Glass Manufacturing Market Trends and Forecast

The technologies in the glass manufacturing market have undergone significant changes in recent years, with a shift from traditional batch processing technology to continuous production technology. Additionally, the market has seen a transition from conventional glass production methods to advanced coatings and smart glass technologies. This includes the development of low-emissivity (Low-E) coatings for flat glass and the introduction of self-cleaning glass and tinted glass to improve energy efficiency in construction. Another significant shift is from manual glass shaping techniques to automated and robotic manufacturing processes, which improve precision and reduce waste. Moreover, the adoption of recycled glass in production has become more widespread, driving sustainability in the industry. The integration of advanced melting furnaces and electric melting technologies further enhances energy efficiency and reduces carbon emissions. These advancements are helping to meet the growing demand for high-performance glass in sectors such as construction, electronics, automotive, and packaging.

Emerging Trends in the Glass Manufacturing Market

The glass manufacturing market is experiencing significant changes, driven by technological innovations and evolving consumer demands. As industries like construction, automotive, electronics, and packaging continue to seek more sustainable, energy-efficient, and high-performance glass solutions, several key trends are shaping the future of the market. These trends highlight advancements in production processes, material science, and the growing demand for smarter and more eco-friendly glass applications. Below are five emerging trends in the glass manufacturing industry.

• Adoption of Smart Glass Technologies

Smart glass, which includes technologies such as electrochromic, thermochromic, and photochromic glass, is gaining popularity in various applications. These glasses can change their properties in response to environmental stimuli like temperature, light, or electrical currents. This trend is particularly prevalent in the construction and automotive sectors, where smart windows provide better energy efficiency, privacy, and comfort. The growing demand for energy-efficient buildings and eco-friendly cars is driving the adoption of smart glass technologies.

• Sustainability and Recycled Glass

Sustainability is becoming a core focus in the glass manufacturing industry. More companies are incorporating recycled glass into their production processes to reduce waste and lower carbon footprints. This trend is not only helping to conserve natural resources but is also driven by government regulations and consumer preference for sustainable products. As a result, the use of post-consumer recycled glass in container glass, flat glass, and fiberglass production is expected to grow significantly in the coming years.

• Automation and Industry 4.0 Integration

The integration of automation and Industry 4.0 technologies into glass manufacturing processes is improving efficiency, precision, and scalability. Robotics, artificial intelligence (AI), and the Internet of Things (IoT) are being used to automate production lines, monitor quality, and predict maintenance needs. These technologies help optimize production cycles, reduce human error, and lower operational costs, making glass manufacturing more competitive and sustainable.

• Advancements in Energy-Efficient Manufacturing

Energy-efficient manufacturing is a critical trend, particularly with increasing energy costs and environmental concerns. The adoption of advanced technologies such as electric melting furnaces, which reduce energy consumption, is becoming more common. These innovations in furnace design and energy management systems are allowing manufacturers to produce glass at lower environmental and economic costs, thereby meeting both regulatory standards and consumer demand for green products.

• Growth of Flat Glass in Construction and Automotive Sectors

Flat glass is increasingly being used in the construction and automotive sectors, driven by a rise in demand for energy-efficient buildings and vehicles. The trend toward larger windows, facades, and sunroofs, combined with the push for better insulation and solar control, is driving the growth of flat glass production. Advanced coatings, such as low-emissivity (Low-E) glass, are improving energy efficiency in these sectors by reducing heat loss and controlling solar gain.

These emerging trends in the glass manufacturing market are reshaping the industry by focusing on innovation, sustainability, and efficiency. From the growth of smart glass technologies to the increased use of recycled materials, the industry is moving toward greener, more energy-efficient solutions. Automation and advancements in energy-efficient manufacturing processes are enhancing productivity, while the demand for flat glass in construction and automotive applications is fueling new opportunities. As these trends continue to evolve, the glass manufacturing market is positioning itself to meet the growing demand for high-performance, environmentally friendly, and cost-effective glass products.

Glass Manufacturing Market : Industry Potential, Technological Development, and Compliance Considerations

The product technologies in the glass manufacturing market, including innovations like smart glass, energy-efficient manufacturing processes, and advanced coatings, hold significant technological potential.

