Global Glass Fiber Roving Market Trends and Forecast

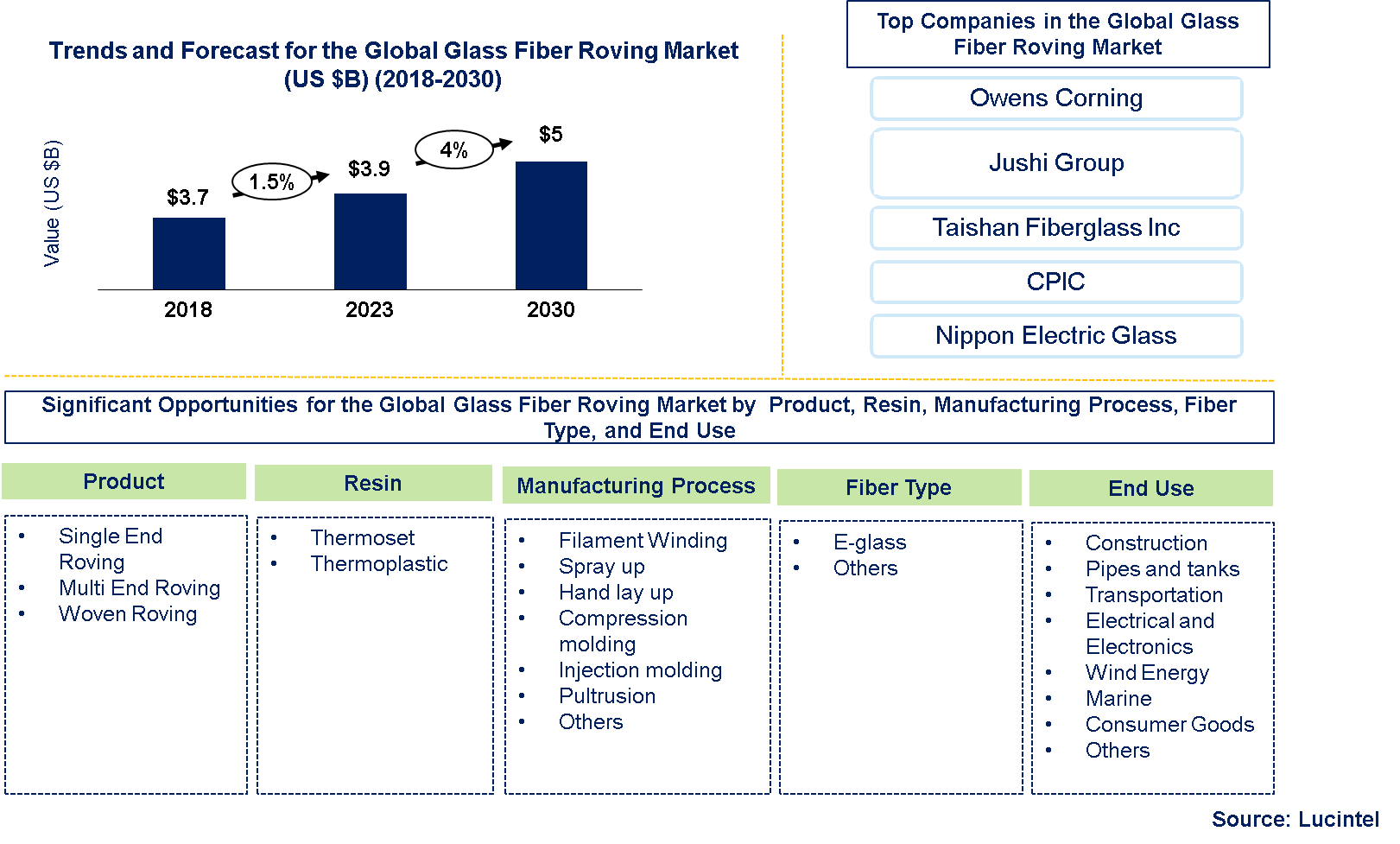

Lucintel finds that the future of the global glass fiber roving market looks promising with opportunities in the construction, pipes and tanks, transportation, electrical & electronics, wind energy, marine, consumer goods and others end use industry. The global glass fiber roving market is expected to reach an estimated $5 billion by 2030 with a CAGR of 4% from 2023 to 2030. The major drivers for growth in this market are increasing demand for lightweight materials in the transportation industry, corrosion and chemical resistance materials demand in construction and pipe & tank industry, electrical resistivity and high flame retardant materials demand in electrical and electronics industry.

