Circuit Protection Market Trends and Forecast

The technologies in the circuit protection market have undergone significant changes in recent years, with a shift from traditional fuse technology to more advanced circuit breakers, offering improved reliability and faster response times. Additionally, there has been a transition from mechanical to solid-state inrush current limiters, enhancing efficiency and reducing wear and tear on components. Overvoltage protection has also evolved, with a move from conventional metal oxide varistors (MOVs) to more durable and responsive gas discharge tubes (GDTs), improving overall system protection. The adoption of HD Pro technology in the protection of power circuits has grown, as it offers higher precision and greater adaptability for complex industrial applications. Mobile power protection has also seen advancements, with the shift from basic thermal protection devices to more sophisticated smart protection systems that can dynamically adjust to varying load conditions. These technology shifts are shaping the future of circuit protection across various applications, including agriculture, automotive, telecommunications, and more.

Emerging Trends in the Circuit Protection Market

The circuit protection market is undergoing significant transformations driven by technological advancements, changing consumer needs, and regulatory pressures. With an increasing demand for more efficient, reliable, and sustainable electrical systems across various industries, the market is witnessing a shift towards smarter, more advanced protection solutions. These innovations are helping enhance the performance of electrical systems, reduce downtime, and improve safety.

• Shift Toward Smart Protection Systems: The rise of smart grid technology and the internet of things (IoT) has led to an increasing demand for intelligent protection systems. These systems can dynamically monitor electrical circuits, detect faults in real time, and make automated decisions based on load conditions and system health. The integration of sensors and advanced analytics enables better predictive maintenance, reducing the risk of system failures. This trend is essential for industries like automotive, telecommunications, and power generation, where uninterrupted service is critical.

• Solid-State Circuit Protection: Solid-state protection technologies, such as solid-state circuit breakers (SSCBs) and inrush current limiters, are replacing traditional mechanical solutions. These solid-state devices offer faster response times, greater precision, and improved reliability, making them ideal for modern electrical systems. The move from mechanical to solid-state protection is particularly beneficial in applications that require high-speed fault detection and response, such as data centers, industrial automation, and electric vehicles.

• Increased Adoption of Overvoltage Protection Solutions: Overvoltage protection technologies are evolving, with a shift from traditional metal oxide varistors (MOVs) to more advanced, durable, and efficient solutions such as gas discharge tubes (GDTs). GDTs provide better protection against power surges and lightning strikes, making them an attractive option for critical infrastructure. This shift enhances the longevity and stability of electrical systems, particularly in industries where equipment reliability is paramount, such as in power distribution networks and telecommunications.

• Focus on Environmental Sustainability: As sustainability becomes a more significant concern, the circuit protection market is seeing the adoption of eco-friendly materials and technologies. Manufacturers are focusing on reducing the environmental footprint of their products, incorporating recyclable materials and energy-efficient manufacturing processes. This trend is driven by increasing regulatory requirements and consumer demand for green technologies. It has a profound impact on industries such as automotive and power generation, where reducing energy consumption and waste is a priority.

• Integration with Renewable Energy Systems: With the growing adoption of renewable energy sources, such as solar and wind, the need for efficient circuit protection in these systems is increasing. Advanced protection solutions are being developed to handle the variability and fluctuations inherent in renewable energy generation. This includes integrating circuit breakers and inrush current limiters specifically designed for renewable energy applications. These technologies ensure that the power generated by renewable sources is safely integrated into the grid and can be distributed without causing system damage.

These emerging trends in the circuit protection market smart protection systems, solid-state solutions, advanced overvoltage protection, sustainability efforts, and integration with renewable energy are significantly reshaping the landscape of electrical protection. As the demand for higher efficiency, safety, and reliability increases, these technologies are driving innovations that enhance system performance and reduce operational risks. With the growing complexity of electrical networks and the shift towards more sustainable energy practices, the circuit protection market is poised for further advancements that will support the next generation of electrical systems.

