Glass Fiber in the Global Automotive Composites Market Trends and Forecast

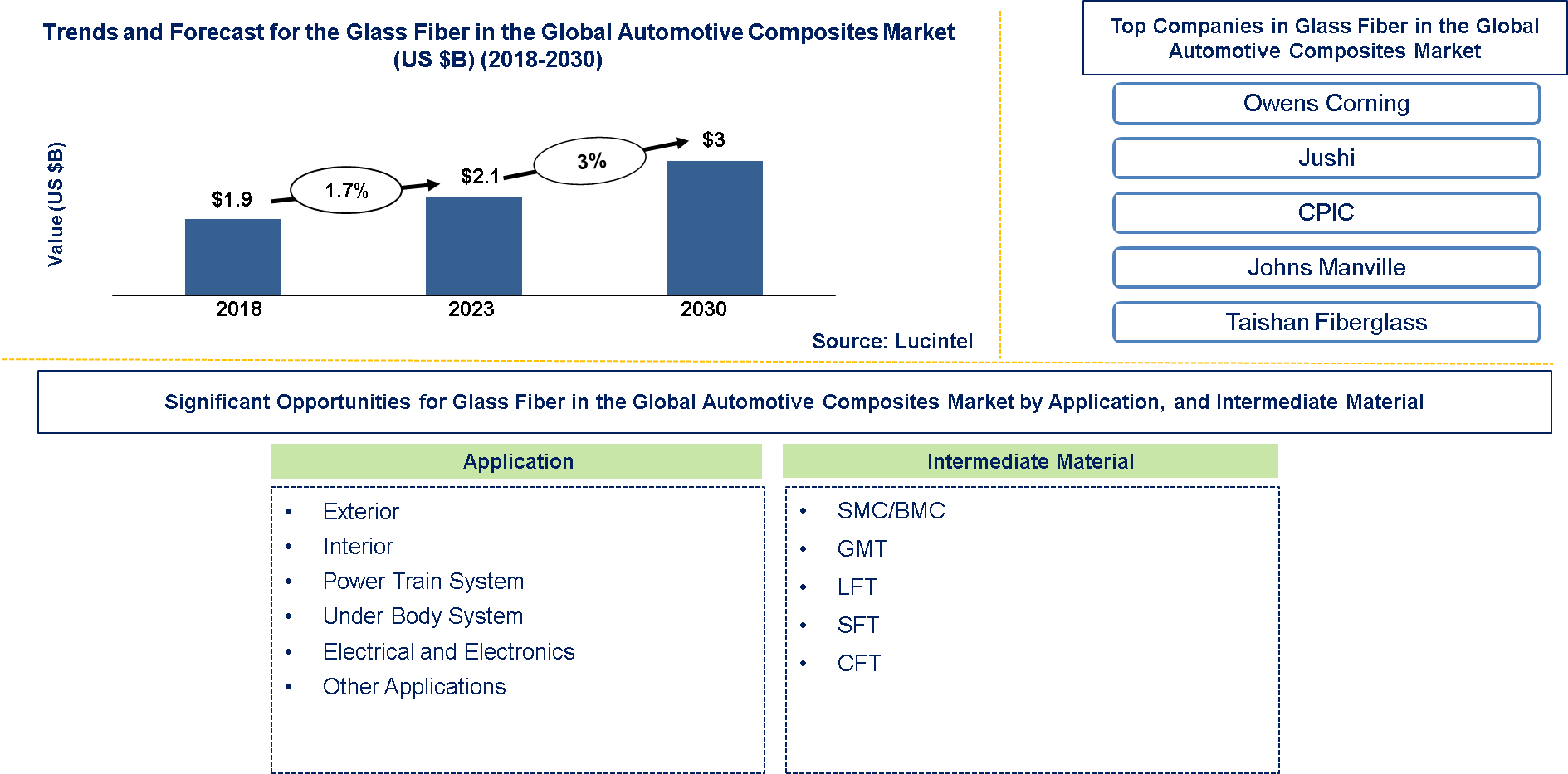

Lucintel finds that the future of glass fiber in the global automotive composites market looks promising with opportunities in the exterior, interior, power train system/engine components, under body system, and electrical & electronics applications. The glass fiber intermediate material in the global automotive market is expected to reach an estimated $3 billion by 2030 with a CAGR of 3% 2023 to 2030. The major growth drivers for this market are increasing automotive production and growing demand for lightweight and durable materials due to stringent government regulations to increase fuel efficiency and reduce greenhouse gas emissions.

