Automotive and Transportation Connector Technology Market Trends and Forecast

The technologies in the automotive and transportation connector technology market have undergone significant changes in recent years, with a shift from traditional copper-based connectors to more advanced fiber optic and radio frequency (RF) technologies. This shift has enabled faster data transmission, improved signal integrity, and enhanced overall system performance, especially in applications like infotainment, safety systems, and navigation. Additionally, there has been a transition from mechanical connectors to more integrated and miniaturized connectors, driven by the increasing demand for compact, lightweight, and reliable solutions in modern automotive designs. The evolution from discrete printed circuit board (PCB) solutions to integrated circuits (ICs) has further improved efficiency, reducing space and cost while enhancing performance. Furthermore, the automotive industry is witnessing a move toward higher-power and energy-efficient connectors, particularly in electric vehicles (EVs) and hybrid powertrains, where integration of connectors with powertrain systems has become crucial. These changes are not only improving vehicle functionality but also supporting the growing trend of autonomous driving, electrification, and advanced driver-assistance systems (ADAS).

Emerging Trends in the Automotive and Transportation Connector Technology Market

The automotive and transportation industries are experiencing rapid advancements in connector technology, driven by the increasing demand for smarter, more efficient, and more reliable solutions. As vehicles become more connected, electrified, and autonomous, the need for advanced connector technologies has never been greater. These innovations are shaping the future of automotive systems, impacting everything from infotainment and powertrains to autonomous driving technologies. The key emerging trends in automotive and transportation connector technology are a direct response to the industryÄX%$%Xs push for higher performance, compactness, and energy efficiency.

Emerging Trends in the automotive and transportation connector technology market:

• Shift to Fiber Optic and RF Technologies: The move from traditional copper-based connectors to fiber optics and radio frequency (RF) technologies is enabling faster data transmission and better signal integrity. This shift is particularly important in advanced infotainment systems, safety technologies, and navigation, ensuring seamless performance in connected vehicles.

• Miniaturization of Connectors: As the demand for lightweight and compact designs in modern automotive systems increases, there is a growing trend toward miniaturized connectors. These connectors are smaller yet more efficient, meeting the requirements for space-saving, high-performance systems in applications like electric vehicles (EVs), autonomous driving, and advanced driver-assistance systems (ADAS).

• Integration of Connectors with Powertrain Systems: With the rise of electric vehicles (EVs) and hybrid powertrains, connectors are becoming increasingly integrated with powertrain systems. This integration is key to ensuring efficient energy flow and power management in EVs and hybrids, where high-power and energy-efficient connectors are necessary for optimal vehicle performance.

• Advancements in High-Power Connectors: The automotive industry is witnessing the development of high-power connectors capable of handling the increased demands of electrification, including the needs of electric and hybrid vehicles. These connectors ensure the safe and efficient transmission of power between components like batteries, motors, and charging systems, supporting the broader transition to electric mobility.

• Move Toward Autonomous and Electric Vehicle Applications: The growth of autonomous vehicles (AVs) and the increasing electrification of vehicles are driving the demand for connectors that can support complex sensor systems, communication networks, and power management solutions. These connectors are crucial for integrating systems like ADAS, vehicle-to-everything (V2X) communication, and autonomous driving technologies.

The automotive and transportation connector technology market is being reshaped by emerging trends that emphasize performance, miniaturization, and integration with evolving vehicle systems. The move toward high-speed fiber optics, miniaturized connectors, and integration with powertrain systems is enhancing the functionality and efficiency of modern vehicles. As the market shifts toward electric vehicles and autonomous driving, connector technologies will continue to evolve to meet the new challenges posed by these innovations, ultimately driving the future of transportation.

Automotive and Transportation Connector Technology Market : Industry Potential, Technological Development, and Compliance Considerations

The automotive and transportation connector technology market is undergoing significant transformation, driven by the increasing complexity of vehicle systems, demand for higher performance, and growing focus on electrification and automation.