Circuit Protection Market : Industry Potential, Technological Development, and Compliance Considerations

The circuit protection market is experiencing significant technological advancements, driven by the need for more reliable, efficient, and sustainable electrical systems. Emerging technologies, such as smart protection systems, solid-state circuit breakers, and gas discharge tubes (GDTs) for overvoltage protection, are gaining traction due to their ability to offer faster response times, better reliability, and reduced downtime compared to traditional solutions.

• Potential in Technology:

Technology potential in this market is high, as advancements like solid-state protection and IoT-based monitoring enable real-time fault detection, predictive maintenance, and enhanced system safety. The integration of these technologies is transforming industries like automotive, telecommunications, and power generation, where system uptime is critical.

• Degree of Disruption:

The degree of disruption is moderate to high. While established technologies such as mechanical fuses and circuit breakers still dominate, newer solutions are gradually replacing them, particularly in high-demand applications like electric vehicles and renewable energy systems.

• Current Technology Maturity Level:

The current technology maturity of these solutions varies. Smart protection systems and solid-state devices are still in the adoption phase, with manufacturers continuing to refine and scale production.

• Regulatory Compliance:

Regulatory compliance is crucial, especially as standards evolve to ensure safety and sustainability. As global regulatory frameworks tighten around energy efficiency and environmental impact, manufacturers must align with new safety and sustainability guidelines, pushing the market toward greener, more innovative solutions.

Recent Technological development in Circuit Protection Market by Key Players

The circuit protection market has been undergoing rapid advancements as key players continue to innovate and improve their offerings to meet the growing demand for reliable, efficient, and sustainable electrical systems. With industries increasingly focused on minimizing downtime, ensuring safety, and enhancing operational efficiency, companies such as ABB, Bel Fuse, Schneider Electric, Mitsubishi Electric Corporation, Eaton Corporation, General Electric Company, and Siemens AG have made significant strides. These developments include the adoption of new technologies, the launch of innovative products, and the enhancement of existing solutions to address the evolving needs of sectors such as automotive, energy, telecommunications, and more.

• ABB: ABB has introduced new solid-state circuit breakers, improving response times and reducing wear and tear in critical applications such as data centers and renewable energy systems. Their focus on integrating IoT-based monitoring systems allows for real-time diagnostics and predictive maintenance, ensuring higher uptime and efficiency.

• Bel Fuse: Bel Fuse has advanced in overvoltage protection with the launch of new gas discharge tubes (GDTs). These offer enhanced protection against power surges and lightning strikes, ensuring the longevity and safety of critical systems. Bel Fuse’s commitment to compact, cost-effective solutions makes it an attractive option for OEMs and system integrators.

• Schneider Electric: Schneider Electric has expanded its range of smart circuit protection solutions. The company now offers integrated protection systems that work seamlessly with smart grids and renewable energy sources, enhancing both energy efficiency and the integration of distributed energy resources. Their focus on sustainability is evident in their use of eco-friendly materials and energy-efficient designs.

• Mitsubishi Electric Corporation: Mitsubishi Electric Corporation has made notable advancements in solid-state circuit protection. Their new range of high-precision circuit breakers offers faster response times and better fault detection, crucial for industries such as automotive and industrial automation. Mitsubishi’s innovations are driving the transition to smarter, more reliable electrical systems.

• Eaton Corporation: Eaton Corporation has strengthened its presence in the electric vehicle (EV) market by developing advanced circuit protection solutions that cater to the high-speed fault detection needs of electric vehicle charging stations. Their products also focus on improving safety and efficiency, which is crucial for the growth of the EV infrastructure.

• General Electric Company (GE): General Electric Company (GE) has invested in IoT-enabled protection devices that allow for remote monitoring and fault detection. GE’s solutions are focused on enhancing the reliability of electrical grids and supporting smart city initiatives, enabling better integration of renewable energy and reducing power outages.