Silica sand and other minerals are the major materials used in making glass fiber roving globally. To improve their adhesion and processing, these fibers are applied with sizing agents, whereas additives and resins increase their strength and durability. The cost of these inputs is usually greater than that of conventional fibers as a result of high prices of glass fibers and specialized coverings. Glass fibers have variable costs which depend on the availability of raw materials, scale of production or technological improvement, thus making them more expensive than some other composites but they perform better.

• Lucintel forecasts that E-glass segment will remain the largest and the fastest growing segment by value and volume due to usage in a wide range of applications designed to face corrosive environments and better performance over traditional glass fiber.

• Construction is projected to remain the largest end use industry due to its corrosive resistivity and durability. Transportation is expected to witness the highest growth due to government regulations, such as CAFE Standards in the US and carbon emission targets in Europe, are putting pressure on OEMs to incorporate lightweight materials to curb the overall vehicle weight are driving the demand for the global glass fiber roving market.

• Asia Pacific is expected to remain the largest region because of growth in construction, transportation, and the pipes and tanks segments. Growing economy, growth in population, and urbanization are the major forces that drive the construction segment, especially in China and India.

Country wise Outlook for the Global Glass Fiber Roving Market

The global glass fiber roving market is witnessing substantial growth, driven by increased demand from various industries. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major glass fiber roving market producers in key regions: China, USA, Germany, and India.

Emerging Trends in Global Glass Fiber Roving Market

Emerging trends in Global Glass Fiber Roving Market are shaping its future applications and market dynamics:

1. Advanced glass fiber materials: New products in glass fiber roving material are designed to improve the strength, toughness and heat resistance. The manufacturers are investing in new formulations that increase the efficiency and cut weight; this is necessary for industries such as automotive and aerospace.

2. Development of High-performance roving: One of the latest developments in glass fiber roving is high-performance materials which come with excellent tensile strength and impact resistances. They are particularly valuable when used in extreme applications like wind turbine blades or advanced composite structures.

3. Customizable roving solutions: Offering customizable glass fiber roving solutions targeting specific sectors is becoming more common today. This incorporates different fiber diameters, lengths, and coatings that meet various applications specifications.

4. Sustainability and eco-friendly products: Sustainability in the glass fiber industry is increasingly being stressed. With recycled glass fibers and eco-friendly resins, new items are coming up. There has been an increasing demand for green manufacturing since more companies want to engage in sustainable practices.

5. Integration with smart technologies: Smart technologies integrated into glass fiber roving represent a growing trend here. This encompasses sensors or other smart components capable of real-time assessing structural health conditions needed for application areas such as aerospace and civil engineering.

6. Cost efficiency and process improvements: Recent advancements made on production processes and technologies have focused on reducing production costs as well as improving the effectiveness of glass fiber roving. Among these include increased automation in production lines as well as enhanced quality control measures.

These innovations and trends reflect a dynamic and evolving market for glass fiber rovings, driven by technological advancements, sustainability efforts, and increasing demands across various industries.

A total of 89 figures / charts and 76 tables are provided in this 181-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Global Glass Fiber Roving Market

Recent developments in global glass fiber roving by highlight ongoing innovations and advancements across different sectors

1. Technological Developments: The performance and efficiency of glass fiber roving are being improved by advances in manufacturing processes. Broader applications of roving are made possible by new technologies that have enhanced the tensile strength, flexibility, and durability of the material.

2. Increasing Demand Across Industries: Sectors such as automotive, aerospace, construction and wind energy require more glass fiber roving. Glass fibre composites are used for lightweight fuel-efficient components in the automotive industry while blades of turbines in the wind energy field use it.

3. Sustainability initiatives: There is a growing focus on sustainable practices during production of glass fibre roving. In order to minimize environmental impact, manufacturers are considering recycled materials as well as environmentally friendly production methods.

4. Expansion of Production Capacity: A number of manufacturers are expanding their facilities or setting up new plants in response to rising demand. This expansion helps address supply chain constraints and increase availability in key markets.

5. Regional Market Growth: Emerging markets particularly from Asia-Pacific region have witnessed substantial growth with regards to glass fibre roving demand. Countries like China and India that have invested heavily on infrastructure development including industrial applications which necessitate advanced composite materials serve as examples.

6. Product Innovation: Glass fibers with specialized attributes such as better thermal resistance or compatibility with resins are being created by companies. These advancements aim at addressing specific needs posed by high-end uses.

7. Strategic Collaborations: Industry players join forces through strategic partnerships and collaborations to pool resources together so as to support each other’s businesses. Many manufactures form alliances that help them develop new products and penetrate into foreign markets.

8. Regulatory and Standards Compliance: Companies conforming to new legal requirements and industry standards affecting glassfiber Roving’s production would be beneficial for market entry and product acceptance. Compliance with these standards is crucial for market access and product acceptance.