• Potential in technology:

Smart glass technologies, such as electrochromic and thermochromic glass, enable windows to change properties based on environmental stimuli, offering improved energy efficiency, privacy, and comfort. This technology has the potential to revolutionize sectors like construction and automotive by reducing energy consumption and enhancing user experience.

• Degree of Disruption:

The degree of disruption is high, as these technologies not only improve existing products but also create new applications, particularly in energy-efficient buildings and eco-friendly vehicles.

• Level of Current Technology Maturity:

The level of current technology maturity is varied. While some technologies, like energy-efficient manufacturing methods and low-emissivity coatings, are well-established, others, like smart glass, are still maturing but rapidly gaining traction due to the growing demand for sustainable, high-performance products.

• Regulatory Compliance:

The regulatory compliance aspect is becoming increasingly important, especially in industries like construction, automotive, and packaging. Regulations regarding energy efficiency, environmental impact, and sustainability (e.g., energy codes, and recycling standards) are pushing manufacturers toward greener technologies.

As a result, these product technologies are driving the shift toward more sustainable production practices, offering both innovation and compliance with emerging regulatory frameworks, making them critical for the future of the glass manufacturing market.

Recent Technological development in Glass Manufacturing Market by Key Players

The glass manufacturing market is evolving rapidly, with key players such as AGC, Heinz Glass, Nippon Sheet Glass, Saint Gobain, Central Glass, Nippon Electric Glass, and Guardian Industries leading the way in innovation. These companies are introducing cutting-edge technologies to meet the increasing demand for energy-efficient, sustainable, and high-performance glass products. They are adapting to shifts in consumer preferences, regulatory pressures, and industry trends like sustainability, smart glass technologies, and eco-friendly manufacturing. Below are the recent developments made by these prominent players in the market.

• AGC (Asahi Glass Company): AGC has been a pioneer in the smart glass sector, particularly with electrochromic glass technology, which allows the glass to change its opacity in response to environmental changes like light and temperature. This innovation enhances energy efficiency in buildings and vehicles, aligning with the growing demand for sustainable solutions. AGC has also been investing in recycling technologies and low-emissivity (Low-E) coatings to reduce energy consumption, making it a leader in eco-friendly glass manufacturing.

• Heinz Glass: Heinz Glass is making notable strides in the glass packaging sector, specifically in producing lightweight glass containers. Their innovative packaging solutions are aimed at reducing the environmental impact of glass products by minimizing energy consumption in transportation and reducing overall material usage. These developments contribute to sustainability in the packaging industry and support efforts to reduce carbon footprints.

• Nippon Sheet Glass (NSG Group): Nippon Sheet Glass continues to lead in high-performance automotive and architectural glass. The company has advanced solar control glass and privacy glass technologies, offering solutions that improve the energy efficiency of buildings and vehicles. Their heat-reflective glass is particularly beneficial in the automotive sector, as it reduces the need for air conditioning, thereby improving fuel efficiency and contributing to environmental sustainability.

• Saint-Gobain: Saint-Gobain is pushing the boundaries of eco-friendly glass solutions, focusing on developing low-emissivity (Low-E) glass for improved thermal insulation. Their SEKURIT® laminated glass provides higher safety and better acoustic performance, making it ideal for automotive applications. The companyÄX%$%Xs efforts are focused on sustainability, as it works towards reducing CO2 emissions in the manufacturing process and creating energy-efficient glass products for both the construction and automotive industries.

• Central Glass: Central Glass has been advancing the development of high-performance glass materials for electronics and automotive applications. They have developed soundproofing glass and lightweight glass solutions, which enhance both vehicle safety and comfort. Additionally, their innovations in display glass and touchscreen technologies position them as a key player in the growing consumer electronics sector, meeting the demand for superior glass products in modern devices.

• Nippon Electric Glass: Nippon Electric Glass (NEG) has become a prominent player in the electronics glass market, specializing in high-purity glass for displays and semiconductor substrates. Their investment in OLED (Organic Light Emitting Diode) glass technology positions them strongly in the fast-growing display market for consumer electronics. NEGÄX%$%Xs focus on producing advanced display panels for smartphones, televisions, and other electronic devices enhances their competitive edge in the digital age.

