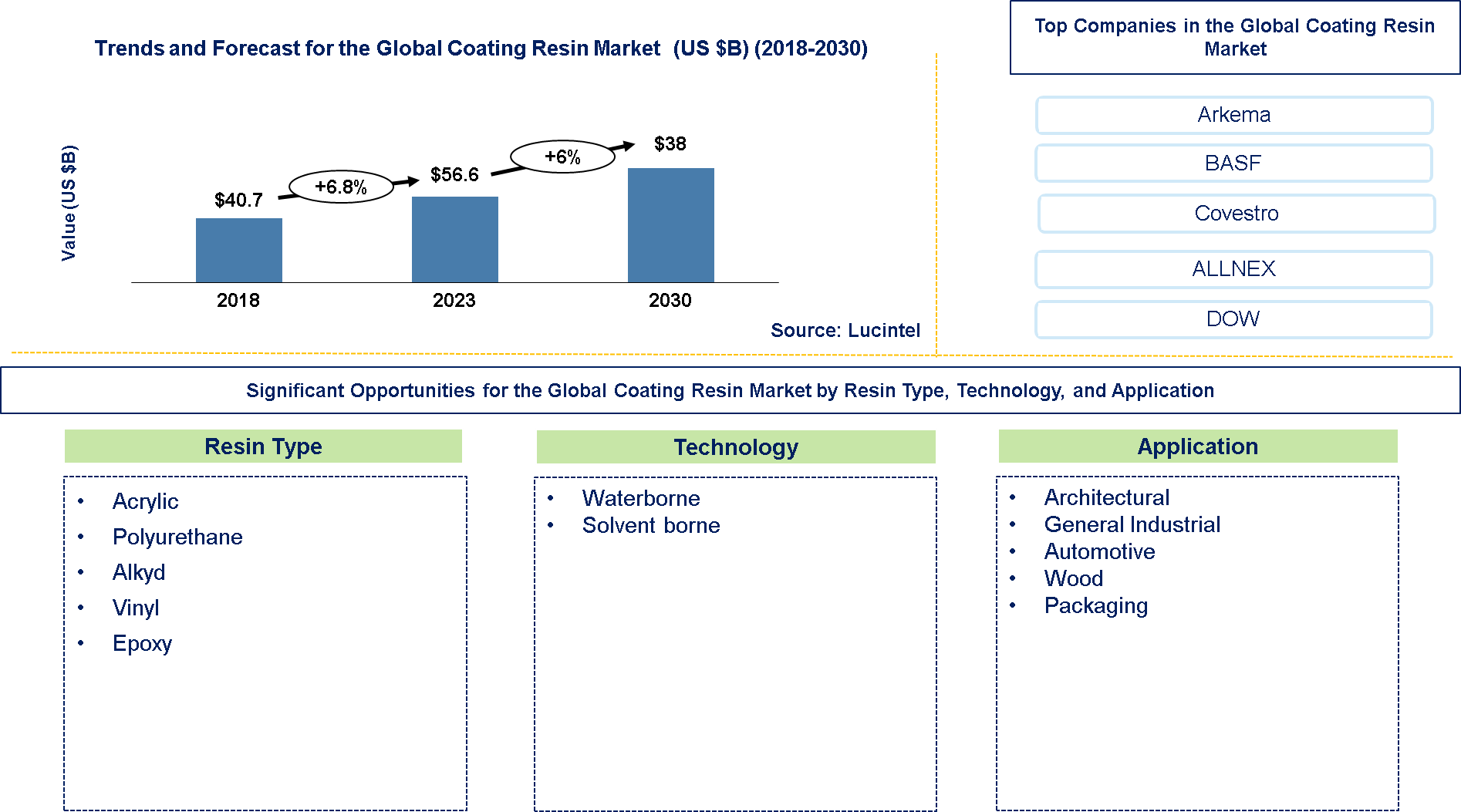

Coating Resins Market Trends and Forecast

The future of the global coating resins intermediate material market looks promising with in the automotive, architecture, and wind energy market. The global coating resins market is expected to reach an estimated $38 billion by 2030 with a CAGR of 6% from 2023 to 2030. The major growth drivers for this market are like increasing preference for environmentally friendly and sustainable products, rapid industrialization and urbanization, and technological advancements and innovations.

The main feedstock used in the coating resin industry are epoxies, polyurethanes and acrylics which give them strength and resistance to chemicals. Natural oils and fatty acids are used as raw materials for making alkyd resins that offer a renewable alternative. Further, polyester and vinyl resins make use of styrene and vinyl acetate, thus contributing to versatile and high-performance coatings. There is a wide variation in the prices of coating resins based on their types, qualities as well as applications. In most cases, epoxies and polyurethanes which are advanced resins cost more due to their superior performance attributes. On the other hand, compared to common coatings, sustainable and eco-friendly resins might sell at a higher price because of their little harm to environment and strict adherence to laws.

