Automotive FPC Technology Market Trends and Forecast

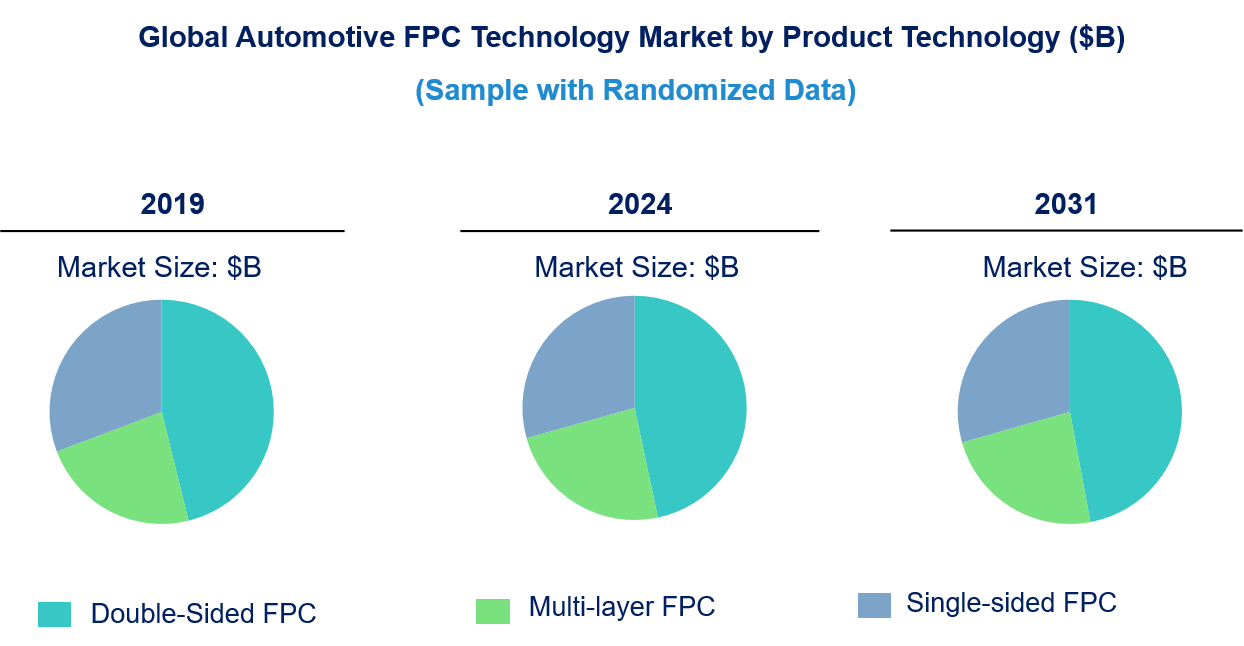

The technologies in the automotive FPC technology market have become very diverse, evolving from the use of single-sided FPC technology to the current double-sided FPC and multi-layer FPC technologies. Modern automotive applications, especially those for new energy vehicles, require more complex and compact designs, improved signal integrity, and greater strength — qualities provided by these advanced technologies. The demand for high-performance electrical systems has driven the transition from simpler, less efficient FPC designs to more advanced, multi-layer configurations. This shift is further fueled by the need to manage newer, more sophisticated automotive features, such as ADAS, infotainment, and electrification components in new energy vehicles. The trend toward multi-layer FPC solutions enables the use of higher-density connections and space-saving designs with greater flexibility, which are increasingly important in next-generation fuel and new energy automotive technologies.

Emerging Trends in the Automotive FPC Technology Market

The automotive industry is experiencing rapid technological advancements, particularly in the adoption of flexible printed circuits (FPC) to meet the demands of modern vehicles. As automotive systems evolve toward greater complexity, with innovations in electric vehicles (EVs), advanced driver-assistance systems (ADAS), and infotainment, FPC technologies are becoming increasingly crucial. These trends are shaping the future of automotive electronics by enabling more compact, reliable, and efficient solutions. Below are five key trends emerging in the automotive FPC technology market:

• Shift to Multi-Layer FPC Designs: The demand for smaller, more efficient, and higher-performance components in modern vehicles is driving the shift toward multi-layer FPC designs. These advanced configurations enable higher-density connections, improved signal integrity, and better space utilization. Multi-layer FPCs are critical for integrating sophisticated automotive systems, particularly in new energy vehicles and autonomous driving technologies.

