Global Carbon Fiber in the Aerospace and Defense Market Trends and Forecast

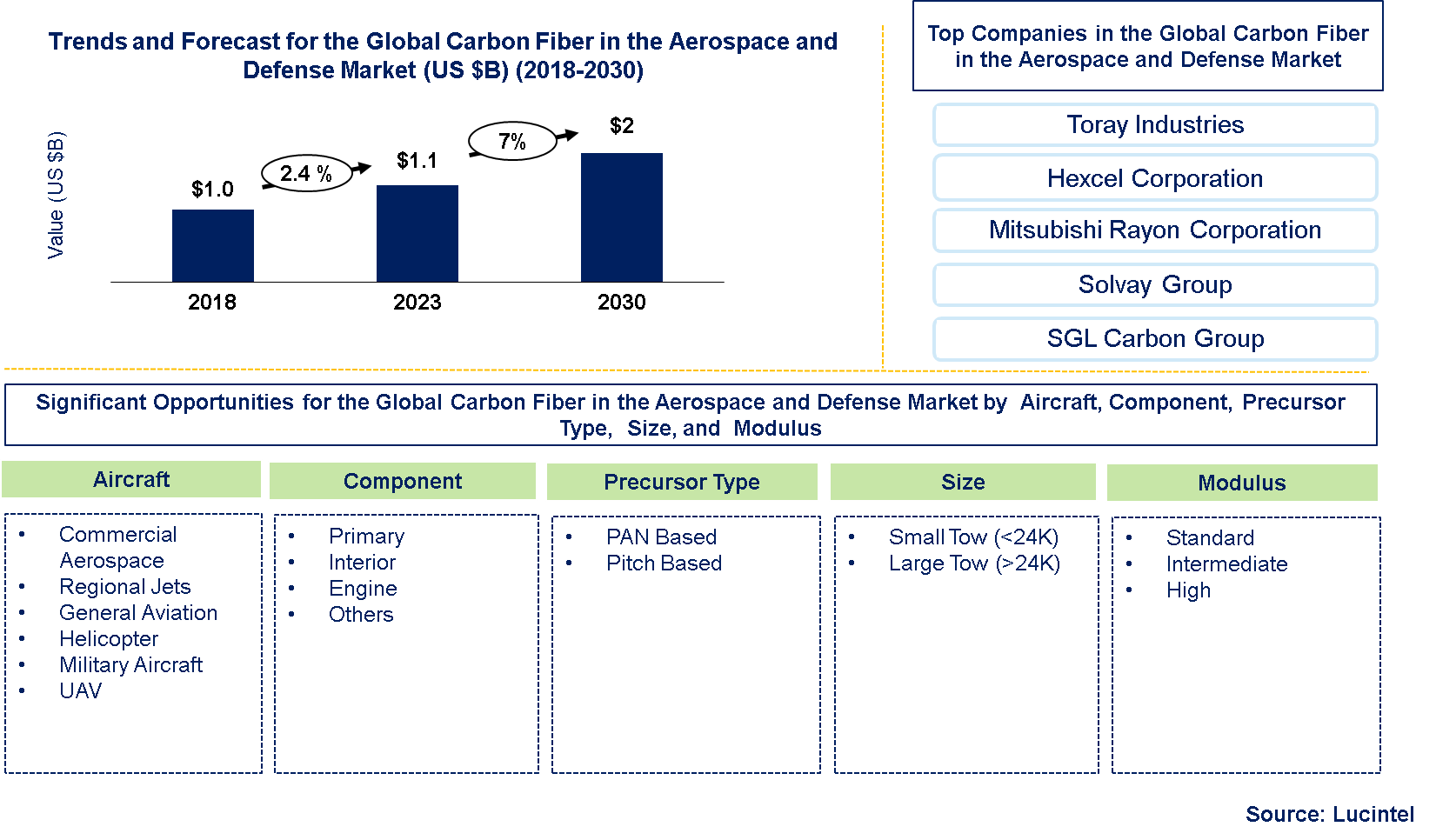

Lucintel finds that the future of the carbon fiber in aerospace and defense market looks attractive with opportunities in the commercial aircraft, regional aircraft, general aviation, helicopter, UAV and Others. The carbon fiber in aerospace and defense market is expected to reach an estimated $2 billion by 2030 with a CAGR of 7% fro m 2023 to 2030. The major drivers for the carbon fiber in aerospace and defense market are the increasing demand for advanced high-performance lightweight materials and growing end use industries, growth of aircraft with high carbon fiber penetration such B787, A350WXB, and A380.