• Guardian Industries: Guardian Industries has made substantial advancements in solar control glass and energy-efficient building materials. Their SunGuard® glass line is designed to improve thermal comfort in buildings by reducing heat absorption, which lowers energy consumption. The company is also dedicated to using recycled glass in its products, contributing to sustainability and reducing the environmental impact of manufacturing. Guardian’s continued focus on eco-friendly production makes them a key player in the global push for green building materials.

Recent developments by leading players in the glass manufacturing market underscore a clear trend toward sustainability, high performance, and technological innovation. From smart glass technologies to energy-efficient manufacturing and advanced packaging solutions, these companies are transforming the glass industry. As they continue to invest in sustainable practices and cutting-edge technologies, the market is poised for continued growth, driven by demand for energy-efficient, eco-friendly, and high-performance glass products in industries like construction, automotive, and electronics.

Glass Manufacturing Market Driver and Challenges

The glass manufacturing market is being shaped by several key drivers and challenges, influenced by evolving consumer demands, technological advancements, and environmental regulations. These factors are pushing the industry to innovate and adopt sustainable solutions. At the same time, manufacturers must navigate several challenges, including high energy costs and regulatory compliance. Below are the major drivers and challenges currently influencing the market.

The factors responsible for driving the glass manufacturing market include:

• Demand for Energy-Efficient and Sustainable Products: Growing environmental awareness and stricter regulations are driving the demand for energy-efficient glass solutions. Products like low-emissivity glass and smart glass offer significant energy savings and sustainability benefits. As industries push toward reducing their carbon footprint, these products have become central to construction, automotive, and electronics sectors.

• Technological Innovations in Smart Glass: Advances in smart glass technologies, such as electrochromic and thermochromic glass, are creating new opportunities in various industries. These innovations allow the glass to adjust to environmental conditions, improving energy efficiency, comfort, and privacy. Smart glass technologies are particularly impacting the construction and automotive sectors by offering enhanced building designs and more eco-friendly vehicles.

• Growth in Construction and Automotive Sectors: The increasing demand for energy-efficient buildings and eco-friendly vehicles is significantly boosting the glass manufacturing industry. The growth in these sectors is driving the need for advanced glass products like solar control glass and low-emissivity glass. This trend is reshaping the industry toward producing high-performance materials tailored for these applications.

• Recycling and Sustainable Manufacturing Practices: Recycling glass is becoming a major trend in the industry, with many manufacturers incorporating recycled glass into their production processes. This trend not only reduces the consumption of raw materials but also helps in reducing carbon emissions and waste. Recycling initiatives are reshaping the market toward more sustainable manufacturing practices.

Challenges in the glass manufacturing market are:

• High Energy Consumption and Costs: Glass manufacturing is energy-intensive, and rising energy costs are a significant challenge for the industry. The need for advanced technologies that reduce energy consumption, such as electric melting furnaces, is crucial for maintaining profitability while meeting sustainability goals. Manufacturers face pressure to balance energy-efficient production with cost-effectiveness.

• Environmental and Regulatory Compliance: Stringent environmental regulations concerning emissions, recycling, and energy usage are pushing manufacturers to adopt more sustainable practices. Compliance with regulations requires substantial investment in energy-efficient technologies, which can be a significant financial burden. Meeting these standards while staying competitive remains a major challenge in the industry.

• Fluctuations in Raw Material Prices: The cost of raw materials used in glass production, such as sand and lime, can fluctuate, impacting production costs and profit margins. These price variations create uncertainty for manufacturers, especially as they seek to adopt more sustainable materials while keeping their products affordable for consumers.

• Intense Competition and Market Saturation: The glass manufacturing market is highly competitive, with established players competing for market share. As the market grows, new entrants are emerging, increasing pressure on existing players to innovate. This intense competition can lead to price wars, which might reduce profitability for companies that fail to differentiate their products.

The Glass Manufacturing Market is currently experiencing a dynamic phase driven by growing demand for energy-efficient, sustainable products and innovations in smart glass technologies. The construction and automotive sectors are key contributors to this growth. However, challenges such as high energy costs, fluctuating raw material prices, and stringent regulations require manufacturers to adapt and invest in advanced production techniques and sustainability practices. These drivers and challenges are reshaping the industry and pushing the market toward more eco-friendly, innovative, and cost-effective glass solutions.

List of Glass Manufacturing Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies glass manufacturing companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the glass manufacturing companies profiled in this report include.

