Dental Implant and Prosthetic Market Trends and Forecast

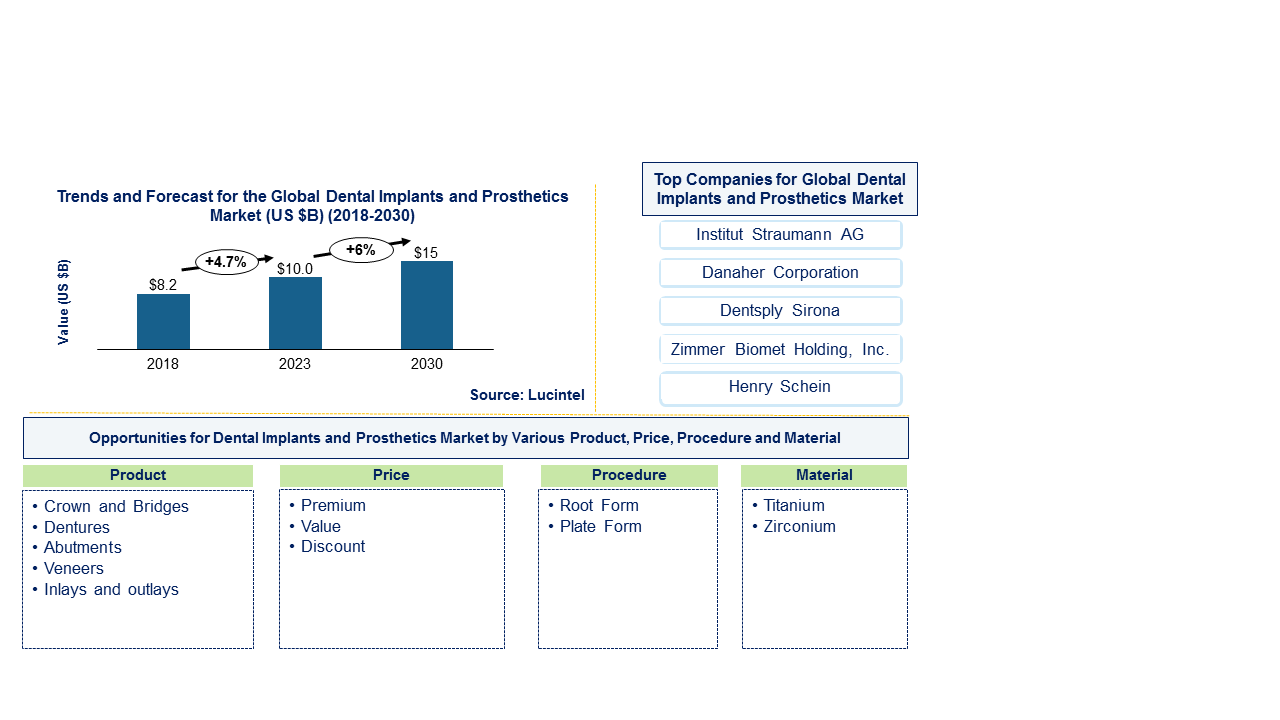

The future of the global dental implant and prosthetic market looks good with opportunities in dental clinics. The global dental implant and prosthetic market is expected to reach an estimated $15 billion by 2030, and it is forecast to grow at a CAGR of 6% from 2024 to 2030. The major drivers for market growth are increasing aging population, increasing awareness of cosmetic and aesthetic dentistry, increasing dental tourism and disposable income, and raising incidences of tooth decay and periodontal diseases.

Dental implants are typically made from titanium or titanium alloys due to their biocompatibility and strength. Prosthetic components often use materials like zirconia or ceramic for their durability and natural appearance. These materials undergo rigorous testing to ensure they meet medical standards and can integrate seamlessly into the oral cavity, providing long-term stability and function. The cost of dental implants and prosthetics can vary significantly based on materials used, complexity of the procedure, and geographic location. Generally, titanium implants are more competitively priced compared to zirconia implants, which tend to be higher due to manufacturing processes and material properties. Factors such as customization, additional treatments, and warranties also influence overall pricing, making it essential for patients to compare quotes and consult with dental professionals for accurate assessments tailored to their needs.