Variety of materials that are used in this market include steel, aluminum and composite. Steel cylinders are firm and lasting; aluminum ones light and immune to corrosion; composites such as carbon fiber reinforced polymers find application due to their exceptional strength to weight ratio. The performance and safety of composite cylinders can be improved by adding glass fibers with resin. In comparison with fiberglass and aramid fibers, carbon fiber is very expensive in the aerospace and defense industries because it has advanced properties which make its production processes costly. Carbon fiber is always worth it even though it may cost a fortune due to its outstanding performance which comes in handy for high-performance applications.

• Lucintel forecasts that commercial aerospace will be the largest aircraft by value and the UAV aircraft will witness the highest growth by value during the forecast period. Increasing demand for light weight materials with higher performance benefits in aerospace and defense industry are driving market growth over the forecast period.

• By tow size, small tow (less than 24k) is expected to remain the largest segment by volume and witness the highest growth over the forecast period because its mainly use in the aerospace industry owing to high tensile strength.

• North America is expected to remain the largest region during the forecast period. The growth of carbon fiber in North American aerospace & defense market is driven by increasing carbon fiber content and growth of aircraft deliveries of B787 and B777.

Country wise Outlook for the Global Carbon Fiber in the Aerospace and Defense Market

The global carbon fiber in the aerospace and defense market is witnessing substantial growth, driven by increased demand from various industries. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major carbon fiber in the aerospace and defense market producers in key regions: China, USA, Germany, and India.

Emerging Trends in Global Carbon Fiber in the Aerospace and Defense Market

1. Nano-Enhanced Carbon Fibers: Incorporating nanomaterials such as carbon nanotubes into carbon fiber composites so as to enhance their mechanical properties, electrical conductivity and thermal performance even further.

2. Automated Manufacturing Processes: Employment of automated methods like automated fibre placement (AFP) and automated tape laying (ATL) to increase efficiency, consistency and precision in production of carbon fibre components.

3. Development of Sustainability and Recycling: Developing recycling techniques for CFRCs to address environmental issues. Research is focused on recycling CF waste into reusable materials while also developing eco-friendly manufacturing processes.

4. Production of High-Temperature Resins: Production of new high temperature resins capable of operating under severe conditions in aerospace applications such as high-speed flight as well as harsh environmental situations without affecting the integrity of the CFRP parts.

5. Unmanned Aerial Vehicles (UAVs): The increased use of carbon fiber in the design and manufacture of UAVs and drones attributed to its lightness and high strength essential for enhancing flight efficiency as well as payload capacity. These innovations and trends reflect the industry’s focus on enhancing performance, safety, and user experience while catering to a wide range of applications and preferences.

6. Improved Repair Techniques: Advancements in repair technologies for CFC’s including new adhesive systems and repair techniques which improve the life span & reliability of aerospace & defense structural components

A total of 89 figures / charts and 76 tables are provided in this 181-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Global Carbon Fiber in the Aerospace and Defense Market

Recent developments in global carbon fiber in the aerospace and defense market by highlight ongoing innovations and advancements across different sectors

1. Increased demand for light materials: The expansion of carbon fiber can be attributed to its high strength and light weight that are important in reducing fuel consumption and improving aerospace and defense performance.

2. New factories: Several companies are establishing new production facilities for carbon fibers as a result of increased market demand. For example, Hexcel has expanded its manufacturing capabilities in the U.S. and Europe.

3. Technological advancements: Carbon fiber technology is evolving with improvements in fiber weaving techniques and resin systems that are enhancing its performance and durability.

