Electronic Cartography Market Trends and Forecast

The technologies in the electronic cartography market have evolved from traditional paper maps and manual cartography to advanced digital mapping technologies such as GIS (geographic information system), GPS (global positioning system), and remote sensing. GIS has developed from simple mapping software to a more integrated system capable of handling large amounts of spatial data for various applications, such as urban planning, disaster management, and environmental monitoring. GPS technology has also advanced from basic navigation systems to high-precision location services used in autonomous vehicles, logistics, and mobile mapping solutions. Advances in remote sensing technology have shifted from satellite-based imagery to sophisticated drone and LiDAR-based systems, enabling high-resolution data for detailed mapping in industries like agriculture, construction, and transportation. These technological changes have enhanced the precision, efficiency, and accessibility of cartographic data across several sectors.

Emerging Trends in the Electronic Cartography Market

The electronic cartography market has been undergoing significant transformations due to the increasing demand for precise and real-time geospatial data across multiple industries. With advancements in technologies such as GIS, GPS, and remote sensing, there has been a noticeable shift in how maps are created, used, and interpreted. The integration of innovative technologies is reshaping how geographic data is captured, processed, and applied for urban planning, agriculture, environmental monitoring, and more. Below are the key emerging trends in the electronic cartography market.

• Integration of AI and Machine Learning: AI and machine learning algorithms are being integrated into GIS and mapping platforms to enhance predictive analytics and automate the mapping process. These technologies enable faster decision-making and more accurate spatial data analysis.

• Real-time Data and Mapping: The demand for real-time geographic data is rising, particularly in industries such as transportation, logistics, and emergency services. Technologies like GPS and IoT are driving the development of real-time mapping solutions that allow for dynamic updates and enhanced operational efficiency.

• Drone and LiDAR Technology: Drones equipped with LiDAR sensors are being widely used to capture high-resolution aerial data for precise mapping. This technology is transforming industries such as construction, agriculture, and forestry by offering cost-effective and efficient mapping solutions.

• Cloud-Based Cartography Solutions: Cloud computing is playing a major role in the expansion of electronic cartography by providing scalable and accessible platforms for geospatial data storage and analysis. Cloud-based solutions enable real-time collaboration and data sharing among multiple users across different locations.

• Augmented Reality (AR) Mapping: The integration of AR with mapping technology is becoming increasingly popular in areas like tourism, retail, and urban development. AR overlays digital mapping information in the real world, enhancing navigation and spatial understanding for users.

These emerging trends are driving innovation in the electronic cartography market. AI, real-time mapping, drones, cloud solutions, and augmented reality are reshaping how geographic data is captured, analyzed, and utilized across different industries, offering greater accuracy, accessibility, and efficiency. These trends are set to enhance decision-making capabilities and improve the way spatial data is applied to real-world scenarios.

Electronic Cartography Market : Industry Potential, Technological Development, and Compliance Considerations

The electronic cartography market is experiencing significant technological advancements, transforming the way geographic data is captured, processed, and applied. As digital mapping technologies such as GIS, GPS, and remote sensing evolve, the potential for further innovation continues to expand, enabling more accurate, efficient, and real-time mapping solutions across industries.

• Potential in Technology:

The technologyÄX%$%Xs potential lies in its ability to provide high-precision spatial data, enabling improved decision-making in urban planning, agriculture, transportation, and environmental monitoring. Technologies such as GIS, GPS, and remote sensing are increasingly being integrated with artificial intelligence (AI) and machine learning, further enhancing their capacity for predictive analytics and automated mapping processes.

• Degree of Disruption:

The disruption potential is high, as these innovations enable automation, real-time updates, and better spatial data analysis, reshaping industries like logistics, construction, and disaster management.

• Current Technology Maturity Level:

Currently, these technologies have reached a relatively mature stage, with widespread adoption across industries. GPS and GIS, for instance, are now standard tools in many sectors. However, there is still room for improvement in terms of real-time data accuracy, the integration of diverse data sources, and the expansion of drone-based LiDAR systems.

• Regulatory Compliance:

Regulatory compliance is an essential consideration, particularly regarding data privacy and security when handling geospatial data. As more sensitive data is being collected, strict regulatory frameworks will need to be in place to ensure compliance and prevent misuse.

