Indian Aerospace and Defense Composite Market Trends and Forecast

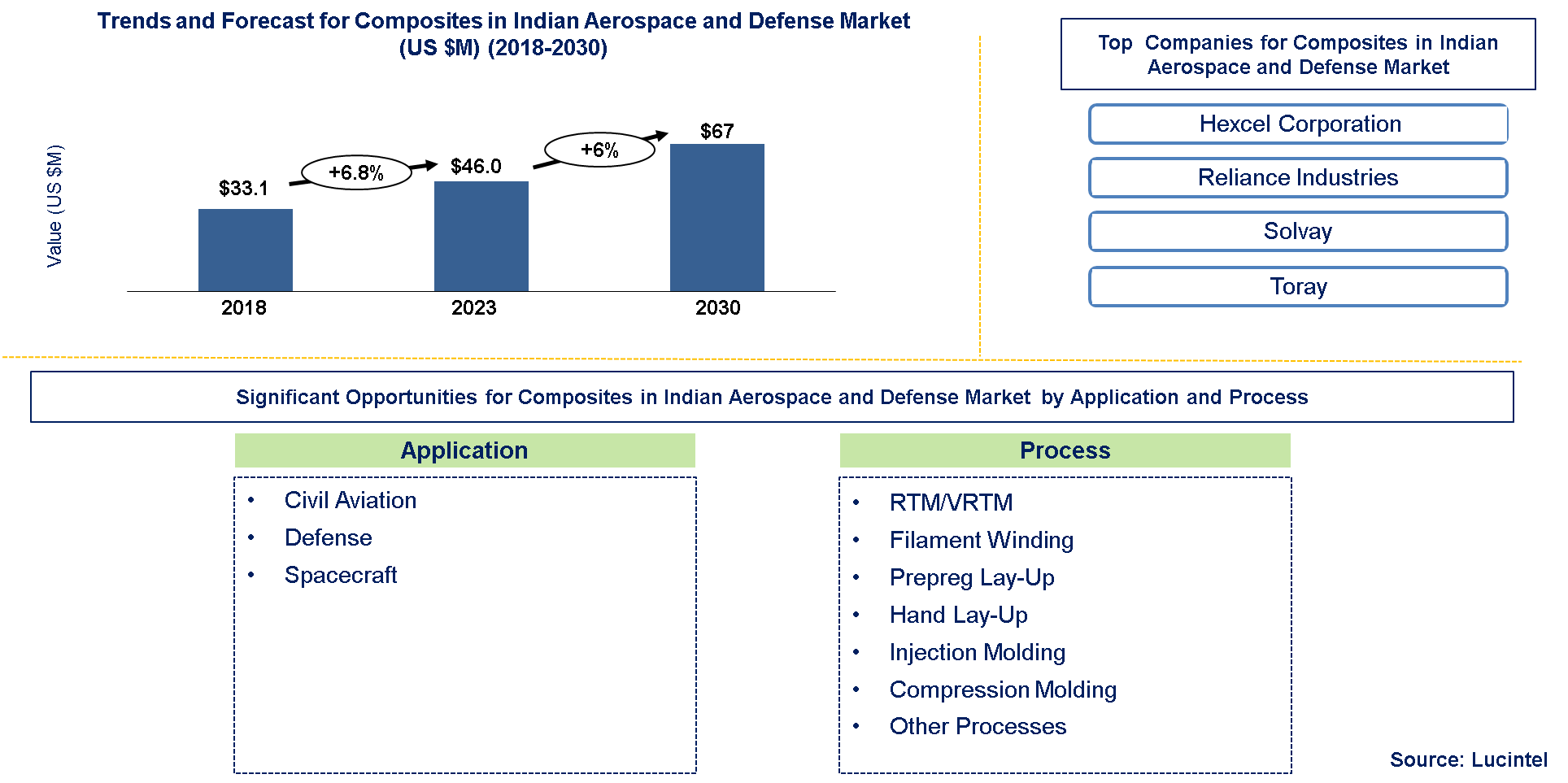

Lucintel finds that the future of the composite material in the Indian aerospace and defense industry looks promising with opportunities in civil aviation, military aviation and spacecraft application. The composite in Indian aerospace and defense industry is expected to reach an estimated $67 million by 2030 with a CAGR of 6% from 2024 to 2030. The major growth drivers for this market are increase in civil aviation and defense expenditure, increasing use of lightweight and high performance material and availability of low-cost skilled manpower.

