Data Center Rack Server Market Trends and Forecast

There has been a significant transformation of technologies in the data center rack server market in recent years, from traditional 1U servers to higher-density 2U and 4U servers. This shift is driven by the need for more computational power and storage space, which requires better server technologies. Other contributing factors include the adoption of hyper-converged infrastructure (HCI) and virtualization, which help businesses maximize server utilization while improving operational efficiency. On-premises data centers have also evolved into cloud-based solutions, leading to changes in server architecture and deployment methods. Additionally, the recent emphasis on energy efficiency and sustainability has prompted the integration of advanced cooling technologies, low-power consumption components, and efficient power distribution units in these servers. These advancements are reshaping the data center landscape, allowing businesses to handle more workloads without increasing costs while improving performance.

Emerging Trends in the Data Center Rack Server Market

The data center rack server market has evolved significantly in recent years, driven by advancements in technology and the growing demand for high-performance computing, data storage, and networking solutions. As enterprises, cloud service providers, and industries with large-scale IT infrastructure expand their operations, the need for more efficient, scalable, and cost-effective data center solutions has become critical. The following are the emerging trends shaping the market:

• Adoption of Edge Computing: Edge computing is becoming increasingly popular because it allows data to be processed closer to its source, reducing latency and improving the performance of applications that require real-time data. This trend is driving the need for smaller, more efficient servers in data centers, fueling growth in the market for compact rack servers.

• Rise of Hyper-Converged Infrastructure (HCI): Hyper-converged infrastructure, which integrates computing, storage, and networking into a single appliance, is gaining traction. HCI reduces complexity, increases scalability, and enhances efficiency in data centers, promoting the adoption of rack servers that can support these integrated systems.

• Increased Demand for High-Density Servers: As organizations handle more data and traffic, the need for high-density servers that offer greater performance in a smaller physical footprint is growing. This trend is leading to the development of higher-density 2U and 4U rack servers that maximize computational capacity while optimizing space usage in data centers.

• Focus on Energy Efficiency and Sustainability: As energy consumption in data centers grows, there is increasing pressure to adopt more energy-efficient server solutions. Rack servers with low-power consumption components, advanced cooling technologies, and improved power distribution units are being designed to reduce operational costs and carbon footprints.

• Integration of AI and Machine Learning Capabilities: Artificial intelligence (AI) and machine learning (ML) capabilities are being incorporated into data center servers to improve workload management, enhance predictive maintenance, and optimize server performance. This trend is enabling data centers to become more intelligent, self-sufficient, and capable of handling complex tasks.

These emerging trends are reshaping the data center rack server market by driving innovations in server design, performance, energy efficiency, and integration with next-gen technologies like AI and edge computing. As businesses increasingly rely on digital infrastructure, the demand for scalable, high-performance, and energy-efficient rack servers is expected to grow, significantly transforming the data center landscape.

Data Center Rack Server Market : Industry Potential, Technological Development, and Compliance Considerations

The data center rack server market has seen rapid advancements due to the increasing demand for high-performance, scalable, and energy-efficient solutions.

• Potential in Technology:

As industries expand their digital infrastructure, technologies such as edge computing, artificial intelligence (AI), machine learning (ML), and hyper-converged infrastructure (HCI) are becoming integral to data center operations. These innovations have vast potential to transform the market by enhancing computational power, operational efficiency, and sustainability.

• Degree of Disruption:

The degree of disruption in this market is high, as these emerging technologies revolutionize traditional data center architectures. For instance, edge computing reduces latency by processing data closer to its source, while AI and ML capabilities enhance workload management and predictive maintenance. Hyper-converged infrastructure simplifies data center operations by integrating computing, storage, and networking into a single unit, reducing complexity and increasing scalability.

• Current Technology Maturity Level:

The level of technology maturity is significant, with solutions such as 1U, 2U, and 4U servers already optimized for performance, density, and energy efficiency. However, there is still potential for further advancements, particularly in AI integration, energy efficiency, and space optimization.

• Regulatory Compliance:

Regulatory compliance is a key consideration in this market, as data centers face increasing scrutiny over energy consumption, sustainability practices, and data privacy. Companies are focusing on developing energy-efficient servers that meet regulatory standards, such as reducing carbon footprints and adhering to data protection laws, ensuring compliance with global regulations.

