Global Composites Distributor Market Trends and Forecast

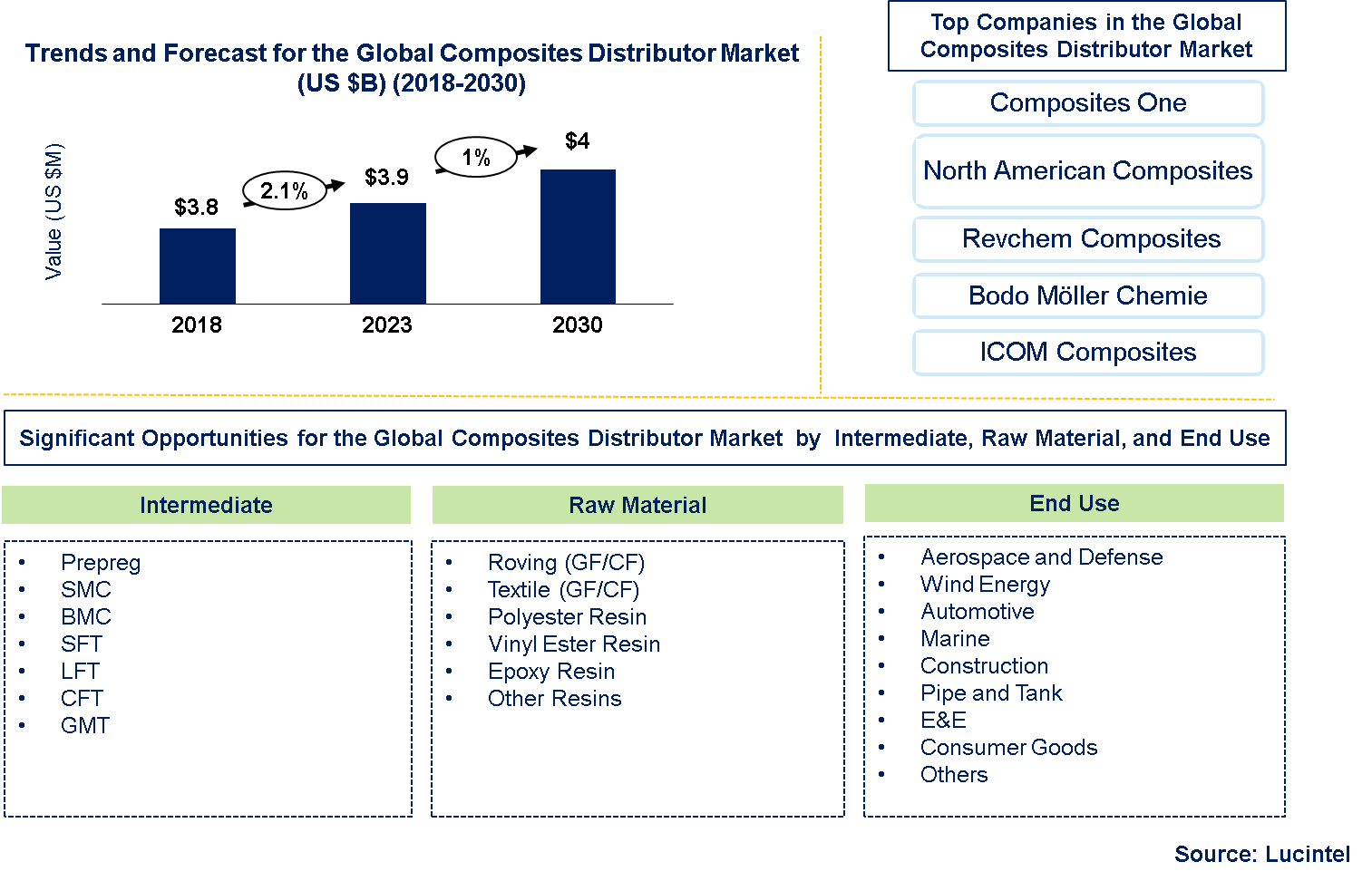

Lucintel finds that the future of the global composites distributor market looks promising with opportunities in transportation, marine, wind energy, aerospace & defense, pipe & tank, automotive, marine, construction, electrical/electronics, and consumer goods. The composites distributor market is expected to reach $4 billion by 2030 with a CAGR of 1% from 2023 to 2030. The major drivers in this market are increasing demand for composites in North America and Asia Pacific region and presence of large number of medium and small composite part manufacturers