• Potential in Technology:

The potential of connector technologies, particularly in fiber optics, radio frequency (RF), and integrated circuits (ICs), is immense. These advancements enable faster data transmission, improved signal integrity, and better power management, which are critical for applications such as infotainment, safety systems, autonomous driving, and electric powertrains.

• Degree of Disruption:

The degree of disruption in the market is considerable, with traditional copper-based connectors giving way to high-speed fiber optics and RF solutions. These technologies enable faster, more reliable communication between vehicle systems, improving the performance of connected and autonomous vehicles. Additionally, miniaturized connectors are replacing bulkier traditional connectors, allowing for more compact and efficient designs, particularly in electric vehicles (EVs) and hybrid powertrains.

• Current Level Technology Maturity:

In terms of current technology maturity, connectors based on copper and basic integrated circuits are well-established. However, newer technologies such as fiber optics, high-frequency RF, and powertrain-integrated connectors are rapidly maturing and beginning to see widespread adoption.

• Regulatory Compliance:

Regulatory compliance is increasingly important, especially for EVs and autonomous vehicles, where safety and environmental standards are rigorous. Connector technologies must meet stringent requirements for energy efficiency, safety, and electromagnetic compatibility (EMC). The market is adapting to these regulations, driving innovation that aligns with global standards for sustainability and safety in the automotive sector.

Recent Technological development in Automotive and Transportation Connector Technology Market by Key Players

Automotive and transport technologies continue to evolve at a breakneck pace from electric vehicles to autonomous driving and more connected, efficient transportation systems. The leading players in the automotive and transportation connector technology market are adapting to these changes by innovating their products to meet the evolving requirements for better performance, safety, and environmental compatibility. Below are some recent developments from leading companies in the market:

• TE Connectivity: TE Connectivity is committed to advancing and refining connectors for electric and hybrid vehicles. They have produced high-performance connectors for powertrain systems and, more recently, introduced novel connections for charging systems and battery management. The company has focused on miniaturization and high-speed communication solutions to support the growing demand for smaller, more efficient components in EVs and autonomous vehicles. TE Connectivity has also expanded its portfolio of sensors and connectors for advanced driver-assistance systems, including infotainment applications.

• YAZAKI: YAZAKI is a leader in automotive wiring and connector systems and has unveiled advanced solutions for electric vehicle applications. The new line of connectors incorporates innovations focused on improving energy efficiency, thermal management, and integration with advanced powertrain systems. These solutions are particularly relevant for EVs and hybrid vehicles, which require efficient power distribution and management. YAZAKI has also invested in smart connectors and integrated modules with high-speed data transfer capabilities, addressing the growing need for more connected vehicle systems.

• Aptiv: Aptiv has been a pioneer in developing next-generation connectors and wiring systems for connected and autonomous vehicles. The company’s recent innovations include lightweight, high-performance connectors for electric and autonomous vehicles. Aptiv has focused on improving signal integrity and reducing the overall size of connectors to accommodate the space constraints in modern vehicle designs. Additionally, their smart connector solutions are designed to support vehicle-to-vehicle (V2V) communication, ADAS, and infotainment systems, contributing to more efficient, connected, and autonomous driving experiences.

• Sumitomo Wiring: Sumitomo Wiring Systems, a leading supplier of high-quality automotive connector systems, has designed and released a new family of high-speed connectors suitable for autonomous vehicles and electric powertrains. The company has introduced solutions that ensure improved data transmission speeds as well as energy efficiency for ADAS and electric vehicle charging infrastructure. Durability and heat-resistant connectors by Sumitomo play an important role in supporting the growing demand for EVs and hybrid vehicles, which require robust, reliable performance.