The Indian aerospace and defense sector relies on carbon fiber, glass fiber, and aramid fiber which are known for their light weights and strength. Other commonly used resins include epoxy, phenolic, and polyester. Meanwhile, advanced fabrics like ceramic and metal matrix composites boast improved performance features. These materials are very important in the making of lightweight high-performance aircraft components as well as missiles and defense systems. The prices of Indian composites tend to be lower than those in developed countries due to cheap labor costs, local sourcing of raw materials, and government incentives offered by the country’s authorities. But prices differ by type or quality with carbon fiber being more expensive among other high performing materials while there exists stiff competition from the international suppliers.

• Lucintel forecasts that in the Indian aerospace and defense industry, hand lay-up is expected to remain the largest market by value and volume. Defense will remain the largest application by value and volume.

• Defense will remain the largest application by value and volume. Civil aviation is also expected to witness highest growth over the forecast period.

Country wise Outlook for the Indian Aerospace and Defense Composite Market

The composite in Indian aerospace and defense market is witnessing substantial growth. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments

Emerging Trends in the Indian Aerospace and Defense Composite Market

Emerging trends in the composites in the defense market shaping its future applications and market dynamics:

• Indigenous Production: India is focusing on self-reliance in defense manufacturing. Companies like Hindustan Aeronautics Limited (HAL) and Bharat Dynamics Limited (BDL) are investing in developing indigenous composite materials for various defense applications.

• 3D Printing and Additive Manufacturing: These technologies are being adopted to produce complex composite components with greater precision and reduced material wastage. This is particularly useful in producing aerospace components that require intricate designs and high performance.

• Nanocomposites: Adding nanomaterials to composites make them have stronger mechanical properties such as strength, stiffness, and resistance to environmental factors. This invention has found wide application in advanced aerospace structures and defense equipments.

• Lightweight Materials: There is a growing demand for lightweight composites to improve fuel efficiency and performance in aerospace applications. Advanced composites like carbon fiber-reinforced polymers (CFRP) are being increasingly utilized for their high strength-to-weight ratio.

• Thermoplastic Composites: The use of thermoplastic composites is rising due to their recyclability, ease of processing, and ability to be reshaped. These materials are suitable for high-volume manufacturing, which is beneficial for both aerospace and defense sectors.

• Collaborations and Joint Ventures: Indian companies are increasingly collaborating with international firms to access advanced composite technologies and expertise. Partnerships with companies from the USA, Europe, and Israel are helping to bring cutting-edge composite solutions to the Indian market.

• Sustainability: There is a growing emphasis on sustainable composites. Research is being conducted on developing bio-based composites and recycling techniques to minimize the environmental impact of composite manufacturing and disposal.

• Advanced Manufacturing Techniques: Techniques such as automated fiber placement (AFP) and resin transfer molding (RTM) are being adopted to improve the efficiency and quality of composite manufacturing. These methods enable the production of large, complex components with high precision.

These trends indicate a robust growth trajectory for the Indian aerospace and defense composites market, driven by technological advancements and a focus on self-reliance and sustainability.

A total of 107 figures / charts and 68 tables are provided in this 205-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Indian Aerospace and Defense Composite Market

Recent developments in composites in Indian aerospace and defense market by various companies highlight ongoing innovations and advancements across different sectors:

• Defense Budget has increased: The defense spending of the Indian government is being increased with an emphasis on modernization of its arm forces; it includes large amount of investments in advanced composite materials.