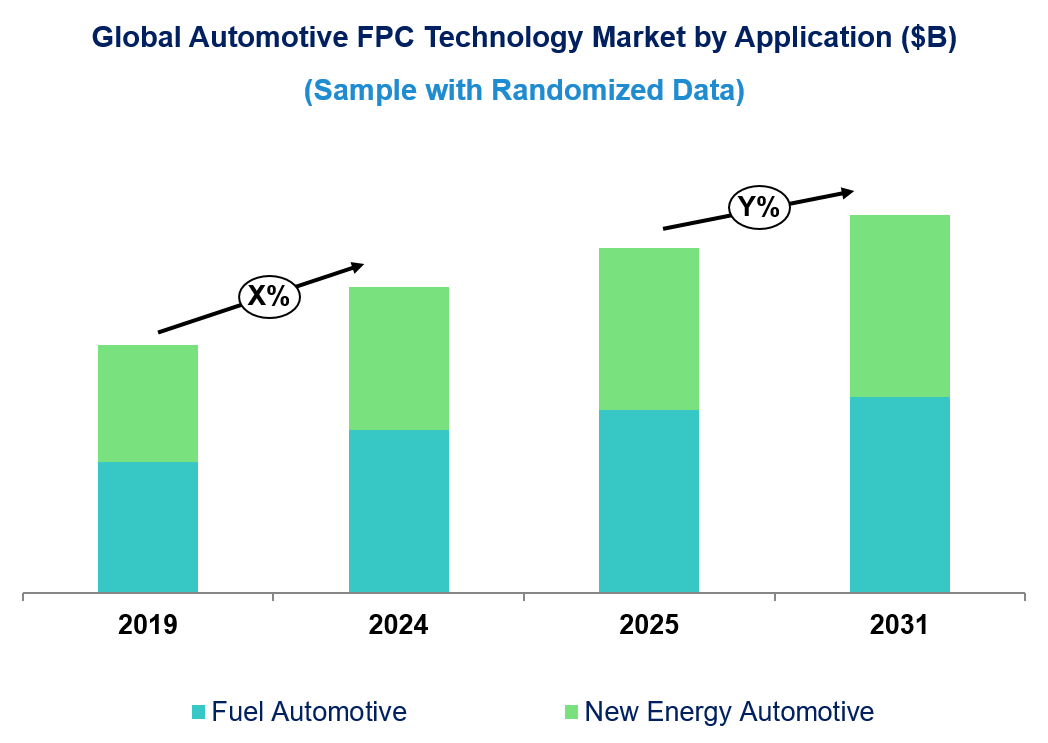

• Increased Adoption in New Energy Vehicles (NEVs): As the automotive market transitions toward electric and hybrid vehicles, FPC technology is playing a pivotal role in supporting electrification components, such as power management and battery systems. Multi-layer FPCs are particularly important for connecting high-voltage and high-current systems within EVs, contributing to improved energy efficiency and compact designs.

• Focus on High-Speed Data Transmission: With the rise of connected vehicles and ADAS, the need for high-speed data transmission has become a major priority. FPCs are being used to enable faster communication between in-vehicle systems, such as sensors, cameras, and communication modules. The demand for high-speed data processing is particularly critical for autonomous vehicles, where real-time data is necessary for decision-making and safety.

• Miniaturization and Space Efficiency: The trend toward miniaturization is driven by the need for more compact and lightweight automotive systems. FPC technology allows manufacturers to reduce the size of complex circuits without sacrificing functionality. Smaller connectors and multi-layer FPCs are key to achieving these compact, space-efficient designs, particularly in next-generation infotainment, HVAC systems, and powertrains.

• Enhanced Durability and Reliability: Automotive systems are expected to perform reliably in harsh environments, including high temperatures, vibration, and exposure to moisture. To meet these challenges, FPC manufacturers are focusing on enhancing the durability and longevity of their products. The development of more robust and heat-resistant FPC solutions is especially important in applications for electric and hybrid vehicles, where components experience higher power loads and thermal stress.

The automotive FPC technology market is evolving rapidly, driven by the increasing need for more compact, efficient, and reliable electronic systems in modern vehicles. Multi-layer FPC designs, the rise of new energy vehicles, high-speed data transmission, miniaturization, and enhanced durability are key trends shaping the market. As these technologies mature, they will continue to play an integral role in the future of automotive electronics, supporting innovations in electric, connected, and autonomous vehicles.

