China HVAC Equipment Market Trends and Forecast

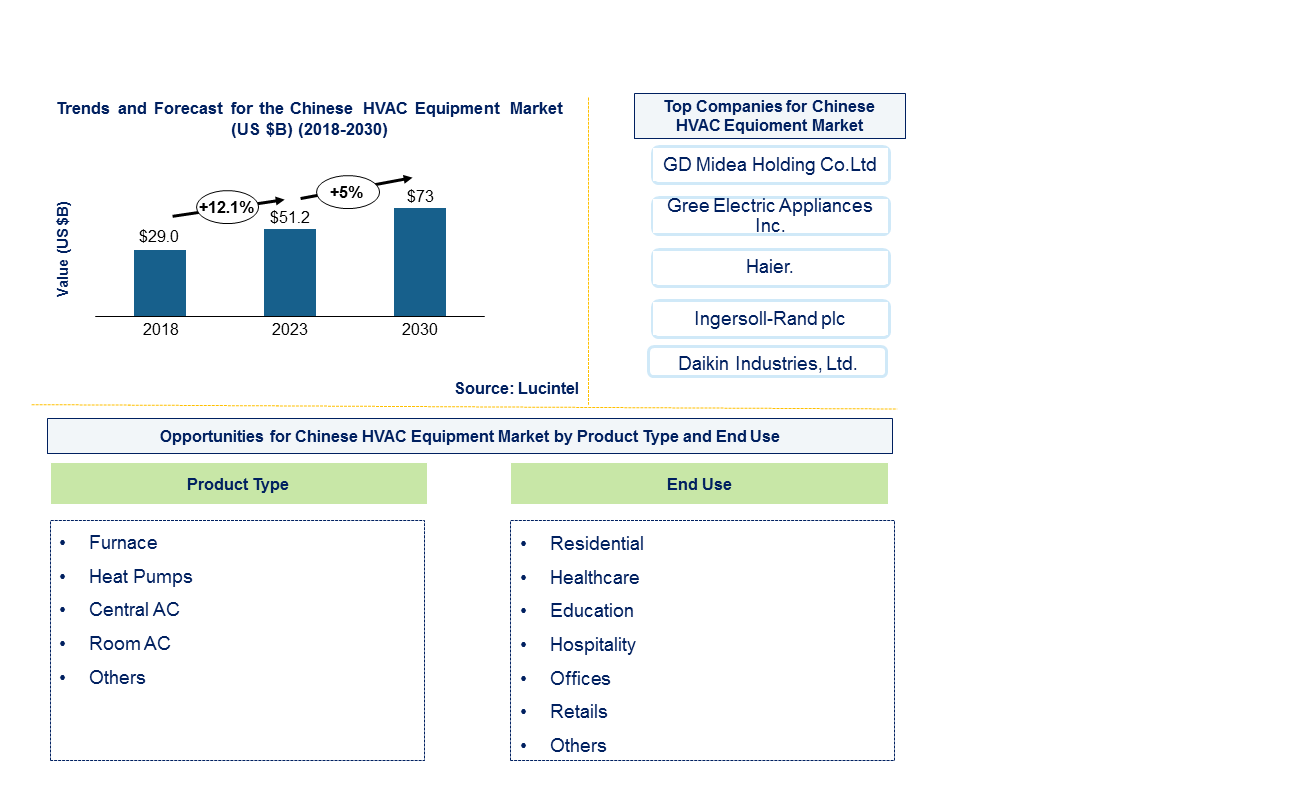

The future of the Chinese HVAC (heating, ventilation and air conditioning) equipment market looks promising with opportunities in the residential and commercial construction industries. The China HVAC equipment market is expected to reach an estimated $73 billion by 2030, and it is forecast to grow at a CAGR of 5% from 2024 to 2030. The major drivers of growth are higher rate of building construction and strict regulations regarding energy efficient buildings in China to make existing facilities energy efficient.