4. Sustainable production efforts: There is an increasing focus on making carbon fibers using sustainable methods. Companies such as Mitsubishi Chemical work on environmentally friendly methods of production and recycling technologies.

5. Upgrade of military aircrafts: Carbon Fiber Composites are being used more frequently than ever before on military aircrafts because they improve performance while requiring less maintenance. For instance, Lockheed Martin and Boeing have added more carbon fiber composites to their latest fighter jets and transport aircrafts.

6. Space exploration: Carbon fiber plays a critical role in space exploration missions. For instance, NASA uses it in making spacecrafts’ bodies, satellite components among others so that they can withstand extreme space conditions through the use of composite polymers like those based on carbon-fiber-reinforced plastic (CFRP).

7. Collaboration with Partnerships: Collaborations between aerospace –defense firms with producers have been instrumental in advancing development of new applications for these products. Rolls-Royce for example has partnered with manufacturers of CFMs to develop advanced turbine blades.

8. Cost cutting programs: The cost associated with producing car-bon fibers has been worked out to make them available for different defence needs such as body armor. These price cuts stems from process innovation coupled to economies of scale attained by large-scale manufacturing processes which includes a continuous tow production process.

Strategic Growth Opportunities for Global Carbon Fiber in the Aerospace and Defense Market

1. Inflated Recreational Use: The increasing demand for inflatable boats is partly attributed to the rising popularity of recreational activities like fishing, boating and water sports. In fact, people who find it more convenient to have a portable and collapsible boat are buying these inflatables for leisure. This trend is very strong in areas with many water bodies such as North America and Europe and it has begun going worldwide.

2. Improvements in Materials and Technologies: High performance fabrics including lightweight materials with tremendous strength have been developed to provide greater service life and enhance the functionality of modern inflatable boats. Furthermore, air chambers, valves and repair kits are now made using better technology thus improving on reliability as well as maintenance ease. Such companies can therefore attract customers looking for products that are superior by investing in this technology.

3. Increased Marine and Military Applications: Owing to their adaptability as well as ease of deployment, inflatable boats are being employed increasingly in marine and military contexts. Governments also find them useful for rescues because they have become patrol vessels when necessary or tenders for large ships. Such government investments therefore result into steady need for robustly performing inflatable boats.

4. Expanding into Emerging Markets: People living in emerging markets like Asia Pacific region, Africa or Latin America earn more nowadays so they’re able to afford marine or other recreational activities. With improved economic conditions coupled with infrastructural development; the demand for such marine vessels is predicted to grow rapidly hence making it ideal as an investment opportunity.

5. Eco-friendly Green Production Methods: Today’s consumers look forward to purchasing environmentally friendly products due to several reasons. Producers ought therefore consider eco-friendly practices which include use of sustainable materials among others that help reduce carbon footprints since this will enable them gain from this consumer preference. Also producing merchandise that conform with ecological regulations while promoting corporate sustainability might attract environmental consciousness customers.

6. Better Distribution Channels: Online retailing growth together with e-commerce platforms can create new opportunities for penetrating larger market segments. Those firms who employ digital marketing strategies and build a strong presence on the internet will capture many customers and hence increase their sales volumes.

Carbon Fiber in the Aerospace and Defense Market Drivers and Challenges

The carbon fiber segment in the aerospace and defense industry is changing very fast because of the need to establish lightweight, high-performance materials. Its weight to strength ratio makes it possible for fuel efficiency and structural integrity to improve. The aerospace evolves and the defense spending grows, thus a wider application of carbon fiber. Nonetheless, this poses some challenges such as high cost of production, complicated processes involved in manufacturing and supply chain constrains. This consideration is essential for stakeholders’ ability to exploit opportunities while mitigating risks that come along with them.

The key drivers for the carbon fiber in the aerospace and defense market include:

1. Increased Demand for Lightweight Materials: In aviation and defense, carbon fiber is admired because it has a high strength to weight ratio which is essential for reducing fuel consumption and enhancing performance. This is also attributed to the need to improve airplane efficiency as well as reduce the cost of operation.

