BRIC Composites Market Trends and Forecast

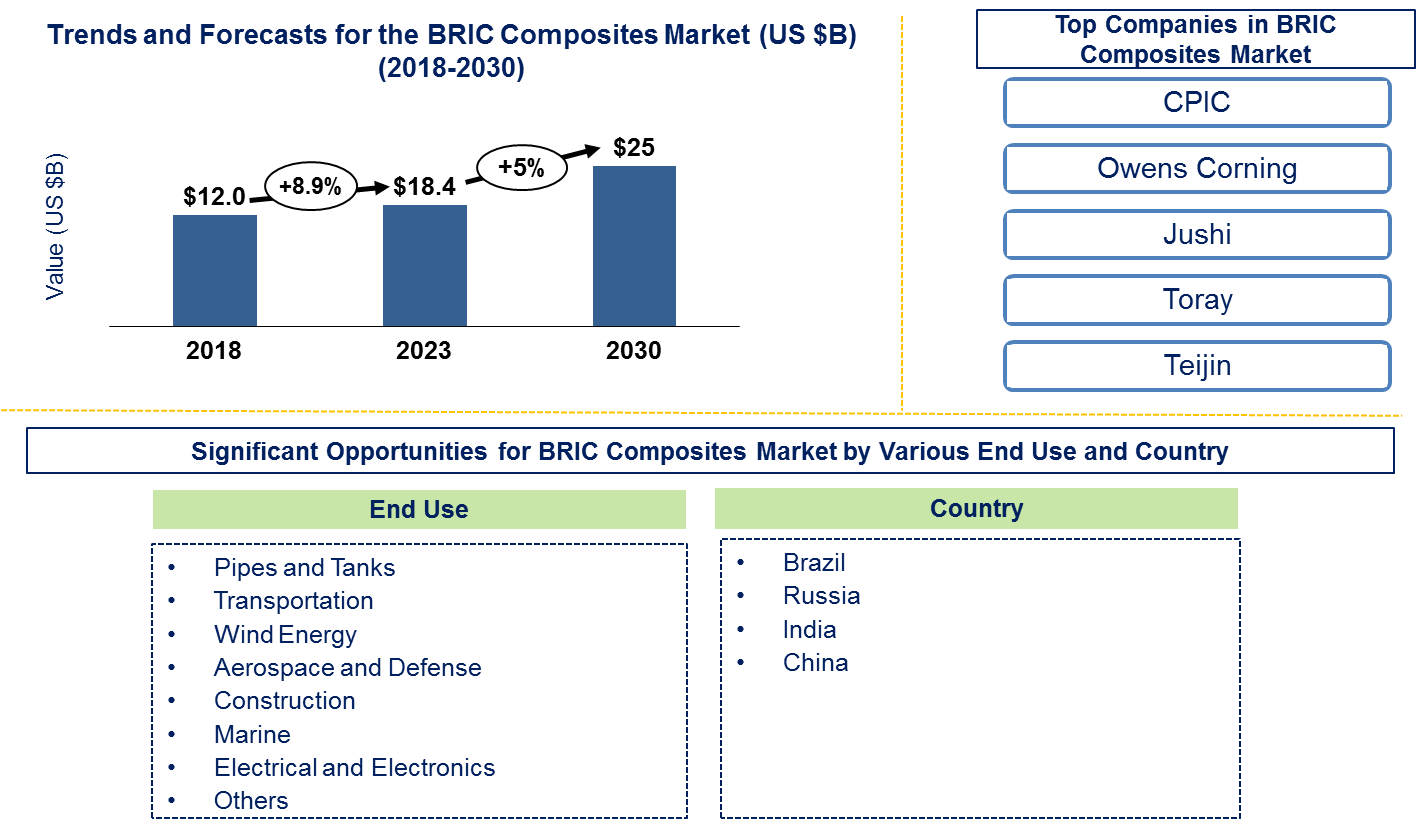

Lucintel finds that the future of the BRIC composites material market looks promising with opportunities in the in the pipe & tank, transportation, wind energy, aerospace & defense, construction, marine, electrical & electronics end use. The BRIC composites market is expected to reach an estimated $25 billion by 2030 with a CAGR of 5% 2023 to 2030. The major driver for market growth is the rise in demand for wind energy, construction, and pipe and tank end uses due to increase in the number of government projects like smart cities development, eco-friendly energy generation, fresh water transportation, sewage treatment system, rehabilitation of water and sewage pipe lines.

The BRIC countries are using various fiber in their composite production such as glass, carbon, aramid and natural fiber. Resins used include polyester, vinyl ester, epoxy and phenolic with fillers like calcium carbonate and silica augmenting their properties. Catalysts, accelerators and pigments are additives that affect the characteristics of a material while foam and honeycomb are core materials essential for lightweight structures in high performance composites. As a result BRIC’s composites have gained popularity in different markets since they offer competitive prices worldwide through use of cheaper labor thus meeting global quality standards.