• Lucintel forecasts that in this market, automotive will remain the largest application supported by growing automotive production and increasing focus on lightweight materials.

• Epoxy based coating resins will remain the largest segment over the forecast period supported by its high performance characteristics and it is also expected to witness the highest growth over the forecast period.

• Asia Pacific is expected to remain the largest market by value and volume. ROW is expected to witness the highest growth over the forecast period because of growing demand from construction and other end uses.

Country wise Outlook for the Coating Resins Market

The coating resins market is witnessing substantial growth globally. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major coating resins producers in key regions: the USA, Germany, China, and Japan.

Emerging Trends in the Coating Resins Market

Emerging trends in the coating resins Market shaping its future applications and market dynamics:

• Sustainability and Eco-Friendly Solutions: There has been an increase in demand for resins derived from renewable resources like vegetable oils and other bio-based materials so as to lessen carbon foot prints. The need to comply with strict environmental laws and cater for environmentally conscious customers necessitate the production of coatings that have low volatile organic compounds (VOCs). they are more environmentally friendly, water based resins are taking over from solvent based coatings.

• Advancements in Resin Technology: High end performance polymers such as polyurethanes and epoxy resins that posses superior durability, chemical resistance and mechanical properties have been introduced. Innovations in nanotechnology and material science have led to the development of self-healing, self-cleaning, anti-corrosive coatings among others. This method is being used extensively because of its eco-friendliness as well as rapid curing times thus reducing energy consumption during processing operations.

• Customization and Application-specific Developments: Meet a wide range of market demands, there is need for the development of a variety of resins which can be used for specific purposes such as antimicrobial, anti-graffiti or antifouling purposes among others. increasingly there has been much emphasis laid on designing resins that provide better aesthetic sensibilities like glossiness, color retainment or texture enhancement for luxurious automotive applications including those meant for consumer goods. For high efficiency in various applications multiple functionalities are integrated into one coating system like antifouling combined with thermal insulating capabilities against corrosion hazards.

• Technological Integration and Digitalization: Smart Manufacturing: Industry 4.0 technologies consisting automation, AI, IoT among others brings smart manufacturing in resin production process which improves efficiency cutting on waste and improving quality control. Digital tools and software are used in accurate formulation and formulation of coating resins, which reduces development cycles for them while creating more bespoke offerings. In order to preempt market trends through predictive maintenance, process optimization as well as market trend analysis big data analytics had become essential so as to remain competitive.

A total of 140 figures / charts and 97 tables are provided in this 205-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Coating Resins Market

Recent developments in coating resins market by various companies highlight ongoing innovations and advancements across different sectors:

• Sustainable and Eco-friendly Resins Innovations: Arkema and Covestro are among the firms that have developed bio-based coating resins which come from renewable sources. These resins strive at reducing the dependence on fossil fuels, while minimizing their environmental effects. There has been a skyrocketing increase in low-VOC (volatile organic compounds) and solvent-free coating resins. For instance, BASF has developed new waterborne resins that have significantly decreased VOC emissions making it compatible with global environmental regulations.

• Technological Advances in Coating Resins: PPG Industries and Sherwin Williams use nanotechnology to produce self-cleaning, self-healing, improved durability coatings among other things. These nano-coatings perform better under harsh conditions. The growth of UV-curable resins is attributed to their fast curing times as well as energy saving rates. Allnex is one of the companies that have expanded its UV curable product lines due to increased demand from different end uses.

• Market Expansion and Strategic Partnerships: Companies have begun expanding into emerging markets so as to take advantage of industrialization/construction opportunities there. This includes Nippon Paint Holdings’ expansion into Southeast Asia where infrastructure developments have fueled demand for coatings. Collaborative arrangements are used by companies trying to reach out more customers while staying innovative at once. DSM’s partnership with AkzoNobel represents just one example of a wider effort to develop more sustainable and high-performing coating resins in the industry by combining DSM’s knowledge of materials science with AkzoNobel’s expertise in coatings.

• Advancements in Digitalization and Smart Manufacturing: There is an increased use of digital formulation tools. For instance, BASF uses digital platforms to speed up its new product development process allowing it to deliver tailored solutions for specific customers’ needs fast. Smart Manufacturing Technologies are being integrated into production processes. PPG Industries for example has implemented IoT and AI driven systems in their manufacturing units that help them optimize waste management, streamline production efficiency as well as ensure quality assurance.

