Canadian Flooring Market Trends and Forecast

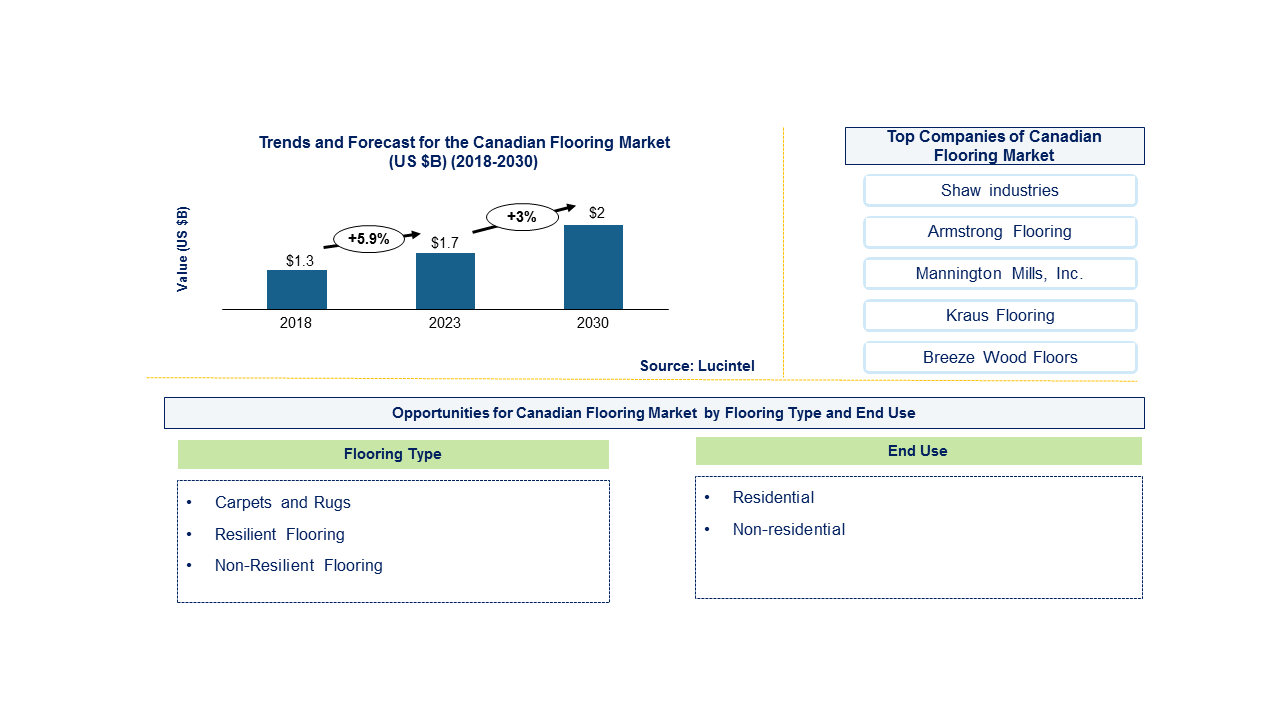

The future the Canadian flooring market looks promising with opportunities in the residential and commercial sectors. The Canadian flooring market is expected to reach an estimated $4.5 billion by 2031 with a CAGR of 4.2% from 2025 to 2031. The major drivers for this market are increasing residential construction and growth in renovation and remodeling activities.

Flooring materials vary widely depending on the type of flooring. Common materials include hardwood (from various tree species), laminate (composite wood with a photographic layer), vinyl (PVC), ceramic or porcelain tiles, natural stone (like marble or granite), carpet (made from synthetic fibers or wool), and sustainable materials like bamboo or cork. Each material offers unique characteristics in terms of durability, aesthetics, and maintenance requirements. Flooring prices are influenced by factors such as material type, quality, brand, installation complexity, and regional market conditions. Hardwood flooring tends to be more expensive due to its natural origin and installation costs, while laminate and vinyl offer more affordable alternatives. Ceramic and porcelain tiles vary in price based on design and manufacturing processes. Competition among manufacturers and retailers also affects pricing, with promotions and discounts influencing consumer choices. Overall, pricing strategies aim to balance quality with affordability, catering to diverse customer preferences in the competitive flooring market.

• Lucintel forecasts that resilient flooring is expected to witness the highest growth over the forecast period due to its minimal maintenance requirements and high durability.

• Within the Canadian flooring market, residential will remain the largest end use market over the forecast period due to growth in single and multi-family buildings.