• Lucintel forecasts the dental prosthetics segment is expected to show an above average growth during the forecast period.

• Within the global dental prosthetic market, crown and bridges, dentures, abutment, veneers and inlays & onlays are the segments by product type. Crown and bridges is expected to be the largest segment during the forecast period. Crowns and bridges are used as substitutes for amalgam fillings; these offer a more permanent solution to tooth decay and periodontal diseases, and this leads to increasing demand. In crowns and bridges, the materials include all ceramics, porcelain fused to metal and metal.

• Europe is expected to remain the largest market during the forecast period mainly due to the increasing aging population of the region and favorable reimbursement programs and government expenditure for dental procedures.

Country wise Outlook for the Dental Implant and Prosthetic Market

Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major dental implant and prosthetic producers in key regions: the USA, Germany, Japan, and Switzerland.

Emerging Trends in the Dental Implant and Prosthetic Market

Emerging trends, which have a direct impact on the dynamics of the dental implant and prosthetic industry, include:

• Augmented Reality (AR) and Virtual Reality (VR): Use of AR/VR technologies for patient education, treatment planning, and surgical guidance, improving precision and patient outcomes.

• Smart Implants: Integration of sensors and IoT (Internet of Things) technology in dental implants to monitor oral health metrics such as pressure, temperature, and pH levels.

• Development of Bioactive Implants: Development of implants with bioactive coatings or materials that promote faster healing, reduce inflammation, and enhance osseointegration.

• Shift Towards Minimal Intervention Techniques: Focus on minimally invasive procedures and techniques like flapless surgery and immediate loading protocols, reducing recovery time and patient discomfort.

• Artificial Intelligence (AI): Application of AI algorithms for data analysis, treatment planning, and predictive analytics to optimize implant success rates and treatment outcomes.

• Use of Nanomaterials and Nanocoatings: Use of nanomaterials and nanocoatings to improve the surface properties of implants, enhancing biocompatibility, antibacterial properties, and longevity.

A total of 119 figures / charts and 93 tables are provided in this 187-page report to help in your business decisions. Sample figures with some insights are shown below. To learn the scope of, benefits, companies researched and other details of dental imp

Recent Developments in the Dental Implant and Prosthetic Market

Recent developments in dental implant and prosthetic market which highlights ongoing innovations and advancements across different sectors:

• Materials Advancements: There is a growing trend towards the use of newer materials such as nanostructured materials, bioactive ceramics, and composite materials in dental implants and prosthetics. These materials offer enhanced biocompatibility, strength, and aesthetic qualities compared to traditional materials.

• Digital Dentistry: The adoption of digital technologies like CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) has revolutionized the production of dental implants and prosthetics. This allows for precise customization, faster production times, and improved fitting accuracy, leading to better patient outcomes.

• Implant Surface Modifications: Innovations in surface modifications of implants aim to improve osseointegration (integration with the bone) and reduce healing times. Techniques such as laser etching, coatings with growth factors, and nano-scale surface modifications enhance implant stability and long-term success rates.

• 3D Printing: The use of 3D printing in dentistry has expanded, allowing for the fabrication of complex implant components and prosthetic devices with high precision and customization. This technology enables dental professionals to create patient-specific solutions quickly and cost-effectively.

• Regenerative Dentistry: Advances in regenerative medicine techniques, such as stem cell therapies and growth factor applications, are being explored to enhance tissue regeneration around implants and prosthetics. These approaches aim to improve healing outcomes and reduce complications.

Strategic Growth Opportunities for Dental Implant and Prosthetic Market

Technological Advancements

• Advanced Materials: Adapting biomaterials like titanium alloys and ceramic composites for dental implants and prosthetics improves their biocompatibility, durability, aesthetics, etc. It also results in the development of bioactive coatings that facilitate Osseo integration and reduces healing periods.