Recent Technological development in Data Center Rack Server Market by Key Players

The data center rack server market has seen tremendous improvements in recent times, driven by the growing demand for high-performance computing, data storage, energy-efficient technologies, and more. Major contributors to the market include key players such as Hewlett Packard Enterprise, Lenovo, Dell, Cisco Systems, Huawei, Oracle, Fujitsu, NEC, Rittal, and Vertiv, who have continuously innovated to meet the changing demands of enterprises and data centers. These innovations are shaping the future of the industry towards enhanced performance, scalability, energy efficiency, and smart infrastructure solutions.

• Hewlett Packard Enterprise (HPE): HPE launched its HPE ProLiant servers with a focus on optimized performance and energy efficiency. The new models support edge computing solutions with integrated AI capabilities, enabling businesses to handle complex workloads using minimal energy.

• Lenovo: Lenovo has enhanced its data center solutions, such as the ThinkSystem servers, which offer advanced computing, machine learning, and support for high-density workloads. These servers maximize performance per watt and deliver flexible, cost-effective infrastructure.

• Dell: Dell Technologies continues to lead with innovations in its PowerEdge server series, which feature enhanced compute capabilities, AI integration, and deep learning. These servers are designed for hyper-converged infrastructure (HCI) and support data center automation and scalability.

• Cisco Systems: Cisco launched its Unified Computing System (UCS) servers, which improve processing power, automation, and integration with cloud environments. CiscoÄX%$%Xs strategy focuses on simplifying and streamlining IT infrastructure for businesses supporting hybrid cloud workloads.

• Huawei: HuaweiÄX%$%Xs FusionServer series continues to innovate with high-density, energy-efficient servers optimized for data center use across industries. The company is introducing AI and 5G technologies into its servers.

• Oracle: Oracle has expanded its server offerings with rack servers optimized for cloud computing. These servers offer improved security, storage management, and performance for large enterprise environments.

• Fujitsu: Fujitsu has upgraded its PrimeQuest and PRIMERGY servers to support AI and edge computing. The company focuses on energy-efficient designs that enhance computational power for businesses across various industries.

• NEC: NECÄX%$%Xs Express5800 servers maintain high-density configurations, emphasizing reliability, scalability, and energy efficiency. NECÄX%$%Xs solutions provide cloud-ready infrastructure that seamlessly integrates with next-generation applications.

• Rittal: RittalÄX%$%Xs data center solutions, including its IT infrastructure enclosures, are designed to optimize space and cooling efficiency. Their innovative modular rack solutions help businesses reduce their carbon footprint while ensuring better airflow and temperature management.

• Vertiv: Vertiv provides critical infrastructure solutions, including rack-mounted power distribution units (PDUs) and thermal management systems. These innovations aim to improve energy efficiency and uptime in data centers while offering real-time monitoring capabilities.

These key developments by major players in the data center rack server market highlight the increasing focus on energy-efficient, scalable, and high-performance solutions. As the industry evolves, these companies are leading the way in meeting the growing demands for digital infrastructure while providing businesses with the tools needed to drive innovation and reduce operational costs.

Data Center Rack Server Market Driver and Challenges

The data center rack server market is experiencing rapid growth due to the increasing demand for high-performance computing, energy-efficient solutions, and scalable infrastructure to meet the expanding digital ecosystem. Data centers are evolving due to the rise of cloud computing, edge computing, and AI, which are demanding more computing power and storage. However, the main constraints in the development of the market are high capital expenditure, energy consumption, and complex integration.

The factors driving the data center rack server market are as follows:

• Digital Transformation: As enterprises adopt digital technologies such as cloud computing, big data analytics, and AI, the demand for high-performance servers has increased to support these applications. This is driving innovation in server design and functionality to meet the needs of modern IT environments.

• Increasing Data Generation: The massive data generation from enterprises, IoT devices, and social media applications creates an increasing need for data storage and processing solutions. Such massive traffic is demanding high-performance rack servers to process large-scale operations.

• Cloud Computing and Virtualization: The adoption of cloud computing and virtualization has increased the demand for scalable, flexible, and cost-effective data center solutions. As businesses continue to move to the cloud, the demand for efficient servers that can support cloud workloads continues to rise.