Country wise Outlook for the Canadian Flooring Market

The Canadian flooring market is witnessing substantial growth, driven increasing residential and commercial construction activities, renovation projects, and a rising trend towards sustainable and innovative flooring solutions. Additionally, advancements in technology and design aesthetics are contributing to market expansion, catering to diverse consumer preferences and environmental considerations. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major Canadian flooring producers

Emerging Trends in the Canadian Flooring Market

Emerging trends in the Canadian flooring market shaping its future applications and market dynamics:

• Introduction of Waterproof and Resilient Flooring: Rising popularity of waterproof and resilient flooring options such as luxury vinyl plank (LVP) and engineered vinyl plank (EVP), which offer durability, easy maintenance, and suitability for areas prone to moisture like kitchens and bathrooms.

• Recycled and Upcycled Materials: Innovation in using recycled materials and upcycled products for flooring, contributing to circular economy practices and reducing environmental impact.

• Introduction of Luxury Vinyl Plank (LVP) and Engineered Vinyl Plank (EVP): There is a growing preference for LVP and EVP due to their durability, water resistance, and realistic wood or stone visuals. These flooring options cater to both residential and commercial sectors seeking low-maintenance and aesthetically pleasing solutions.

• Sustainability and Eco-Friendly Materials: Increasing consumer demand for sustainable flooring materials such as bamboo, cork, reclaimed wood, and recycled materials. Canadian consumers are prioritizing environmental impact, driving manufacturers to offer eco-friendly options that meet green building standards.

• Increasing Adoption of Loose-Lay Flooring: Loose-lay flooring refers to a type of luxury vinyl plank (LVP) or tile that does not require glue or adhesive for installation. Instead, it relies on its weight and friction to stay in place, making it easier to install and replace compared to traditional flooring options.

A total of 46 figures/charts and 34 tables are provided in this 103 pages report to help in your business decisions. Sample figures with some insights are shown below. To learn the scope of, benefits, companies researched and other details of flooring mar

Recent Developments in the Canadian Flooring Market

Recent developments in Canadian flooring market which highlights ongoing innovations and advancements across different sectors:

• Sustainability Initiatives: Canadian flooring companies are increasingly focusing on sustainability by offering eco-friendly materials such as bamboo, cork, and recycled materials. Companies like TORLYS and Divine Flooring are expanding their eco-conscious product lines to meet consumer demand for environmentally responsible flooring options.

• Technological Advancements: There is a notable integration of advanced technologies in flooring products. This includes digital printing techniques for realistic designs on tiles and laminates, as well as smart flooring solutions with embedded sensors for temperature control and energy efficiency. These advancements enhance functionality and appeal to modern consumers.

• Luxury and Customization: There is a growing trend towards luxury and customizable flooring options. Companies are introducing high-end products with unique designs and superior materials to cater to affluent residential and commercial markets. Customization in colors, patterns, and sizes is becoming increasingly important to meet diverse consumer preferences.

• Health and Wellness: The focus on health and wellness continues to influence the flooring market. There is a demand for flooring materials that contribute to indoor air quality and are low in volatile organic compounds (VOCs) and allergens. Manufacturers are responding by developing products that promote healthier indoor environments.

• Ease of Installation and Maintenance: There is a shift towards flooring solutions that offer easy installation methods such as click-lock systems and adhesive-free options. These systems appeal to DIY homeowners and contractors, reducing installation time and costs. Additionally, advancements in surface treatments are making flooring easier to clean and maintain.

Strategic Growth Opportunities for Canadian Flooring Market

With changing tastes in customers, technological advancements, as well as other environmental factors, there are a number of strategic growth opportunities in the Canadian flooring market. Below are some key growth avenues for the Canadian flooring market:

Sustainability and Environmental Considerations

• Demand for Eco-Friendly Materials: A preference for floor coverings made from natural resources like bamboo, cork and reclaimed woods due to greater consumer awareness and increased regulatory focus on sustainability. Eco-friendly building standards such as Leadership in Energy and Environmental Design (LEED) encourage use of these materials.

• Recyclable and Low-VOC Materials: In addition to better indoor air quality [IAQ], consumers’ choice is also influenced by low Volatile Organic Compound (VOC) emissions. Competitive benefits can be gained by manufacturers specializing in recyclable inputs and sustainable production strategies.

Technological Advancements in Flooring

• Advanced Manufacturing Processes: The replication of laminate and luxury vinyl tile (LVT) floors that mimic wood as well as stone through digital printing technologies is possible. Consumer preferences driven by improved durability, appearance and maintenance tasks determine demand.

• Smart Flooring Solutions: This includes heating systems beneath floors among others. These advances greatly enhance comfortability, energy efficiency particularly in homes or offices.

Shifts in Consumer Preferences and Design Trends

• Customization and Personalization: There is a growing demand for modular flooring systems that are customizable to suit an individual’s taste regarding interior decoration or architectural design. Unique patterns that exist within modular flooring systems make it possible to have more innovative styles thereby improving our interior decorum.