• Local Development: Companies like Hindustan Aeronautics Limited (HAL) and Bharat Electronics Limited (BEL) have been focusing on developing indigenous composite materials. HAL has involved itself in the development of composites for aircraft components including Light Combat Aircraft (LCA) Tejas and Advanced Medium Combat Aircraft (AMCA).

• Strategic Partnership and Collaboration: Many Indian companies have entered into collaborations with global leaders of composite technologies. For example, partnerships between private sector players such as Larsen & Toubro (L&T) and international firms are improving the production capacity for high-end composites.

• R&D: Research Organizations such as Defense Research and Development Organization (DRDO) are actively investing in R&D programs for next generation composites. DRDO’s focus is on lighter, stronger, more robust materials to be used in missile systems, ships, and planes.

• Initiatives & Projects: Examples include Carbon fiber reinforced polymer (CFRP)-based aerospace grade composite development. Within this space companies such as Aequs Aerospace or Mahindra Aerospace are increasingly building up their composite manufacturing capabilities.

• Eco-friendly Strategy: Sustainable Composite Materials have become a priority. Indian firms are concentrating research dollars towards creating recyclable/bio-based composites that fit into global sustainability patterns.

• Export Opportunities: This includes partnering with international defense contractors and participating in global defense expositories since India’s technology advances coupled with enhanced production capacities are opening up scope for Indian companies to look at exports in the global aerospace and defense markets.

• Skill Development & Training: Consequently there exist skill enhancement initiatives to support sectors growth which focus on advanced composite technology training schools/centers, joint ventures with educational institutions etc.

Strategic Growth Opportunities for Indian Aerospace and Defense Composite Market

The composites in Indian aerospace and defense market are very dynamic due to its unique properties of being lightweight, strong and thermally stable. Some key strategic growth opportunities for this market include:

Science and technology development:

• Invest in research and development to enhance mechanical properties of composites like strength, toughness, and resistance to extreme conditions.

• Develop advanced manufacturing methods for optimizing production processes and reducing costs.

Collaboration with global partners:

• Form alliances with international aerospace companies for technology transfer and knowledge sharing.

• Access cutting-edge composites technologies as well as exploit global supply chains to obtain competitive advantage.

Expansion of applications:

• Broaden the use of composites beyond airframes to include radomes, engine nacelles, interior structures etc.

• Seek opportunities in defense applications such as armored vehicles and naval vessels etc.

Local manufacturing capabilities:

• Establish domestic capacities for producing composite materials and parts.

• Create special facilities as well as training programs for the training of skilled labor pool in composite technology sector.

Cost efficiency measures:

• Adopt inexpensive manufacturing processes and procurement techniques in order to lower cost of production.

• Optimize source chain management in order to reduce lead-time while improving operational efficiency.

Regulatory support and compliance:

• Work closely with regulators to streamline certification requirements for composite-based materials used in aerospace and defense sectors

• Ensure that they are compliant with global quality standards ensuring increased market acceptance

Focus on sustainability:

• Make eco-friendly composite materials as well as manufacturing processes commensurate with global sustainability objectives or goals

• Position India as a country offering sustainable solutions in aviation industry including defense too.

Strategic investment on infrastructure:

• Investing on infrastructure where we have composite manufacturing, testing, certification facility,

• Setting up composite technology parks or clusters so that collaboration, innovation can be fostered.

Indian Aerospace and Defense Composite Market Drivers and Challenges

The lightweight features of composites, which allow for weight reduction without compromising on strength, have been crucial in facilitating the growth of India’s aerospace and defense sectors. Hence, XYZ and other balsa materials are used to make the core of the composite structures. This makes the planes strong while still being light enough for efficient fuel consumption. Nonetheless, high costs and lack of specialized production abilities have hampered their wider application. Effective use of composites by India in its pursuit of excellence in aerospace and defense industry will depend on how it can resolve these issues using new materials science techniques, partnering with strategic firms and training programs targeted at developing skilled labor forces.