In the global automotive composites market, glass fiber is made from raw materials such as silica (sand), limestone, soda ash, and other minerals. These materials are melted together to form glass, which is then drawn into thin fibers. Glass fiber is preferred for its high strength, durability, and lightweight properties, making it an ideal choice for reinforcing automotive composites. It is generally more affordable than carbon fiber and aramid fiber, which are its main competitors. Carbon fiber, known for its superior strength-to-weight ratio and stiffness, is more expensive and thus limited to high-performance and luxury vehicles. Aramid fiber, valued for its heat resistance and strength, also comes at a higher cost and is used in specialized applications. Glass fiber's balance of performance and cost makes it popular across various automotive applications.

• Lucintel forecasts that powertrain system/ engine components will remain the largest application by value and volume due to growing demand for lightweight composite parts. Underbody system is expected to witness highest growth over the forecast period.

• Short fiber thermoplastic (SFT) material of glass fiber in the global automotive composites will remain the largest segment over the forecast period due to its growing demand for lightweight composite parts.

• APAC/ROW is expected to remain the largest market and is also expected to witness the highest growth over the forecast period due to higher penetration of composites in automotive than other region.

Country wise Outlook for the Glass Fiber in the Global Automotive Composites Market

The glass fiber in the global automotive composites market is witnessing substantial growth globally, driven by increased demand from automotive industries. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major carbon fiber producers in key regions: the USA, Germany, China, India, and Japan.

Emerging Trends in the Glass Fiber in the Global Automotive Composites Market

Emerging trends in recycled carbon fiber textile are shaping its future applications and market dynamics:

1. Noise, Vibration, and Harshness (NVH) Reduction: Glass fiber composites help in the muting of noise and vibrations, thus improving overall comfort and driving experiences in vehicles.

2. Nanostructured Glass Fibers: Incorporation of nanostructures into glass fibers to enhance mechanical characteristics such as rigidity and shock resistance better.

3. Smart Glass Fibers: Inclusion of sensors or functional coatings into glass fibers that can make them capable of monitoring structural health or providing electromagnetic shielding.

4. Design Flexibility: Glass fiber composites have more design flexibility for complex shapes and curves that will allow for innovative car designs with improved aerodynamics.

5. Recycled Glass Fibers: Production of glass fibers made from recycled materials is aiding sustainability by reducing raw material consumption as well as waste generation.

6. Cost Efficiency: Technological advancements in manufacturing techniques are cutting down the costs of producing glass fiber composites making them an attractive alternative in wide use for automobile applications.

7. Recyclability: Technologies that are focused on recycling methods for glass fiber composites are solving end-of-life issues through sustainability improvements with a reduced environmental impact.

8. Light weighting: They are trying to bring down the weight of vehicles by utilizing more glass fiber composites while still preserving their sound structure and safety standards requirements.

A total of 107 figures / charts and 68 tables are provided in this 205-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Glass Fiber in the Global Automotive Composites Market

Several companies in the global automotive composites market have recently introduced new glass fibers, demonstrating ongoing innovations and advancements in different industries:

• Developments focused on Light weighting and Performance: Some of these firms are Owens Corning and Johns Manville which had been developing highly developed glass fiber materials with an improved power per weight ratio. These materials allow for lighter vehicles that do not put safety or durability at risk.

• Electric Vehicle (EV) Focus: As electric cars rise, there is a need for light weight materials that can add more mileage to their range. For example, Glass fiber composites are increasingly being used in EV battery enclosures, structural components and interior parts of vehicles to reduce weight of the whole vehicle.

• Incorporation of Sustainable Materials: It is clear that the trend in auto composites manufacturers is towards making use of sustainable materials. Thus, glass fibers are blended with bio-based resins or recycled content to make environmentally friendly composite solutions conforming to regulatory standards and customer preferences.

• Strategic Partnerships and Investments: Major auto manufacturers as well as material suppliers are entering strategic partnerships besides committing huge amounts of money into R&D as well as production facilities for glass fiber composites. The aim of such collaborations is to speed up innovation and increase production so as to meet the ever-growing market demands.

• Regional Developments: Different regions like North America, Europe, Asia-Pacific; emerging markets such India, Brazil etc., local developments in glass fiber composites can be seen. This involves regional specific launches for products capacity expansions; technology upgrades among others within an area’s automobile industry perspective.

• Application Expansion: Glass fiber composites now find application beyond conventional structural parts. They find applications in automotive interiors; under-the-hood parts; exterior body panels due to their versatility, cost effectiveness and ability to meet performance requirements.

