Aramid Fiber Market Trends and Forecast

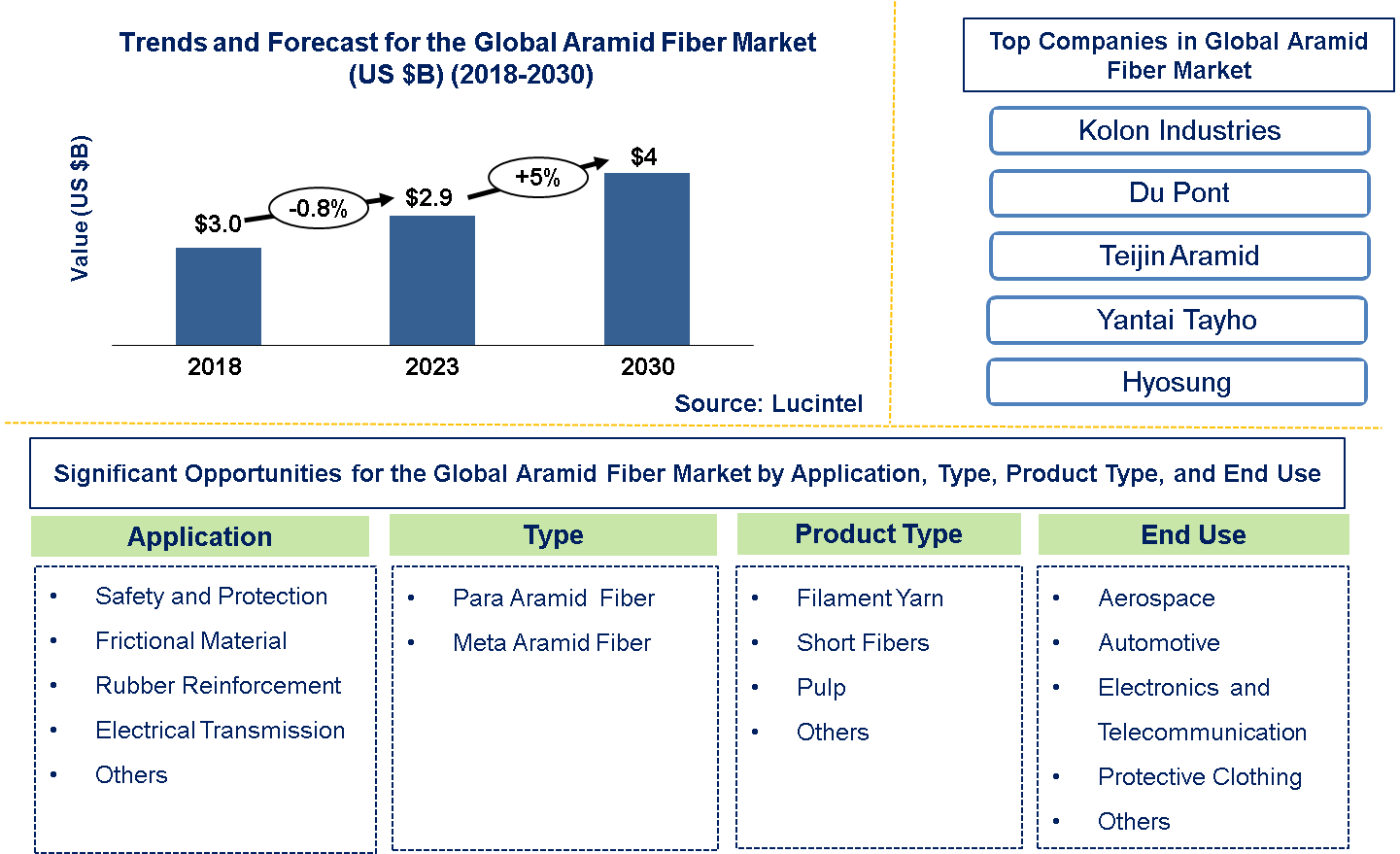

Lucintel finds that the future of the global aramid fiber material market looks promising with opportunities in safety and protection, frictional material, rubber reinforcement, and electrical transmission applications. The global aramid fiber market is expected to reach an estimated $4 billion by 2030 with a CAGR of 4% from 2023 to 2030. The major drivers of growth for this market are increasing usage of aramid fiber in brake pads, clutches, gaskets, linings, and tires in automotive and the growing demand for protective clothing from defense and industrial sectors.