• Digital Dentistry: The application of CAD/CAM technology allows for accurate designing and developing of dental restorations which include crowns, bridges and custom abutments. Digital workflows speed up delivery schedules by simplifying production as well as promoting accuracy.

• 3D Printing: Additive manufacturing integration enables the creation of personalized dental implants and prosthetics unique to each patient thus enabling customization at a fraction of cost with prototyping conducted instantly.

Increasing Aging Population

• Rising Demand: Ageing populations globally need care such as those for edentulism. Elders desire strong dental implants or prostheses that will enable them retain better oral function capabilities throughout their lives.

• Focus on Aesthetics: For instance, aesthetic choice plays a key role in choosing implant systems that would mimic natural teeth in terms of color, shape and functioning. Market growth is also driven up by improved customer satisfaction rates due to increased acceptance rate for this product category.

Minimally Invasive Procedures

• Surgical Innovations: Developments around minimally invasive surgical procedures have seen flapless surgery which uses navigation systems during guided implant placement becoming more popular because patients recover faster from the operation yet face less pain after it has been completed successfully compared to past practices thereby improving treatment outcomes.

• Immediate Loading: Timely loading techniques are indicated so as to increase convenience satisfaction among patients who want quicker results without compromising long-term success rates concerning implants.

Patient Awareness and Education

• Healthcare Awareness: Increasing awareness on benefits associated with dental implants over traditional dentures including improved chewing efficiency; speech clarity; bone preservation promotes its adoption amongst patients thereby encouraging acceptance.

• Educational Campaigns: Dental practitioners and implant manufacturers should carry out educational programs on the latest developments in order to enlighten patients and other dentists about these alternatives and merits of employing dental implants as well as prosthetics.

Regulatory Environment and Market Expansion

• Regulatory Compliance: Conformity to strict regulatory standards/ certifications on safety, efficacy or quality control is a preconditions for market entry and product reception. Streamlining regulatory processes facilitates market expansion.

• Global Market Reach: Expanding presence within emerging economies where there is growing healthcare infrastructure coupled with per capita income increases would enable penetration into these markets with resultant revenue increase.

Collaboration and Partnerships

• Research Collaborations: Research partnership between universities, research institutions, dental firms has been instrumental in enhancing innovation regarding implant design, material science and clinical outcomes research.

• Strategic Partnerships: Partnering with dental implant companies, dental laboratories as well as health care providers improves supply chain network strengths product mix broadens knowledge impartation extends trade credit periods streamlines transactions training support systems enhancing the defense industry shield training medical school suppliers complementing new entrants from small businesses advertising regional alliances thus improving the capacity of each player.

Focus on Long-Term Outcomes and Patient Satisfaction

• Clinical Research: Continued investment in clinical studies provides information that supports long-term success stories of dental implants/prosthetics that boost confidence levels for practitioners leading to increased satisfaction among subjects of this treatment approach.

• Quality of Life: A focus on restored oral function, aesthetics and psychological wellbeing are among the factors driving demand for more developed implants & prosthetic solutions that can significantly enhance ones’ lifestyle.

Dental Implant and Prosthetic Market Driver and Challenges

Dental implant and prosthetic has a very important role in dental clinics. The changing market dynamics are being driven by increasing aging population, increasing awareness of cosmetic and aesthetic dentistry, increasing dental tourism and disposable income, and raising incidences of tooth decay and periodontal diseases. However, challenges like production costs highlight strategic solutions to sustain growth and innovation in the dental implant and prosthetic sector.

The factors responsible for driving the dental implant and prosthetic market include:

Drivers of the Dental Implant and Prosthetic Market:

1. The Increasing Aging Population: This demographic shift to aging populations worldwide drives the need for dental implants and prosthetics. Aged people want tooth replacement options that will last, function well and improve their quality of life.

2. Technological Advancements: Advanced Materials: For instance, titanium alloys such as ceramics composites have revolutionized dental implant materials by improving not only biocompatibility but also lifespan.

