Battery Material Market Trends and Forecast

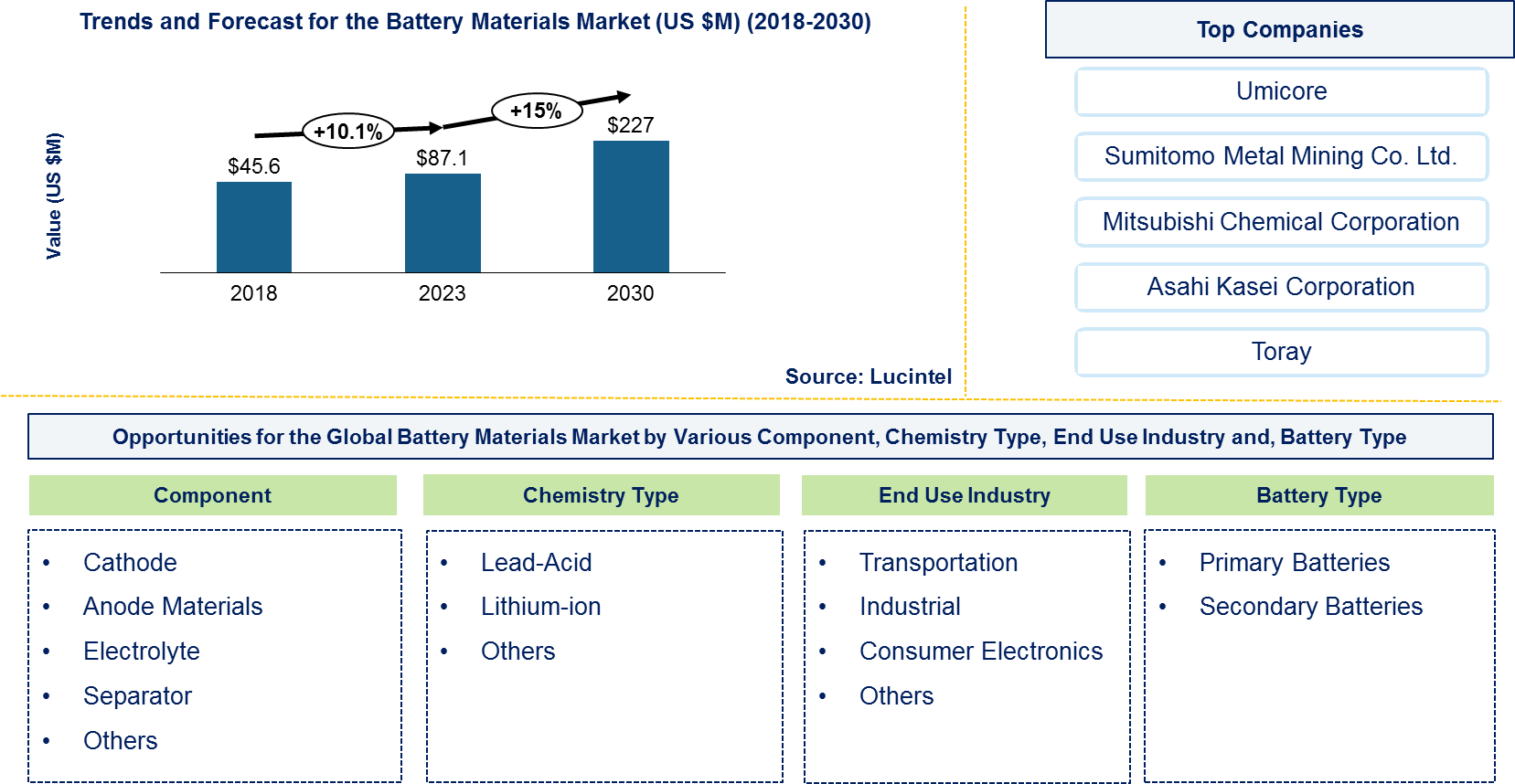

The future of the battery material market looks promising with opportunities in the transportation, industrial, and consumer electronics industries. The global battery material market is expected to reach an estimated $227 million by 2030 with a CAGR of 15% from 2023 to 2030. The major drivers for this market are growing adoption of electric vehicles, rising demand for portable electronics, and growing need for energy storage devices.