The global market for aramid fiber is therefore reliant on aromatic amines and acids, which are then polymerized into polyamide and spun into high-strength fibers through controlled chemical reactions to ensure toughness and heat resistance. Quality assurance involves sourcing 100% pure raw materials worldwide. Competitive price determinants consider the cost of raw materials, efficient production, and demand in the market, whereby leaders utilize economies of scale and technology for their profitability. Prices differ according to fiber strength, modulus and application based on industry benchmarks affected by regional variations coupled with specialty purposes. Pricing strategies revolve around innovation and partnerships to help respond to dynamic market forces as well as bolstering growth in chemical synthesis plus material engineering in the sector of aramid fibers.

• Lucintel forecasts that safety and protection will remain the largest application by value and volume due to increasing in government initiatives for the safety of the employees and public.

• Para aramid fiber is expected to remain the largest market by value and volume over the forecast period mainly driven by its increasing use in automotive, defense, and industrial sector.

• Europe is expected to remain the largest market and due to increasing demand for lightweight and flexible materials from the automotive and military & defense industries. Europe is expected to witness the highest growth over the forecast period.

Country wise Outlook for the Aramid Fiber Market

The aramid fiber market is witnessing substantial growth globally, driven by increased demand from various industries such as safety and protection, electrical transmission, automotive. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major aramid fiber producers in key regions: the USA, Germany, China, India, and Brazil.

Emerging Trends in the Aramid Fiber Market

Emerging trends in the Aramid fiber Market shaping its future applications and market dynamics:

1. Nanostructured Aramid Fibers: Kevlar nanostructures that can enhance their physical properties such as strength and toughness for applications in high-performance textiles and structural components.

2. Smart Textiles: Development of wearable technology where aramid fibers form a part of them, which could have fire resistance or electrical conductivity for applications in protective clothing and healthcare sector.

3. Bio-based Aramid Fibers: Study investigations on bio-aramids derived from renewable resources to minimize environmental impact and improve the sustainability of the manufacturing process.

4. Functional Coatings: Designing functional coatings using aramid fibers to improve features such as water repellency, UV resistance and antibacterial properties in various applications.

5. Advanced Composite Materials: Designing new composite materials made with aramid fibers with improved stiffness, impact resistance, and fatigue life for aerospace, automotive industries and sporting goods.

A total of 107 figures / charts and 68 tables are provided in this 205-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Aramid Fiber Market

Recent developments in aramid fiber market by various companies highlight ongoing innovations and advancements across different sectors:

• Automotive Industry: To lightweight and enhance fuel efficiency, aramid fibers are increasingly being incorporated into automotive applications. For instance, these fibers can be used in tires to enhance their durability and performance; they can also be found in light body parts that would aid crash resistance.

• Military and Defense: Aramid fibers like Kevlar continue to play a vital role in ballistic protection applications such as body armors or helmets. The latest trends focus on improving the strength-to-weight ratio of such products and developing multifunctional materials that offer enhanced protection from a wider range of threats.

• Aerospace: Aerospace makes use of aramid fibers due to their high strength, heat, and chemical resistance. They are also increasingly being integrated into aircraft structures to reduce weight and improve fuel efficiency while at the same time providing better fire resistance for cabin interiors.

• Sporting Goods: Aramid fiber based materials are used extensively in bicycle frames, tennis rackets, hockey sticks among others because of their high tensile strength and impact resistance. One recent development has been the combining of aramid with other materials so as to give it improved characteristics such as stiffness and durability.

• Industrial Applications: Aramid fibers are employed in various industries including construction, oil & gas as well as marine. Recent progress has centered on using aramid fiber composites to improve the longevity of industrial equipment or structures.

• Electronics and Telecommunications: Because of their thermal properties, mechanical characteristics especially for flexible printed circuit boards (PCBs) or electronic device protective cases; aramid fibers feature significantly in electronics. What is more is that thinner/lighter materials with greater robustness have been developed.

Strategic Growth Opportunities for Global Aramid Fiber Market

Expansion in Automotive Sector

• Market Demand: Aramid fibers are increasingly used in automotive applications such as tires, brake pads, and reinforcements due to their lightweight and high-strength properties.

• Opportunity: Growth in electric vehicles (EVs) and demand for fuel-efficient vehicles enhance opportunities for aramid fibers to replace traditional materials, improving performance and sustainability.

Aerospace and Defense Applications

• Critical Requirements: Aramid fibers are essential in aerospace for aircraft components, ballistic protection, and structural reinforcements due to their exceptional strength-to-weight ratio.