Strategic Growth Opportunities for Global Glass Fiber Roving Market

1. Automotive Sector Demand on the rise: The automotive business is progressively turning its attention towards lightweight components to enhance fuel efficiency and slash emissions that has propelled demand for glass fiber rovings which are used in production of bumpers, hoods and other structural parts of cars, providing them with strength and durability yet being light. Electric vehicles (EVs) are further driving demand for advanced automotive composites in general.

2. Growth in Aerospace and Defense: The aerospace industry’s relentless quest for high-performance, lightweight materials drives up demand for glass fiber rovings, which are increasingly being used as fuselage parts, wing structures and interior parts by virtue of their high strength to weight ratio they possess over other materials. Moreover, the defense sector’s need for strong and tough products employed in a variety of applications also assists in this market development.

3. Development of Infrastructure and Construction: The increasing worldwide construction activities particularly in emerging economies have resulted to a higher demand for glass fiber rovings which find their usage in reinforced concrete structures, pre-fabricated products as well as building envelopes where they provide increased resistance against environmental impacts such as humidity or temperature fluctuations. Furthermore, towards sustainable construction materials that last long is another factor contributing growth in this area.

4. Technological Advances And Inventions: Developments made around the manufacturing stage relating to glass fiber like high performance rovings with improved properties have come up thus creating new possibilities within the industry; therefore even innovation such as advanced sizing agents or specialty glass fibers focused on particular applications only assist improve productivity besides opening new markets. Investment companies can gain an advantage through research leading-edge products.

5. The Marine Industry Growing Adoption Rate: Increased adoption of lightweight yet corrosion resistant materials is driven by growing focus on it by marine industry leading to increased consumption of fiberglass yarns due to boat hulls, deck components among others’ needs considering its water resistance and chemical inertness when compared to other alternatives. The expansion of recreational boating and commercial maritime activities contributes to this trend.

6. New Markets: Emerging economies in Asia-Pacific, Latin America, and the Middle East are becoming industrialized rapidly and developing infrastructure which has led to their rising demand for glass fiber rovings. These regions are therefore ripe for market expansion as they continue to grow. Local manufacturers and distributors can tap into these emerging markets by building a strong presence.

Glass Fiber Roving Market Drivers and Challenges

Dynamic growth is being experienced in global glass fiber roving market due to the broad applications it enjoys in several key industries including automotive, aerospace, wind energy and construction. As a versatile material with high performance as well, glass fiber roving has significant strength and durability benefits. Nonetheless, there are various issues that the market encounters namely price instability of raw materials, tough environmental laws as well as rivalry from other supplies. For investors willing to successfully navigate through such complexities in the glass fiber roving industry it is vital they know these forces and hurdles.

The key drivers for the glass fiber roving market include:

1. Increasing Demand in Automotive Industry: The automobile industry’s need to improve fuel efficiency and lower emissions by shifting to lighter materials has led to mounting demand for glass fiber roving which possesses a high strength-to-weight ratio and is well suited for automotive components.

2. Growth in Aerospace and Defense Sector: Market for the aerospace and defense sectors are fueled up by utilization of glass fiber rovings as a composite material with high strength and durability.

3. Expansion of Wind Energy Sector: Growing emphasis on renewable energy especially wind power has raised the demand for glass fiber rovings used in production of wind turbine blades.

4. Rising Construction and Infrastructure Activities: Thus, Glass Fiber Roving is increasingly being used in the construction industry where it is used to reinforce concrete leading to stronger, light weight building materials.

5. Technological Advancements: Innovations in manufacturing technologies and product formulations enhance the performance and versatility of glass fiber roving, expanding its application range and market potential.

The challenges in the glass fiber roving market include:

1. Volatile Raw Material Prices: Variations in raw material costs such as silica sand or glass that are used during manufacture of fiberglass have an impact on total production expenses as well as price stability.

2. Environmental Regulations: Manufacturers may face challenges due to strict legislations regarding the production and disposal of glasses which means they need to invest more money into sustainable practices and technologies.

3. Competition from Alternative Materials: The growth of the market for glass fibers can be hampered by other substitutes like carbon fibers, aramid fibers among others which have unique advantages over them under specific conditions.

4. Economic Fluctuations: Global economic changes including recessions as well as political instability may greatly affect worldwide industrial activities thus curbing any demands that could have been met through use of this material particularly in constructions or aerospace sector.

5. High Production Costs: This involves significant energy consumption & capital investment hence affects profitability & competitiveness.

In summary, the growth of the global glass fiber roving market is supported by increasing demand in the automotive, aerospace, wind power and construction sectors due to advancements in technology. Although these positive forces exist, there are also negative factors such as changes in prices of raw materials, legal restrictions on pollution and alternative materials. As a result, stakeholders need to overcome these obstacles as well as exploit future opportunities so that they prosper in changing environment of this sector.