• Minimalist and Natural Aesthetics: People prefer smooth surfaces with no finish applied or matt or distressed surface treatments hence matt finishes are popular today; hardwood, laminates, engineered wood etc all trend towards neutral shades nowadays so you will notice a lot of earth tones around.

Residential/Commercial Sector Growth

• Urbanization and Housing Development: New housing projects plus urban population increases fuel demand for floor materials in the residential segment. Excellent flooring options that are both durable and beautiful are sought after by multi-family units and condos.

• Commercial Spaces and Renovations: Investments have been made in office spaces, retail outlets, hospitality venues as well as healthcare facilities. Floorings that have features like slip resistance, acoustic properties, or ease of maintenance, etc. are in high demand.

Digital Transformation and E-commerce

• Online Retail Expansion: This has opened up access to a wide variety of different types of floors especially with the help of e-commerce platforms and digital marketing strategies. The existence of virtual room visualizers [VRV] and augmented reality (AR) tools also makes it an easier experience shopping online because they assist with decision making.

• Direct-to-Consumer Models: So as to reach consumers directly, flooring manufacturers can use this channel which offers better pricing options; customization alternatives; quick delivery time frames among other factors.

Economic Stability and Infrastructure Projects

• Infrastructure Investments: Increasing investments by governments into transport system such as railway lines as well as schools will see more usage of these products for flooring purposes since new floors are required for infrastructure developments. There is market opportunity in provision of sustainable resilient floor coverings.

Aging Population and Accessibility Needs

• Accessibility Solutions: Aging population demographics present a need for specific floorings capable of accommodating their requirements without necessarily limiting mobility; making accessible surfaces is crucial to individuals of different abilities who may opt alternative approaches toward moving from one point to another within their homes or public facilities where home care services are available).

Canadian Flooring Market Driver and Challenges

Canadian flooring has a very important role in residential and non-residential sectors. The changing market dynamics are being driven by increasing residential construction and growth in renovation and remodeling activities. However, challenges like production costs highlight strategic solutions to sustain growth and innovation in the Canadian flooring sector.

The factors responsible for driving the Canadian flooring market include:

Canadian Flooring Market Drivers:

1. Construction and Housing Market Growth: Continuous growth in the Canadian housing market fuels demand for various types of flooring materials in both new constructions and renovations.

2. Commercial Sector Expansion: Increased investments in commercial spaces such as offices, retail outlets, and hospitality venues drive demand for durable and aesthetically pleasing flooring solutions.

3. Advanced Materials: Adoption of innovative flooring materials such as luxury vinyl tiles (LVT), engineered wood, and hybrid flooring (e.g., WPC, SPC) that offer enhanced durability, ease of maintenance, and aesthetic appeal.

4. Digitalization: Integration of digital printing technology allows for customizable designs and realistic replication of natural textures and patterns, catering to diverse consumer preferences.

5. Environmental Awareness: Growing consumer preference for sustainable and eco-friendly flooring options made from renewable materials like bamboo, cork, and recycled wood.

Challenges in the Canadian Flooring Market:

1. Cost and Pricing Pressures: Fluctuations in raw material prices impact production costs and pricing strategies for flooring manufacturers. Intense competition in the market leads to price pressures and margin constraints, challenging profitability.

2. Technological Integration and Expertise: Adoption of new technologies such as digital printing and smart flooring solutions requires investments in equipment, infrastructure, and workforce training. Ensuring compatibility and reliability of new technologies in flooring products can be a barrier.

3. Regulatory Compliance: Meeting diverse and evolving regulatory requirements across different provinces and territories in Canada adds complexity for flooring producers. Compliance with environmental standards and certifications (e.g., LEED, FloorScore) necessitates continuous monitoring and adaptation.

4. Supply Chain Management: Managing logistics, transportation, and inventory of flooring materials across vast geographical areas in Canada poses challenges in ensuring timely delivery and availability. Risks associated with global supply chain disruptions, natural disasters, and geopolitical uncertainties affect material sourcing and distribution channels.

5. Consumer Behavior and Market Trends: Rapid shifts in consumer preferences and design trends require agility in product development, marketing strategies, and inventory management. Educating consumers about the benefits and features of different flooring materials is crucial for making informed purchasing decisions.

Canadian Flooring Suppliers and their Market Shares

In this globally competitive market, several key players such as Shaw industries, Armstrong Flooring, Mannington Mills, Inc., Kraus Flooring, Breeze Wood Floors, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us by email at helpdesk@lucintel.com.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies Canadian flooring companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the Canadian flooring companies profiled in this report include.

