Adhesives in the Global Composite Market Trends and Forecast

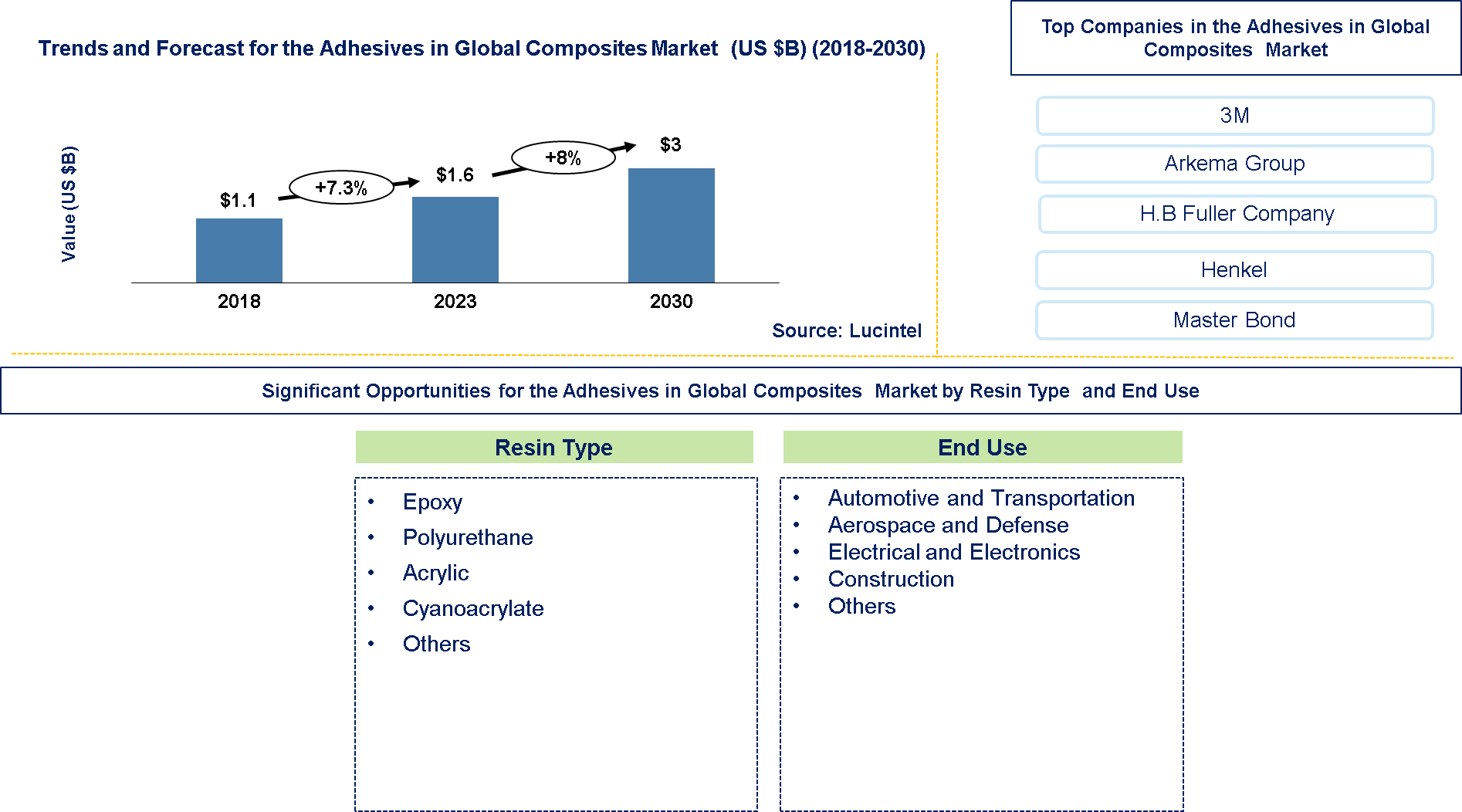

The future of the adhesives in the global composite intermediate material market looks promising with in the transportation, electrical & electronics, and construction industries. The adhesives in the global composite market is expected to reach an estimated $3 billion by 2030 with a CAGR of 8% from 2023 to 2030. The major growth drivers for this market are increasing use of lightweight materials in transportation, and performance benefits, such as lower corrosion in construction and higher thermal resistance in E&E industries.

