposers.

Q6. Who are the key interposer companies?

Answer: Some of the key interposer companies are as follows:

• Murata

• Amkor

• AGC

• Atomica

• TSMC

Q7.Which interposer product segment will be the largest in future?

Answer: Lucintel forecasts that 2.5D interposer will remain the largest segment due to better speed, power, heterogeneous integration, and simplified integration properties.

Q8: In interposer market, which region is expected to be the largest in next 7 years?

Answer: Asia Pacific is expected to remain the largest region and witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high growth opportunities for the global interposer market by product type (2D interposer, 2.5D interposer, and 3D interposer), application (CIS, CPU/GPU, MEMS 3D capping interposer, RF devices, logic SoC, ASIC/FPGA, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 5 years in this market?

For any questions related to interposer market or related to interposer market share, interposer market analysis, interposer market size, and interposer manufacturers, write to Lucintel analysts at helpdesk@lucintel.com. We will be glad to get back to you soon.