Lucintel forecasts that construction will remain the largest end use over the forecast period due to widespread acceptance and excellent corrosion resistance properties. Wind energy is expected to witness highest growth over the forecast period

Country wise Outlook for the BRIC Composites Market

The BRIC Composites market is witnessing substantial growth globally, driven by increased demand from various industries such as aerospace, automotive, wind energy, and construction. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major BRIC Composites in key regions: the Brazil, Russia, India, and China.

Emerging Trends in the BRIC Composites Market

Emerging trends in BRIC Composites Market are shaping its future applications and market dynamics:

1. Nano composites: The addition of nanomaterials (e.g., nanoparticles, nanotubes) to composites for increasing mechanical properties, electrical conductivity and thermal stability to open new frontiers in aerospace, electronics and automotive industries.

2. 3D Printing of Composites: Progresses in designing methods for making composite parts additively that can introduce complex geometries, reduced waste and made-to-order fabrication; thus changing the process of prototyping and small volume manufacturing.

3. Bio-based Composites: This is the manufacture of composites using natural fibers and resins obtained from sustainable sources, which helps reduce greenhouse gas emissions and achieve conservation goals in architecture, packaging and automobile industry.

4. Smart Composites: Combining sensors with actuators within structures made up of composites to allow functionalities such as structural integrity monitoring, damage identification as well as self-healing properties.

A total of 107 figures / charts and 68 tables are provided in this 205-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the BRIC Composites Suppliers

Recent developments in BRIC composites market by various companies highlight ongoing innovations and advancements across different sectors:

• Automotive Sector: In BRIC countries, composite integration has become a trend for firms looking to reduce vehicle weight, improve fuel efficiency and enhance safety standards.

• Construction and Infrastructure: Innovations in this field have been geared towards the utilization of composites as building materials that are durable and light contributing to sustainable construction practices and infrastructure development.

• Aerospace and Defense: Improvement has been made in such areas as avionics for aircrafts through the use of composites resulting in improvements in performance and reduction in maintenance costs.

• Renewable Energy: In wind turbine blades, composites are used to obtain higher efficiencies and reliabilities thus promoting renewable energy generation.

• Consumer Goods: Companies involved with consumer electronics, sports equipment, or healthcare devices should consider using composites given their lightness and strength.

Strategic Growth Opportunities for BRIC Composites Market

Infrastructure Development:

• Market Demand: In construction and civil engineering, the need for composites is driven by rapid urbanization, infrastructure projects in Brazil, Russia, India, and China.

• Opportunity: Government investments in sustainable development make composites a lightweight but long-lasting solution to bridge-building and transport infrastructures.

Automotive Sector Expansion:

• Industry Applications: BRIC nations’ increasing automotive production creates demand for composites in light weight vehicle components thus reducing fuel consumption and emissions.

• Opportunity: Innovations in composite materials for electric vehicles (EVs), including battery enclosures and structural components, meet changing market preferences.

Renewable Energy Projects:

• Wind and Solar Energy: Wind turbine blades and solar panel structures are demanding more composites because of BRIC countries’ expansion of renewable energy capabilities.

• Opportunity: Composites-based manufacturing technologies and materials underpin energy efficiency improvements while upholding sustainable energy objectives.

Consumer Goods and Electronics:

• Market Segment: There is an increase in demand for composites in electronics, appliances, and consumer goods as a result of growing consumer spending within the BRIC nations.

• Opportunity: Lightweight durable composites can be used to produce smart-phones or any other home appliance due to the flexibility they offer in designing products with high performance capabilities respectively.

Aerospace and Defense Applications:

• Industry Needs: Composite demand will continue to rise given that aerospace & defense sectors are blossoming across India, Brazil, China & Russia worldwide.

• Opportunity: Aircraft performance has been improved by introducing such materials as carbon fiber reinforced polymer (CFRP) which reduces costs related to maintenance plus boosts fuel economy at large extent.

BRIC Composites Market Drivers and Challenges

The BRIC composites market is impacted by strong catalysts such as hyper industrialization, construction of infrastructure, rising demand across the automotive, aerospace, and renewable sectors. These drivers propel a dynamic market as composite materials are increasingly used in light weight and tough constructions. Nonetheless, challenges like fluctuating prices of raw materials, technological barriers and regulations complexities are considered to be serious impediments. In order to exploit the ever changing opportunities in the versatile BRIC composites market, players must find ways of overcoming these difficulties while adopting sustainability practices and making use of advanced technology.

The key drivers for the BRIC composites market include:

1. Industrial Growth: The demand for composite materials in the automotive, aerospace, construction, and energy sectors rises due to rapid industrialization in these countries.

2. Infrastructure Development: Transportation, energy and housing projects among others have massive infrastructures that increase the use of light and strong composites.

3. Technological Advancements: Composites’ manufacturing processes and material science are better than ever before leading to improved performance and wider application possibilities.

4. Environmental Regulations: Composite usage is favored by the growing emphasis on sustainability as well as stricter environmental laws.