• Molex: Molex has recently made significant strides in expanding its automotive connector portfolio, focusing on connectors for electric vehicles, autonomous systems, and high-speed data transmission applications. Molex offers high-speed, high-density connectors that meet the demands for in-vehicle communication, advanced infotainment, and ADAS. The development of optical and RF connectors that enable faster data transfer with higher reliability between components is crucial for modern connected and autonomous vehicles. MolexÄX%$%Xs innovations are helping shape smart and connected mobility solutions.

These developments demonstrate how leading players are pushing the envelope of connector technology to meet the demanding needs of an industry where the automobile is fundamentally changing. Innovative high-speed data transmission, energy-efficient power distribution, and miniaturization will play key roles in a future automotive world characterized by greater connectivity, electrification, and autonomy. As these trends continue, connector technologies will support the integration of more advanced vehicle systems and contribute to the creation of future mobility solutions.

Automotive and Transportation Connector Technology Market Driver and Challenges

The automotive and transportation connector technology market is experiencing significant growth due to the ongoing advancements in electrification, connectivity, and autonomous driving. As vehicles become smarter, more connected, and more energy-efficient, the demand for innovative connector technologies has surged. These connectors are critical for powering systems in electric vehicles (EVs), enhancing data transmission for infotainment and advanced driver-assistance systems (ADAS), and supporting the integration of autonomous driving features. However, several challenges must be addressed to fully realize the potential of these technologies. Below are key drivers and challenges impacting the market:

The factors responsible for driving the automotive and transportation connector market include:

• Growing Demand for Electric Vehicles (EVs): The rise of EVs is a key driver in the connector technology market. As electric vehicles require complex powertrains and high-capacity charging systems, there is an increasing need for robust connectors that can handle high-power loads and ensure efficient energy distribution. This demand drives innovations in powertrain connectors and charging infrastructure.

• Shift Toward Autonomous Vehicles: The development of autonomous vehicles (AVs) requires advanced connectors capable of supporting high-speed data transmission for sensors, cameras, and vehicle-to-vehicle communication systems. This trend fuels the demand for high-performance connectors that can ensure reliable data flow for critical AV systems, contributing to safer and more reliable autonomous driving experiences.

• Miniaturization and Increased Connectivity: As automotive systems become smaller and more integrated, the need for miniaturized connectors that can fit into tight spaces while still providing high-performance data transmission increases. This trend supports the growing demand for smaller, lighter, and more efficient connector solutions in modern vehicles, especially for EVs and hybrid systems.

• Increased Demand for In-Vehicle Infotainment Systems: With consumers demanding more sophisticated in-vehicle entertainment, navigation, and connectivity, the need for high-speed connectors for infotainment systems has grown. These connectors are necessary for ensuring seamless communication between multimedia systems, onboard sensors, and external devices, driving the need for high-performance data connectors.

Challenges in the automotive and transportation connector market are:

• Rising Complexity in Automotive Electrical Systems: As vehicle systems become more integrated, the complexity of automotive electrical systems increases. This presents challenges in designing connectors that can accommodate a wider range of applications, handle higher data speeds, and maintain reliability under varying conditions.

• Cost and Reliability Concerns: Automotive connectors must balance performance with cost-effectiveness. As the industry increasingly turns to advanced technologies like fiber optics and RF connectors, there is a challenge to keep manufacturing costs competitive while maintaining high reliability and durability in demanding automotive environments.

• Compliance with Environmental and Safety Regulations: The automotive industry is subject to stringent regulatory requirements for safety, electromagnetic compatibility (EMC), and environmental standards. Ensuring that connectors meet these evolving regulations can be challenging, especially as new technologies like autonomous driving systems and EVs introduce additional requirements for energy efficiency, safety, and emissions control.

• Integration with Evolving Automotive Platforms: As vehicle architectures evolve, integrating new connector technologies with existing platforms becomes complex. Many vehicles are designed with legacy connectors, and retrofitting them to support new, high-speed, high-power, and data-heavy applications can be challenging from a design and cost perspective.