The most common constituents of adhesives in the global composite are resins, fillers, and hardeners. Among the common types of resins are epoxy, polyurethane and acrylic which give it adhesive’s strength and durability. For instance, silica or carbon black can be used as fillers to improve adhesion properties and increase viscosity. Finally, hardeners help in controlling curing process to produce a greater bond. For the most part, adhesives in the global composite outstrip regular adhesives in terms of prices due to their advanced performance and tailored make-up. Their cost mirrors an unsurpassed bonding strength, durability and application under high stress conditions. In fact these advantages far outweigh higher prices in crucial industry sectors.

• Lucintel forecasts that in this market, transportation will remain the largest end use supported by growing automotive production and increasing focus on lightweight materials. Pickup truck boxes, deck lids, fenders, hoods, and bumpers are some of the major applications of adhesives in the global composite in the transportation industry. Construction is expected to witness the highest growth over the forecast period.

• Epoxy based adhesives in the global composite will remain the largest segment over the forecast period supported by its high performance characteristics and it is also expected to witness the highest growth over the forecast period.

• Asia Pacific is expected to remain the largest market by value and volume. ROW is expected to witness the highest growth over the forecast period because of growing demand from construction and other end uses.

Country wise Outlook for the Adhesives in the Global Composite Market

The adhesives in the global composite market is witnessing substantial growth globally. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major adhesives in the global composite producers in key regions: the USA, Germany, China, and Japan

Emerging Trends in the Adhesives in the Global Composite Market

Emerging trends in the adhesives in the global composite Market shaping its future applications and market dynamics:

• Developments in Viscous Substance Composition: Advanced epoxy and polyurethane based blends of new resin systems are driving the industry. This formulation enhances bonding strength, flexibility and resistance to environmental factors for demanding applications in aerospace, automotive and construction fields. It move towards adhesives with low amounts of volatile organic compounds (VOCs) is gaining momentum. These products meet stricter environmental regulations and appeal both to customers and sectors searching for alternative practices that are more environmentally friendly. Innovations in thermoplastic adhesives improve their application versatility. These adhesives are easy to process and recycle, thus they become attractive for industries focusing on sustainability as well as waste reduction.

• Integration with Advanced Manufacturing Technologies: Automation and Robotics: This integration improves manufacturing efficiency and accuracy through automation of composite adhesive with automated dispensing as well as robotic systems. It reduces human error, boosts consistency, speeds up production processes favoured by the automotive or aerospace industries. Nowadays we see a growing trend where adhesives in the global composite are combined with 3D printing technologies. Integration like this enables creation of intricate custom parts while allowing design flexibility and rapid prototyping capabilities. Development of smart adhesives which respond to external stimuli such as temperature among others is gaining ground today. Such features allow these adhesives alter their properties depending on the environment hence advanced options for dynamic high-performance applications.

• Growth in End-Use Industries: Lightweight high-strength bonding applications in the aerospace and defense sectors have seen increased employment of advanced adhesives in the global composite. They ensure durability of aircraft components and defense equipment under extreme conditions. In terms of better performance, safety as well fuel economy, the automobile industry has shifted to adhesives in the global composite. Bonding lightweight materials using these types would enhance crash resistance and decrease overall vehicle weight. An increasing number of adhesives in the global composite are used in the construction and infrastructure industries for bonding materials in high-stress environments. The structural application is characterized by a need for strong and durable bonds that many innovations in adhesive formulations address.

• Focus on Sustainability and Eco-Friendliness: Interest in developing bio-based adhesives from renewable resources is growing. These types of adhesives have lower environmental impact, which aligns with the industry’s drive towards sustainability. Adhesive technology advances are targeting products that are either recyclable or reusable. Such trends support circular economy principles while helping industries to minimize waste production as well as cut on their carbon footprints. Stricter environmental regulations push for development of adhesives that meet new standards for low emission rates, less hazardous substances among others. Market acceptance and growth depend on compliance with these regulations.

• Emergence of New Regional Markets: Rapid industrialization as well as infrastructure development within Asia-Pacific region drives the demand for adhesives in the global composite. China or India constitute large markets on automotive, construction, electronics etc., where these countries are emerging economies. Latin America has an expanding construction industry , automobile sector thereby creating additional opportunity for composite adhesive manufacturers to enter into new markets.. Strong demand from advanced adhesive solutions is backed by investments into infrastructure and industrial growth. Increasing infrastructural projects or industrial activities in the Middle East necessitate stronger performance from adhesives. In this region, construction together with oil/gas sectors cause significant demand for adhesion agents.