• AGC

• Heinz Glass

• Nippon Sheet Glass

• Saint Gobain

• Central Glass

• Nippon Electric Glass

Glass Manufacturing Market by Technology

• Technology Readiness by Technology Type: The technology readiness of flat glass, container glass, fiberglass, and other glass technologies varies. Flat glass technologies are highly advanced, with low-emissivity glass and smart glass gaining widespread use in the construction and automotive sectors. Container glass is mature but evolving with innovations in lightweight and recycling. Fiberglass technologies are ready for widespread adoption, especially in automotive and construction for lightweight, durable materials. Other glass technologies, including solar glass and specialty glass, are still developing but show great potential in energy efficiency and renewable energy applications. Competitive intensity varies, with more advanced technologies like smart glass seeing fierce competition, while traditional technologies maintain steady demand due to their wide application base. Regulatory compliance is becoming more demanding, especially regarding sustainability and energy efficiency, driving all types of glass technologies to innovate.

• Competitive Intensity and Regulatory Compliance: The competitive intensity in the glass manufacturing market is high, with established players competing across technologies like flat glass, container glass, fiberglass, and specialty glass. Manufacturers are investing in innovation to stay ahead, such as incorporating recycled materials and developing smart glass solutions. Regulatory compliance is crucial, especially regarding carbon emissions, recycling regulations, and energy consumption. Stringent global regulations push companies to adopt more sustainable practices, which increases operational costs but also drives competition toward more eco-friendly, compliant solutions.

• Disruption Potential by Technology Type: The glass manufacturing market is witnessing disruptive changes with technologies like flat glass, container glass, and fiberglass. Flat glass innovations, particularly in low-emissivity coatings and smart glass, offer energy-saving solutions, revolutionizing the construction and automotive sectors. Container glass technologies, focusing on lightweight and recycled glass, are addressing sustainability concerns. Fiberglass production technologies, aimed at enhancing strength-to-weight ratios, are transforming applications in automotive and construction. Technologies in specialty glass, including solar glass and tinted glass, are becoming increasingly important in energy-efficient and aesthetic applications. These disruptive advancements are driving market growth by meeting evolving consumer demands for sustainability, performance, and energy efficiency.

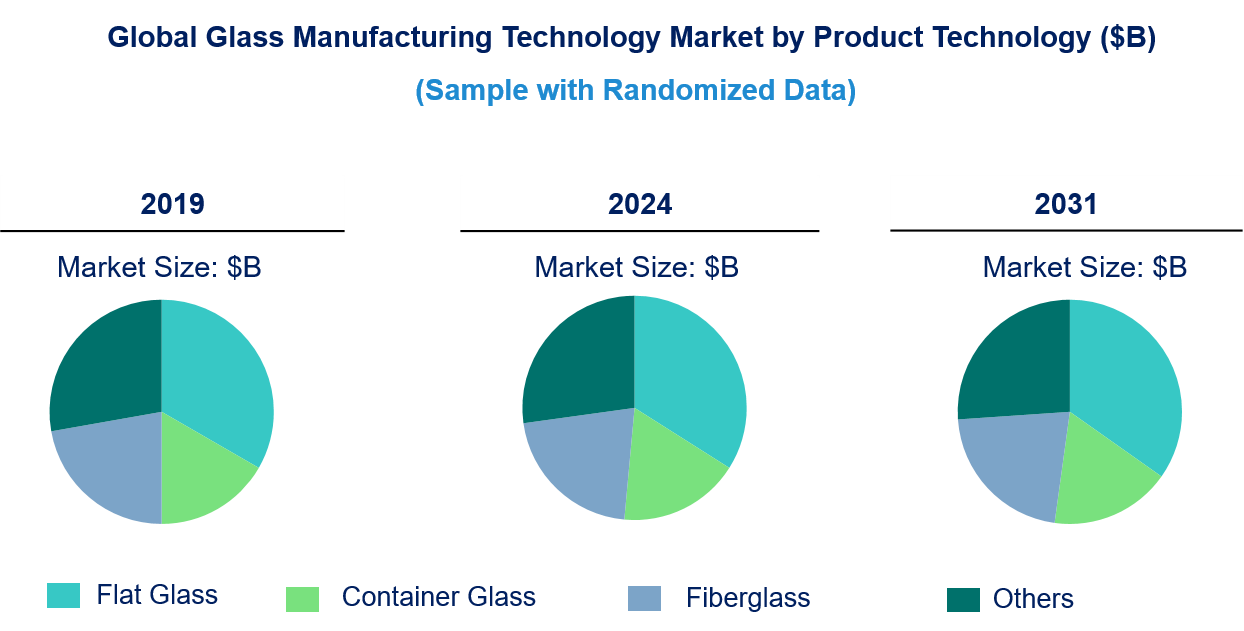

Glass Manufacturing Market Trend and Forecast by Product Technology [Value from 2019 to 2031]:

• Flat Glass

• Container Glass

• Fiberglass

• Others

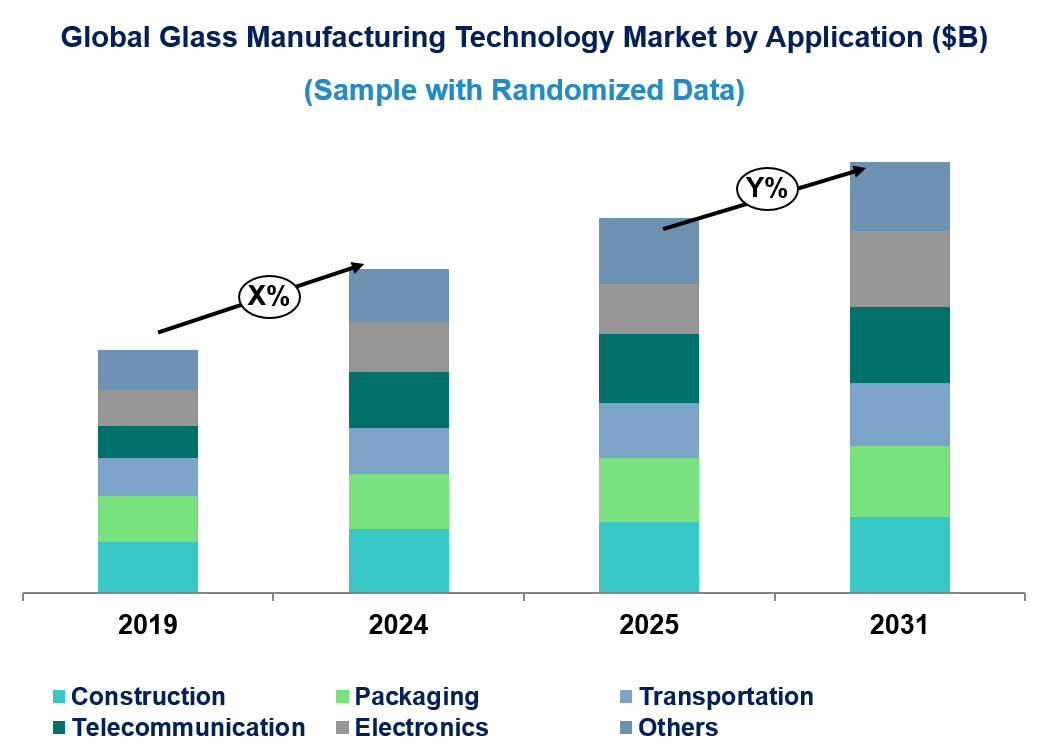

Glass Manufacturing Market Trend and Forecast by Application [Value from 2019 to 2031]:

• Construction

• Packaging

• Transportation

• Telecommunication

• Electronics

• Others

Glass Manufacturing Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Glass Manufacturing Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Glass Manufacturing Market

Market Size Estimates: Glass manufacturing market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global glass manufacturing market size by various segments, such as application and product technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global glass manufacturing market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different applications, technologies, and regions for technology trends in the global glass manufacturing market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global glass manufacturing market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global glass manufacturing market by product technology (flat glass, container glass, fiberglass, and others), application (construction, packaging, transportation, telecommunication, electronics, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different product technologies? What are the drivers and challenges of these product technologies in the global glass manufacturing market?

Q.5. What are the business risks and threats to the technology trends in the global glass manufacturing market?

Q.6. What are the emerging trends in these product technologies in the global glass manufacturing market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global glass manufacturing market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global glass manufacturing market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this glass manufacturing technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global glass manufacturing market?