Access Control as a Service Market Trends and Forecast

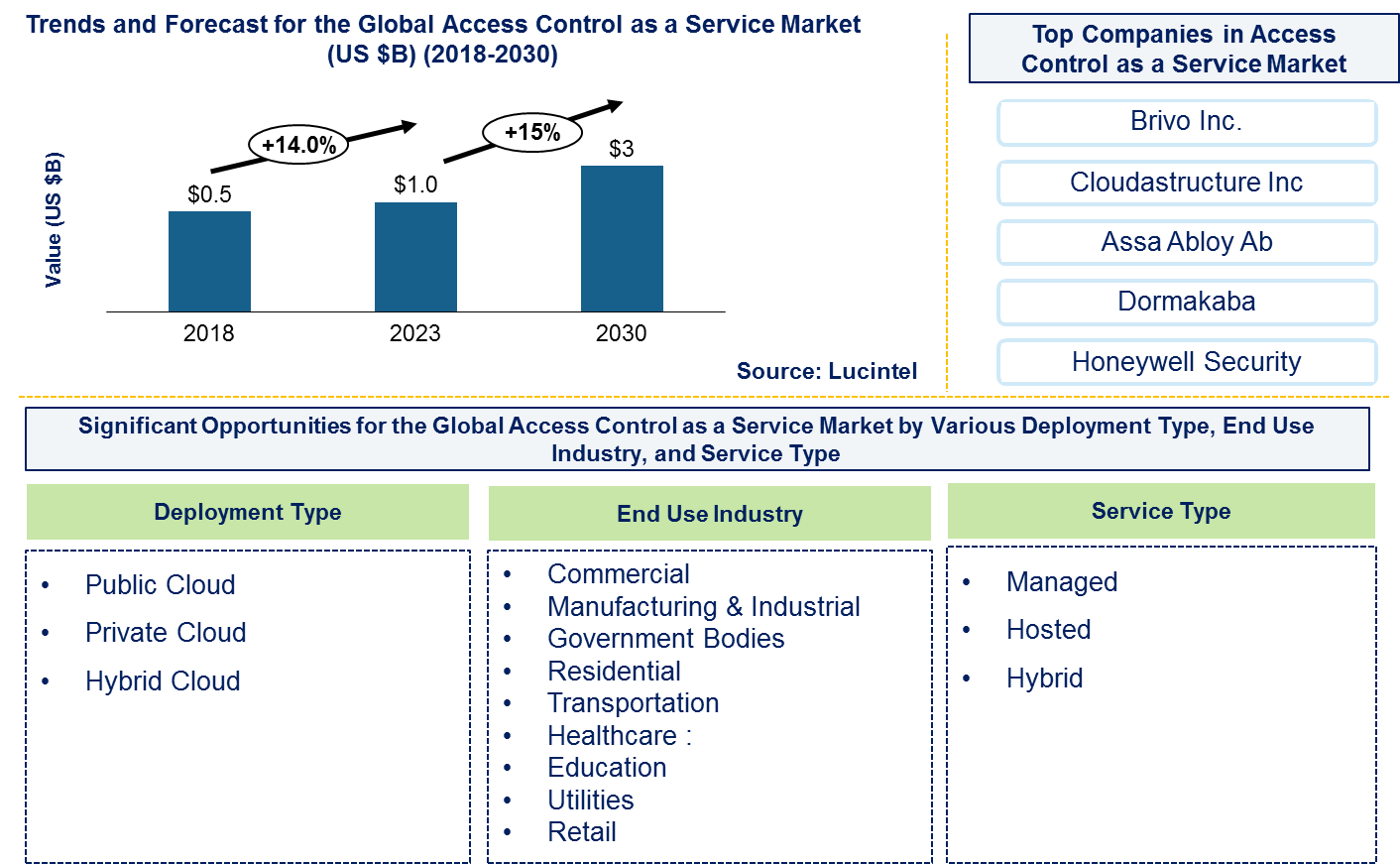

Lucintel finds that the future of the global access control as a service market looks attractive with opportunities in the commercial, manufacturing and industrial, government bodies, residential, transportation, healthcare, education, and utilities. The global access control as a service (ACaaS) market is expected to reach an estimated $3 billion by 2030 with a CAGR of 15% from 2023 to 2030. The major drivers for this market are increasing uses of cloud computing platforms and IoT technology, growing demand for cloud based hosted and managed services and rising adoption of electronic security products in access control as a services market.