3. Digital Dentistry: Thanks to computer-aided design (CAD) and computer-aided manufacturing (CAM), dentists can produce highly accurate customized restorations within a short turnaround time thereby improving accuracy as well as reducing production time.

4. 3D Printing: Additive manufacturing has allowed for the production of patient-specific implants and prosthetics, which are both affordable and customizable.

5. Aesthetic Considerations: For instance, dental implants that mimic natural teeth in terms of color, shape and function are in high demand due to increased emphasis on aesthetics. What matters most now is how good patients look like after they have undergone aesthetic procedures like crowning etc.

6. Rising Oral Health Awareness: Increasing awareness about oral health benefits as well as limitations associated with traditional dentures forces patients towards opting for dental implants because they enhance masticatory efficiency, speech clarity while maintaining bone density.

7. Minimally Invasive Techniques: With the development of new surgical techniques such as guided implant surgery or flapless surgery, this has become possible since it narrows down pain given to patient after operation plus it helps in shortening recovery time thus improving treatment outcomes hence adoption is guaranteed.

Challenges Facing the Dental Implant and Prosthetic Market:

1. High Cost of Treatment: Dental implants and prosthetics can be expensive, limiting accessibility for some patients. Cost considerations and lack of insurance coverage may deter potential candidates from undergoing treatment.

2. Technological Complexity: Integration and adoption of advanced technologies, such as CAD/CAM and 3D printing, require significant investment in equipment and training. Implementation challenges and initial costs may hinder adoption by smaller dental practices.

3. Regulatory Compliance: Strict regulatory requirements for safety, efficacy, and quality assurance vary across regions and can delay product launches and market entry. Adhering to regulatory standards is essential but can be resource-intensive for manufacturers.

4. Long-Term Durability and Complications: Ensuring the long-term success and durability of dental implants remains a challenge. Complications such as implant failure, peri-implantitis, and bone resorption require ongoing monitoring and management.

5. Patient Education and Acceptance: Educating patients about the benefits, risks, and long-term outcomes of dental implants is crucial for informed decision-making. Misconceptions, fear of surgery, and lack of awareness may impact patient acceptance and treatment uptake.

6. Skill Shortages and Training: Adequate training and expertise in implantology and prosthetic dentistry are essential for achieving optimal clinical outcomes. Shortages of skilled professionals and the need for continuous education pose challenges to meeting growing demand.

Dental Implant and Prosthetic and their Market Shares

In this globally competitive market, several key players such as Straumann AG, Danaher Corporation, Dentsply Sinora, Zimmer Biomet Holding, Henry Schein, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us by email at helpdesk@lucintel.com.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies dental implant and prosthetic companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the dental implant and prosthetic companies profiled in this report include.

• Straumann AG

• Danaher Corporation

• Dentsply Sinora

• Zimmer Biomet Holding

• Henry Schein

These companies have established themselves as leaders in the dental implant and prosthetic industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the dental implant and prosthetic are evolving, with the entry of new players and the emergence of innovative dental implant and prosthetic. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Dental Implant and Prosthetic Market by Segment

Key types include dental implants, such as endosteal and subperiosteal, and dental prosthetics, including crowns, bridges, and dentures. Materials used range from titanium and zirconium for implants to ceramic and metal for prosthetics. The market caters to various end-users, such as dental clinics, hospitals, and dental laboratories. Geographically, the market is divided into North America, Europe, Asia-Pacific, and other regions, with growth driven by advancements in dental technology and increasing demand for aesthetic dentistry.