Battery materials are composed of various components based on battery type. Lithium-ion batteries use lithium-based cathodes, graphite anodes, and electrolytes like lithium salts. Lead-acid batteries feature lead dioxide and spongy lead in the plates, with sulfuric acid as the electrolyte. Nickel-Cadmium (NiCd) and Nickel-Metal Hydride (NiMH) batteries use nickel hydroxide and metal hydride alloys, respectively, with potassium hydroxide electrolytes. Solid-state batteries employ solid electrolytes such as lithium phosphorus oxynitride and various high-capacity cathode and anode materials. Battery material prices vary significantly: Lithium-ion battery materials like lithium and cobalt are relatively expensive, with lithium costing $10,000 to $20,000 per ton and cobalt around $30,000 to $50,000 per ton. Lead-acid batteries use cheaper lead and sulfuric acid, costing $2,000 to $3,000 per ton and $100 to $200 per ton, respectively. Nickel-Cadmium (NiCd) and Nickel-Metal Hydride (NiMH) batteries use costly materials like cadmium and rare earth metals. Solid-state batteries have high material costs, with solid electrolytes reaching $50,000 to $100,000 per ton.

• Lucintel forecasts that transportation is expected to remain the largest end use industry for battery materials and witness the highest growth over the forecast period. Customer inclination towards electric vehicles and growing preference for NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum) based lithium-ion batteries in electric vehicles are expected to drive the market of battery materials in the transportation sector.

• Cathode will remain the largest segment by component type, and it is expected to witness the highest growth during the forecast period due to growth in lead acid and lithium ion battery, considering growth in the automotive industry.

• Asia Pacific is expected to remain the largest market and witness the highest growth over the forecast period. Growing production of electric vehicles, consumer electronics, and the growing demand for backup power systems are expected to boost demand for the battery material market in this region.

Country wise Outlook for Battery Material

The battery material is witnessing substantial growth globally, driven by increased demand from various industry such as medication, iron and steel. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major battery material producers in key regions: the USA, China, India, Japan, Germany and Canada

Emerging Trends in the Battery Meterial Market

Emerging trends in the battery material market shaping its future applications and market dynamics:

• Solid-State Batteries: Solid-state batteries use a solid electrolyte instead of the liquid or gel electrolytes found in conventional lithium-ion batteries. This shift can improve energy density, safety, and longevity. Companies like QuantumScape and Solid Power are making strides in this area.

• Lithium-Sulfur Batteries: Lithium-sulfur (Li-S) batteries have the potential to offer higher energy densities compared to traditional lithium-ion batteries. They use sulfur as a cathode material, which is more abundant and less expensive than the materials used in conventional batteries.

• Sodium-Ion Batteries: Sodium-ion batteries are gaining traction as an alternative to lithium-ion batteries. Sodium is more abundant and cheaper than lithium, which could make these batteries more cost-effective for large-scale applications, such as grid energy storage.

• Silicon Anodes: Replacing the traditional graphite anodes with silicon can significantly increase the energy density of batteries. Silicon can store more lithium ions, but it expands and contracts during charging, which presents challenges. Advances are being made to address these issues and improve the stability and longevity of silicon anodes.

• Cobalt-Free Cathodes: Reducing or eliminating cobalt in battery cathodes is a major trend driven by the need for more sustainable and less expensive materials. Researchers are exploring alternative materials, such as nickel-rich cathodes or iron-based compounds.

A total of 133 figures / charts and 136 tables are provided in this 244-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Development in the Battery Material Market

Ongoing innovations and advancements in various sectors of the battery material market which have been highlighted by recent developments:

• Advanced Solid-State Electrolytes: Researchers are making significant strides in developing solid-state electrolytes with higher ionic conductivity and better stability. For example, the introduction of sulfide-based solid electrolytes and ceramic electrolytes aims to improve safety and energy density compared to traditional liquid electrolytes.

• High-Energy-Density Lithium-Sulfur Batteries: Progress in lithium-sulfur (Li-S) batteries includes advancements in sulfur cathode formulations and electrolytes that enhance the cycle life and energy density of these batteries. Recent developments focus on overcoming the challenges related to sulfurÄX%$%Xs poor conductivity and volume changes during cycling.

• Silicon Anode Innovations: Companies like Sila Nanotechnologies and others are working on advanced silicon anode materials that improve performance and stability. These innovations include using silicon composites and novel binder materials to address the expansion issues associated with silicon.

• Sodium-Ion Battery Progress: Sodium-ion batteries are advancing with improvements in cathode materials, such as sodium iron phosphate (NFP) and sodium manganese oxide. These advancements aim to enhance the energy density and cycle life of sodium-ion batteries, making them a more viable alternative to lithium-ion batteries for certain applications.

• Cobalt-Free Cathodes: There is ongoing development of cathode materials that reduce or eliminate cobalt. Recent advances include high-nickel cathodes and iron-based cathodes. Companies like Tesla and CATL are working on new formulations that lower reliance on cobalt while maintaining performance.

• Recycling and Second-Life Applications: Innovations in battery recycling technologies have improved the efficiency and economic viability of reclaiming valuable materials from used batteries. There are also developments in "second-life" applications where used EV batteries are repurposed for stationary energy storage.