• Shaw industries

• Armstrong Flooring

• Mannington Mills, Inc.

• Kraus Flooring

• Breeze Wood Floors

These companies have established themselves as leaders in the Canadian flooring industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the Canadian flooring are evolving, with the entry of new players and the emergence of innovative Canadian flooring. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Canadian Flooring Market by Segment

Major product types include hard flooring, such as hardwood and laminate, and soft flooring, such as carpet and vinyl. Popular materials include wood, ceramic, and luxury vinyl tile (LVT). The market serves both residential and commercial end-users, with significant demand in new construction and renovation projects. Distribution channels encompass both offline retailers, like specialty flooring stores and home improvement centers, and online platforms, reflecting the growing trend of e-commerce in home improvement. In this market, residential is the largest end use, whereas carpets and rugs is the largest in flooring type. Growth in various segments of the flooring market is given below:

This Canadian flooring market report provides a comprehensive analysis of the market's current trends, growth drivers, challenges, and future prospects in all major segments like above. The report offers insights into regional dynamics, highlighting the major markets for Canadian flooring and their growth potentials. The study includes a trend and forecast for the flooring market by flooring type and end use, as follows:

Flooring Market by Type [Value ($ Million) and Volume (Million Square Feet) from 2019 to 2031]:

-

Carpet and Rugs

-

Resilient Flooring

-

Non-Resilient Flooring

-

Wood and Laminates

-

Ceramic Tiles

-

Others

Flooring Market by End Use [Value ($ Million) from 2019 to 2031]:

Flooring Market by Residential End Use [Value ($ Million) from 2019 to 2031]:

-

Single-family

-

Multiple-family

Flooring Market by Province [Value ($ Million) from 2019 to 2031]:

-

Quebec

-

British Columbia

-

Alberta

-

Ontario

-

Others

Features of the flooring Market

Market Size Estimates: Canadian flooring market size estimation in terms of value ($M).

Trend and Forecast Analysis: Market trends (2018-20233) and forecast (2024-2030) by various segments.

Segmentation Analysis: Canadian flooring market size by various segments, such as type and end use.

Growth Opportunities: Analysis on growth opportunities in different type and end use for Canadian flooring market.

Strategic Analysis: This includes M&A and competitive landscape for the Canadian flooring.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in Canadian flooring or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the Canadian flooring market size?

Answer: The Canadian flooring market is expected to reach an estimated $4.5 billion by 2031.

Q2. What is the growth forecast for Canadian flooring market?

Answer: The Canadian flooring market is expected to grow at a CAGR of 4.2% from 2025 to 2031.

Q3. What are the major drivers influencing the growth of the Canadian flooring market?

Answer: The major drivers for this market are increasing residential construction and growth in renovation and remodeling activities.

Q4. What are the major applications or end use industries for Canadian flooring?

Answer: Residential and non-residential (healthcare, education, hospitality, offices, retail, and other) are the major end use for Canadian flooring.

Q5. What are the emerging trends in Canadian flooring market?

Answer: Emerging trends, which have a direct impact on the dynamics of the market, introduction of luxury vinyl plank (LVP) and engineered vinyl plank (EVP), increasing adoption of loose-lay flooring and introduction of waterproofing vinyl flooring.

Q6. Who are the key flooring companies?

Answer: Some of the key Canadian flooring companies are as follows:

o Shaw industries

o Armstrong Flooring

o Mannington Mills, Inc.

o Kraus Flooring

o Breeze Wood Floors

Q7. Which will be the largest product type segment of the Canadian flooring market in the forecast period?

Answer: Lucintel forecasts that resilient flooring is expected to witness the highest growth over the forecast period due to its minimal maintenance requirements and high durability.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising, high-growth opportunities for the Canadian flooring market by end use (residential and commercial), residential end use (single-family and multiple-family), flooring type (carpets and rugs, resilient flooring (vinyl and others), and non-resilient (wood and laminates, ceramic tiles, and others), and by province (Quebec, British Columbia, Alberta, Ontario, and others)?

Q.2 Which segments will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the Canadian flooring market?

Q.5 What are the business risks and threats to the Canadian flooring market?

Q.6 What are emerging trends in the Canadian flooring market and the reasons behind them?

Q.7 What are some changing demands of customers in the Canadian flooring market?

Q.8 What are the new developments in the Canadian flooring market? Which companies are leading these developments?

Q.9 Who are the major players in the Canadian flooring market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in the flooring market, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M&A activities did take place in the last five years in the flooring market?

For any questions related to Canadian flooring market or related to Canadian flooring companies, Canadian flooring market size, Canadian flooring market share, and Canadian flooring analysis, write Lucintel analyst at email: helpdesk@lucintel.com. We will be glad to get back to you soon.