The Automotive and Transportation Connector Technology Market is being shaped by several key drivers including the rise of EVs, the shift toward autonomous vehicles, miniaturization, and the growing demand for in-vehicle infotainment systems. At the same time, challenges such as rising complexity, cost concerns, regulatory compliance, and integration with evolving automotive platforms remain. However, these drivers and challenges are pushing the industry toward more innovative solutions, including high-speed data transmission technologies, miniaturized connectors, and integrated powertrain systems. These advancements are pivotal in supporting the shift toward smarter, safer, and more efficient vehicles, ultimately shaping the future of automotive and transportation systems.

List of Automotive and Transportation Connector Technology Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies automotive and transportation connector technology companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the automotive and transportation connector technology companies profiled in this report include.

• TE Connectivity

• Yazaki

• Aptiv

• Sumitomo Wiring

• Molex

Automotive and Transportation Connector Technology Market by Technology

• Technology Readiness by Technology Type: The technology readiness of printed circuit boards (PCBs), integrated circuits (ICs), radio frequency (RF), and fiber optics varies within the automotive and transportation connector technology market. PCB and IC technologies are highly mature, with well-established applications in traditional automotive and powertrain systems. These technologies are essential for power distribution and signal processing in internal combustion engine vehicles and some electric vehicle systems. RF connectors are progressing rapidly in the context of advanced driver-assistance systems (ADAS), in-vehicle communications, and vehicle-to-vehicle (V2V) systems. Fiber Optic connectors, though still emerging in automotive applications, are becoming more viable, especially for high-speed data transmission in autonomous and connected vehicles. RF and Fiber Optics technologies are particularly suited for autonomous vehicles and EVs due to their ability to handle vast amounts of data at high speeds with minimal interference. However, the regulatory compliance and cost-effectiveness of these technologies are still under scrutiny. As they mature, these technologies are expected to play a critical role in enabling next-generation vehicle systems, from infotainment to power management and autonomous navigation. While PCBs and ICs are mature, RF and Fiber Optics are nearing readiness, particularly for electric and autonomous vehicles. The key applications across all these technologies are improving vehicle safety, communication, and performance.

• Competitive Intensity and Regulatory Compliance: The competitive intensity in the automotive and transportation connector technology Market is high, driven by the adoption of advanced technologies like PCBs, ICs, RF, and Fiber Optics. Companies are racing to develop next-gen connectors for electric vehicles (EVs), autonomous driving systems, and high-speed data transmission. The entry of new players, along with increasing investments in research and development, has intensified competition. Regarding regulatory compliance, each technology faces distinct challenges. PCBs and ICs must adhere to safety standards for automotive wiring, electromagnetic compatibility (EMC), and energy efficiency, while RF and Fiber Optics must meet stringent environmental regulations and data transmission standards for autonomous and connected vehicles. As regulatory standards evolve, connector manufacturers must ensure that their technologies comply with global standards such as ISO, UL, and IEC certifications. Furthermore, innovations must align with the industryÄX%$%Xs shift toward sustainability, reducing the carbon footprint of vehicle systems. Overall, balancing innovation with regulatory requirements remains a key challenge as the market becomes more competitive.

• Disruption Potential by Technology Type: The disruption potential of technologies like printed circuit boards (PCBs), integrated circuits (ICs), radio frequency (RF), and fiber optics in the automotive and transportation connector technology market is significant. PCB and IC technologies are evolving to accommodate the increasing demand for smaller, more efficient connectors in electric and autonomous vehicles. RF and fiber optic technologies, which enable high-speed data transmission and robust signal integrity, have the potential to replace traditional copper-based connectors, offering faster communication between vehicle systems. Fiber optics, in particular, offers high bandwidth and low latency, making it ideal for autonomous vehicle applications. The integration of these technologies could enable smarter vehicles, with enhanced safety, performance, and efficiency. As these technologies mature and become more cost-effective, they will disrupt traditional connector technologies, driving innovation in the automotive and transportation sectors. The demand for next-generation connectors will only grow, pushing the boundaries of what is possible in terms of communication, power distribution, and overall vehicle performance.