Strategic Growth Opportunities for Global Coating Resins Market

Expansion into Emerging Markets

• Geographical Diversification: As such, high growth areas in Asia-Pacific, Latin America and Middle East are being focused on because there is an accelerating demand for coatings due to population expansion and increased industrialization and infrastructure development.

• Localized Production: The company can also establish plants in such countries to reduce the costs, improve its supply chain efficiency and offer products customized to meet local requirements.

• Strategic Partnerships: At the same time, alliances and joint ventures with indigenous companies will help Painted Rock International leverage their market knowledge, distribution networks and regulatory expertise.

Innovation and R&D Investments

• New Product Development: In addition, investments are made in research and development activities which aim at producing innovative resin formulations that address unmet needs of the customers while incorporating emerging environmental sustainability trends, as well as performance enhancements.

• Collaborative R&D: The company should enter into partnerships with academic institutions, research organizations and industry players so as to pool resources together, share expertise among themselves thus speeding up the process of developing new coating technologies which are cutting-edge in nature.

• Intellectual Property: In connection herewith management must strengthen patent portfolio which is susceptible to be breached from outside competitors who intend borrowing such innovative ideas from this company so that it would gain competitive advantage over others by owning these patents.

Sustainability Initiatives

• Green Certifications: They could also opt for certifications or eco-labels like LEED certification, Green Seal certification or EU Ecolabel in order to portray themselves as being environmentally conscious corporations hence attracting a wide range of customers who care about the environment.

• Circular Economy Practices: This means re-using waste along with recycling of other substances that are not utilized during production apart from reducing those use in the end-life period of coating resins thus improving their credentials as responsible users of these resources(Anderson et al., 2017).

• Renewable Energy Integration: For example; using solar panels, wind turbines and biomass in the factories would help to bring down the amount of carbon dioxide emitted to the atmosphere as well as lower operational costs.

Customer-centric Strategies

• Customization and Personalization: These include offering tailor-made products that are customized to meet specific customer needs thereby promoting customer satisfaction and loyalty.

• Enhanced Service Offerings: Such additional services should be added so as to make differentiation from other players like technical support for coatings application, training on how to apply coating properly or even maintaining such products throughout their lifespan (Nguyen et al., 2017).

• Digital Engagement: Its customers can connect with Painted Rock International by using digital tools which provide a seamless online journey from purchasing up to after sales care.

Mergers and Acquisitions

• Strategic Acquisitions: Other than that, it has been noted that through identifying and buying companies having complimentary brands or technologies, could expand its product portfolio, enter new markets or even realize economies of scale.

• Vertical Integration: In addition, another merger strategy is where Painted Rock International acquires suppliers and downstream partners so that they gain total control over supply chain processes ensuring steady quality delivery while reducing costs due to reduced dependences on others.

• Innovation-driven M&A: For example; this company may target innovative startups as well as technology firms in order to acquire disruptive technologies hence be ahead of both market trends and competitors.

Coating Resins Market Drivers and Challenges

The coating resins market is pivotal in industries requiring corrosion-resistant storage solutions. Driven by benefits like increasing preference for environmentally friendly and sustainable products, rapid industrialization and urbanization, and technological advancements and innovations, it faces challenges such as stringent environmental regulations, and volatility in raw material prices.

The key drivers for the global coating resins market include:

1. Increasing preference for environmentally friendly and sustainable products: The demand for environmental-friendly coating resins is driven by the increasing emphasis on sustainability and environmental regulations. Customers want coatings with low VOC emissions that have less impact on the environment. Because they are green alternatives to conventional solvent-based coatings, bio-based and waterborne resins are now in high demand. As a result of implementing regulatory requirements and meeting consumer preferences, businesses are investing in research and development to provide innovative and sustainable options in an attempt to maintain market growth.

2. Rapid Industrialization And Urbanization: Coating resins have witnessed a rise in demand due to the rapid industrialization and urbanization occurring globally, especially within emerging economies. High-performance coatings are required in construction, automotive, industrial sectors for purposes of durability improvement, aesthetics enhancement as well as protection of materials. The infrastructural projects expansion, growing automotive production rates and escalating manufacturing activities lead to advanced coating resin requirement which offers superior performance properties such as longer life spans withstanding harsh climatic conditions among others thereby stimulating market growth.

3. Technological Advancements And Innovations: Market growth is driven by continuous advancements of coating resin technologies. For instance, nanotechnology has resulted in smart coatings or UV curable resins that offer much higher efficiency levels when used but still possess environmentally friendly characteristics compared toothers that were previously available on the market before these advances were made. Resins with improved qualities like self-cleaning effects; anti-corrosiveness features or fast curing speed are being developed by companies focusing on technological advancements so as to expand the application areas of coating resins across different industries based on customer needs and desires that change over time hence this creates new opportunities for expanding their operations.

?