Access Control as a Service (ACaaS) is a cloud-based security model that provides organizations with a flexible and scalable solution for managing access control systems. By leveraging cloud technology, ACaaS enables businesses to monitor and control who has access to their physical and digital assets without the need for extensive on-premises infrastructure. This service model is increasingly popular due to its cost-effectiveness, ease of deployment, and ability to integrate with various security systems. ACaaS platforms offer tools for creating and managing user profiles, including roles, permissions, and access rights. Administrators can easily add, modify, or revoke access for users based on organizational needs. ACaaS solutions support various authentication mechanisms, such as passwords, biometrics (fingerprint or facial recognition), and multi-factor authentication (MFA). This multi-layered approach enhances security by ensuring that only authorized individuals gain access.

• Lucintel forecasts that managed service will remain the largest service type and it is also expected to witness the highest growth over the forecast period due to the increasing demand in organizations to secure data and as adding and deleting access rights and credentials.

• Within the access control as a service market, public cloud will remain the largest segment by deployment type and private cloud is also expected to witness the highest growth over the forecast period due to growing demand from end user such as single organization, managed, and operated by the organization, a third party, or some combination of them.

• North America will remain the largest region due to high adoption of advanced and IoT based cloud computing to minimizing risk for a business or organization. APAC is expected to witness the highest growth over the forecast period supported by increasing uses of access control as service in commercial, manufacturing and industrial sectors.

Country wise Outlook for Access Control as a Service Market

The market is witnessing substantial growth globally, driven by increased demand from printing and packaging, building & construction, transportation, and industrial sectors. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major access control as a service producers in USA, Germany, China, India, Japan, and Brazil.

Emerging Trends in the Access Control as a Service Market

The specialty carbon black marketÄX%$%Xs size has been expanding rapidly, driven by the increasing adoption of polyimide film in various applications. The market size is influenced by factors such as development of self-healing polyimide films and integration of polyimide films in lightweight composite materials. The market size is estimated to continue its upward trajectory as industries across the globe seek to improve performance, efficiency, and sustainability.

Emerging trends in access control as a service market are shaping its future applications and market dynamics:

1. Cloud Integration: Digital Age’s Access Control as a Service (ACaaS) are now realistically becoming the choice for most organizations, providing centralized management and remote accessibility that ensures flexibility, scalability and no heavy on-premises infrastructure commitments.

2. Mobile Access Control: The trend of using mobile apps to manage access is growing. Smartphones can be utilized by the users to control entrance such as digital keys, and mobile credentials in order to have personalized security access anytime needed.

3. IoT Integration: This is increasingly being integrated into internet of things systems which enables real time monitoring and control through smart sensors, cameras and interconnected security systems leading to an overall better security measure.

4. Artificial Intelligence and Machine Learning: Advanced analytics, anomaly detection, predictive maintenance all based on AI machine learning technologies are improving security effectiveness and operational efficiency.

5. Biometric Authentication: The use of biometric authentication approaches such as fingerprints scanning or facial recognition has been increasing in adoption. These technologies enhance safety features while ensuring that only authorized individuals enter secured zones.

6. Unified Security Solutions: Physical security is more commonly being blended with cyber-security; hence ACaaS providers have started offering unified solutions. Management becomes easier while the general posture over security is strengthened.

A total of 80 figures / charts and 74 tables are provided in this 150-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments in Access Control as a Service Market

Recent developments in the access control as a service market reflect ongoing advancements in technology, expanding applications across industries, and evolving consumer needs.

• Cloud Security Reinforced: Cloud-based access control systems are being made more secure by using advanced encryption and multi-factor authentication, thus assuring data integrity and user secrecy.

• AI and Analytics Merging: The use of artificial intelligence with machine learning is encouraging real-time threat detection through predictive analytics, therefore improving the capability to forecast potential security breaches.

• Mobile Credentialing: A shift has been seen in mobile access solutions leading to increased rates at which providers of ACaaS are offering mobile credentials such as smartphones that make it even better for users to reach given facilities enhancing convenience and safety.

• Integration with Other Security Systems: This makes the access control as a service (ACaaS) unit work well with video surveillance, alarm system as well as identity management where they become one comprehensive security ecosystem which makes operations faster.

• User Experience Focus: Most recently, there have been developments which aimed at creating user-friendly interfaces and dashboards so that organizations would easily manage their respective access controls without necessarily requiring sophisticated knowledge on technology application.