Recent Technological development in Electronic Cartography Market by Key Players

The electronic cartography market is experiencing significant advancements due to the integration of innovative technologies, such as GIS (geographic information systems), GPS (global positioning systems), remote sensing, and AI-powered analytics. These developments are reshaping industries such as automotive, transportation, aerospace, agriculture, and government, enabling more efficient, accurate, and real-time mapping solutions. Key players in the market, including Garmin, Raytheon, Honeywell International, and others, are at the forefront of these innovations, contributing to the rapid evolution of digital cartography solutions.

• Garmin: Garmin has enhanced its GPS and mapping technologies, particularly for the automotive and outdoor recreational sectors. Their focus on high-precision navigation and real-time mapping solutions continues to shape the industry, providing more accurate, user-friendly experiences for drivers and outdoor enthusiasts.

• Raytheon: Raytheon has integrated advanced geospatial data analytics into its cartography solutions, supporting military and defense applications. By combining real-time satellite imagery with GIS capabilities, Raytheon offers improved situational awareness, enhancing decision-making for defense operations.

• Honeywell International: Honeywell International has introduced sophisticated mapping and navigation solutions for aviation. Their innovations in GPS and flight planning software are streamlining route management, improving efficiency, and ensuring safety for aviation operators.

• Navico: Navico a leader in marine electronics, has developed advanced cartography tools with high-definition mapping capabilities. These innovations provide more accurate marine navigation and are highly beneficial for both commercial and recreational boating.

• Jeppesen: It is part of Boeing, and offers integrated mapping and navigation solutions to the aviation and maritime sectors. Their advanced flight planning systems and weather data integration are revolutionizing operational efficiency and safety for pilots.

• Furuno Electric: It focuses on marine electronics, with a particular emphasis on navigation systems that incorporate high-resolution cartographic data for maritime applications, enhancing safety and efficiency at sea.

• Thales Group is advancing satellite-based remote sensing and GPS technologies to support the military, aerospace, and transportation sectors. Their innovations allow for precise mapping of geographic regions and the optimization of logistical operations.

• Praxis Automation Technology: It offers advanced marine navigation systems, integrating electronic chart display and information systems (ECDIS) with GPS data. This enhances route optimization and maritime safety, particularly for shipping industries.

• Northrop Grumman: The company has enhanced geospatial intelligence and GIS capabilities, offering high-resolution mapping for military and defense applications. Their technologies enable better threat detection and strategic planning in global defense operations.

• Transas: Transas is a key player in maritime navigation, and provides electronic chart solutions with real-time data updates. Their integration of GPS, AIS, and weather data in mapping systems has improved operational safety and efficiency in the maritime industry.

These developments demonstrate how advancements in electronic cartography are shaping industries and driving innovations in precision navigation, safety, and efficiency across various sectors.

Electronic Cartography Market Driver and Challenges

The electronic cartography market is witnessing significant growth, driven by advances in GPS, GIS, and remote sensing technologies, which are improving the precision and application of mapping solutions. This market is being further expanded by sectors such as automotive, government, transportation, and agriculture, which require high-accuracy, real-time mapping systems. However, challenges such as data security concerns, high infrastructure costs, and technology integration complexities persist, hindering market growth in some areas.

The factors responsible for driving the electronic cartography market include:

• Technological Advancements: Continuous innovations in GIS, GPS, and remote sensing technologies are enhancing mapping accuracy and accessibility. The integration of AI and machine learning allows for more detailed, real-time mapping, improving decision-making in industries like transportation, urban planning, and environmental monitoring.

• Growing Adoption of Autonomous Vehicles: The demand for high-precision, real-time maps is rising as autonomous vehicles rely heavily on electronic cartography for navigation. This shift is driving the demand for advanced mapping technologies capable of supporting autonomous navigation and ensuring safe vehicle operations.

• Government Investments in Smart Cities: Governments are investing in smart city infrastructure, creating a growing demand for electronic cartography solutions. These systems are used for urban planning, traffic management, environmental monitoring, and disaster response, enhancing city management and efficiency.

• Increase in Remote Sensing Applications: Advances in satellite and drone technologies are enabling high-resolution, real-time data collection. This is particularly beneficial for sectors such as agriculture, construction, and environmental monitoring, which require precise mapping to optimize resource management and improve sustainability.