Strategic Growth Opportunities for Glass Fiber in the Global Automotive Market

The automotive market across the globe is rapidly changing and glass fiber has emerged as a key material in this change. Here are some strategic growth opportunities for glass fiber in the automobile industry:

1. Increasing Demand for Light-Weight Materials

Goal: To reduce vehicle weight to improve fuel economy and reduce emissions.

Opportunity: Glass fiber composites offer high strength-to-weight ratio thus can be used to replace heavier metallic components.

2. The Rise of Electric Vehicles (EVs)

Goal: To improve battery performance and increase range.

Opportunity: EV battery enclosures, structural components, and lightweight parts could be made from glass-fiber composites which lead to overall efficiency and safety of vehicles.

3. Advances in Composite Technology

Objective: Enhance performance while reducing costs.

Opportunity: New methods of manufacturing glass-fiber composite materials, like automated processes or improved resin systems, can ensure cost-effective production and better material qualities.

4. Safety Improvements And Longer Lasting Durability Requirements

Goal: Improve crash performance and durability of automotive systems and components.

Opportunity: Highly impact resistant fiberglass composites can be used for critical safety parts or long life structural members.

5. Customization And Aesthetic Versatility

Goal: Satisfy customer needs for individualized automobiles that are appealing to look at.

Opportunity: Glass fiber composites are able to take any form desired by designers with various surface textures and finishes which enable greater design flexibility as well as customization.

6. Sustainable Development And Environmental Concerns

Objective: Comply with emerging environmental legislations as well as consumer preferences for environmentally safe products.

Opportunity: Make eco-friendly glass fiber composites including recycled content ones or those based on bio-based resins that address sustainability questions around automotive manufacturing’s carbon footprint reduction efforts.

Glass Fiber in the Global Automotive Composites Market Drivers and Challenges

In the global automotive composites market, glass fiber is a crucial material due to its strength, lightweight properties, and versatility. However, its adoption and growth are influenced by various drivers and challenges. Here's an overview.

The key drivers for the glass fiber in the global automotive composites market include:

• Lightweighting Trends

Glass fiber composites offer a high strength-to-weight ratio, making them ideal for reducing vehicle weight without compromising performance.

• Growing Electric Vehicle (EV) Market

Glass fiber composites are used in EV battery enclosures, structural components, and lightweight parts, which can contribute to improved performance and range of EVs.

• Regulatory Pressure for Emission Reductions

The need to comply with regulations drives the use of lightweight materials like glass fiber to achieve better fuel economy and lower emissions.

• Advancements in Composite Technology

Innovations in manufacturing techniques, such as automation and better resin systems, make glass fiber composites more cost-effective and efficient.

• Increasing Demand for Vehicle Safety and Durability

Glass fiber composites provide excellent impact resistance and durability, making them suitable for safety-critical components and long-lasting parts.

• Customization and Aesthetic Appeal

Glass fiber composites can be molded into complex shapes and finished in various styles, supporting vehicle customization and aesthetic preferences.

The key challenges in the glass fiber in the global automotive composites market include:

• High Material and Processing Costs

Glass fiber composites can be more expensive compared to traditional materials, both in terms of raw materials and processing.

• Limited Awareness and Understanding

Lack of widespread knowledge about the benefits and applications of glass fiber composites.

• Manufacturing and Production Complexities

Complex manufacturing processes and the need for specialized equipment.

• Recycling and End-of-Life Management

Difficulty in recycling glass fiber composites and managing end-of-life disposal.

• Performance Variability

Variability in the performance of glass fiber composites depending on the quality of materials and manufacturing processes.

• Competition from Other Materials

Competition from alternative materials such as carbon fiber composites, metals, and advanced polymers.

Addressing these challenges while leveraging the drivers can help companies navigate the automotive composites market effectively and capitalize on the growing opportunities for glass fiber materials.

Glass Fiber in the Global Automotive Composites Suppliers and Their Market Shares

In this globally competitive market, several key players such as Owens Corning, Jushi, CPIC, Johns Manville, Taishan Fiberglass. etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us by email at helpdesk@lucintel.com. If you wish to deep dive in competitive positioning of these players then you can look into our other syndicated market report on “Glass Fiber in the Global Automotive Composites Leadership Report".

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies carbon fiber companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the glass fiber companies profiled in this report include.