2. Advancements in Aerospace Technologies: Continuous innovation by the aerospace industry in aspects like advancing aircrafts and spacecrafts demands improved materials like carbon fibers with better performances and efficiency.

3. Enhanced Structural Performance: Carbon fibers have good mechanical properties such as high strength (tensile) and stiffness that are necessary for producing robust structures needed in defense applications such as military planes or tanks that undergo a lot of stress.

4. Growing Defense Budgets: Globally there has been an increase in defense expenditure especially in areas like Europe, Asia-Pacific and United States. As a result, the demand for advanced materials including carbon fiber used in defense applications is growing leading to an increased demand globally.

5. Focus on Fuel Efficiency and Environmental Concerns: The emphasis on minimizing fuel use coupled with environmental impact mitigation befits aerospace. Reduction of weight through utilizing carbon fibers aids in improving fuel efficiency while limiting emissions during combustion processes.

The challenges facing the carbon fiber in the aerospace and defense market include:

1. High Production Costs: Making carbon fiber involves complex capital intensive methods resulting into expensive raw materials plus manufacturing hence limiting market opportunities especially in low-cost market segments.

2. Complex Manufacturing Processes: Sometimes, manufacture of components made from carbon fiber could be intricate requiring special tools as well as being done by experts. Therefore, it might take a long time to complete this process giving room for additional costs incurred during production.

3. Limited Recycling Options: The recycling of composites containing carbon fibers is difficult due to their complicated nature and difficulty when separating matrix material from them. This affects its sustainability aspect besides raising environmental concerns too.

4. Supply Chain Constraints: Raw materials’ availability together with production facilities for carbon fiber may not always be reliable leading to disruptions. Consequently, this alters both availability level plus price of the end product.

5. Competition from Alternative Materials: Other materials that could be a threat to carbon fiber include advanced composites and lightweight alloys as technology advances. These may sometimes have equal or better performance as carbon fiber but at a lower cost.

Adding to that, more people are taking part in recreational activities, technology has advanced, marine and military uses have been extended, and emerging markets are demanding for them. In conclusion, market expansion will be aided by such factors as the use of sustainable practices; embracing digital distribution; and coming up with new products that are innovative

Global Carbon Fiber in the Aerospace and Defense Market Suppliers and Their Market Shares

In this globally competitive market, several key players such as Toray Industries, Hexcel Corporation, Mitsubishi Chemical Corporation, Solvay Group, and SGL Carbon Group etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each major players Contact Us. Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies carbon fiber in the aerospace and defense market companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the carbon fiber in the aerospace and defense market companies profiled in this report includes.

• Toray Industries

• Hexcel Corporation

• Mitsubishi Chemical Corporation

• Solvay Group

• SGL Carbon Group

These companies have established themselves as leaders in the global carbon fiber in the aerospace and defense market with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations. The market share dynamics within the global carbon fiber in the aerospace and defense market are evolving, with the entry of new players and the emergence of innovative technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Carbon Fiber in the Aerospace and Defense Market by Segment

The carbon fiber main growth areas are aircraft structures reducing fuselage, wings and tail sections thereby reducing weight thus improving fuel efficiency in the aerospace and defense market. Carbon fiber is increasingly being used in defense equipment because of its lightweight properties and high strength for military vehicles and gear. The reason why carbon fiber is used in satellite components is that it has low weight as well as being strong which enables structural integrity. In helicopters, carbon fiber is employed to develop rotor blades for improved performance and reduced weight. Moreover, unmanned aerial vehicles (UAVs) have begun incorporating carbon fiber to enhance their performance and durability with advanced lightweight materials.