• Opportunity: Increasing defense budgets globally and advancements in aerospace technology drive demand for lightweight, durable materials like aramid fibers, supporting market growth.

Protective Clothing and Ballistic Protection

• Industry Needs: Aramid fibers are widely used in protective gear, including body armor, helmets, and cut-resistant gloves, due to their resistance to abrasion and impact.

• Opportunity: Growing emphasis on workplace safety, law enforcement requirements, and military applications expand the market for high-performance protective textiles made from aramid fibers.

Infrastructure and Construction Projects

• Market Segment: Aramid fibers reinforce concrete structures, cables, and geotextiles, providing enhanced durability and resistance to environmental factors.

• Opportunity: Urbanization trends, infrastructure development, and investments in sustainable construction drive demand for aramid fiber-based solutions that improve structural integrity and longevity.

Electronics and Telecommunications

• Sector Growth: Aramid fibers are used in electronic components, fiber optic cables, and printed circuit boards (PCBs) for their dielectric properties and mechanical strength.

• Opportunity: Expansion of telecommunications networks, demand for high-speed data transmission, and miniaturization of electronic devices create opportunities for aramid fibers in high-tech applications.

Energy Sector Utilization

• Renewable Energy: Aramid fibers support wind turbine blades, solar panel reinforcements, and oil exploration equipment, offering lightweight and durable solutions.

• Opportunity: Growth in renewable energy projects and focuses on energy efficiency drive demand for aramid fibers that withstand harsh environmental conditions and enhance operational reliability.

Aramid Fiber Market Drivers and Challenges

The market of aramid fibers is being driven by the fact that it has an exceptional strength weight ratio, high temperature resistance and is applicable in many industries. It is crucial to acknowledge its importance in terms of lightness high technology solutions by looking at how it’s increasingly required in these areas such as the automotive industry, aerospace sector and protective clothing. Nevertheless, there exist barriers to entry into this market including expensive production costs, limited production capacity and substitute raw materials. This would mean developing new technologies on a regular basis, investing strategically in production capacities and producing innovative products that can meet the changing demands and needs of consumers as well as international guidelines.

The key drivers for the global aramid fiber market include:

1. Properties that are highly resistant and lightweight: Kevlar, an example of aramid fiber has an excellent strength-to-weight ratio thus being suitable for use where light but strong materials are required.

2. Demand growth in Defense and Security: The aramid fibers’ demand is driven by growing security concerns worldwide which necessitate their use in protective clothing, ballistic applications, and military vehicles.

3. Expansion of Automotive Safety: Use for safety parts like airbags in vehicles is one of the automotive applications driving demand for aramid fiber.

4. Industrial Growth: Heat resistance as well as mechanical properties causes the application of aramid fibers such as construction, aerospace, and electronics.

5. Environment and Sustainability Trends: As industries shift towards green materials, which are known to be long lasting and reusable rather than traditional substances; this supports more usage of these kinds of textiles made from aramids.

The challenges in the global aramid fiber market include:

1. High Cost: This makes them more expensive compared to other types of synthetic fibers due to complicated production processes involved in making them.

2. Limited Production Capacity: Aramid fibers have limited availability due to constraints on their production capacities creating an imbalance between supply and demand situations thus creating price instability.

3. Competitive Substitutes: It hinders market progression of aramid fibers when there are alternative materials or synthetic fibers that have similar features.

4. Environmental Concerns: Activities associated with aramid fiber manufacturing process also lead to environmental damage which necessitates consistent attempts at controlling it even with existing recycling technologies presently available for addressing this aspect of production and disposal challenges simultaneously faced by these fibers’ users in many application sectors globally.

5. Regulatory and Safety Standards: To expand into defense, aerospace or automotive markets companies producing those fibers should comply with rigorous regulatory requirements applied in these areas.

6. Technological Advancements: In order to remain competitive on the market, ongoing innovations are required for improving production efficiency, reducing costs and developing new applications.

The aramid fiber market has to remain innovative in order to tackle difficulties and take advantage of growth promoters. Growth in this market will be achieved through further development of manufacturing processes, sustainable alternatives and new applications. In order to stay competitive and meet the changing market needs, it will require strategic investments and cross-sector partnerships to address production constraints and cost issues.