A total of 140 figures / charts and 97 tables are provided in this 205-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Adhesives in the Global Composite Market

Recent developments in adhesives in the global composite market by various companies highlight ongoing innovations and advancements across different sectors:

• Technological Developments in Adhesive Formulations: Latest developments have seen the creation of advanced resins which possess superior adhesion property, flexibility and resistance to extreme conditions; new epoxy and polyurethane formulations for example offer enhanced performance for aerospace and automotive applications. The market is moving toward low volatile organic compound (VOC) adhesives and eco-friendly ones. For instance, Henkel Company and BASF are introducing low-emission glues because of more exacting environmental laws as well as satisfying the needs of customers who desire green products.

• Capacity Expansion: New Manufacturing Facilities: Sika AG and 3M among other major players have increased their production capacity recently to satisfy increasing demand for adhesives in the global composite. New manufacturing plants in China and the U.S will help improve supply chain efficiency while supporting global market growth. In an effort to enhance productivity precision, companies are investing in state-of-the-art manufacturing technologies such as automation or robotics. Automation has improved product consistency through dispensation or curing processes hence reducing operational costs.

• Strategic Partnerships and M&A Activities: Increasingly, there has been a trend towards merger and acquisition activities within the industry as firms strive to expand into newer product lines as well as reach out to wider markets; for instance Huntsman Corporation acquired the adhesive business wing from one of its prominent rivals intending on strengthening its position in the aerospace industry. Collaborations between adhesive manufacturers with end-user industries such as aerospace sectors alongside automotive ones has helped in spearheading innovations. Additionally, research institutions collaborative partnerships facilitate ground breaking adhesive technology development.

• Growth in End-Use Applications: Due to lightweight bonding materials that improve structural performance, demands increases regarding adhesives in the global composite’ usage within aerospace segment, whereas automotive sector is not an exception. Adhesive formulations innovation has made them more applicable in such areas with high stress or advanced vehicle designs. In construction industry, adhesives in the global composite are employed to bond materials in high performance applications. Such as adhesive developed for better durability and environmental resistance thereby supporting infrastructure projects and renovations.

• Focus on Sustainability and Recycling: There has been a search for biobased glues which are produced from renewable sources; firms are also developing adhesives that have less impact on the environment so that they can be aligned with global trends of sustainability and decreased reliance on fossil fuels. There have been advances in recycling technologies of adhesives in the global composite. Innovations such as adhesives designed for ease of disassembling or recycling thus minimize waste while promoting reutilization of composites.

Strategic Growth Opportunities for Adhesives in the Global Composite Market

Expanding Product Offerings

• Specialized Formulations: Creating specialized adhesive formulations for niche applications such as medical devices or advanced electronics will open new market segments. Custom solutions that address specific performance needs can differentiate products and attract new customers.

• Multi-Functional Adhesives: The creation of multi-functional adhesives that exhibit an added property like thermal conductivity or electrical insulation could offer greater value and wider application possibilities. These inventions serve industries with complicated specifications and various demands.

• Enhanced Packaging Solutions: Introducing innovative packaging alternatives like user-friendly dispensing systems, extended shelf life may enhance customer satisfaction and ease of use. Effective packaging solutions can improve the appeal of a product and make it more competitive in the market.

Strategic Partnerships and Collaborations

• Industry Alliances: Strategic alliances with players in the aerospace, automotive, and construction industries can drive product development and market penetration. Cooperative efforts may result in joint solution development process thus strengthening our presence in the marketplace.

• Research Collaborations: Partnering with research institutions and universities can accelerate innovation and technology development. Joint research projects have led to breakthroughs in the adhesive technology which have given access to cutting edge technological advancement.

• Global Partnerships: Establishing global partnerships with regional distributors/manufacturers is capable of increasing market reach while enabling entry into new geographic regions. They encourage localized production and distribution strategies.

Investment in R&D and Technology

• Innovation in Adhesive Chemistry: Investing into R&D activities aimed at discovering completely different adhesive chemistries or formulations helps to create superior performing products. Continuous innovation is a must to keep pace with competitors’ changes that happen within industry demands.

• Advanced Manufacturing Technologies: By employing advanced manufacturing technologies such as automated production lines or precise mixing systems, quality consistency of products can be improved hence raising productivity levels. Technological advancements enable better overall operational capabilities to be achieved.