Raw materials used in Chinese HVAC equipment typically include metals like steel and aluminum for manufacturing components such as compressors, heat exchangers, and ventilation ducts. Copper and various alloys are used for piping and heat transfer elements, while plastics and synthetic materials are employed for insulation and casing. Additionally, electronic components and sensors are integrated for control and monitoring functionalities, ensuring efficiency and reliability in operation. Chinese HVAC equipment is often competitively priced compared to global competitors due to lower manufacturing costs and economies of scale. This affordability has positioned Chinese manufacturers favorably in international markets, offering cost-effective solutions without compromising on quality standards. Pricing strategies may vary based on factors such as market demand, raw material costs, and technological advancements, influencing competitiveness and market penetration.

• China HVAC equipment companies profiled in this market report includes Gree Electric Appliances, GD Midea, Haier are the major manufacturers of HVAC equipment in China.

• On the basis of our comprehensive research, Lucintel forecasts that the room AC segment is expected to show above average growth during the forecast period due to a higher rate of urbanization and a higher demand for energy efficient HVAC equipment.

• Within the Chinese HVAC equipment market, residential is expected to remain the largest segment during the forecast period. Increasing penetration and renovation activities are the major driving forces that will spur growth for this segment over the forecast period.

Country wise Outlook for the China HVAC Equipment Market

Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major China HVAC equipment producers in China.

Emerging Trends in the China HVAC Equipment Market

Emerging trends in the China HVAC equipment market shaping its future applications and market dynamics:

• Energy Efficiency: Increasing focus on energy-efficient HVAC systems driven by government regulations and consumer demand for sustainability.

• Smart Technology Integration: Adoption of smart HVAC solutions with IoT capabilities for remote monitoring, predictive maintenance, and energy management.

• Air Quality Improvement: Growing emphasis on air purification and filtration technologies to address indoor air quality concerns, particularly in urban environments.

• Green Building Initiatives: Integration of HVAC systems into green building designs and certifications, promoting sustainable construction practices.

A more than 150-page report to help in your business decisions. Sample figures with some insights are shown below.

Recent Developments in the China HVAC Equipment Market

Ongoing innovations and advancements in various sectors of the China HVAC equipment market which have been highlighted by recent developments:

• Energy Efficiency: Manufacturers are increasingly focusing on improving the energy efficiency of HVAC systems through advanced technologies such as variable refrigerant flow (VRF) systems and energy-efficient compressors.

• Smart HVAC Solutions: Integration of smart technologies, including IoT-enabled devices and cloud-based monitoring systems, to optimize energy consumption, enhance user comfort, and enable remote management.

• Air Quality Management: Development of HVAC systems with enhanced air purification capabilities, including advanced filtration systems and air quality sensors, to address growing concerns about indoor air pollution.

• Green Building Standards: Alignment with green building standards and certifications, such as LEED (Leadership in Energy and Environmental Design), driving the adoption of sustainable HVAC solutions in new construction projects.

• Market Expansion and Localization: Expansion of production capacities and localization of manufacturing to cater to domestic demand and reduce dependence on imported equipment, supported by government policies promoting self-sufficiency in critical technologies.

Strategic Growth Opportunities for China HVAC Equipment Market

Energy Efficiency Initiatives:

• Adoption of Inverter Technology: Increase the penetration of inverter-driven HVAC systems to improve energy efficiency and reduce operational costs.

• Development of High-efficiency Components: Innovate compressors, motors, and heat exchangers to enhance overall system efficiency.

• Compliance with Energy Efficiency Standards: Align product development with stringent government regulations promoting energy-efficient equipment.

Smart HVAC Solutions:

• Internet of Things (IoT) Integration: Embed IoT capabilities for remote monitoring, predictive maintenance, and real-time energy management.

• Smart Controls and Automation: Develop advanced control systems that optimize HVAC operation based on occupancy, weather conditions, and user preferences.

• Data Analytics and AI: Utilize data analytics and artificial intelligence to improve system performance, energy efficiency, and user comfort.

Air Quality Management:

• Enhanced Filtration Technologies: Integrate advanced filtration systems to improve indoor air quality and address health concerns.

• Air Purification Technologies: Develop HVAC solutions with built-in air purification technologies to capture and neutralize pollutants.