Strategic Growth Opportunities for Battery Material Market

The battery material market presents several strategic growth opportunities driven by global demand for high-quality iron ore and advancements in technology and sustainability. Here are key growth opportunities:

• Investment in Advanced Technologies: Investing in cutting-edge technologies like solid-state batteries, lithium-sulfur, and silicon anodes presents significant opportunities. These innovations promise higher energy densities, improved safety, and longer lifespans, catering to the increasing demand for high-performance batteries in electric vehicles (EVs) and consumer electronics.

• Expansion into Emerging Markets: The rapid growth of EVs and renewable energy infrastructure in regions like Asia-Pacific, Latin America, and Africa offers substantial market potential. Companies can tap into these burgeoning markets by aligning with local needs and government policies that support green technologies.

• Sustainable and Ethical Sourcing: Developing advanced recycling technologies and focusing on ethical sourcing can address environmental concerns and appeal to eco-conscious consumers. Innovations in recycling can reclaim valuable materials and reduce the environmental impact of battery production.

• Strategic Partnerships and Collaborations: Forming alliances with automotive manufacturers, technology firms, and research institutions can accelerate technology development and market entry. Joint ventures can enhance production capabilities and facilitate the commercialization of new battery technologies.

• Diversification of Product Offerings: Exploring niche markets such as flexible and wearable batteries or large-scale energy storage systems can open new revenue streams. Diversification into these areas can meet specific needs in consumer electronics, medical devices, and grid energy storage.

By taking advantage of these strategic growth opportunities, the battery material market can realize its full potential and transform numerous industries through strength, lightness, versatility.

Battery Material Market Driver and Challenges

Battery material has a very important role in industry like consumer electronics, transportation, and industrial. The changing market dynamics are being driven by the rising demand for electric vehicles, renewable energy storage, technological advancements and government incentives and regulations. however, challenges like high costs of advanced materials, raw material supply chain issues, environmental and ethical concerns and technological hurdles.

The factors responsible for driving the battery material market include:

• Rising Demand for Electric Vehicles (EVs):The growing adoption of electric vehicles is a major driver for battery materials. As EV sales increase, so does the demand for high-performance battery materials to enhance energy density and vehicle range.

• Renewable Energy Storage: The need for efficient energy storage solutions to support renewable energy sources (like solar and wind) drives demand for advanced battery technologies. Energy storage systems (ESS) require high-capacity and durable batteries.

• Technological Advancements: Innovations in battery technologies, such as solid-state batteries and high-energy-density materials, are pushing the market forward. New materials that offer better performance and safety are continually being developed and commercialized.

• Government Incentives and Regulations: Policies and incentives aimed at reducing carbon emissions and promoting clean energy contribute to the growth of the battery materials market. Subsidies for EVs and renewable energy projects boost demand for advanced batteries.

• Increased Consumer Electronics Usage: The proliferation of consumer electronics, including smartphones, tablets, and wearable devices, increases the demand for high-performance and long-lasting batteries.

Challenges facing the battery material market are:

1. High Costs of Advanced Materials: The cost of developing and manufacturing advanced battery materials, such as solid-state electrolytes or high-capacity anodes, can be high. This can limit their widespread adoption and impact overall market growth.

2. Raw Material Supply Chain Issues: The supply of key raw materials, such as lithium, cobalt, and nickel, can be volatile and subject to geopolitical and economic factors. Supply chain disruptions or price fluctuations can impact battery production.

3. Environmental and Ethical Concerns: The mining and processing of materials like cobalt and lithium can have significant environmental and ethical implications. There is growing pressure to address these issues and develop more sustainable sourcing practices.

4. Technological Hurdles: Many advanced battery technologies face technical challenges, such as performance issues, safety concerns, and scalability problems. Overcoming these hurdles requires substantial research and development.

Innovations in battery materials are transforming energy storage with advancements like solid-state batteries for improved safety and energy density, lithium-sulfur batteries for higher capacity, and silicon anodes for enhanced performance. Sodium-ion batteries offer cost-effective alternatives to lithium-ion, while cobalt-free and iron-based cathodes address sustainability concerns. Additionally, flexible and lightweight batteries cater to new applications, and advanced recycling technologies enhance material recovery and reduce environmental impact.

Battery Material Suppliers and Their Market Share

The battery material is highly competitive, with several key players such as Umicore, Asahi Kasei, Sumitomo Metal Mining, Mitsubishi Chemical, Toray, Toda Kogyo Corporation, and Showa Denko K.K. have established their presence in the market and hold a significant market share. To know the current market share of each of major players Contact Us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies battery material companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Battery material insulation companies profiled in this report includes.