Global Composites Distributor Suppliers and Their Market Shares

In this globally competitive market, several key players such as Owens Corning, Jushi Group, Taishan Fiberglass Inc, CPIC, and Nippon Electric Glass etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each major players Contact Us. Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies glass fiber roving companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the glass fiber roving companies profiled in this report includes.

• Owens Corning

• Jushi Group

• Taishan Fiberglass Inc

• CPIC

• Nippon Electric Glass

These companies have established themselves as leaders in the global glass fiber roving market with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the global glass fiber roving market are evolving, with the entry of new players and the emergence of innovative technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Glass Fiber Roving Market by Segment

The glass fiber roving market in the world is divided into end-use industries including automotive, aerospace, construction, marine and wind energy who exploit its strength and longevity. It also splits into continuous filament roving, chopped strand roving and multi-end roving for different uses. North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa are covered with each having its own characteristics. There are woven and non-woven rovings as product forms to meet specific manufacturing requirements. In terms of market reach and accessibility distribution channels are divided into direct sales, distributors and online platforms.

Glass Fiber Roving Market by End Use Industry [$M and Volume (M lbs) analysis for 2018 – 2030]:

• Construction

• Pipes and tanks

• Transportation

• Electrical and Electronics

• Wind Energy

• Marine

• Consumer Goods

• Others

Glass Fiber Roving Market by Fiber Type [$M and Volume (M lbs) analysis for 2018 – 2030]:

• E-glass

• Others

Glass Fiber Roving Market by Product [$M and Volume (M lbs) analysis for 2018 – 2030]:

• Single End Roving

• Multi End Roving

• Woven Roving

Glass Fiber Roving Market by Composites Manufacturing Process [$M and Volume (M lbs) analysis for 2018 – 2030]:

• Filament Winding

• Spray up

• Hand lay up

• Compression molding

• Injection molding

• Pultrusion

• Others

Glass Fiber Roving Market by Processing Resin Type [$M and Volume (M lbs) analysis for 2018 – 2030]:

• Thermoset

• Thermoplastic

Features of Glass Fiber Roving Market

• Market Size Estimates: Glass fiber roving market size estimation in terms of value ($M) and volume (M lbs)

• Trend And Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Glass fiber roving market size by various segments, such as end use industry, fiber type, product, reinforcement and regions in terms of value and volume.

• Regional Analysis: Glass fiber roving market breakdown by North America, Europe, Asia Pacific, and Rest of the World.

• Growth Opportunities: Analysis on growth opportunities in different end use industries, fiber type, product, reinforcement, and regions for the global glass fiber roving market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the global glass fiber roving market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in composites in the global glass fiber roving market or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ_

Q1. What is the glass fiber roving market size?

Answer: The global glass fiber roving market is expected to reach an estimated $5 billion by 2030.

Q2. What is the growth forecast for glass fiber roving market?

Answer: The glass fiber roving market is expected to grow at a CAGR of 4% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the glass fiber roving market?

Answer: The major drivers for the growth of this market are growing automotive industry, growth in aerospace and defense sector, expansion of wind energy sector, and rising construction and infrastructure activities.

Q4. What are the major applications or end use industries for glass fiber roving market?

Answer: construction is the major end uses for glass fiber rovings.

Q5. What are the emerging trends in glass fiber roving market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include the innovation of advanced glass fiber materials, development of high-performance roving, customizable roving solutions, sustainability and eco-friendly products, and integration with smart technologies.

Q6. Who are the key glass fiber roving companies?

Answer: Some of the key glass fibers roving companies are as follows:

• Owens Corning

• Jushi Group

• Taishan Fiberglass Inc

• CPIC

• Nippon Electric Glass

Q7.Which glass fiber roving resin segment will be the largest in future?

Answer: Lucintel forecasts that the polyester resin distributor segment will show above average growth during the forecast period.

Q8. In glass fiber roving market, which region is expected to be the largest in next 7 years?

Answer: APAC will remain the largest region and is expected to witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high-growth opportunities for the global glass fiber roving market by end use industry, fiber type, manufacturing process, reinforcement and region (North America, Europe, Asia Pacific, and Rest of the World)?

Q.2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the global glass fiber roving market?

Q.5 What are the business risks and threats to the global glass fiber roving market?

Q.6 What are emerging trends in this global glass fiber roving market and the reasons behind them?

Q.7 What are some changing demands of customers in the global glass fiber roving market?

Q.8 What are the new developments in the global glass fiber roving market? Which companies are leading these developments?

Q.9 Who are the major players in the global glass fiber roving market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in the global glass fiber roving market, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M&A activities did take place in the last five years in the global glass fiber roving market?