• Sustainability Research: Focusing on sustainable/eco-friendly adhesive related research is aligned with industry trends and regulatory requirements. This leads to products with less environmental impact that are positioned well in the market and can attract environmentally conscious customers.

Geographic Market Expansion

• Emerging Market Penetration: Targeting emerging markets with increasing industrialization and construction activities such as Asia-Pacific, Latin America and others could create growth opportunities. Making products compliant to local needs and regulations will facilitate entry into new markets.

• Regional Manufacturing Facilities: Building or expanding manufacturing facilities within key regions may be necessary to reduce production costs while improving supply chain efficiency. Local production capabilities help ensure faster delivery terms as well as better customer service.

• Localized Marketing Strategies: The use of localized marketing strategies that take into account regional preferences and industry trends can boost market penetration. Better promotional efforts can be achieved if a marketer understands local buyer behavior, it helps one to improve on marketing approaches.

Leveraging Digital Technologies

• Digital Marketing and E-Commerce: Employing online marketing tactics like email marketing campaigns provides an opportunity to reach a wider audience directly through e-commerce sites. By using online channels businesses increase their chances of being more visible for potential clients hence more engagements.

• Data Analytics: Depending on data analysis about market trends, customer preferences or product performance; companies make decisions for the future development of their business projects. Such approach is aimed at optimizing product development as well as marketing strategies through data driven methods.

• Virtual Product Demonstrations: Adhesive performance and applications can be understood better by incorporating virtual demonstrations of products. Decision making process is guided by digital tools which support virtual testing together with evaluation thus giving useful information based on which choices must be taken into account in the end but not limited by them.

Adhesives in the Global Composite Market Drivers and Challenges

The adhesives in the global composite market is pivotal in industries requiring corrosion-resistant storage solutions. Driven by benefits like increased demand from aerospace and automotive industries, progress in adhesive formulation technologies, and increased manufacturing capacity and automation, it faces challenges such as high initial cost and investment, and technical and performance limitations.

The key drivers for the adhesives in the global composite market include:

1. Increased Demand from Aerospace and Automotive Industries: Advanced high strength adhesives in the global composite are being driven by the space program and automobile industry with their low weight, strong bond strength, and ability to bond advanced materials. These adhesives achieve weight savings thus improving fuel economy and performance. They can be employed in aggressive environments as well as in high-stress applications that require adhesive formulations with high-performance characteristics essential for durability.

2. Progress in Adhesive Formulation Technologies: Advancements in adhesive technology such as new high performance resins and low-volatile organic compound (VOC) formulations are expanding the use of adhesives in the global composite. Epoxy-polyurethane-blend-based advanced resins are more flexible, stronger adhesion, and can withstand environmental conditions affecting their quality among other things. Additionally, development of eco-friendly adhesives aligns with a stricter regulatory regime for environment safety and growing consumer preference for sustainable products thereby enhancing market growth.

3. Increased Manufacturing Capacity and Automation: The expansion of composites adhesives is also supported by increased production capacities and advancements in manufacturing technologies. Companies have been investing on new facilities aimed at enhancing efficiency of production, accuracy as well as scalability through automation. Costly dispensing and curing operations are automated which consequently reduce variation within the product line while minimizing operational expenses; this enables manufacturers to meet increased demand without raising prices hence continued growth of the market.

Challenges in the Adhesives in the Global Composite Market

1. High Production Costs: Advanced materials used in adhesives in the global composite often necessitate complex manufacturing processes that make them more expensive than traditional adhesive bonding methods. In addition to this, specialty resins, fillers, advanced production technologies tend to be expensive making it difficult for them to be widely adopted especially where cost is considered a key determinant for selecting raw materials or products. Maintaining both high performance and affordability at the same time is therefore a major challenge for manufacturers who wish to play in price-sensitive markets.

2. Technical and Performance Limitations: Despite their benefits, adhesives in the global composite have some technical and performance limitations. Some of the issues related to adhesive performance include but not limited to compatibility with different substrates, cure challenges and environmental stability. Quality consistency is hard to achieve under these specific conditions even when production levels are scaled up or when special needs are being addressed; meeting stringent application requirements can be quite difficult due to this aspect. Such restrictions can hinder the uptake of adhesives in the global composite in particular applications.

The industry’s growth is fueled by innovation in adhesive technology and strong demand from end-use sectors, but expensive production processes and technical drawbacks pose major challenges. However, opportunities exist in developing environmentally friendly formulas as well as automating the processes while still addressing concerns over cost and performance. It is important to strike a balance between these factors for market dynamics and adoption.