• Focus on Environmental Sustainability: With increasing attention to climate change, environmental monitoring, and resource management, the need for advanced mapping solutions is growing. Remote sensing and GIS technologies are helping governments and organizations better monitor ecosystems and natural resources.

Challenges in the electronic cartography market are:

• Data Security and Privacy Concerns: The collection and storage of vast amounts of cartographic data raise significant security and privacy concerns. Protecting sensitive data from cyber threats is critical, particularly when dealing with governmental or personal information in the mapping process.

• High Infrastructure and Maintenance Costs: The implementation and maintenance of high-end mapping technologies, including satellite systems, GIS software, and remote sensing equipment, can be costly. Small and medium-sized enterprises may struggle to afford these technologies, hindering their adoption.

• Complex Integration with Existing Systems: Integrating new mapping technologies with existing systems in industries like transportation, government, and logistics can be challenging. The complexity of ensuring compatibility and interoperability can slow down the adoption and full utilization of these technologies.

The electronic cartography Market is being shaped by advancements in technology, increased demand for real-time data, and growing applications across industries. Despite challenges such as data security concerns, high costs, and integration complexities, these drivers are significantly transforming the market, and pushing forward the adoption of advanced mapping solutions in various sectors.

List of Electronic Cartography Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies electronic cartography companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the electronic cartography companies profiled in this report include.