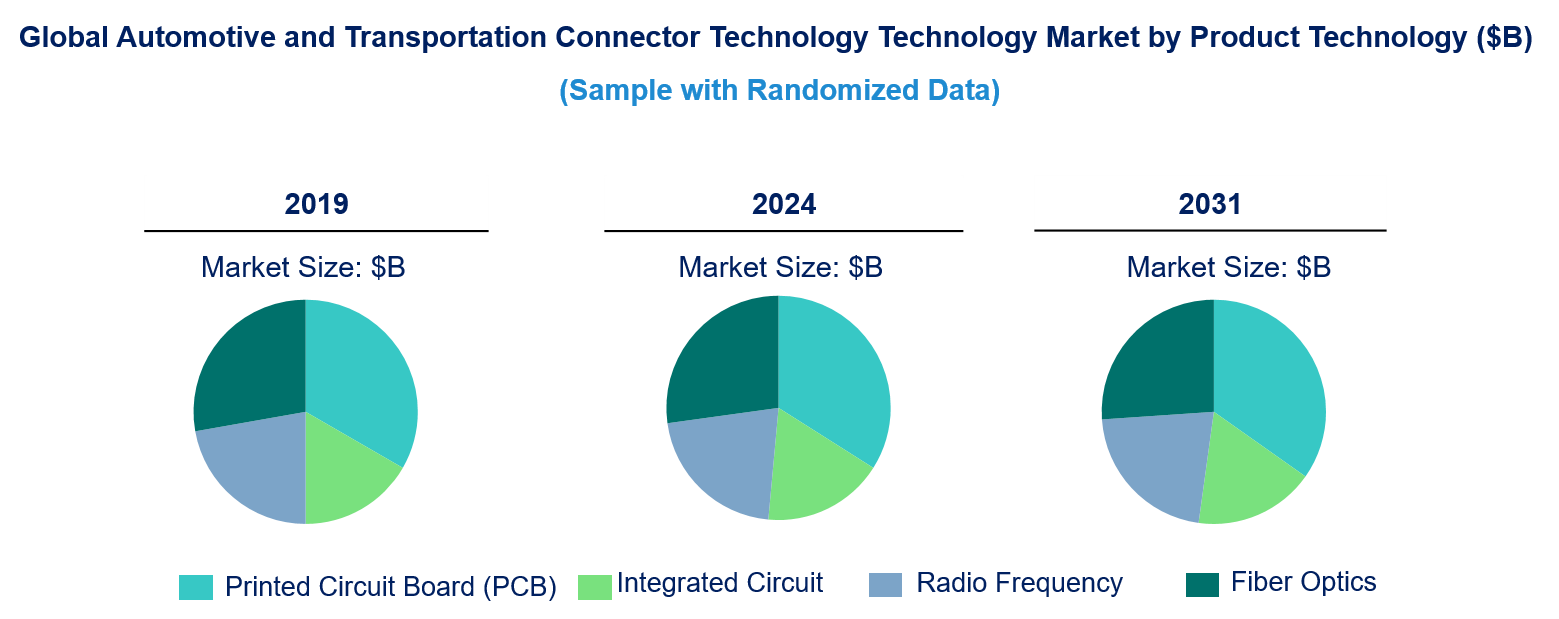

Automotive and Transportation Connector Technology Market Trend and Forecast by Product Technology [Value from 2019 to 2031]:

• Printed Circuit Boards (PCB)