Aramid Fiber Suppliers and Their Market Shares

In this globally competitive market, several key players such as Kolon Industries, Du Pont, Teijin Aramid, Yantai Tayho, Hyosung. etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us. If you wish to deep dive in competitive positioning of these players then you can look into our other syndicated market report on “Aramid Fiber Market Leadership Report".

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies aramid fiber companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the aramid fiber companies profiled in this report include.

• Kolon Industries

• Du Pont

• Teijin Aramid

• Yantai Tayho

• Hyosung Corporation

These companies have established themselves as leaders in the global aramid fiber market, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the aramid fiber market are evolving, with the entry of new players and the emergence of innovative composite cylinder market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Aramid Fiber Market by Segment

The market for aramid fiber is growing fast in various areas. In this case, protective clothing will continue to be a major driver of expansion by the rules that are now demanding safety of people. Aramid fibers have become popular for use as ballistic protection and lightweight structural components in aerospace and defense due to their remarkable strength/weight ratio. The spread in automotive applications is also noticed as some manufacturers resort to composites made from aramid fiber in pursuit of light weighting and energy consumption reduction through following stringent emissions requirements, and consumer preference for eco-friendly materials. Flexible circuit boards based on aramid fibers are increasingly being engaged in electronics and telecommunications because they last longer than any other type. Also, industries exploit the advantages of using solidified liquid filaments, which help them resist severe environmental conditions thus boosting the overall industry’s growth. This discussion highlights some driving forces that encourage their wider acceptance and significant obstacles to it too.

Aramid Fiber Market by Application [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Safety and Protection

• Frictional Material

• Rubber Reinforcement

• Electrical Transmission (Optical Fiber)

• Others

Aramid Fiber Market by Type [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Meta Aramid Fiber

• Para Aramid Fiber

Aramid Fiber Market by End Use Industry [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Aerospace

• Automotive

• Electronics and Telecommunication

• Protective Clothing

• Others

Aramid Fiber Market by Region [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

Features of Aramid Fiber Market

• Market Size Estimates: Aramid fiber market size estimation in terms of value ($M) and volume (M lbs).

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Market size by application, type, end use, and region

• Regional Analysis: Aramid fiber market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different application, type, end use, and regions for the aramid fiber market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the aramid fiber market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in aramid fiber or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the aramid fiber market size?

Answer: The global aramid fiber market is expected to reach an estimated $4 billion by 2030.

Q2. What is the growth forecast for aramid fiber market?

Answer: The aramid fiber market is expected to grow at a CAGR of 5% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the aramid fiber market?

Answer: The major drivers of growth for this market are increasing usage of aramid fiber in brake pads, clutches, gaskets, linings, and tires in automotive and the growing demand for protective clothing from defense and industrial sectors.

Q4. What are the major applications for aramid fiber?

Answer: Protective clothing and aerospace & defense are the major applications for aramid fiber.

Q5. What are the emerging trends in aramid fiber market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, includes nanostructured aramid fibers, smart textiles, bio-based aramid fibers, functional coatings, and advanced composite materials.

Q6. Who are the key aramid fiber companies?

Answer: Some of the key aramid fiber companies are as follows:

• Du Pont de Nemours

• Teijin Aramid

• Yantai Tayho Advanced Materials Co. Ltd.

• Hyosung Corporation

• China National Bluestar Co. ltd

• Huvis Corporation

• Kermel

• X-Fiper New Material Co. Ltd.

Q7. Which aramid fiber product segment will be the largest in future?

Answer: Lucintel forecasts that Para aramid fiber is expected to remain the largest market by value and volume over the forecast period mainly driven by its increasing use in automotive, defense, and industrial sector. Meta aramid is expected to witness highest growth over the forecast period.

Q8. In aramid fiber market, which region is expected to be the largest in next 7 years?

Answer: Europe is expected to remain the largest region and witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high-growth opportunities for the global aramid fiber market by application (safety and protection, frictional material, rubber reinforcement, electrical transmission, and others), type (para aramid fiber and meta aramid fiber), end use (aerospace, automotive, electronics and telecommunication, protective clothing, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the global aramid fiber market?

Q.5 What are the business risks and threats to the global aramid fiber market?

Q.6 What are emerging trends in the global aramid fiber market and the reasons behind them?

Q.7 What are some changing demands of customers in the global aramid fiber market?

Q.8 What are the new developments in the global aramid fiber market? Which companies are leading these developments?

Q.9 Who are the major players in the global aramid fiber market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in the global aramid fiber market, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M&A activities did take place in the last five years in the global aramid fiber market?