• Need for Cost Efficiency: There is a growing need for data centers to reduce operational costs, which makes energy-efficient technologies and server designs gain precedence. Rack servers offering low power consumption, coupled with efficient cooling technologies, will help data centers reduce costs without compromising performance.

• Data Protection and Government Regulations: Growing concerns over data privacy and the increasing need for improved data protection regulations are driving up compliance requirements. Data centers are increasingly focusing on adopting servers that meet the highest regulatory standards for data protection and privacy.

Challenges in the data center rack server market are:

• High Capital Cost: It can be excessively expensive to upgrade or deploy the latest server technologies in data centers, particularly high-density servers and AI capabilities. Smaller-scale companies find it challenging to maintain the infrastructure needed to compete effectively.

• Energy Consumption and Cooling Requirements: High-performance servers and high-density systems are increasingly being used in data centers, which increase energy and cooling requirements. High energy consumption and temperature levels remain significant challenges for the efficient operation of data centers.

• Complex Integration: Introducing advanced technologies such as AI, machine learning, or edge computing into existing data center infrastructure can be challenging and expensive. The integration of these advanced technologies into established data center infrastructures will pose a significant challenge for businesses.

The data center rack server market is seeing substantial growth due to the influence of edge computing, AI integration, energy efficiency, high-density servers, and growth in cloud and hybrid IT infrastructures. On the flip side, capital-intensive, energy-intensive, and complex integration issues need to be resolved for continued growth. These opportunities and challenges are reshaping the future of this market and encouraging innovation in design, performance, and sustainability to meet emerging business requirements.

List of Data Center Rack Server Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies data center rack server companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the data center rack server companies profiled in this report include.