• Compliance with Indoor Air Quality Standards: Ensure HVAC systems meet or exceed national and international indoor air quality standards.

Green Building Initiatives:

• LEED and Green Certification: Align HVAC equipment designs with green building standards such as LEED certification to meet sustainable construction requirements.

• Integration with Renewable Energy: Promote the integration of HVAC systems with renewable energy sources like solar and geothermal for greener building solutions.

• Lifecycle Environmental Impact: Focus on reducing the lifecycle environmental impact of HVAC equipment through sustainable design and materials.

Market Expansion and Localization:

• Infrastructure Development: Participate in large-scale infrastructure projects, such as urbanization initiatives and industrial parks, to expand market reach.

• Regional Market Penetration: Target growth opportunities in emerging cities and provinces where urbanization is driving demand for modern HVAC solutions.

• Localization of Manufacturing: Establish localized manufacturing facilities to reduce costs, improve supply chain efficiency, and meet local market demands.

Technological Collaboration and Partnerships:

• Research and Development Collaboration: Partner with research institutions and universities to drive technological innovation in HVAC equipment.

• Joint Ventures and Acquisitions: Explore strategic partnerships, joint ventures, or acquisitions with local and international firms to leverage complementary strengths and expand market presence.

• Supplier and Distributor Networks: Strengthen relationships with suppliers and distributors to enhance product availability, customer support, and market competitiveness.

China HVAC Equipment Market Driver and Challenges

Following are the drivers and challenges for HVAC Equipment

Market Drivers:

1. Rapid Urbanization and Infrastructure Development: China's ongoing urbanization drives the demand for HVAC equipment in residential, commercial, and industrial sectors.

2. Government Initiatives and Policies: Supportive policies promoting energy efficiency, green buildings, and environmental sustainability encourage adoption of advanced HVAC technologies.

3. Technological Advancements: Continuous innovation in HVAC systems, including smart technology integration, energy-efficient components, and advanced air quality solutions, enhances market appeal.

4. Growing Awareness of Indoor Air Quality: Increasing awareness and concerns about indoor air pollution drive demand for HVAC systems with enhanced filtration and purification capabilities.

Challenges:

1. Environmental Regulations: Compliance with stringent environmental regulations and standards regarding energy efficiency and emissions poses challenges for HVAC manufacturers.

2. Intense Competition: Fierce competition among domestic and international manufacturers leads to price pressures and challenges in maintaining profitability.

3. Supply Chain Disruptions: Vulnerability to supply chain disruptions, including fluctuations in raw material prices and geopolitical tensions, impacts manufacturing and delivery schedules.

4. Technological Adoption and Skills Gap: Adoption of advanced technologies like IoT and AI in HVAC systems requires investment in infrastructure and skilled workforce, presenting challenges for some companies.

Navigating these drivers and challenges is crucial for stakeholders in the China HVAC equipment market to capitalize on growth opportunities while addressing industry complexities and regulatory demands.

China HVAC Equipment Suppliers and Their Market Shares

In this competitive market, several key players such as Gree Electric Appliances, GD Midea, Haier, Ingersoll-Rand plc, and Daikin Industries, Ltd, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies China HVAC equipment companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the China HVAC equipment companies profiled in this report include.

• Gree Electric Appliances

• GD Midea

• Haier

• Ingersoll-Rand plc

• Daikin Industries Ltd,

These companies have established themselves as leaders in the China HVAC equipment industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the China HVAC equipment market are evolving, with the entry of new players and the emergence of innovative China HVAC equipment. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

China HVAC Equipment Market by Segment

The major growing segment in the China HVAC equipment market is heat pumps. This growth is driven by the increasing demand for energy-efficient and environmentally friendly heating and cooling solutions. As China intensifies its efforts to reduce carbon emissions and promote green energy, heat pumps have gained popularity due to their ability to provide both heating and cooling with high efficiency. The government's supportive policies and incentives for adopting renewable energy technologies further boost the heat pump market. Additionally, the growing construction of residential and commercial buildings, coupled with rising consumer awareness of energy savings, contributes to the robust demand for heat pumps in China.