• Integrated Circuits

• Radio Frequency

• Fiber Optics

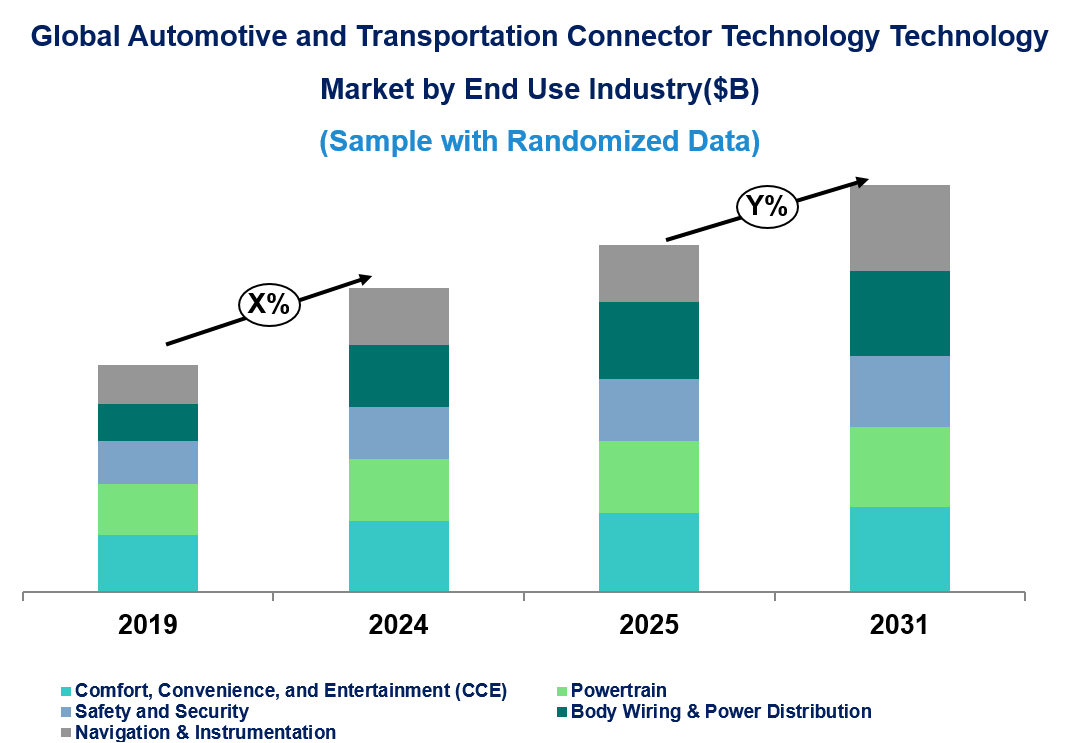

Automotive and Transportation Connector Technology Market Trend and Forecast by End Use Industry [Value from 2019 to 2031]:

• Comfort, Convenience, and Entertainment (CCE)

• Powertrain

• Safety and Security

• Body Wiring & Power Distribution

• Navigation & Instrumentation

Automotive and Transportation Connector Technology Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Automotive and Transportation Connector Technology Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Automotive and Transportation Connector Technology Market

Market Size Estimates: Automotive and transportation connector technology market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global automotive and transportation connector technology market size by various segments, such as end use industry and product technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global automotive and transportation connector technology market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different applications, technologies, and regions for technology trends in the global automotive and transportation connector technology market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global automotive and transportation connector technology market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global automotive and transportation connector technology market by product technology (printed circuit boards (pcb), integrated circuits, radio frequency, and fiber optics), end use industry (comfort, convenience, and entertainment (cce), powertrain, safety and security, body wiring & power distribution, and navigation & instrumentation), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different product technologies? What are the drivers and challenges of these product technologies in the global automotive and transportation connector technology market?

Q.5. What are the business risks and threats to the technology trends in the global automotive and transportation connector technology market?

Q.6. What are the emerging trends in these product technologies in the global automotive and transportation connector technology market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global automotive and transportation connector technology market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global automotive and transportation connector technology market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this automotive and transportation connector technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global automotive and transportation connector technology market?