• Garmin

• Raytheon

• Honeywell International

• Navico

• Jeppesen

• Furuno Electric

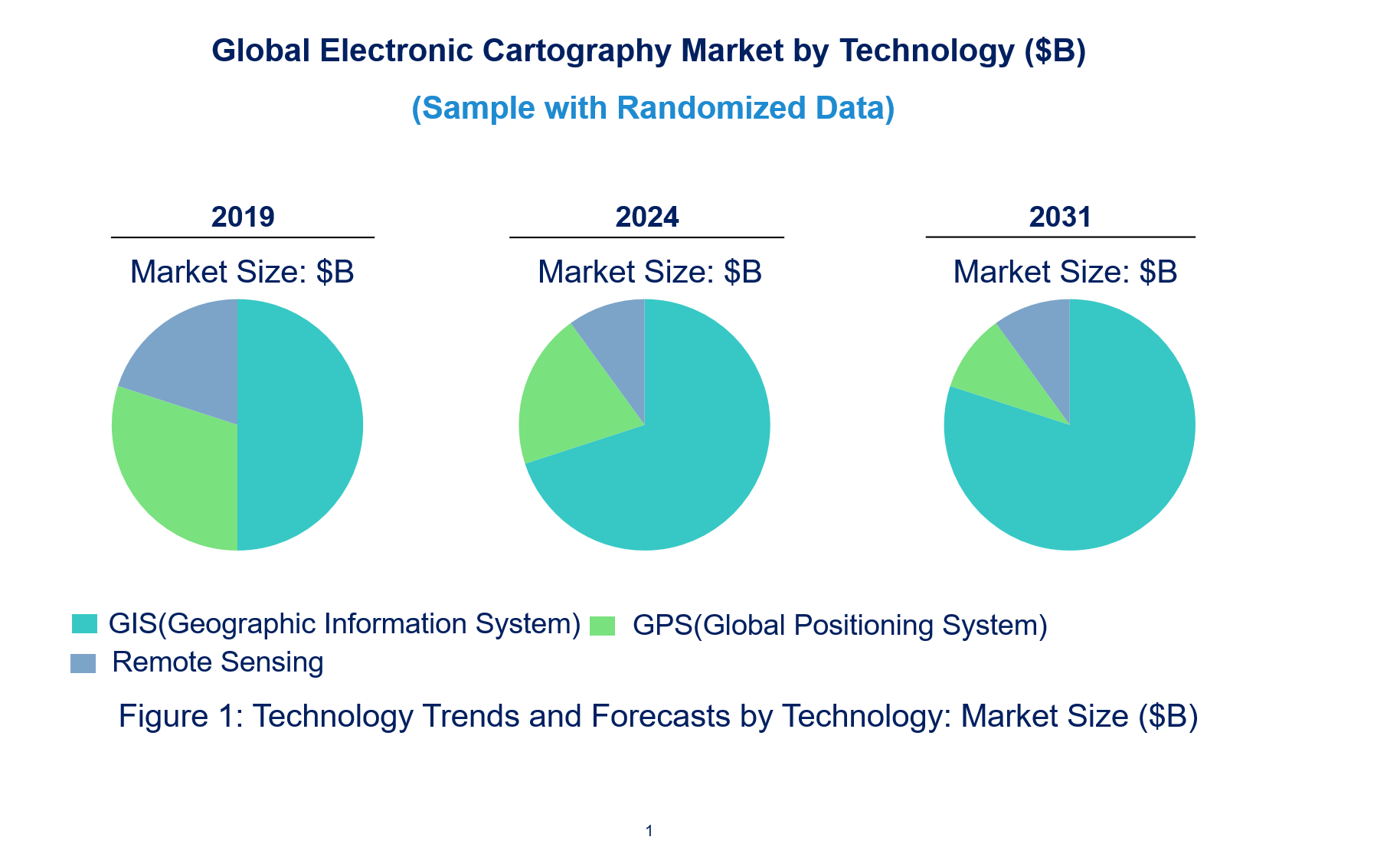

Electronic Cartography Market by Technology

• Technology Readiness: The technology readiness of GIS, GPS, and remote sensing technologies in the electronic cartography market is varied. GIS technology is highly mature, with widespread adoption across industries, including government, urban planning, and environmental management. GPS technology is also well-established, with broad applications in navigation, logistics, and autonomous vehicles. Remote sensing technology, although mature in satellite and aerial imagery, is rapidly evolving with advances in drones, LiDAR, and high-resolution imaging. While all three technologies are highly competitive, the level of regulatory compliance depends on the industry and region. GIS and GPS are often used in government and commercial applications with established regulatory frameworks, while remote sensing faces increasing regulatory scrutiny due to privacy concerns. These technologies are highly ready for deployment across various sectors, with GIS leading in broad applications and remote sensing offering cutting-edge innovation for specialized industries.

• Competitive Intensity and Regulatory Compliance: The competitive intensity in the electronic cartography market is high, as companies compete to deliver more advanced, precise, and real-time mapping solutions. GIS, GPS, and remote sensing technologies are integral to this market, with players vying to innovate and offer unique value propositions. Regulatory compliance remains a crucial challenge, particularly regarding data privacy, security, and the use of sensitive geographic information. As governments implement stricter regulations around data protection, companies must ensure that their technologies comply with these laws, which can vary by region. This adds complexity to market strategies but also ensures that only the most secure and reliable solutions succeed.

• Disruption Potential of Different Technologies: The technologies in the electronic cartography market, such as GIS, GPS, and remote sensing, hold significant disruption potential. GIS enhances mapping by integrating spatial data for applications like urban planning, disaster management, and environmental monitoring. GPS provides real-time, high-precision location data, transforming sectors like automotive, logistics, and navigation. Remote sensing, especially through satellites, drones, and LiDAR, provides high-resolution imagery for various industries, including agriculture, construction, and environmental monitoring. Together, these technologies are revolutionizing how data is captured, analyzed, and utilized, making cartography more accessible, efficient, and precise. As industries demand more advanced solutions, these technologies are poised to continue driving innovation, enabling smarter decision-making, and creating new business opportunities.

Electronic Cartography Market Trend and Forecast by Technology [Value from 2019 to 2031]:

• GIS (Geographic Information System)

• GPS (Global Positioning System)