• Regulatory Compliance Features: In order to meet regulatory compliance requirements such as GDPR or CCPA, ACaaS providers are now focusing on offered services including data protection and reporting capabilities among others within their platforms.

• Customization and Scalability: As organizations increasingly call for advanced customization in their access control systems with room for scalability options, solutions also keep offering more room for such adjustments while allowing businesses increase efficiency levels by over 30%.

Strategic Growth Opportunities for Access Control as a Service Market

Technological advances, regulatory changes and evolving consumer preferences will create strategic growth opportunities for the access control as a service market. Below are the key strategic growth opportunities for access control as a service:

• Emerging Markets Expansion: Rapid urbanisation and growth in infrastructure such as Asia-Pacific and Latin America creates a conducive environment for the adoption of ACaaS. The technology can help meet new business and government security needs that are much more scalable and efficient.

• IoT Integration: This rise of Internet of Things (IoT) devices offers great prospects for developers to build integrated security solutions on top of ACaaS platforms. For example, organizations could create comprehensive safety ecosystems by combining access control with smart devices, which enhance both digital as well as physical safety.

• Cybersecurity Focus: As the number of cyber threats increases, there is an increasing demand for integrated physical/cyber security solutions. So ACaaS providers have an opportunity to meet this need by offering access control combined with advanced cyber security measures ensuring a complete solution to overall organization’s protection.

• Tailored Access Control Solutions: Such organizations require customized access controls that match their specific requirements increasingly. It means that these flexible systems can be utilized by different businesses like small enterprises or large corporates therefore available from ACaaS vendors.

• Partnerships and Collaboration: ACaaS offerings can leverage strategic partnerships with technology providers, security companies, and system integrators to boost their capabilities within the market place. Consequently, this approach will enhance innovation development processes leading to wider market coverage for service providers.

• Mobile Remote Access Solutions: There exists surge in demand for mobile access alongside remote management capabilities mostly post-Covid-19 pandemic era. ACAAS vendors could develop user-friendly mobile apps where administrators can manage access control from anywhere thus enhancing convenience as well as maximizing the level of protection that it provides.

Access Control as a Service Market Driver and Challenges

Access control as a service play a crucial role in security management, scalability, cost efficiency, and remote management. The changing market dynamics are being driven by the increasing adoption of cloud computing and growing security concerns. However, challenges like cybersecurity threats and integration complexities to sustain growth and innovation in access control as a service market. The factors responsible for driving the access control as a service market include:

1. Cloud Adoption: The move to the cloud is a major catalyst in the growth of ACaaS. Cloud based solutions are preferred by organizations because they are easily scaled and flexible, which eliminates the necessity of huge upfront investments in hardware and infrastructure.

2. Growing Security Concerns: There has been an increased realization on strong security measures due to more incidents of security breaches and unauthorized access. This is where ACaaS comes in as it provides all-inclusive remedies for these problems.

3. Regulatory Compliance: Organizations have been forced to adopt reliable access control solutions to ensure compliance and avoid penalties occasioned by stricter regulations about data privacy such as GDPR or CCPA.

4. Cost-Effectiveness: A subscription based pricing model usually characterizes ACaaS making it a reasonable choice. It helps companies manage their budgets better, minimizes financial risks.

5. Integration with IoT: The rise of IoT devices presents opportunities for increased blending of security techniques. ACaaS can therefore be used in conjunction within smart technologies thus providing a 360 degree approach to managing security.

6. User-Friendly Solutions: Advances in technology have led to user-friendly interfaces that make it easy even for organizations to implement and manage access control systems through their mobile applications.

Challenges facing the access control as a service market are:

1. Cybersecurity Threats: ACaaS solutions are vulnerable to cyberattacks, given their reliance on cloud infrastructure. Unauthorized access can lead to data breaches, posing a significant risk to organizations.

2. Integration Complexities: Integrating ACaaS with existing security and IT systems can be complex, leading to potential compatibility issues that may hinder implementation.

3. Dependence on Internet Connectivity: ACaaS requires a stable internet connection; any disruption can impact access control capabilities, creating security vulnerabilities.

4. Customer Perception and Trust: Some organizations remain hesitant to adopt cloud-based solutions due to concerns over data privacy and the security measures employed by third-party providers.

5. Market Competition: The ACaaS market is becoming increasingly saturated, with numerous providers competing for market share, which can lead to price wars and pressure on profit margins.