Automotive FPC Technology Market : Industry Potential, Technological Development, and Compliance Considerations

The automotive FPC (flexible printed circuit) technology market is evolving rapidly, with significant potential for growth and disruption.

• Potential in Technology :

FPCs offer numerous advantages, including flexibility, lightweight design, compactness, and efficient use of space, making them ideal for modern automotive applications such as electric vehicles (EVs), advanced driver-assistance systems (ADAS), and infotainment systems. As automotive systems become more complex, the need for FPCs in power management, battery systems, and high-speed data transmission will only increase. The transition from traditional wiring to FPCs is expected to drive further adoption due to their ability to handle sophisticated, space-constrained designs, such as those required in EVs and autonomous vehicles.

• Degree of Disruption:

FPC technology is poised to disrupt traditional wiring solutions by offering a more compact, flexible, and efficient alternative. With the ability to integrate high-density connections and manage complex electronic systems, FPCs are expected to replace older, bulkier systems, especially in next-generation vehicles.

• Current Technology Maturity Level:

While FPC technology is mature in some applications (e.g., automotive powertrains and infotainment), multi-layer FPC designs for advanced automotive applications, including EVs and autonomous vehicles, are still maturing.

• Regulatory Compliance:

FPC manufacturers must adhere to stringent automotive industry standards, including those related to electromagnetic compatibility (EMC), safety, and environmental concerns, to meet regulatory requirements for next-gen vehicles. Compliance with these standards is critical for the mass adoption and scaling of FPC technology in the automotive sector.

Recent Technological development in Automotive FPC Technology Market by Key Players

The automotive FPC (flexible printed circuit) technology market is witnessing significant advancements, driven by the increasing demand for compact, high-performance, and reliable electronic components in modern vehicles. Key players like Nippon Mektron, Chin Poon Industrial, TTM Technologies, CMK, and Meiko Electronics are at the forefront of these innovations, continuously enhancing FPC technologies to meet the evolving requirements of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and infotainment. These companies are leveraging their expertise in flexible circuit manufacturing to develop solutions that address the complexities of next-generation automotive applications, such as high-speed data transmission, power management, and miniaturization of electronic systems.

• Nippon Mektron: Nippon Mektron, a leading supplier of flexible printed circuits, has been focusing on enhancing the performance and durability of FPCs for automotive applications. The company has introduced advanced multi-layer FPC solutions designed to meet the high-density requirements of electric and autonomous vehicles. These innovations allow for better signal integrity, efficient power distribution, and space-saving designs, which are crucial for integrating systems like ADAS and infotainment in modern vehicles.

• Chin Poon Industrial: Chin Poon Industrial has been expanding its offerings in the automotive FPC market, particularly with solutions designed for electric vehicles and connected car applications. The company has introduced high-performance FPCs that enable faster data transmission and improved connectivity between vehicle systems. Chin Poon is also focusing on developing flexible and robust FPC solutions to withstand the harsh environmental conditions encountered by automotive components, such as high temperatures and vibrations.

• TTM Technologies: TTM Technologies, a global leader in advanced printed circuit board (PCB) solutions, has made strides in the automotive FPC market by enhancing its capabilities in multi-layer FPC production. The company has been investing in the development of FPCs that support high-speed data transfer and high-density connections, which are essential for EVs, ADAS, and autonomous vehicles. TTM’s innovations aim to improve the reliability and performance of automotive electronics, particularly in terms of signal integrity and power management.

• CMK: CMK has been focusing on providing high-quality FPC solutions tailored to the needs of next-generation automotive systems. The company’s recent developments include FPCs that support advanced features like real-time data processing for autonomous driving applications. CMK is also addressing the increasing demand for miniaturization by creating ultra-thin FPC designs that help reduce the size and weight of automotive electronics, enhancing both performance and fuel efficiency in electric and hybrid vehicles.

• Meiko Electronics: Meiko Electronics has been advancing its FPC technology with an emphasis on high-performance, high-density flexible circuits for automotive applications. The company has been working on improving the durability and heat resistance of its FPCs, which are critical for EVs and other high-power automotive systems. MeikoÄX%$%Xs FPC solutions are enabling more efficient power management and integration of complex systems, such as battery management and ADAS, contributing to the overall performance and safety of modern vehicles.

These developments highlight the growing importance of flexible printed circuits in the automotive sector, particularly in the context of electrification, automation, and connectivity. As these key players continue to innovate, FPC technology will play a crucial role in the future of automotive electronics, enabling more compact, efficient, and reliable systems for next-generation vehicles.