The market for global composite distributors depends on the strengths of such raw materials as glass, carbon and aramid fibers while epoxy, polyester and vinyl ester resins are used as polymer matrices. Additionally, silica and calcium carbonate are applied to improve the properties whereas foam or honeycomb cores are employed in manufacturing lightweight structures. In addition to quality and application, prices vary depending on the material involved; hence, high-performance composites such as Carbon Fiber-Reinforced Polymers cost more than Glass Fibre Reinforced Polymers. Distributors can offer competitive pricing through contracts, bulk purchases or other additional services. Moreover, prices are also affected by demand in the market place for a particular product, changes in raw material costs and advances in technology so that there is both a premium option and a cost-effective one available.

• Lucintel forecasts that, polyester resin is expected to remain the largest material by value and volume and it is also expected to witness the highest growth during the forecast period due to increasing demand in construction and pipe & tank industry.

• Construction will remain the largest end use due to growth in demand for light weight and non-corrosive materials in industrial, commercial, residential, and civil construction applications as well as presence of large number of composite part fabricators. Distributors generally serve small to medium size part fabricators as they buy small to mid-sized quantities for various applications.

• Asia Pacific is expected to remain the largest region by value and volume and is also expected to experience the highest growth over the forecast period because of growing composites market and presence of a large number of small part fabricators especially for pipe & tank, construction, and consumer goods end use industries

Country wise Outlook for the Global Composites Distributor Market

The global composites distributor market is witnessing substantial growth, driven by increased demand from various industries. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major composites distributor market producers in key regions: China, USA, Germany, and India.

Emerging Trends in Global Composites Distributor Market

Emerging trends in Global Composites Distributor Market are shaping its future applications and market dynamics:

1. Rise Digitalization and Automation: To improve efficiency and traceability, digital tools and automation are adopted in supply chains. With the aim of automating warehousing solutions, advanced inventory management systems have been introduced.

2. Increasing Demand for Sustainable Development and Green Composites: Demand increase for eco-friendly and sustainable composite materials is due to the regulations and consumer preferences. Production as well as sale of composites that are made from bio-based materials or that has been recycled.

3. Increasing Regulatory Compliance and Quality Assurance: Distributors, due to increasing regulations that are in place, are now very keen on ensuring their products meet very strict quality standards and certifications. These include giving out detailed documentation and traceability of the materials they use.

4. Technical Support and Value-added Services: To enhance service offering, distributors are now providing technical support, training, and consultancy services to their customers in order to assist them in material selection, processing techniques and application development.

5. 3D Printing and Additive Manufacturing: Incorporation of 3D printing technologies for manufacture of multifarious composite parts and units. The use of additive manufacturing to reduce the amount of material waste and time in production is investigated.

These trends underscore the dynamic evolution of the composites distributor market, driven by innovation, sustainability, and the demand for high-performance solutions across diverse industrial sectors

A total of 89 figures / charts and 76 tables are provided in this 181-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Global Composites Distributor Market

Recent developments in global composites distributor by highlight ongoing innovations and advancements across different sectors

1. Expansion of Distribution Networks: Several companies are amplifying their distribution networks to amplify their reach and spruce up the effectiveness. For instance, global distributors are opening new sites in particular patches of the world so as to be able to distribute locally in those areas, especially in emerging economies such as Brazil and India.

2. Technological Advancements: Distributors are investing in advanced technologies for stock management and order processing. This involves adoption of automated systems and e-platforms that can make running more efficient while boosting customer satisfaction.

3. Sustainability Initiatives: Increasing attention is paid to environmental matters within the distribution industry. Some corporations are considering environmentally friendly packaging materials alternative, which would lower their carbon footprints through sustainable logistics approaches.

4. Market Diversification: Suppliers are diversifying the products offered to include advanced composites and specialty materials. They want to attract a wide range of industries like automotive, aerospace, construction.

5. Digital Transformation: The rise of e-commerce and digital platforms has transformed traditional distributorship activities across key sectors of national economies. Most online outlets are enhancing their virtual presence and electronic facilities for better services including online ordering or real-time inventory check-up.

Strategic Growth Opportunities for Global Composites Distributor Market

1. Expansion into Developing Economies: The countries that are referred to as emerging markets include those in the Asia-Pacific, Latin America and Africa, which are experiencing fast industrialization and infrastructure development. India, China, Brazil, Indonesia among others have increased their investments in construction industry, automotive sector aerospace industry and defense industry leading to high demand for composite materials. Also they can take advantage of this huge growth by entering into partnerships with domestic manufacturers and suppliers.