Carbon Fiber in Aerospace and Defense Market by Aircraft [Volume (M lbs) and Value ($ Million) from 2018 to 2030]:

• Commercial Aerospace

• Regional Jets

• General Aviation

• Helicopter

• Military Aircraft

• UAV

Carbon Fiber in Aerospace and Defense Market by Component [Volume (M lbs) and Value ($ Million) from 2018 to 2030]:

• Primary

• Interior

• Engine

• Others

Carbon Fiber in Aerospace and Defense Market by Precursor Type [Volume (M lbs) and Value ($ Million) from 2018 to 2030]:

• PAN Based

• Pitch Based

Carbon Fiber in Aerospace and Defense Market by Tow size [Volume (M lbs) from 2018 to 2030]:

• Small Tow (<24K)

• Large Tow (>24K)

Carbon Fiber in Aerospace and Defense Market by Modulus [Volume (M lbs) from 2018 to 2030]:

• Standard

• Intermediate

• High

Features of Carbon Fiber in the Aerospace and Defense Market

• Market size estimates: Carbon fiber in the aerospace and defense market size estimation in terms of value ($M) and volume (M lbs) shipment.

• Trend and forecast analysis: Market trend (2018-2023) and forecast (2024-2030) by application, and end use industry.

• Segmentation analysis: Carbon fiber in the aerospace and defense market size by various applications such as aircraft, component type, precursor type, tow size type, and by modulus type in terms of value and volume shipment.

• Regional analysis: Carbon fiber in the aerospace and defense breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth opportunities: Analysis on growth opportunities in different applications and regions of carbon fiber in the aerospace and defense market.

• Strategic analysis: This includes M&A, new product development, and competitive landscape of carbon fiber in the aerospace and defense market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in composites in the global carbon fiber in the aerospace and defense market or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ_

Q1. What is the carbon fiber in the aerospace and defense market size?

Answer: The global carbon fiber in the aerospace and defense market is expected to reach an estimated $2 billion by 2030.

Q2. What is the growth forecast for carbon fiber in the aerospace and defense market?

Answer: The carbon fiber in the aerospace and defense market is expected to grow at a CAGR of 7% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the carbon fiber in the aerospace and defense market?

Answer: The major drivers for the growth of this market are increased demand for lightweight materials, advancements in aerospace technologies, enhanced structural performance, and growing defense budgets.

Q4. What are the major applications or end use industries for carbon fiber in the aerospace and defense market?

Answer: commercial aerospace is the major end uses for carbon fiber in the aerospace and defense markets.

Q5. What are the emerging trends in carbon fiber in the aerospace and defense market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include nano-enhanced carbon fibers, automated manufacturing processes, development of sustainability and recycling, and production of high-temperature resins .

Q6. Who are the key carbon fiber in the aerospace and defense market companies?

Answer: Some of the key carbon fiber in the aerospace and defense market companies are as follows:

• Toray Industries

• Hexcel Corporation

• Mitsubishi Chemical Corporation

• Solvay Group

• SGL Carbon Group

Q7.Which carbon fiber in the aerospace and defense market material segment will be the largest in future?

Answer: Lucintel forecasts that the interior component segment will show above average growth during the forecast period.

Q8. In carbon fiber in the aerospace and defense market, which region is expected to be the largest in next 7 years?

Answer: APAC will remain the largest region and is expected to witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. How big are the opportunities in the carbon fiber market in aerospace and defense industry by aircraft (commercial aerospace, regional jets, general aviation, helicopter, military aircraft and UAV), by precursor type (PAN based, pitch based), by tow size (small tow, large tow), by modulus (standard, intermediate, high), and region (North America, Europe, Rest of the World (including APAC)?

Q.2. Which product segments will grow at a faster pace and why?

Q.3. Which region will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the drivers, challenges, and business risks of carbon fiber in the aerospace and defense market?

Q.5. What are the business risks and competitive threats of carbon fiber in the aerospace and defense market?

Q.6. What are the emerging trends of carbon fiber in the aerospace and defense market and the reasons behind them?

Q.7. What are some of the changing demands of customers for carbon fiber in the aerospace and defense market?

Q.8. What are the new developments of carbon fiber in the aerospace and defense market and which companies are leading these developments?

Q.9. Who are the major players of carbon fiber in the aerospace and defense market? What strategic initiatives are being taken by key companies for business growth?

Q.10. What are some of the competing products for carbon fiber in the aerospace and defense market and how big of a threat do they pose for loss of market share by product substitution?

Q.11. What M&A activity has occurred in the last have years and what has its impact been of carbon fiber in the aerospace and defense industry?