5. Cost Efficiency: Given their ability to endure wear, weightlessness, and durability composites create advantages compared to other materials leading to long-term cost savings.

6. Government Initiatives: Government policies aimed at promoting advanced manufacturing technologies and advanced materials stimulate market growth

The challenges in the BRIC composites market include:

1. High Raw Material Costs: Production costs may escalate when there is reliance on imported raw materials or price fluctuations leading in profit declines

2. Technological Barriers: Market expansion can be retarded by inadequate knowledge about new manufacturing methods within composite technologies.

3. Market Fragmentation: A fragmented market structure exists due to a large number of small and medium-sized enterprises with few resources and capacities.

4. Regulatory Complexities: Compliance difficulties as well as higher expenses can be caused by different certificates’ requirements from several regions

5. Economic Uncertainty: Volatile economic trends along with geopolitical risks greatly affect investment plans and stability of the market

6. Supply Chain Issues: Other factors such as logistics challenges or shortages of raw materials which disrupt the supply chains impacts delivery timescales and production.

In conclusion, the future of BRIC composites market is highly dependent on innovation in composite materials and manufacturing processes. By overcoming challenges such as regulatory compliance and supply chain disruptions while promoting technological development, new opportunities can be created. In a sector that is continuously changing, companies that place emphasis on sustainability and are well adjusted to regional market dynamics stand out as potential leaders in this field.

BRIC Composites Suppliers and Their Market Shares

In this BRIC competitive market, several key players such as China Jushi Co., Ltd., CPIC, Owens Corning, Toray Industries, Tejin Limited dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us. If you wish to deep dive in competitive positioning of these players then you can look into our other syndicated market report on “BRIC Composites Market Leadership Report".

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies BRIC composites companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the BRIC composites companies profiled in this report include.

• Chongqing Polycomp International Corporation

• Owens Corning

• Jushi Group Co., Ltd.

• Toray Industries Inc.

• Teijin Limited

• Polynt Group

• Ineos Composites

These companies have established themselves as leaders in the BRIC Composites market, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the Chinese glass fiber market are evolving, with the entry of new players and the emergence of innovative BRIC composites technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

BRIC Composites Market by Segment

Significant growth is being experienced in several key segments of the BRIC composites market. In the automotive industry, companies are increasingly turning to composites for light weighting to enhance fuel efficiency and improve overall performances. Construction is presently preferentially using composites for infrastructure projects as they entail longer life span, corrosion resistance, and offer freedom in design. The aerospace sector is witnessing an increasing use of composites in aircraft manufacturing that come with advantages such as high strength but low weight ratios and better fuel economy. In wind energy, blades are built with a combination of materials including fibers due to their stiffness and fatigue resistance properties. Electronics nowadays also look for mechanical robustness and composite insulating properties.

BRIC Composites Market by End Use [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Pipe and Tank

• Transportation

• Wind Energy

• Aerospace and Defense

• Construction

• Marine

• Electrical and Electronics

• Others

BRIC Composites Market by Country [Value ($M) Volume (M lbs) Analysis for 2018 – 2030]:

• Russia

• Brazil

• India

• China

Features of BRIC Composite Market

• Market Size Estimates: BRIC composite market size estimation in terms of value ($B) and volume (M lbs)

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and countries.

• Segmentation Analysis: Market size by end use industry and country

• Growth Opportunities: Analysis of growth opportunities in different end use and country for the BRIC composite market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the BRIC composite market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in BRIC composites or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the BRIC composites market size?

Answer: The BRIC composites market is expected to reach an estimated $25 billion by 2030.

Q2. What is the growth forecast for BRIC composites market?

Answer: The BRIC composites market is expected to grow at a CAGR of 5% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the BRIC composites market?

Answer: The major driver for market growth is the rise in demand for wind energy, construction, and electrical and electronics end uses due to increase in the number of government projects like smart cities development, eco-friendly energy generation, fresh water transportation, sewage treatment system, rehabilitation of water and sewage pipe lines.

Q4. What are the major applications or end use industries for BRIC composites?

Answer: construction and wind energy are the major end use for BRIC composites.

Q5. What are the emerging trends in BRIC composites market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include nano composites, 3D printing of composites, bio-based composites, and smart composites

Q6. Who are the key BRIC composites companies?

Answer: Some of the key BRIC composites companies are as follows:

• CPIC

• Owens Corning

• Jushi Group

• Toray Industries

• Teijin Limited

Q7. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 10 key questions

Q.1 what are some of the most promising potential, high growth opportunities for the BRIC composites market by end use (pipe and tank, transportation, wind energy, aerospace and defense, construction, marine, electrical and electronics, and others) and country (Brazil, Russia, India and China)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.4 What are the business risks and threats to the market?

Q.5 What are the emerging trends in this market and the reasons behind them?

Q.6 What are the changing demands of customers in the market?

Q.7 What are the new developments in the market? Which companies are leading these developments?

Q.8 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.9 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.10 What M & A activities have taken place in the last 5 years in this market?