2. Focus on Ecological Techniques: Sustainability is a keyword now in every sphere of life. For example, composites known for their weight saving properties in addition to being durable are able to improve energy efficiency as well as reduce carbon footprinting. By offering green composites made from recycled materials or bio-based resins distributors have opportunity to exploit this trend. Distributors that want to be thought leaders when it comes to sustainability may court eco-conscious customers while keeping up with the regulatory environment.

3. New Technologies: Innovative manufacturing processes such as 3D printing and automation alongside advanced composite technologies like high-performance materials provide opportunities for further growth (e.g., 3D Printing & Automation). These companies must stay ahead of technology innovation and deliver cutting-edge products with regard to these innovations so as to remain competitive (i.e., they need to ensure that they remain at the forefront of these technologies). They also can engage tech firms or invest heavily in R&D so as enhance their product offerings and meet ever changing needs of sectors such as aerospace, automotive and sports equipment.

4. Product Line Diversification: Increasing the number of composite materials provided can help reach new customer segments (increase its customer base). This can include diversifying into niche markets such as ballistic composites, marine composites or renewable energy composites for instance. It helps mitigate exposure related with volatile markets but also positions them as one-stop shops for all sorts of composites.

5. Improving Supply Chain Efficiency: Being able to deliver composite materials on time and efficiently is a significant competitive advantage which comes with optimizing supply chain management. Distributors may improve their operations through investment in advanced logistics, inventory systems as well as digital platforms. They can also try to reduce lead times and enhance customer satisfaction by embracing JIT inventory practices while building strong buyer-supplier relationships.

Composites Distributor Market Drivers and Challenges

The global market for composites distributors is growing dynamically owing to a variety of factors and challenges. As the world’s industries increasingly embrace composites due to their better performance, it becomes critical for distributors to facilitate efficient delivery systems and markets. The demand for advanced composites cuts across a wide range of sectors from automotive and aerospace to construction and renewable energy that present opportunities and obstacles as well to those distributing them. Key stakeholders who wish to sail through the changing face of the composite distribution industry have to know these forces influencing it as well as its challenges.

The key drivers for the composites distributor market include:

1. Increasing demand for composites in different sectors: The growing use of composites in automotive, aerospace, construction and sporting goods leads to efficient distribution channels being required.

2. Innovations: Technological advancements in composite materials and manufacturing processes drive demand and give way for specialized distribution channels to handle these state-of-the-art products.

3. Sustainability and environmental concerns: A move towards more sustainable and eco-friendly materials drives up the market for higher grade composites which necessitates efficient distribution networks.

4. Diversification of applications: Various emerging areas like renewable energy and defense are making use of composites hence opening up new opportunities for distributors.

5. Globalization of supply chains: As organizations increase their global presence they require comprehensive distribution systems to facilitate movement of composites thus this is a driver to their growth.

6. Economic growth: Economic development in developing regions increases the demand for infrastructure development as well as industrial applications utilizing composite materials.

The challenges facing the composites distributor market include:

1. Elaborate logistics and supply chain management: It can be difficult to handle or transport composite materials that usually need special conditions applied on them.

2. Expensive costs: High prices charged on advanced composites together with specific infrastructures needed for distribution may hinder entry into the business by some distributors

3. Regulatory compliance: Various legislations applied across countries make it complicated to distribute products thus raising operational costs related with this activity

4. Market volatilities: Changes in raw material costings as well as economic situation has an impact on stability of composite markets

5. Technological integration: Inclusion of technological advancements while incorporating new systems into existing distribution network may not be easy

6. Competition: Intense competition among distributors can lead to pricing pressures and reduced margins.

Ultimately, the worldwide market for distributor composites is driven by various factors such as technological advances, the movement towards sustainability use in different industries. Distributors are faced with a number of problems including intricate logistics, huge expenses and legal obstacles. It is the successful tackling of these issues while benefiting from the market drivers that can make distributors capitalize on growth opportunities and stay ahead of their rivals. For distributors to flourish within this ever-changing economic climate, strategic adaptation and innovation will be indispensable in this scenario as market continues to change its nature

Global Composites Distributor Suppliers and Their Market Shares

In this globally competitive market, several key players such as Composites One, North American Composites, Revchem Composites, Bodo Möller Chemie, and ICOM Composites etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each major players Contact Us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies composites distributor companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the composites distributor companies profiled in this report includes.