• Siemens AG: Siemens AG has been focusing on smart grid technology and the integration of solid-state protection devices. Their development of high-performance circuit breakers tailored for industrial and renewable energy applications is helping industries meet the growing demand for safer and more efficient electrical systems, contributing to the global shift toward sustainability.

These key players are advancing the circuit protection market with innovative technologies such as solid-state devices, smart protection systems, and IoT integration, which are driving efficiency, safety, and sustainability across industries. These developments are reshaping the market, ensuring that electrical systems can better meet the demands of a modern, energy-efficient world.

Circuit Protection Market Driver and Challenges

The circuit protection market is experiencing rapid growth, driven by advancements in technology, increasing demand for energy-efficient solutions, and regulatory pressures. As industries become more reliant on electricity, the need for reliable, safe, and sustainable electrical systems has grown, fueling innovations in circuit protection. However, there are also significant challenges, including cost constraints and regulatory hurdles. Below are the key drivers and challenges shaping the market.

The factors responsible for driving the circuit protection market include:

• Technological Advancements: The development of smart protection systems, IoT integration, and solid-state devices is enabling faster, more accurate fault detection and system monitoring. These innovations enhance the safety and reliability of electrical grids, reducing downtime and improving overall performance across industries such as automotive, telecommunications, and energy.

• Increasing Demand for Energy Efficiency: As industries move toward sustainability, energy efficiency has become a top priority. Circuit protection solutions are evolving to ensure optimal energy usage, reduce power losses, and improve grid stability. The growing emphasis on green technologies, such as renewable energy and electric vehicles, is driving the demand for efficient circuit protection systems.

• Regulatory Pressures: Governments worldwide are implementing stricter regulations for safety and energy efficiency. This is pushing companies to adopt advanced protection systems that meet compliance standards. For instance, the automotive, telecommunications, and power generation sectors are seeing stricter regulations for safety, creating a demand for better circuit protection solutions.

• Growth of Renewable Energy: The rise of renewable energy sources, including solar and wind, has increased the need for circuit protection solutions tailored for variable and intermittent power. Advanced protection technologies are being developed to handle fluctuations in renewable energy generation, ensuring stable power integration into the grid and protecting infrastructure.

• Growing Industrial Automation and IoT Adoption: Industries are increasingly adopting IoT-based systems for real-time monitoring and predictive maintenance, which has created a demand for smarter circuit protection devices. These systems offer enhanced fault detection, enabling operators to prevent damage and reduce operational downtime, ultimately boosting efficiency and safety in industrial operations.

Challenges Impacting the Circuit Protection Market:

• High Cost of Advanced Protection Systems: While advanced circuit protection solutions offer numerous benefits, their high upfront costs are a significant barrier to adoption, especially for small and medium-sized enterprises (SMEs). Many companies are hesitant to invest in costly systems, limiting the marketÄX%$%Xs growth in cost-sensitive industries.

• Complexity of Regulatory Compliance: Varying regulations across regions complicate the development and implementation of circuit protection systems. Companies must navigate different standards, which can delay product development and increase costs. This regulatory complexity presents a challenge for manufacturers aiming to introduce new solutions in global markets.

• Lack of Awareness and Education: In some regions, there is a lack of awareness about the benefits of advanced circuit protection systems. Many stakeholders, particularly in emerging markets, may not fully understand the value of these technologies, hindering their adoption. Industry education and awareness programs are critical to overcoming this challenge.

The circuit protection market is witnessing significant growth, driven by technological advancements, the need for energy efficiency, and growing regulatory pressures. However, challenges such as high costs, regulatory complexity, and supply chain disruptions remain. The marketÄX%$%Xs ability to address these issues and leverage growth opportunities will determine the pace and scope of future advancements in electrical protection systems. As industries continue to embrace new technologies and sustainability initiatives, the demand for reliable and efficient circuit protection solutions will only increase.

List of Circuit Protection Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies circuit protection companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the circuit protection companies profiled in this report include.