• Remote Sensing

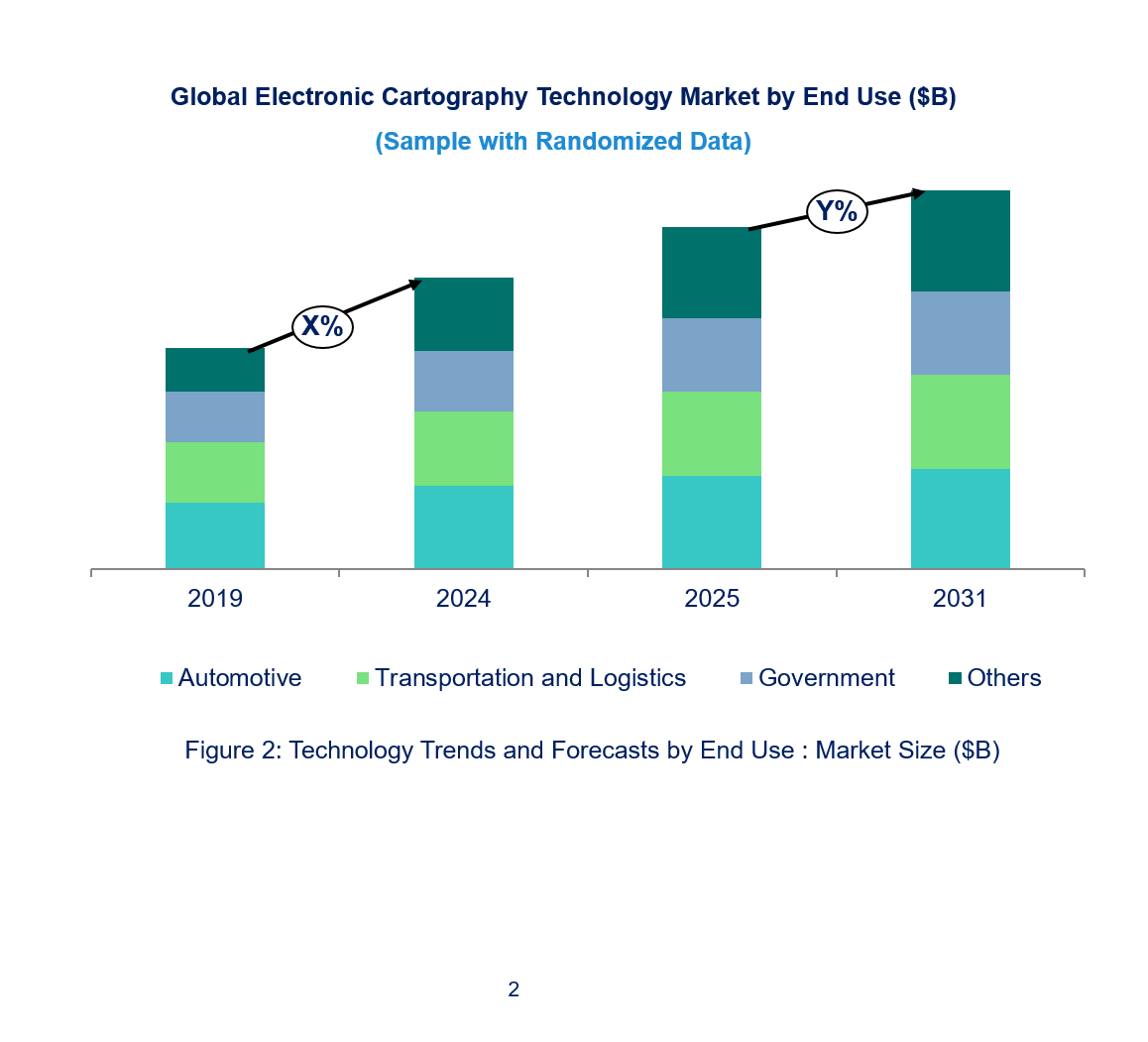

Electronic Cartography Market Trend and Forecast by End Use Industry [Value from 2019 to 2031]:

• Automotive

• Transportation and Logistics

• Government

• Others

Electronic Cartography Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Electronic Cartography Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Electronic Cartography Market

Market Size Estimates: Electronic cartography market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global electronic cartography market size by various segments, such as end use industry and technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global electronic cartography market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different end use industries, technologies, and regions for technology trends in the global electronic cartography market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global electronic cartography market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global electronic cartography market by technology (gis (geographic information system), gps (global positioning system), and remote sensing), end use industry (automotive, transportation and logistics, government, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different technology? What are the drivers and challenges of these technologies in the global electronic cartography market?

Q.5. What are the business risks and threats to the technology trends in the global electronic cartography market?

Q.6. What are the emerging trends in these technologies in the global electronic cartography market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global electronic cartography market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global electronic cartography market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this electronic cartography technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global electronic cartography market?