• Hewlett Packard Enterprise

• Lenovo

• Dell

• Cisco Systems

• Huawei

• Oracle

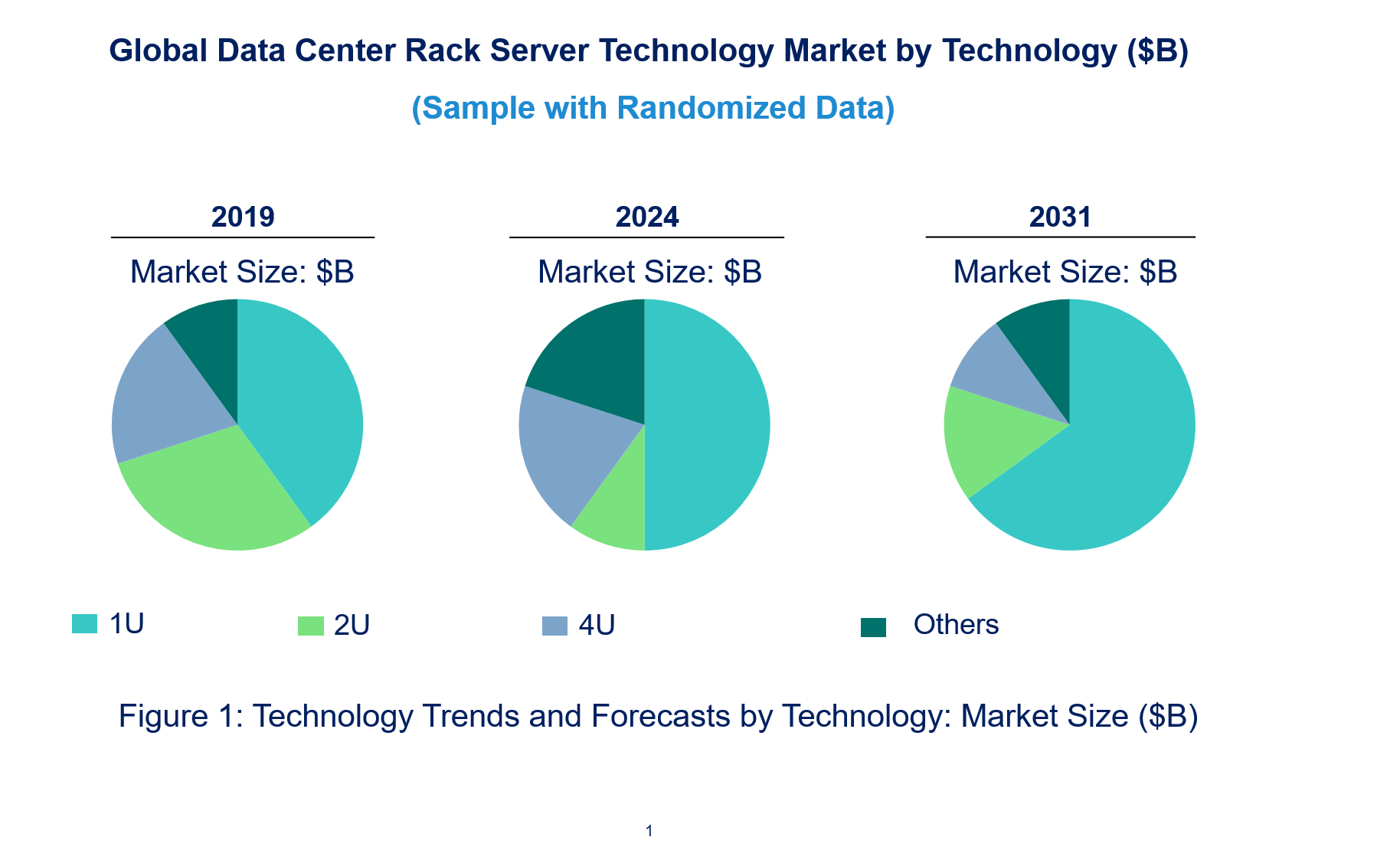

Data Center Rack Server Market by Technology

• Technology Readiness by Technology Type: The technology readiness of 1U, 2U, 4U, and other data center rack servers is shaped by their performance, scalability, and adaptability to evolving applications. 1U servers are highly ready for deployment in large-scale cloud and enterprise environments, offering efficiency and space optimization, with competitive pricing ensuring broad adoption. 2U servers have strong readiness for a wide range of applications, particularly those needing moderate computing power and storage. 4U servers, while more mature and ready for mission-critical applications requiring higher performance and storage, face competition from newer, more flexible technologies like blade and modular servers. Regulatory compliance is crucial, especially for data security and energy consumption, with all technologies needing to align with global standards. Each technology type is tailored for specific use cases, from standard hosting to high-performance computing, with readiness increasing as demand for specialized computing power grows.

• Competitive Intensity and Regulatory Compliance: Competitive intensity in the data center rack server market varies by technology, with 1U, 2U, and 4U servers each facing distinct challenges. 1U servers dominate in space-constrained environments but face stiff competition in price and performance from 2U and 4U alternatives. 2U servers strike a balance, offering improved processing power while being less costly than 4U systems. 4U servers, with larger capacity, cater to high-performance needs but come at a higher cost, facing less direct competition due to their specialized application. Regulatory compliance, such as energy efficiency standards and data security requirements, varies across these form factors. As regulations become more stringent, the market is also seeing greater innovation to meet compliance, influencing competitive dynamics.

• Disruption Potential by Technology Type: The disruption potential of various technologies in the data center rack server market is largely shaped by form factors such as 1U, 2U, 4U, and others. 1U servers are compact, energy-efficient, and ideal for high-density environments, driving their popularity in large-scale data centers. 2U servers offer a balance between space efficiency and processing power, making them versatile for a range of applications. 4U servers, being larger, provide greater storage and processing capabilities, often used in specialized environments requiring high performance. Other form factors, like blade servers, provide modular scalability, adding flexibility and energy efficiency to data center operations. As cloud computing and edge computing evolve, these technologies will play a pivotal role in transforming data center infrastructure and reducing operational costs.

Data Center Rack Server Market Trend and Forecast by Technology [Value from 2019 to 2031]:

• 1U

• 2U

• 4U

• Others

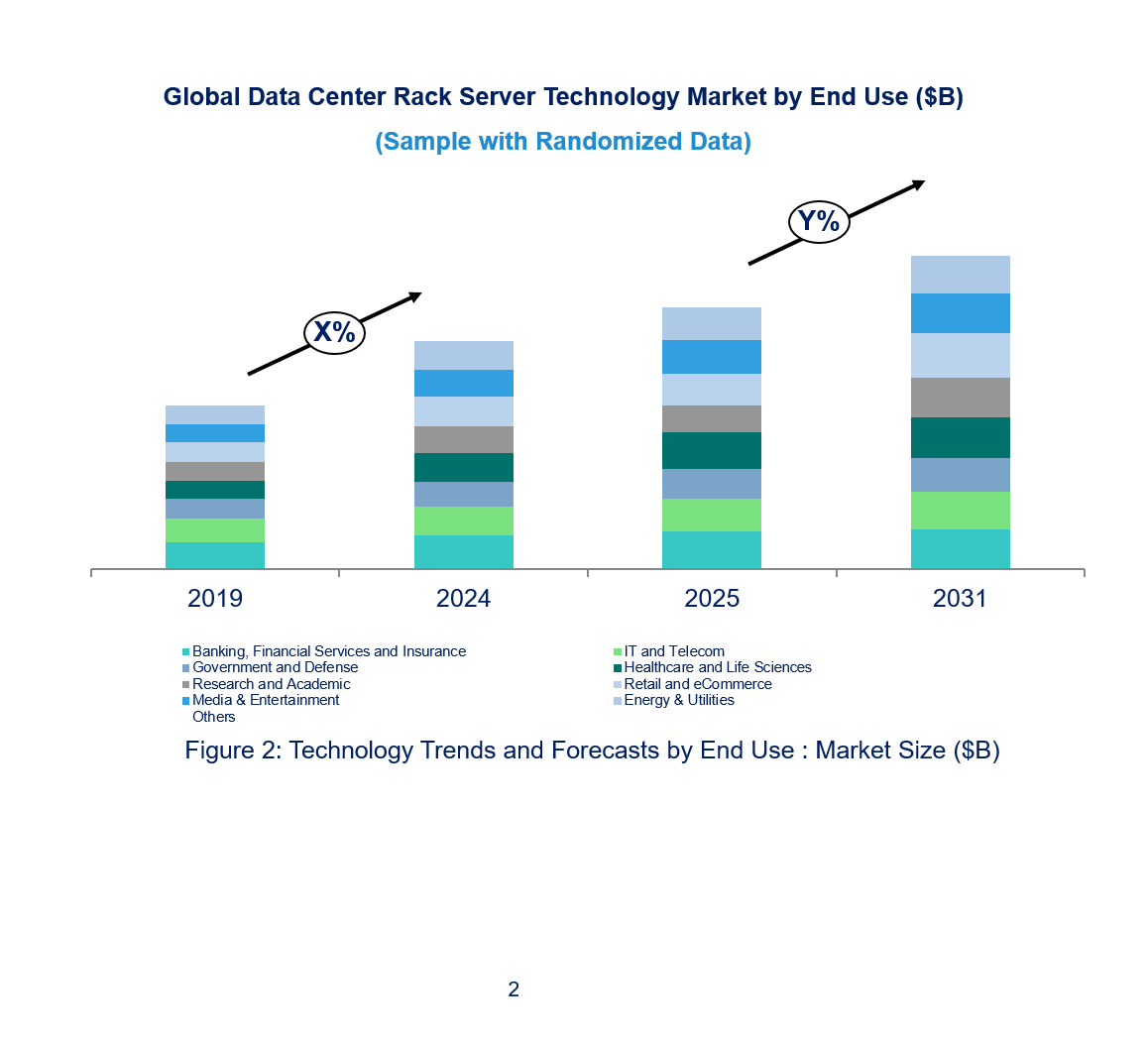

Data Center Rack Server Market Trend and Forecast by End Use Industry [Value from 2019 to 2031]:

• Banking, Financial Services and Insurance

• IT and Telecom

• Government and Defense

• Healthcare and Life Sciences

• Research and Academic

• Retail and E-Commerce

• Media & Entertainment

• Energy & Utilities

• Others

Data Center Rack Server Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Data Center Rack Server Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Data Center Rack Server Market

Market Size Estimates: Data center rack server market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global data center rack server market size by various segments, such as end use industry and technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global data center rack server market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different end use industries, technologies, and regions for technology trends in the global data center rack server market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global data center rack server market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global data center rack server market by technology (1U, 2U, 4U, and others), end use industry (banking, financial services and insurance, IT and telecom, government and defense, healthcare and life sciences, research and academic, retail and e-commerce, media & entertainment, energy & utilities, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different technology? What are the drivers and challenges of these technologies in the global data center rack server market?

Q.5. What are the business risks and threats to the technology trends in the global data center rack server market?

Q.6. What are the emerging trends in these technologies in the global data center rack server market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global data center rack server market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global data center rack server market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this data center rack server technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global data center rack server market?