• ABB

• Bel Fuse

• Schneider Electric

• Mitsubishi Electric Corporation

• Eaton Corporation

• General Electric Company

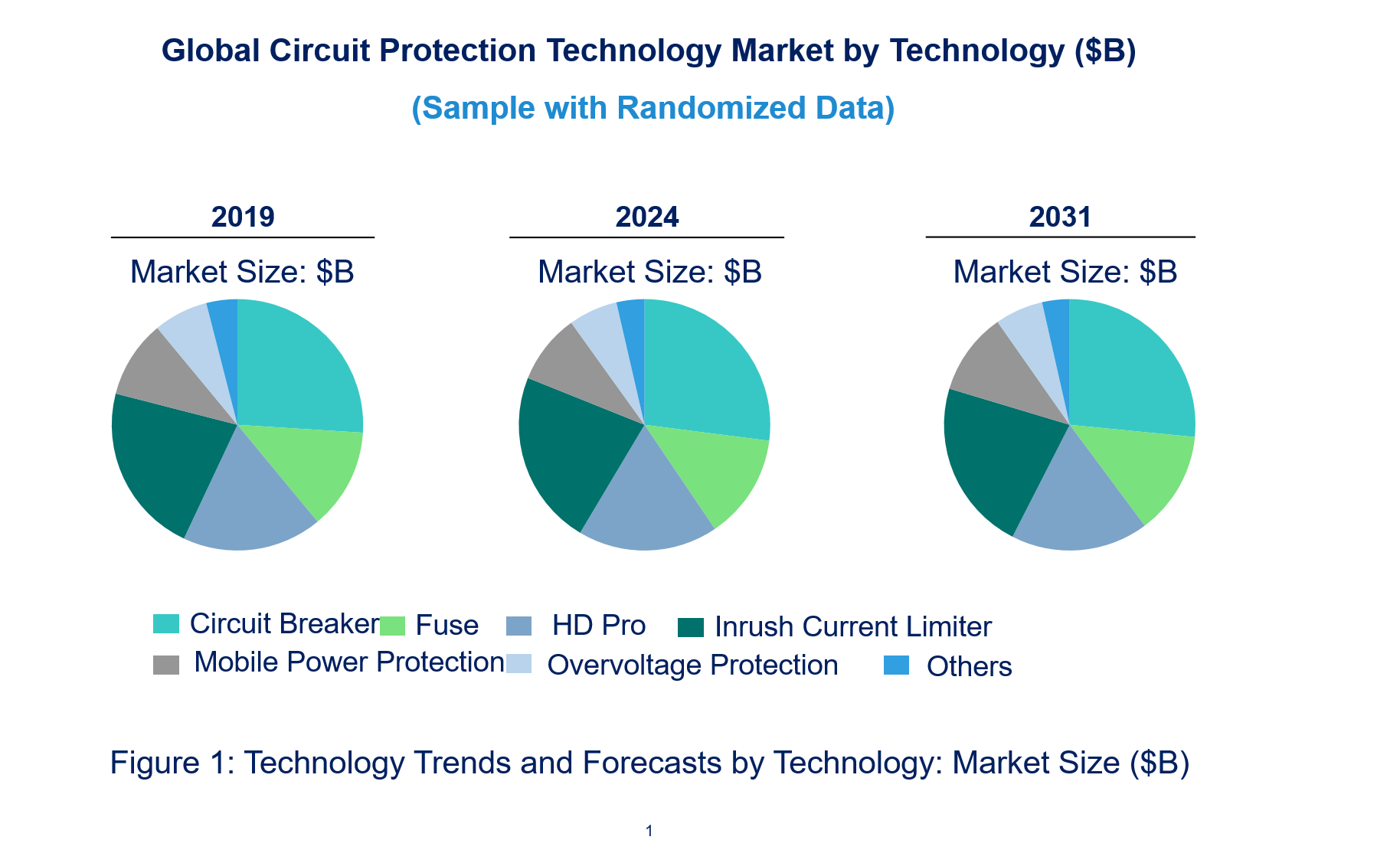

Circuit Protection Market by Technology

• Technology Readiness by Technology type: The readiness of circuit protection technologies varies depending on their maturity and market adoption. Circuit breakers, especially solid-state versions, are highly mature, with widespread applications in industries like energy and telecommunications. Fuses remain reliable and widely used in many sectors but are evolving with newer materials and designs for better performance. HD Pro technology, while innovative, is still in the adoption phase in some industrial sectors, though its precision is highly valued in complex applications. Inrush current limiters are well-established in applications involving high transient currents but are seeing increased demand in electric vehicles and renewable energy systems due to higher load capacities. Mobile power protection technologies are still emerging but are gaining traction in industries needing adaptive, smart solutions for real-time load balancing. Overvoltage protection technologies, especially gas discharge tubes, are rapidly gaining acceptance, particularly in industries with high surge risks, such as power generation and telecommunications. Overall, these technologies are at different stages of adoption, with regulatory compliance being a key factor driving their evolution in various applications.

• Competitive Intensity and Regulatory Compliance: The circuit protection market experiences moderate to high competitive intensity due to the presence of major players like ABB, Siemens, Schneider Electric, and Eaton, who are constantly innovating and releasing new solutions. Technologies such as circuit