Automotive FPC Technology Market Driver and Challenges

The automotive FPC (flexible printed circuit) technology market is being driven by the increasing complexity and technological advancement in modern vehicles. As vehicles become more connected, autonomous, and electrified, there is a growing demand for compact, high-performance electronic components that can withstand harsh automotive environments. Flexible printed circuits are increasingly being adopted for their ability to meet these requirements, enabling high-speed data transmission, miniaturization, and integration of advanced automotive systems. However, challenges related to technology maturity, cost, and regulatory compliance remain. The following outlines the major drivers and challenges impacting this market.

The factors responsible for driving the automotive FPC market include:

• Demand for Electrification and EVs: The rise of electric vehicles (EVs) and hybrid vehicles is driving the adoption of flexible printed circuits. FPCs provide essential benefits like space efficiency and high-density connections, supporting power management, battery systems, and charging infrastructure. This trend is critical for enabling the integration of complex electronic systems within EVs.

• Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles: The growing adoption of ADAS and autonomous driving technologies is fueling the need for high-performance FPC solutions. FPCs are used to manage the complex systems that support these technologies, such as sensors, cameras, and communication modules, helping to deliver real-time data transmission and enhanced vehicle safety.

• Miniaturization of Automotive Components: As automotive designs trend toward smaller and lighter components, FPC technology is enabling the miniaturization of circuits and connectors. Multi-layer FPC designs allow for higher-density connections in compact spaces, contributing to the development of lightweight and efficient automotive electronics in infotainment, powertrains, and more.

• Increased Connectivity and In-Vehicle Communication: The demand for connected vehicles is accelerating the need for FPCs, which facilitate faster data transfer and reliable in-vehicle communication. With the growth of infotainment, navigation, and vehicle-to-vehicle (V2V) communication systems, FPC technology plays a crucial role in ensuring seamless communication between various automotive systems.

• Focus on Durability and Reliability: As vehicles face harsher operating environments, there is a greater emphasis on the durability and heat resistance of automotive components. FPC manufacturers are addressing these needs by developing flexible circuits that can withstand high temperatures, vibrations, and moisture, thus improving the longevity and reliability of automotive electronics.

Challenges in the automotive FPC market are:

• High Production Costs: The production of flexible printed circuits, especially multi-layer designs, can be costly. This limits the widespread adoption of FPC technology in mass-market vehicles, particularly for price-sensitive applications. Overcoming cost barriers is essential for making FPC solutions more accessible to a broader range of automotive manufacturers.

• Technology Maturity and Integration: While FPC technology is mature in some automotive applications, its integration into more complex systems, such as autonomous vehicles and EV powertrains, is still developing. Manufacturers must continue to refine and innovate to ensure that FPCs meet the performance and reliability standards required for next-generation automotive technologies.

• Regulatory Compliance and Industry Standards: FPC manufacturers must comply with stringent automotive industry standards regarding safety, electromagnetic compatibility (EMC), and environmental impact. Meeting these regulations can pose challenges, particularly for newer FPC designs used in advanced automotive systems. The evolving nature of these standards adds complexity to the development process.

• Supply Chain Constraints: The increasing demand for advanced automotive electronics, combined with global supply chain disruptions, can impact the availability of materials and components required for FPC manufacturing. Supply chain constraints pose challenges in scaling up production and meeting the growing demand for FPC solutions in the automotive industry.

• Competition from Traditional Wiring Solutions: Despite the advantages of flexible printed circuits, traditional wiring solutions remain entrenched in the automotive sector. Convincing manufacturers to transition from traditional wiring systems to FPC technology may require significant investment in education, testing, and demonstrating the long-term benefits of FPC adoption.

The automotive FPC technology market is shaped by a combination of significant growth drivers and challenges. As electrification, autonomy, and connectivity continue to transform the automotive industry, FPC technology plays an essential role in enabling the advanced, high-performance systems that are becoming standard in modern vehicles. However, overcoming challenges such as high production costs, regulatory compliance, and integration into complex systems will be key to the marketÄX%$%Xs continued growth. As the technology matures and production efficiencies improve, FPC solutions are expected to play an increasingly prominent role in shaping the future of automotive electronics.

List of Automotive FPC Technology Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies, automotive FPC technology companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the automotive FPC technology companies profiled in this report include.