• Umicore

• Asahi Kasei

• Sumitomo Metal Mining

• Mitsubishi Chemical

• Toray

• Toda Kogyo Corporation

• Showa Denko K.K.

These companies have established themselves as leaders in the battery material industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the battery material market are evolving, with the entry of new players and the emergence of innovative battery material. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Battery Material by Segment

The battery materials sector is experiencing significant growth across several key segments, notably consumer electronics, transportation, and industrial applications. In consumer electronics, the demand for advanced batteries is driven by the proliferation of portable devices such as smartphones, laptops, and wearables. The transportation sector, particularly with the rise of electric vehicles (EVs), is fueling the need for high-performance battery materials to enhance energy storage and efficiency. Meanwhile, in industrial applications, the focus is on improving battery technology to support automation, renewable energy storage, and other industrial processes. This expansion across diverse fields underscores the increasing reliance on advanced battery materials to power modern technology and sustainable solutions.

This battery materials market report provides a comprehensive analysis of the marketÄX%$%Xs current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments, component type, chemistry type, battery type, and end use industry. The report offers insights into regional dynamics, highlighting the major markets for magnetite and their growth potentials. The study includes a forecast for the global battery material market by component type, chemistry type, battery type, end use industry, and region as follows:

Battery Material Market by Component [Volume (Kilotons) and $M shipment Analysis from 2018 to 2030]:

• Cathode

o Lead Dioxide

o Lithium Cobalt Oxide (LCO)

o Nickel Manganese Cobalt (NMC)

o Nickel Cobalt Aluminum (NCA)

o Lithium Manganese Oxide (LMO)

o Lithium-iron Phosphate (LFP)

o Other Cathode Materials

o Anode

o Lead

o Natural Graphite

o Synthetic Gra

Battery Material Market by Chemistry Type [Volume (Kilotons) and $M shipment Analysis from 2018 to 2030]:

• Lead-Acid

• Lithium-ion

• Others

Battery Material Market by End Use Industry [Volume (Kilotons) and $M shipment Analysis from 2018 to 2030]:

• Transportation

o Electric Vehicles

o Internal Combustion Engine (ICE)

• Industrial

o Energy Storage

o Others

• Consumer Electronics

o Cellphone

o Portable Computers

o Others

• Others

By Battery Type [Volume (Kilotons) and $M shipment analysis from 2016

Battery Material Market by Region [Volume (Kilotons) and $M shipment Analysis from 2018 to 2030]:

• North America

o United States

o Canada

o Mexico

• Europe

o Germany

• Asia Pacific

o China

o Japan

o South Korea

• The Rest of the World

Features of Battery Materials Market

• Market Size Estimates: Battery material market size estimation in terms of value ($B)

• Trend and Forecast Analysis: Market trends (2016-2021) and forecast (2022-2027) by various segments and regions.

• Segmentation Analysis: Market size by component type, chemistry type, battery type, and end use industry.

• Regional Analysis: Battery material market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different component type, chemistry type, battery type, end use industry, and regions for the battery material market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the battery material market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in battery material or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the battery material market size?

Answer: The global battery material market is expected to reach an estimated $227 million by 2030

Q2. What is the growth forecast for battery material market?

Answer: The battery material market is expected to grow at a CAGR of 15% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the battery material market?

Answer: The major drivers for this market are growing adoption of electric vehicles, rising demand for portable electronics, and growing need for energy storage devices.

Q4. What are the major applications or end use industries for battery material?

Answer: Transportation and consumer electronics are the major end use industries for battery material.

Q5. What are the emerging trends in battery material market?

Answer: Emerging trends, which have a direct impact on the dynamics of the battery material industry, include development of solid state electrolyte and the emergence of sodium-ion batteries.

Q6. Who are the key battery material companies?

Answer: Some of the key battery material companies are as follows:

• Umicore

• Asahi Kasei

• Sumitomo Metal Mining

• Mitsubishi Chemical

• Toray

• Toda Kogyo Corporation

• Showa Denko K.K.

Q7. Which battery material product segment will be the largest in future?

Answer: Lucintel forecasts that cathode will remain the largest segment by component type, and it is expected to witness the highest growth during the forecast period due to growth in lead acid and lithium ion battery, considering growth in the automotive industry.

Q8. In battery material market, which region is expected to be the largest in next 7 years?

Answer: Asia Pacific is expected to remain the largest region and witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high growth opportunities for the global battery material market by component type (cathodes, anodes, electrolytes, separators, and others), battery type (primary batteries and secondary batteries), end use industry (consumer electronics, transportation, industrial, and others), chemistry type (lithium-ion, lead acid, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 7 years in this market?