• Composites One

• North American Composites

• Revchem Composites

• Bodo Möller Chemie

• ICOM Composites

These companies have established themselves as leaders in the global composites distributor market with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the global composites distributor market are evolving, with the entry of new players and the emergence of innovative technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities

Composites Distributor Market by Segment

Major developing segments in the global composites distributor market are aerospace and defense, automotive industry, and construction industry. Enhanced aircraft technologies have led to increased demand for high-performance composites from aerospace and defense. Vehicle weight reduction and improved fuel efficiency are of much concern in the automobile sector. The construction field is well served by the versatility and longevity of these materials which can be used for infrastructure and building applications. Furthermore, renewable energy initiatives like wind turbines lift the growth of this market for composite distributors. These sectors altogether drive up the need for advanced composites materials as well as distribution solutions.

Composites Distributor Market by End Use [$M analysis for 2018 – 2030]:

• Aerospace and Defense

• Wind Energy

• Automotive

• Marine

• Construction

• Pipe and Tank

• E&E

• Consumer Goods

• Others

Composites Distributor Market by Raw Material [$M analysis for 2018 – 2030]:

• Roving (GF/CF)

• Textile (GF/CF)

• Polyester Resin

• Vinyl Ester Resin

• Epoxy Resin

• Other Resins

Composites Distributor Market by Intermediate [$M analysis for 2018 – 2030]:

• Prepreg

• SMC (Sheet Molding Compound)

• BMC (Bulk Molding Compound)

• SFT (Short Fiber Thermoplastic)

• LFT (Long Fiber Thermoplastic)

• CFT (Carbon Fiber Thermoplastic)

• GMT (Glass Mat Thermoplastic)

Composites Distributor Market by Region [$M analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the Worl

Features of Composites Distributor Market

• Market Size Estimates: Composites Distributor market size estimation in terms of value ($M)

• Trend And Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Composites distributor market size by various segments, such as such as end use, raw material, and intermediate in terms of value .

• Regional Analysis: Composites Distributor market breakdown by North America, Europe, Asia Pacific, and Rest of the World.

• Growth Opportunities: Analysis on growth opportunities in different applications and regions for composites distributor in the composites distributor market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the composites distributor market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in composites in the global composites distributor market or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ_

Q1. What is the composites distributor market size?

Answer: The global composites distributor market is expected to reach an estimated $4 billion by 2030.

Q2. What is the growth forecast for composites distributor market?

Answer: The composites distributor market is expected to grow at a CAGR of 1% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the composites distributor market?

Answer: The major drivers for the growth of this market are growing demand for composites in various industries, technological advancements, sustainability and environmental concerns, and expanding applications.

Q4. What are the major applications or end use industries for composites distributor market?

Answer: construction is the major end uses for composites distributors.

Q5. What are the emerging trends in composites distributor market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include the rise of digitalization and automation, increasing demand for sustainability and green composites, increasing regulatory compliance and quality assurance , technical support and value-added services, and 3D printing and additive manufaturing

Q6. Who are the key composites distributor companies?

Answer: Some of the key composites distributor companies are as follows:

• Composites One

• North American Composites

• Revchem Composites

• Bodo Möller Chemie

• ICOM Composites

• FRP Services & Company

• Soon Yang Chemicals Sdn Bhd

Q7.Which composites distributor resin segment will be the largest in future?

Answer: Lucintel forecasts that the polyester resin distributor segment will show above average growth during the forecast period.

Q8. In composites distributor market, which region is expected to be the largest in next 7 years?

Answer: APAC will remain the largest region and is expected to witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high-growth opportunities for the global composites distributor market by end use industry (aerospace and defense, wind energy, automotive, marine, construction, pipe and tank, electrical/electronics, consumer goods, and others), by raw material (roving, textile, polyester resin, vinylester resin, epoxy resin, and other resins), by intermediate (prepreg, SMC, BMC, SFT, LFT, CFT, and GMT), and by region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the composites distributor market?

Q.5 What are the business risks and threats to the composites distributor market?

Q.6 What are the emerging trends in this composites distributor market and the reasons behind them?

Q.7 What are some changing demands of customers in the composites distributor market?

Q.8 What are the new developments in the composites distributor market? Which companies are leading these developments?

Q.9 Who are the major players in the composites distributor market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in the composites distributor market, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M&A activities did take place in the last five years in the composites distributor market?