Challenges in the Coating Resins Market

1. Stringent Environmental Regulations: Compliance with strict environmental regulations is a major challenge for the coating resin market. Governments worldwide are enforcing stringent rules aimed at reducing volatile organic compounds (VOC) emissions and encouraging sustainable practices. In order to meet this requirement, research and development of eco-friendly resins that are also high performing necessitate huge investments. Additionally, manufacturers may find it cumbersome to navigate through a complex regulatory environment given their need to comply within different regions and markets which can have an effect on production costs thereby limiting market growth.

2. Volatility in Raw Material Prices: The coating resin market is vulnerable to changes in raw material prices. This is so because petrochemical feedstocks form the basis of resins whose pricing is directly affected by crude oil price fluctuations. Moreover, geopolitical tensions, supply chain disruptions or any shift in trade policies can affect the availability of critical inputs used in making these items thus increasing production costs ultimately resulting in price pressures which in turn affects profit margins making it difficult to maintain competitive pricing in the industry.

Factors driving the coating resin market have been sustainability, urbanisation and technological advancements but then this industry has faced challenges emanating from environmental regulations becoming stringent as well as fluctuation in prices of raw materials. Growth is still being pushed by innovation in eco-friendly solutions and smart coatings; However, the need for adherence and cost control keep providing obstacles to guide the market dynamics.

Coating Resins Suppliers and Their Market Shares

In this globally competitive market, several key players such as Dow, BASF, and Covestro. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies coating resins companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the coating resins companies profiled in this report includes.

• Arkema

• BASF

• Covestro

• ALLNEX

• Dow

These companies have established themselves as leaders in the global coating resins market, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the coating resins market are evolving, with the entry of new players and the emergence of innovative coating resins market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Coating Resins Market by Segment

One of the coating resin market major segments that are growing rapidly is the waterborne coatings because of stringent environmental regulations and the need for low-VOC products. The UV-curable resins are also gaining popularity since they cure fast and save energy. Moreover, bio-based resins are expanding as businesses turn towards green materials while high-performance industrial coatings continue to grow given the infrastructure and manufacturing developments.

The study includes a forecast for the coating resins industry market by resin type, technology application, and region as follows:

By Resin Type [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Acrylic

• Alkyd

• Polyurethane

• Vinyl

• Epoxy

By Application [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Automotive

• Architectural

• General Industrial

• Wood

• Packaging

By Technology [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Waterborne

• Solvent borne

By Region [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific

• Rest of the World

Features of Coating Resins Market

• Market Size Estimates: coating resins market size estimation in terms of value ($B) and (M lbs).

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Market size by resin type, technology, application, and region

• Regional Analysis: coating resins market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different end use, resin type, and region for the coating resins market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the coating resins market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

.

If you are looking to expand your business in Coating Resinsor adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the coating resins market size?

Answer: The global coating resins market is expected to reach an estimated $38 billion by 2030.

Q2. What is the growth forecast for coating resins market?

Answer: The coating resins market is expected to grow at a CAGR of 6% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the coating resins market?

Answer: The major growth drivers for this market are like increasing preference for environmentally friendly and sustainable products, rapid industrialization and urbanization, and technological advancements and innovations.

Q4. What are the major applications or end use industries for coating resins?

Answer: Transportation and Construction are the major end uses for coating resins.

Q5. What are the emerging trends in coating resins market?

Answer: Emerging trends which have a direct impact on the dynamics of the industry include sustainability and eco-friendly solutions, advancements in resin technology, customization and application-specific developments, and technological integration and digitalization.

Q6. Who are the key coating resins companies?

Answer: Some of the key coating resins companies are as follows:

• Dow

• BASF

• Huntsman

• Momentive

• Bayer

• Polynt

• AOC

• Olin Epoxy

Q7.Which coating resins fiber type segment will be the largest in future?

Answer: Lucintel forecasts that glass fiber based coating resins will remain the largest segment and it is also expected to witness the highest growth over the forecast period supported by its high performance characteristics.

Q8. In coating resins market, which region is expected to be the largest in next 7 years?

Answer: Asia Pacific is expected to remain the largest region and witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high growth opportunities for the global coating resins market by end use (transportation, electrical and electronics, construction, and others), fiber type (glass fiber and carbon fiber), resin type (polyester, vinyl ester and others), density (low density, and mid and high density), and region (North America, Europe, Asia Pacific and the Rest of the World)?

Q. 2. Which segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5. What are the business risks and threats to the market?

Q.6. What are the emerging trends in this market and the reasons behind them?

Q.7. What are the changing demands of customers in the market?

Q.8. What are the new developments in the market? Which companies are leading these developments?

Q.9. Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11. What M & A activities have taken place in the last five years in this market?