breakers and fuses are mature and face intense competition, while newer innovations like HD Pro and mobile power protection are emerging, offering niche market opportunities. Regulatory compliance is a significant factor across all technologies. Governments and industries are implementing stricter safety standards, particularly in the automotive, telecommunications, and power sectors. This drives companies to comply with regional and international standards, ensuring their products meet safety and energy-efficiency guidelines. Companies that align with evolving regulations have a competitive edge in markets like renewable energy, where standards for circuit protection are becoming increasingly stringent.

• Competitive Intensity and Regulatory Compliance: The circuit protection market experiences moderate to high competitive intensity due to the presence of major players like ABB, Siemens, Schneider Electric, and Eaton, who are constantly innovating and releasing new solutions. Technologies such as circuit breakers and fuses are mature and face intense competition, while newer innovations like HD Pro and mobile power protection are emerging, offering niche market opportunities. Regulatory compliance is a significant factor across all technologies. Governments and industries are implementing stricter safety standards, particularly in the automotive, telecommunications, and power sectors. This drives companies to comply with regional and international standards, ensuring their products meet safety and energy-efficiency guidelines. Companies that align with evolving regulations have a competitive edge in markets like renewable energy, where standards for circuit protection are becoming increasingly stringent.

Circuit Protection Market Trend and Forecast by Technology [Value from 2019 to 2031]:

• Circuit Breaker

• Fuse

• HD Pro

• Inrush Current Limiter

• Mobile Power Protection

• Overvoltage Protection

• Others

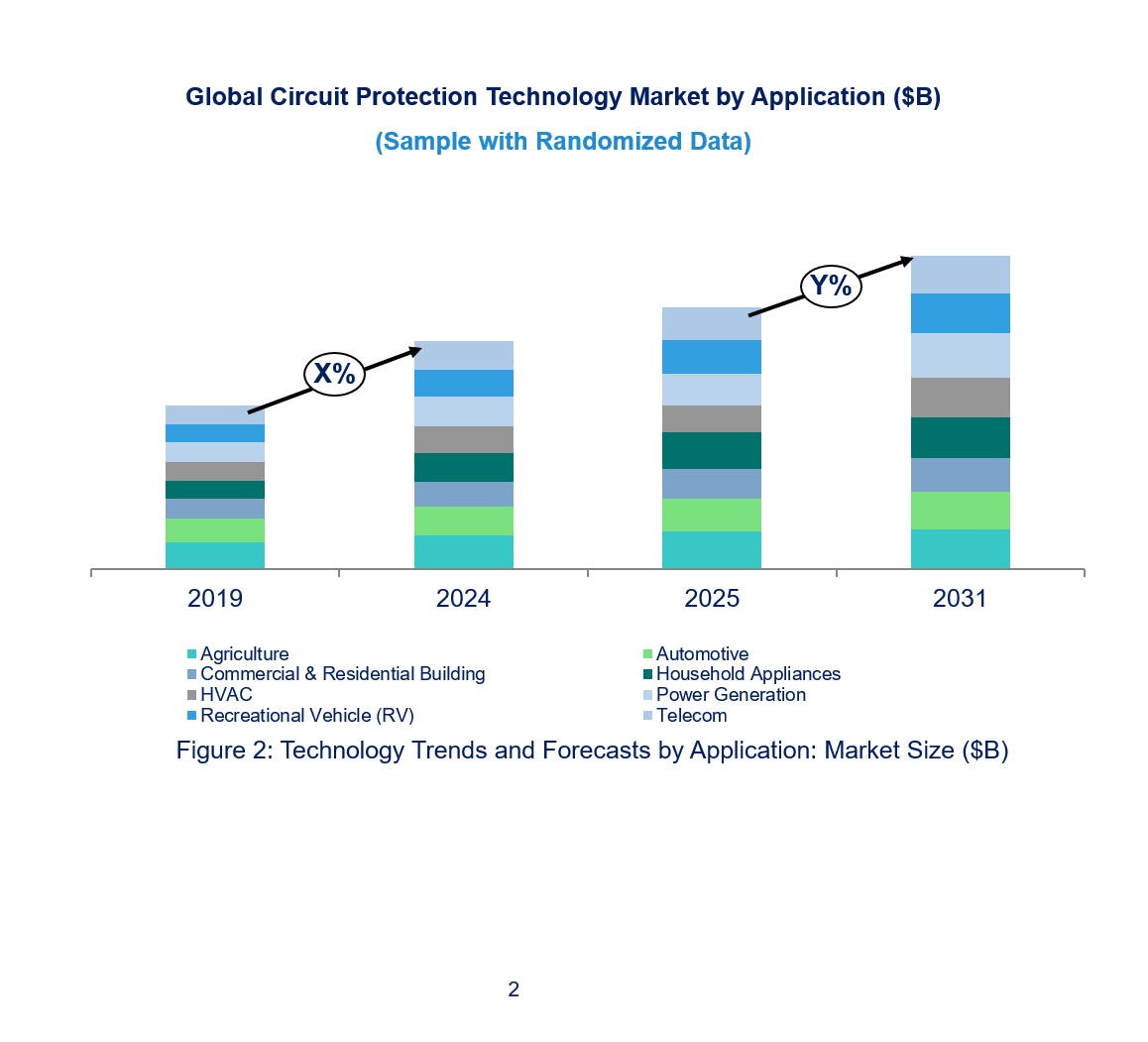

Circuit Protection Market Trend and Forecast by Application [Value from 2019 to 2031]:

• Agriculture

• Automotive

• Commercial & Residential Building

• Household Appliances

• HVAC

• Power Generation

• Recreational Vehicle (RV)

• Telecom

• Others

Circuit Protection Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Circuit Protection Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Circuit Protection Market

Market Size Estimates: Circuit protection market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global circuit protection market size by various segments, such as application and technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global circuit protection market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different applications, technologies, and regions for technology trends in the global circuit protection market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global circuit protection market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global circuit protection market by technology (circuit breaker, fuse, hd pro, inrush current limiter, mobile power protection, overvoltage protection, and others), application (agriculture, automotive, commercial & residential building, household appliances, hvac, power generation, recreational vehicle (rv), telecom, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different technology? What are the drivers and challenges of these technologies in the global circuit protection market?

Q.5. What are the business risks and threats to the technology trends in the global circuit protection market?

Q.6. What are the emerging trends in these technologies in the global circuit protection market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global circuit protection market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global circuit protection market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this circuit protection technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global circuit protection market?