This China HVAC equipment market report provides a comprehensive analysis of the market's current trends, growth drivers, challenges, and future prospects in all major segments like above. The report offers insights into regional dynamics, highlighting the major markets for China HVAC equipment and their growth potentials. The study includes China HVAC equipment market size and forecast for the China’s HVAC equipment market through 2030 segmented by product type, and end use as follows:

China HVAC Equipment Market by Product Type [Volume (M units) and Value ($ million) from 2018 to 2030]:

• Furnace

• Heat Pump

• Central AC

• Room AC

• Others

China HVAC Equipment Market by End Use [Volume (M units) and Value ($ million) from 2018 to 2030]:

• Residential

• Healthcare

• Education

• Hospitality

• Office

• Retail

• Others

Features of China HVAC Equipment Market:

Market size estimates: China HVAC equipment market size estimation in terms of value ($M) and volume (million units) shipment.

Trend and forecast analysis: China HVAC equipment market trend (2018-2023) and forecast (2024-2030) by segments.

Segmentation analysis: China HVAC equipment market size by various applications such as product, and end use in terms of value and volume shipment

Growth opportunities: Analysis on growth opportunities in different applications.

Strategic analysis: This includes M&A, new product development, competitive landscape, and expansion strategies of China HVAC equipment suppliers.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the China HVAC equipment market size?

Answer: The China HVAC market is expected to reach an estimated $73 billion by 2030.

Q2. What is the growth forecast for China HVAC equipment market?

Answer: The China HVAC market is expected to grow at a CAGR of 5% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the China HVAC equipment market?

Answer: The major drivers for market growth are rapid urbanization and infrastructure development.

Q4. What are the emerging trends in China HVAC equipment market?

Answer: Emerging trends, which have a direct impact on the dynamics of the Chinese HVAC equipment industry, includes smart technology integration, air quality improvement, and green building initiatives

Q5. Who are the key Chinese HVAC equipment companies?

Answer: Some of the key HVAC companies are as follows:

• Gree Electric Appliances

• GD Midea

• Haier

• Ingersoll-Rand plc

• Daikin Industries Ltd

Q6.Which end use segment will be the largest in future?

Answer: Lucintel forecasts that, residential will remain the largest end use segment and it is also expected to witness the highest growth.

Q7. What is the price of Chinese HVAC equipment?

Answer: The price of Chinese HVAC equipment is often competitively priced compared to global competitors due to lower manufacturing costs and economies of scale. This affordability has positioned Chinese manufacturers favorably in international markets, offering cost-effective solutions without compromising on quality standards. Pricing strategies may vary based on factors such as market demand, raw material costs, and technological advancements, influencing competitiveness and market penetration.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 10 key questions

Q.1. What are some of the most promising, high-growth opportunities for the Chinese HVAC equipment market by product type (furnace, heat pump, central AC, room AC and others), and end use (residential, office, retail, hospitality, education, healthcare and others)?

Q.2. Which segments will grow at a faster pace and why?

Q.3. What are the key factors affecting market dynamics? What are the drivers, challenges, and business risks in this market?

Q.4. What are the business risks and competitive threats in the China HVAC equipment market?

Q.5. What are the emerging trends in this market and reasons behind them?

Q.6. What are some changing customer demands in the market?

Q.7. What are the new developments in the market? Which China HVAC equipment companies are leading these developments?

Q.8. Who are the major China HVAC equipment suppliers? What strategic initiatives are being taken by key players for business growth?

Q.9. What are some of the competing products of China HVAC equipment companies in this market and how big of a threat do they pose for loss of market share by material / product substitution?

Q.10. What M&A activity has occurred in the last 5 years?

For any questions related to China HVAC equipment market or related to China HVAC equipment companies, China HVAC equipment market size, China HVAC equipment market share, China HVAC equipment analysis, China HVAC equipment market growth, and China HVAC equipment market research, write Lucintel analyst at email: helpdesk@lucintel.com we will be glad to get back to you soon.