• Nippon Mektron

• Chin Poon Industrial

• TTM

• CMK

• Meiko Electronics

Automotive FPC Technology Market by Technology

• Technology Readiness by Technology Type: The readiness of different FPC technologies for automotive applications varies significantly. Single-sided FPCs are the most mature and widely used in traditional automotive systems, such as power distribution and basic infotainment. However, as the industry moves towards electric vehicles (EVs) and autonomous driving, the demand for more advanced FPC technologies has driven the adoption of double-sided and multi-layer FPCs. Double-sided FPCs offer better space utilization and are increasingly used in applications where higher connectivity and density are required. Multi-layer FPCs are still maturing but are gaining traction due to their ability to support the complex, high-speed data requirements of ADAS, EV battery systems, and other advanced automotive applications. The competitive level for single-sided FPCs is moderate due to their established market presence, while double-sided and multi-layer FPCs face higher competition because of the need for innovation in handling high-density connections and supporting next-generation technologies. Regulatory compliance for all three FPC types is essential, with multi-layer FPCs facing more stringent requirements to meet automotive safety, performance, and environmental standards. The evolution of FPC technology aligns with the industryÄX%$%Xs need for smaller, more efficient, and reliable components, ultimately supporting the transition to more connected and electrified vehicles.

• Competitive Intensity and Regulatory Compliance: The competitive intensity in the automotive FPC technology market is high, driven by continuous advancements in FPC technology, especially in the transition from single-sided FPCs to double-sided and multi-layer FPCs. As the demand for electric and autonomous vehicles grows, the need for sophisticated FPC solutions with higher performance and better durability has increased. Key players in the market are constantly innovating to meet these demands, which has led to intensified competition among manufacturers. Regulatory compliance is a critical aspect of this competitive landscape, as FPC manufacturers must adhere to automotive industry standards related to electromagnetic compatibility (EMC), safety, and environmental sustainability. Multi-layer FPCs, in particular, face strict regulations to ensure they can withstand the harsh environments typical in automotive applications, such as exposure to high temperatures, vibrations, and moisture. Adherence to certifications such as ISO, UL, and IEC is essential for mass adoption and scaling of these technologies. As competition intensifies, companies must balance innovation with the need to meet regulatory requirements, ensuring their FPC solutions are compatible with the next generation of automotive systems without compromising performance, safety, or environmental standards.

• Disruption Potential By Technology Type: The automotive FPC technology market is experiencing disruption from the evolution of flexible printed circuit (FPC) technologies, driven by the increasing demand for compact, efficient, and high-performance systems. Single-sided FPCs are being replaced by more sophisticated solutions like double-sided and multi-layer FPCs, which offer higher-density connections, better signal integrity, and improved durability. Multi-layer FPCs, in particular, have the potential to disrupt traditional wiring solutions, enabling space-saving designs and integration of complex systems such as ADAS, infotainment, and electrification components. As automotive systems become more electrified and autonomous, the need for more robust, high-speed data transmission and energy-efficient components is driving the adoption of multi-layer FPCs. These advanced solutions can handle the increasing complexity of modern automotive electronics, reducing wiring bulk and offering more design flexibility. As a result, multi-layer FPCs have the potential to replace traditional wiring designs and even other flexible circuit technologies, particularly in the growing sectors of EVs and autonomous vehicles. Over time, these technologies will lead to further miniaturization, enhanced performance, and cost savings, reshaping the automotive electronics landscape.

Automotive FPC Technology Market Trend and Forecast by Product Technology [Value from 2019 to 2031]:

• Double-Sided FPC

• Multi-Layer FPC

• Single-Sided FPC

Automotive FPC Technology Market Trend and Forecast by Application [Value from 2019 to 2031]:

• Fuel Automotive

• New Energy Automotive

Automotive FPC Technology Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Automotive FPC Technology Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Automotive FPC Technology Market

Market Size Estimates: Automotive FPC technology market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global automotive FPC technology market size by various segments, such as application and product technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global automotive FPC technology market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different applications, technologies, and regions for technology trends in the global automotive FPC technology market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global automotive FPC technology market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global automotive FPC technology market by product technology (double-sided FPC, multi-layer FPC, and single-sided FPC), application (fuel automotive and new energy automotive), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different product technologies? What are the drivers and challenges of these product technologies in the global automotive FPC technology market?

Q.5. What are the business risks and threats to the technology trends in the global automotive FPC technology market?

Q.6. What are the emerging trends in these product technologies in the global automotive FPC technology market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global automotive FPC technology market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global automotive FPC technology market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this automotive FPC technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global automotive FPC technology market?