In this market, prosthetics is the largest segment by type, and titanium is the largest material segment. Growth in various segments of the dental implant and prosthetic market are given below:

This dental implant and prosthetic market report provides a comprehensive analysis of the marketÄX%$%Xs current trends, growth drivers, challenges, and future prospects in all major segments like above. The report offers insights into regional dynamics, highlighting the major markets for dental implant and prosthetic and their growth potentials. The study includes trends and forecast for the dental implant and prosthetic market by type, material, procedure, price, product, and region as follows:

Dental Implant and Prosthetic Market by Type [Value ($ Million) from 2018 to 2030]:

Implants

By Material

• Titanium

• Zirconium

By Procedure

• Root Form

• Plate Form

By Price

• Premium

• Value

• Discounted

Prosthetics

By Product

Crowns and Bridges

All Ceramic

Porcelain Fused to Metal

Metal

Others

Dentures

Abutments

Veneers

Inlays and Ou

Dental Implant and Prosthetic Market by Region [Value ($ Million) from 2018 to 2030]:

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• Spain

APAC

• South Korea

• Japan

• India

ROW

• Brazil

Features of Dental Implant and Prosthetic Market

Market Size Estimates: Dental implant and prosthetic market size estimation in terms of value ($M).

Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

Segmentation Analysis: Dental implant and prosthetic market size by various segments, such as type, material, procedure, price, and product.

Regional Analysis: Dental implant and prosthetic market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis on growth opportunities in different type, material, procedure, price, product , and regions for dental implant and prosthetic market.

Strategic Analysis: This includes M&A and competitive landscape for the dental implant and prosthetic.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in dental implant and prosthetic or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the dental implant and prosthetic market size?

Answer: The global dental implant and prosthetic market is expected to reach an estimated $15 billion by 2030.

Q2. What is the growth forecast for dental implant and prosthetic market?

Answer: The dental implant and prosthetic market is expected to grow at a CAGR of 6% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the dental implant and prosthetic market?

Answer: The major drivers for market growth are increasing aging population, increasing awareness of cosmetic and aesthetic dentistry, increasing dental tourism and disposable income, and raising incidences of tooth decay and periodontal diseases.

Q4. What are the major applications or end use industries for dental implants and prosthetics?

Answer: Implants and prosthetics are the major applications of dental implants and prosthetics.

Q5. What are the emerging trends in dental implant and prosthetic market?

Answer: Emerging trends, which have a direct impact on the dynamics of the dental implant and prosthetic industry, include development of implants with bioactive coatings, shift towards minimal intervention techniques and use of nanomaterials and nanocoatings.

Q6. Who are the key dental implant and prosthetic companies?

Answer: Some of the key dental implant and prosthetic companies are as follows:

• Straumann AG

• Danaher Corporation

• Dentsply Sinora

• Zimmer Biomet Holding

• Henry Schein

Q7.Which will be the largest dental implant and prosthetic product segment in the future?

Answer: Lucintel forecasts crown and bridges is expected to be the largest segment during the forecast period.

Q8: In dental implant and prosthetic market, which region is expected to be the largest in next 7 years?

Answer: Europe is expected to remain the largest market during the forecast period mainly due to the increasing aging population of the region and favorable reimbursement programs and government expenditure for dental procedures.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% customization without any additional cost.

This report answers following 11 key questions

Q1 What are some of the most promising potential, high-growth opportunities for the dental implant and prosthetic market by type (dental implants and prosthetics), implant by material (titanium and zirconium implants), by procedure (root form and plate form implant), by price (premium, value and discount implant), prosthetics by product (crown and bridges, dentures, abutment, veneers, inlays and outlays), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the dental implant and prosthetic market?

Q.5 What are the business risks and threats to the dental implant and prosthetic market?

Q.6 What are emerging trends in this dental implant and prosthetic market and the reasons behind them?

Q.7 What are some changing demands of customers in the dental implant and prosthetic market?

Q.8 What are the new developments in the dental implant and prosthetic market? Which companies are leading these developments?

Q.9 Who are the major players in the dental implant and prosthetic market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in the dental implant and prosthetic market, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M&A activities did take place in the last five years in the dental implant and prosthetic market?

For any questions related to dental implant and prosthetic market or related to dental implant and prosthetic market share, dental implant and prosthetic market analysis, dental implant and prosthetic market size, and dental implant and prosthetic companies, write to Lucintel analysts at helpdesk@lucintel.com. We will be glad to get back to you soon.