The key drivers for the Indian aerospace and defense in composite market include:

1. Growing Defense Budget: India has more funds going to the military, and thus it is putting lots of money into advanced materials such as composites for use by the war industry.

2. Composites in aerospace and defense: The Make in India policy of the government encourages domestic manufacturing through which composites can be developed and utilized in aerospace and defense.

3. Lightweight Yet Strong: The lightweight properties of composites come with an added advantage since they are used for applications in aerospace or defense resulting to improved performance and fuel efficiency.

4. Corrosion Resistance: Military gear made from composites instead of other traditional materials is much less prone to corrosion, thereby reducing maintenance expenses and prolonging their service life.

5. Breakthroughs on Composite Technology: Progresses being realized by suppliers of composite raw material like automated fiber placement and additive manufacturing has made these products cheaper for purchase from sources that supply armies.

6. Collaborations and Partnerships: Joint ventures with overseas firms pushing growth: Collaborative efforts between Indian companies and international names within the field of aviation have contributed towards the adoption of modern composite capabilities.

7. Increased UAV Use: The increasing use of UAVs in defense applications is stimulating demand for lightweight composite materials.

8. Environmental Regulations: In attempt to save our planet, stringent measures are forcing airframe manufacturers to invest more in sustainable materials such as carbon fiber reinforced plastics (CFRPs).

The challenges in the Indian aerospace and defense in composite market include:

1. High Production Costs: Cost of production for composite materials is generally higher compared to the ordinary materials, a fact that has not made it easy for their wide acceptance.

2. Technical Expertise: Skilled man power and technical know-how in composite manufacturing and design is lacking in India.

3. Supply Chain Issues: Inadequate availability of raw materials and components for composites manufacture sometimes leads to erratic supply chains.

4. Quality Control: Coming up with consistent quality control on composites is not easy without advanced inspection methods and testing techniques.

5. Regulatory Hurdles: It can be time consuming and expensive to navigate the intricate regulations required for certification of defense application composite materials.

6. Market Competition: Established international companies with better technologies, wider market coverage are tough competition to Indian firms operating in this sector.

7. Infrastructure Limitations: Limited facilities for research, development and commercial scale production of composites may discourage market growth.

8. Slow Adoption Rate: Because defense procurement practices remain traditional and people still prefer tried-and-tested stuff, new composite technology might be adopted slowly by users in this industry.

In India, the aerospace and defense industries make use of composites in ways which are creative as well as critical for improving performance, reducing weight, and achieving operating efficiencies. Continuous research funding is necessary to overcome difficulties like high cost of production and demand for regulatory compliance. In order for India to retain its status in the worldwide aerospace and defense market, it must seek help from advanced manufacturing systems and collaborations that embrace technology transfer.

Composites in Indian aerospace and Defense Market Suppliers and Their Market Shares

In this globally competitive market, several key players such Hexcel Corporation, Reliance Industries, Toray Industries, and Solvay etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us by email at helpdesk@lucintel.com.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies in composites in Indian aerospace and defense cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the composites in Indian aerospace and defense companies profiled in this report include.

• Hexcel Corporation

• Reliance Industries

• Toray Industries

• Solvay Group

These companies have established themselves as leaders in the Indian composites in the aerospace and defense market, with extensive product portfolios, India presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations. The market share dynamics within the composites in Indian aerospace and defense market are evolving, with the entry of new players and the emergence of innovative composites in the aerospace and defense market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Indian Aerospace and Defense Composite Market by Segment

Many things drive the growth of these interiors in the Indian aerospace and defense composites market, including weight reduction and better passenger comfort. This is due to increased use of light-weight material for aircrafts and defense vehicles’ structure components that are strong. Radomes and antennas made out of composites are required for electromagnetic transparency as well as durability. Range and payload capacity in airframes for Unmanned Aerial Vehicles (UAVs) is also enhanced by composites. Composites play a key role in this area since they offer ballistic protection while keeping vehicle weights manageable. These sectors suggest that India’s aerospace sector continues to innovate its defense industry thus it still remains vibrant with regard to future potentiality.