6. Customization Needs: Organizations often seek tailored solutions to meet specific requirements, but not all ACaaS providers can offer the necessary level of customization, limiting their appeal.

In summary, while the ACaaS market is bolstered by strong drivers such as cloud adoption and growing security needs, it must navigate challenges like cybersecurity risks and market competition to ensure sustainable growth.

Access Control as a Service Suppliers and their Market Shares

In this globally competitive market, several key players such as Brivo, Cloud Structure, Assa Abloy, Dormakaba, Honeywell, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us by email at helpdesk@lucintel.com. Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies specialty carbon black companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the access control as a service companies profiled in this report includes.

• Brivo Inc.

• Cloud structure Inc

• Assa Abloy Ab

• Dormakaba

• Honeywell Security

These companies have established themselves as leaders in access control as a service industry, with extensive product portfolios, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within access control as a service market are evolving, with the entry of new players and the emergence of access control as a service technologies. Additionally, collaborations between raw material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Access Control as a Service Market by Segment

Major segments of access control as a service experiencing growth include commercial, industrial, and residential industries which contribute to enhancing the features of access control as a service. This access control as a service market report provides a comprehensive analysis of the marketÄX%$%Xs current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments, including by end use industry, service, and deployment. The report offers insights into regional dynamics, highlighting the major markets for access control as a service and their growth potentials. The study includes trends and forecast for access control as a service market through 2030, segmented by end use industry, service, deployment, and region are as follows:

By End Use Industry [Value ($M) Analysis from 2018 to 2030]:

• Commercial

• Manufacturing & Industrial

• Government Bodies

• Residential

• Transportation

• Healthcare :

• Education

• Utilities

• Retail

By Service [Value ($M) Analysis from 2018 to 2030]:

• Managed

• Hosted

• Hybrid

By Deployment [Value ($M) Analysis from 2018 to 2030]:

• Public Cloud

• Private Cloud

• Hybrid Cloud

By Region [Value ($M) Analysis from 2018 to 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

Features of Access Control as a Service Market

Market Size Estimates: Access control as a service market size estimation in terms of value ($M)

Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions

Segmentation Analysis: Market size by end use industry, service, and deployment

Regional Analysis: Access control as a service market breakdown by North America, Europe, Asia Pacific, and the Rest of the World

Growth Opportunities: Analysis of growth opportunities in different end use industry, service, deployment, and regions for the access control as a service market

Strategic Analysis: This includes M&A, new product development, and competitive landscape for the access control as a service market

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the access control as a service market size?

Answer: The global access control as a service market is expected to reach an estimated $3 billion by 2030.

Q2. What is the growth forecast for access control as a service market?

Answer: The access control as a service market is expected to grow at a CAGR of 15% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the access control as a service market?

Answer: The major drivers for this market are increasing uses of cloud computing platforms and IoT technology, growing demand for cloud based hosted and managed services and rising adoption of electronic security products in access control as a services market.

Q4. What are the major service type for access control as a service?

Answer: Managed service will remain the largest service type and it is also expected to witness the highest growth over the forecast period due to the increasing demand in organizations to secure data and as adding and deleting access rights and credentials.

Q5. Who are the key access control as a service companies?

Answer: Some of the key access control as a service companies are as follows:

• Brivo Inc.

• Cloud structure Inc

• Assa Abloy Ab

• Dormakaba

• Honeywell Security

• Digital Hands

• Microsoft Corporation

• Cisco Systems, Inc.

• Datawatch Systems, Inc

• Centrify Corporation

Q6. Which access control as a service deployment type segment will be the largest in future?

Answer: Lucintel forecasts that public cloud will remain the largest segment by deployment type and private cloud is also expected to witness the highest growth over the forecast period due to growing demand from end user such as single organization, managed, and operated by the organization, a third party, or some combination of them.

Q7. In access control as a service market, which region is expected to be the largest in next 7 years?

Answer: North America is expected to remain the largest region and Asia Pacific witness the highest growth over next 7 years

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost

This report answers following 11 key questions

Q.1 What are some of the most promising, high-growth opportunities for the global access control as a service by access control as a service by end use industry (commercial, manufacturing and industrial, government bodies, residential, transportation, healthcare, education, and utilities), service (hosted, managed, and hybrid), deployment (public cloud, private cloud, and hybrid cloud and by region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 5 years in this market?