Adhesives in the Global Composite Suppliers and Their Market Shares

In this globally competitive market, several key players such as 3M, Arkem Group, H.B and Fuller Company etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies adhesives in the global composite companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the adhesives in the global composite companies profiled in this report includes.

• 3M

• Arkema Group

• H.B. Fuller Company

• Henkel AG & Co. KGaA

• Master Bond Inc.

• Parker Hannifin Corp (Lord Corporation)

• Parsons Corporation

• Permabond LLC

• Pidilite Industries Ltd

• Sika AG

These companies have established themselves as leaders in the adhesives in the global composite market, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the adhesives in the global composite market are evolving, with the entry of new players and the emergence of innovative adhesives in the global composite market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Adhesives in the Global Composite Market by Segment

Aerospace and automotive industries are two of the leading sectors in the growing market for adhesives in the global composite, which is being fueled by a demand for lightweight, high-performance bonding solutions. The construction industry is also expanding because it has found more uses in structural applications and infrastructure projects. Furthermore, electronics and renewable energy businesses are on the rise with composites adhesives being utilized in advanced electronic devices and wind turbine manufacturing due to their toughness and specialized bonding properties.

The study includes a forecast for the adhesives in the global composite industry market by resin type, end use, and region as follows:

By Resin Type [Value ($M) Analysis for 2018 – 2030]:

• Epoxy

• Polyurethane

• Cyanoacrylate

• Acrylic

• Others

By End Use [Value ($M) Analysis for 2018 – 2030]:

• Automotive & Transportation

• Aerospace & Defense

• Electrical & Electronics

• Construction & Infrastructure

• Others

By Region [Value ($M) Analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific

• Rest of the World

Features of Adhesives in the Global Composite Market

• Market Size Estimates: adhesives in the global composite market size estimation in terms of value ($M) and (M lbs).

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Market size by product and application

• Regional Analysis: adhesives in the global composite market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different product, application, and region for the adhesives in the global composite market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the adhesives in the global composite market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

.

If you are looking to expand your business in Adhesives in the Global Compositeor adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the adhesives in the global composite market size?

Answer: The adhesives in the global composite market is expected to reach an estimated $3 billion by 2030.

Q2. What is the growth forecast for adhesives in the global composite market?

Answer: The adhesives in the global composite market is expected to grow at a CAGR of 8% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the adhesives in the global composite market?

Answer: The major growth drivers for this market are increased demand from aerospace and automotive industries, progress in adhesive formulation technologies, and increased manufacturing capacity and automation.

Q4. What are the major applications or end use industries for adhesives in the global composite?

Answer: Transportation and Construction are the major end uses for adhesives in the global composite.

Q5. What are the emerging trends in adhesives in the global composite market?

Answer: Emerging trends which have a direct impact on the dynamics of the industry include developments in viscous substance composition, integration with advanced manufacturing technologies, growth in end-use industries, focus on sustainability and eco-friendliness, and emergence of new regional markets.

Q6. Who are the key adhesives in the global composite companies?

Answer: Some of the key adhesives in the global composite companies are as follows:

• 3M

• Arkema Group

• H.B. Fuller Company

• Henkel AG & Co. KGaA

• Master Bond Inc.

• Parker Hannifin Corp (Lord Corporation)

• Parsons Corporation

• Permabond LLC

• Pidilite Industries Ltd

• Sika AG

Q7.Which adhesives in the global composite fiber type segment will be the largest in future?

Answer: Lucintel forecasts that epoxy resin based adhesives will remain the largest segment and it is also expected to witness the highest growth over the forecast period supported by its high performance characteristics.

Q8. In adhesives in the global composite market, which region is expected to be the largest in next 7 years?

Answer: Asia Pacific is expected to remain the largest region and witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high growth opportunities for the adhesives in the global composite market by application (automotive & transportation, aerospace & defense, electrical & electronics, construction & infrastructure and others), product (epoxy, polyurethane, cyanoacrylate, acrylic and others), and region (North America, Europe, Asia Pacific and the Rest of the World)?

Q. 2. Which segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5. What are the business risks and threats to the market?

Q.6. What are the emerging trends in this market and the reasons behind them?

Q.7. What are the changing demands of customers in the market?

Q.8. What are the new developments in the market? Which companies are leading these developments?

Q.9. Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11. What M & A activities have taken place in the last five years in this market?