• Owens Corning

• Jushi

• CPIC

• Johns Manville

• Taishan Fiberglass

These companies have established themselves as leaders in the global glass fiber in the global automotive composites market, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the glass fiber in the global automotive composites market are evolving, with the entry of new players and the emergence of innovative recycled carbon fiber market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Glass Fiber in the Global Automotive Composites Market by Segment

In the global automotive composites market, glass fiber segments experiencing notable growth include Glass Fiber Reinforced Plastics (GFRP), used in body panels and structural components for their strength-to-weight ratio and affordability. Glass Mat Thermoplastics (GMT) are rising in applications like underbody shields, driven by demands for lightweight and recyclable materials. Continuous glass fiber composites are increasingly replacing metals in chassis and suspension components due to their superior mechanical properties. In electric vehicles (EVs), glass fiber composites are crucial for battery enclosures, enhancing safety and thermal management. Interior applications also see growth, with glass fiber used in dashboards, door panels, and seating for durability and aesthetics.

Glass Fiber in the Global Automotive Composites Market by Application [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Interior

• Exterior

• Powertrain System/Engine Components

• Under the Body

• Electrical & Electronics

• Others

Glass Fiber in the Global Automotive Composites Market by Intermediate Material [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Sheet Molding Compound/ Bulk Molding Compound (SMC/BMC)

• Glass Mat Thermoplastic (GMT)

• Long Fiber Thermoplastic (LFT)

• Short Fiber Thermoplastic (SFT)

• Continuous Fiber Thermoplastic (CFT)

• Phenolic Molding Compound (PMC)

• Others

Glass Fiber in the Global Automotive Composites Market by Region [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific / Rest of the World

Features of Glass Fiber in the Global Automotive Composites Market

• Market Size Estimates: Glass fiber in the global automotive composites market size estimation in terms of value ($M) and Volume (M lbs)

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Market size by application, intermediate material, and region

• Regional Analysis: Glass fiber in the global automotive composites market breakdown by North America, Europe, Asia Pacific / Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different application, intermediate material, and regions for the glass fiber in the global automotive composites market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the glass fiber in the global automotive market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in glass fiber in the global automotive composites market or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the glass fiber in the global automotive composites market size?

Answer: The glass fiber in the global automotive composites market is expected to reach an estimated $3 billion by 2030.

Q2. What is the growth forecast for glass fiber in the global automotive composites market?

Answer: The glass fiber in the global automotive composites market is expected to grow at a CAGR of 3% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the glass fiber in the global automotive composites market?

Answer: The major growth drivers for this market are increasing automotive production and growing demand for lightweight and durable materials due to stringent government regulations to increase fuel efficiency and reduce greenhouse gas emissions.

Q4. What are the major applications or end use for glass fiber in the global automotive composites?

Answer: Power train system and interior segments are the major applications for glass fiber in the global automotive composites.

Q5. What are the emerging trends in glass fiber in the global automotive composites market?

Answer: Emerging trend, which have a direct impact on the dynamics of the glass fiber in the global automotive composites market, include nanostructured glass fibers, smart glass fibers, design flexibility, and recycled glass fibers.

Q6. Who are the key glass fibers in the global automotive composites companies?

Answer: Some of the key glass fiber in the global automotive composites companies is as follows:

• Owens Corning

• Jushi Group Co., Ltd.

• Johns Manville Corporation

• Chongqing Polycomp International Corporation

• Taishan Fiberglass Inc.

• 3B the Fiber Glass Company ( Goa Glass Fiber)

• Nitto Boseki Co. Ltd

• Nippon Electric Glass Co. Ltd.

• Lanxess

Q7.Which glass fiber in the global automotive composites product segment will be the largest in future?

Answer: Lucintel forecasts that SFT is expected to remain the largest market by value and volume, mainly driven by applications such as small complex shaped components in power train system/engine components applications.

Q8: In glass fiber in the global automotive composites market, which region is expected to be the largest in next 6 years?

Answer: APAC/ROW is expected to remain the largest region over next 6 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 10 key questions

Q.1. What are some of the most promising potential, high growth opportunities for the glass fiber in the global automotive composites market by application (interior, exterior, powertrain system/engine components, under the body, electrical and electronics, and others), intermediate material (SMC/BMC, LFT, SFT, GMT, and CFT), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q. 2. Which segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5. What are the business risks and threats to the market?

Q.6. What are the emerging trends in this market and the reasons behind them?

Q.7. What are the changing demands of customers in the market?

Q.8. What are the new developments in the market? Which companies are leading these developments?

Q.9. Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11. What M & A activities have taken place in the last 5 years in this market?