The Impact of COVID-19 is included in Automotive Millimeter- Wave Radar IC Market. Buy it today to get an advantage.

Request the impact of COVID-19 on your product or industry

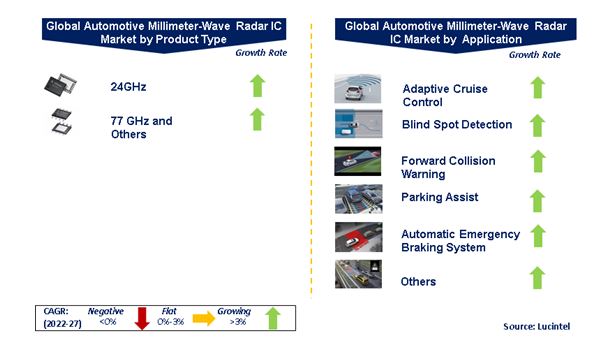

The future of the automotive millimeter-wave (mmWave) radar IC market looks attractive with opportunities in adaptive cruise control, blind spot detection (BSD), forward collision warning, parking assist, automatic emergency braking system (AEBS), and other automotive advanced driver assistance systems (ADAS) applications. The global automotive millimeter-wave radar IC market is expected to reach $877.9 million by 2027 with a CAGR of 15.5% from 2021 to 2027. The major drivers for this market are increase in the adoption of ADAS technology by OEMs, increasing governments’ regulations for vehicle safety, and growing demand for autonomous vehicles.

Emerging Trends in the Automotive Millimeter-Wave Radar IC Market

Emerging trends, which have a direct impact on the dynamics of the industry, include introduction of CMOS RF transceiver and focus on miniaturization of products. Infineon Technologies AG, NXP Semiconductors N.V., United Monolithic Semiconductors, Mitsubishi Electric Corporation, and Texas Instruments are among the major automotive mmWave radar IC providers.

A total of 96 figures / charts and 87 tables are provided in this 165-page report to help in your business decisions. A sample figure with insights is shown below. To learn the scope of benefits, companies researched, and other details of the automotive millimeter-wave radar IC market report, please download the report brochure.

Automotive Millimeter-Wave Radar IC Market by Segment

The study includes a forecast for the global automotive millimeter-wave radar IC market by product type, application, frequency range, technology, and region as follows:

By Product Type [$M and M unit shipment analysis from 2016 to 2027]:

By Application [$M shipment analysis from 2016 to 2027]:

-

Adaptive Cruise Control

-

Blind Spot Detection (BSD)

-

Forward Collision Warning

-

Parking Assist

-

Automatic Emergency Braking System (AEBS)

-

Others

By Frequency Range [$M and M Unit shipment analysis from 2016 to 2027]:

-

Short and Medium Radar

-

Long-Range Radar

By Technology [$M shipment analysis from 2016 to 2027]:

By Region [$M and M Unit shipment analysis for 2016 – 2027]:

-

North America

-

United States

-

Canada

-

Mexico

-

Europe

-

United Kingdom

-

Germany

-

Asia Pacific

-

Japan

-

China

-

The Rest of the World

List of Automotive Millimeter-Wave Radar IC Companies

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their new product developments, partnerships, mergers & acquisition, and leverage integration opportunities across the value chain. With these strategies automotive millimeter-wave radar IC companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the automotive millimeter-wave radar IC companies profiled in this report include.

-

Infineon Technologies AG

-

NXP Semiconductors N.V.

-

Texas Instruments

-

United Monolithic Semiconductor

-

Mitsubishi Electric Corporation

Automotive Millimeter-Wave Radar IC Market Insight

-

Lucintel forecasts that 24 GHz is the largest product type used due to its low cost. 77 GHz & other types mmWave radar IC are expected to witness the highest growth during the forecast period due to its wider bandwidth, improve range resolution, and accuracy.

-

Adaptive cruise control will remain the largest application over the forecast period.

-

North America will remain the largest region and Europe is expected to witness highest growth over the forecast period

Features of Automotive Millimeter-Wave Radar IC Market

-

Market Size Estimates: Automotive millimeter-wave radar IC market size estimation in terms of value ($M)

-

Trend and Forecast Analysis: Market trends (2016-2021) and forecast (2022-2027) by various segments and regions.

-

Segmentation Analysis: Market size by product type, application, frequency range, technology, and region as follows:

-

Regional Analysis: Automotive millimeter-wave radar IC market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

-

Growth Opportunities: Analysis of growth opportunities in product type, application, frequency range, technology, and region as follows:

-

Strategic Analysis: This includes M&A, new product development, and competitive landscape for the automotive millimeter-wave radar IC market.

-

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the automotive millimeter-wave radar IC market size?

Answer: The global automotive millimeter-wave radar IC market is expected to reach an estimated $ 877.9 million by 2027

Q2. What is the growth forecast for automotive millimeter-wave radar IC market?

Answer: The automotive millimeter-wave radar IC market is expected to grow at a CAGR of 15.5% from 2021 to 2027.

Q3. What are the major drivers influencing the growth of the automotive millimeter-wave radar IC market?

Answer: The major drivers for this market are increase in the adoption of ADAS technology by OEMs, increasing governments’ regulations for vehicle safety, and growing demand for autonomous vehicles.

Q4. What are the major applications or end use industries for automotive millimeter-wave radar IC market?

Answer: Adaptive cruise control is the major application for automotive millimeter-wave radar IC market.

Q5. What are the emerging trends in automotive millimeter-wave radar IC market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include introduction of CMOS RF transceiver and focus on miniaturization of products.

Q6. Who is the key automotive millimeter-wave radar IC companies?

Answer: Some of the key Automotive Millimeter-Wave Radar IC companies are as follows:

-

Infineon Technologies AG

-

NXP Semiconductors N.V.

-

Texas Instruments

-

United Monolithic Semiconductor

-

Mitsubishi Electric Corporation

Q7. Which automotive millimeter-wave radar IC product segment will be the largest in future?

Answer: Lucintel forecasts that 24 GHz is the largest product type used due to its low cost. 77 GHz & other types mmWave radar IC are expected to witness the highest growth during the forecast period due to its wider bandwidth, improve range resolution, and accuracy.

Q8. In automotive millimeter-wave radar IC market, which region is expected to be the largest in next 5 years?

Answer: Europe is expected to remain the largest region and witness the highest growth over next 5 years

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. What are some of the most promising, high-growth opportunities for the global automotive millimeter-wave radar IC by product type (24GHz , 77GHz and others) by application (adaptive cruise control, blind spot detection (BSD), forward collision warning, parking assist, automatic emergency braking system (AEBS), and other automotive advanced driver assistance systems (ADAS)), by frequency range (short and medium radar and long-range radar), by technology (GaAs, SiGe BICMOS, RF CMOS) and by region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5. What are the business risks and threats to the market?

Q.6. What are the emerging trends in this market and the reasons behind them?

Q.7. What are some changing demands of customers in the market?

Q.8. What are the new developments in the market? Which companies are leading these developments?

Q.9. Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via product substitution?

Q.11. What M&A activity has occurred in the last 5 years?

For any questions related to automotive millimeter-wave radar IC market or related to radar IC, automotive radar sensor, automotive radar frequency, 77 Ghz radar, automotive radar testing simulation, automotive imaging radar, automotive radar calibration, automotive radar target simulator, 4D radar automotive, automotive millimeter-wave radar IC companies, automotive millimeter-wave radar IC market size, automotive millimeter-wave radar IC market share, automotive millimeter-wave radar IC analysis, write Lucintel analyst at email: helpdesk@lucintel.com we will be glad to get back to you soon.