Composites in the Indian Aerospace and Defense Industry by Application [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Civil Aviation

• Defense

• Spacecraft

Composites in the Indian Aerospace and Defense Industry by Process [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• RTM/VARTM

• Filament Winding

• Prepreg Lay-Up

• Hand Lay-Up

• Injection Molding

• Compression Molding

• Other Processes

Features of Indian Aerospace and Defense Composite Market

• Market Size Estimates: Composites in Indian aerospace and defense industry size estimation in terms of value ($M) shipment and volume (M lbs)

• Trend And Forecast Analysis: Composites in Indian aerospace and defense industry trends (2018-2023) and forecast (2024-2030) by various segments.

• Segmentation Analysis: Composites in Indian aerospace and defense industry size by various segments, such as application and process in terms of value and volume.

• Growth Opportunities: Analysis on growth opportunities in different application, and process for the composites in the Indian aerospace and defense industry.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the Composites in Indian aerospace and defense industry.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in aerospace and defense market or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the composites in Indian aerospace and defense market size?

Answer: The composites in Indian aerospace and defense market is expected to reach an estimated $67 billion by 2030.

Q2. What is the growth forecast for composites in Indian aerospace and defense market?

Answer: The composites in Indian aerospace and defense market is expected to grow at a CAGR of 6% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the composites in Indian aerospace and defense market?

Answer: The major growth drivers for this market are increase in civil aviation and defense expenditure, increasing use of lightweight and high performance material and availability of low-cost skilled manpower.

Q4. What are the major segment for composites in Indian aerospace and defense market?

Answer: Civil aviation and defense are the major fiber types of Indian composites market.

Q5. What are the emerging trends in composites in Indian aerospace and defense market?

Answer: Emerging trends, which have a direct impact on the dynamics of the Indian composites market, includes indigenous production, 3D printing and additive manufacturing, nanocomposites, lightweight materials and increasing thermoplastic composites in aerospace.

Q6. Who are the key composites in Indian aerospace and defense companies in India?

Answer: Some of the key companies for composites in Indian aerospace and defense are as follows:

• Hexcel Corporation

• Reliance Industries

• Toray Industries

• Solvay Group

Q7.Which composites in Indian aerospace and defense market manufacturing process segment will be the largest in future?

Answer: Lucintel forecasts that in the Indian aerospace and defense industry, hand lay-up is expected to remain the largest market by value and volume. Defense will remain the largest application by value and volume.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high-growth opportunities for the composites in the Indian aerospace and defense industry by application (civil aviation, military aviation and spacecraft), process (RTM/VARTM, filament winding, prepreg lay-up, hand lay-up, injection molding, compression molding and others )?

Q.2 which segments will grow at a faster pace and why?

Q.3 What are the key factors affecting market dynamics? What are the drivers and challenges of the composites in the Indian aerospace and defense industry?

Q.4 What are the business risks and threats to the composites in the Indian aerospace and defense industry?

Q.5 What are emerging trends in this composites in the Indian aerospace and defense industry and the reasons behind them?

Q.6 What are some changing demands of customers in the composites in the Indian aerospace and defense industry?

Q.7 What are the new developments in the composites in the Indian aerospace and defense industry? Which companies are leading these developments?

Q.8 Who are the major players in the composites in the Indian aerospace and defense industry? What strategic initiatives are being implemented by key players for business growth?

Q.9 What are some of the competitive products and processes in the composites in the Indian aerospace and defense industry, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.10 What M&A activities did take place in the last five years in the composites in the Indian aerospace and defense industry?